How to get URL link on X (Twitter) App

2. 🇳🇴 $EPR - Norska lågprisjätten, som förvisso "alltid" sett billig ut, handlas nu enligt konsensus till ~9x FCF två år ut. Borde väl vara boom time för denna typen av biz framöver? Knäckfrågan är väl marginalen.

2. 🇳🇴 $EPR - Norska lågprisjätten, som förvisso "alltid" sett billig ut, handlas nu enligt konsensus till ~9x FCF två år ut. Borde väl vara boom time för denna typen av biz framöver? Knäckfrågan är väl marginalen.

2/ Let’s set the stage med en låt. Dra på denna innan du fortsätter läsa, för den ultimata upplevelsen 🎧 open.spotify.com/track/0dVOO1yF…

2/ Let’s set the stage med en låt. Dra på denna innan du fortsätter läsa, för den ultimata upplevelsen 🎧 open.spotify.com/track/0dVOO1yF…

I don’t have a hard definition for quality though, but I look at ROIC/ROE, margins, network effects, switching costs, brand strength, longevity, market share, scale/cost advantages, management, etc. The usual suspects.

I don’t have a hard definition for quality though, but I look at ROIC/ROE, margins, network effects, switching costs, brand strength, longevity, market share, scale/cost advantages, management, etc. The usual suspects.

2/ The death of security analysis..? Buffett's speech was sort of an opposing response to Michael Jensen's (a University of Rochester professor) speech about the efficient-market hypothesis, which he gave the same day.

2/ The death of security analysis..? Buffett's speech was sort of an opposing response to Michael Jensen's (a University of Rochester professor) speech about the efficient-market hypothesis, which he gave the same day.

2/9 With scale comes efficiency, and efficiency + trust at the end of the day beats price for insurers;

2/9 With scale comes efficiency, and efficiency + trust at the end of the day beats price for insurers;

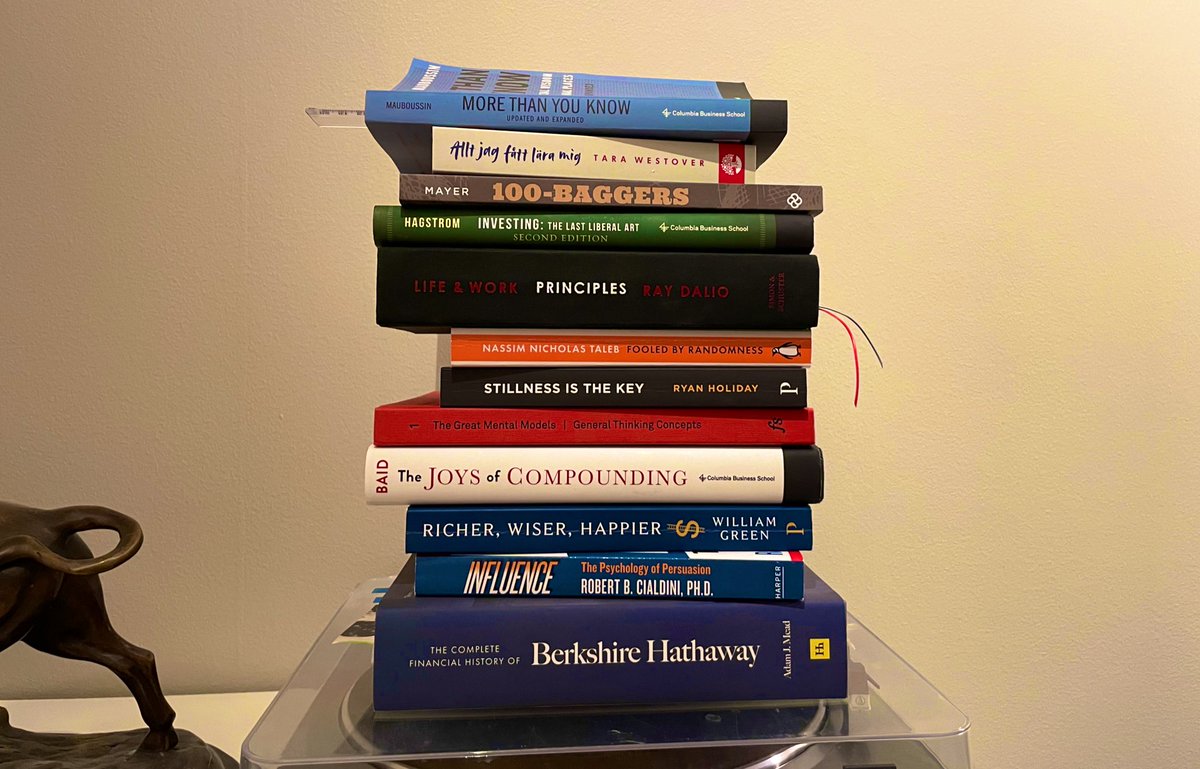

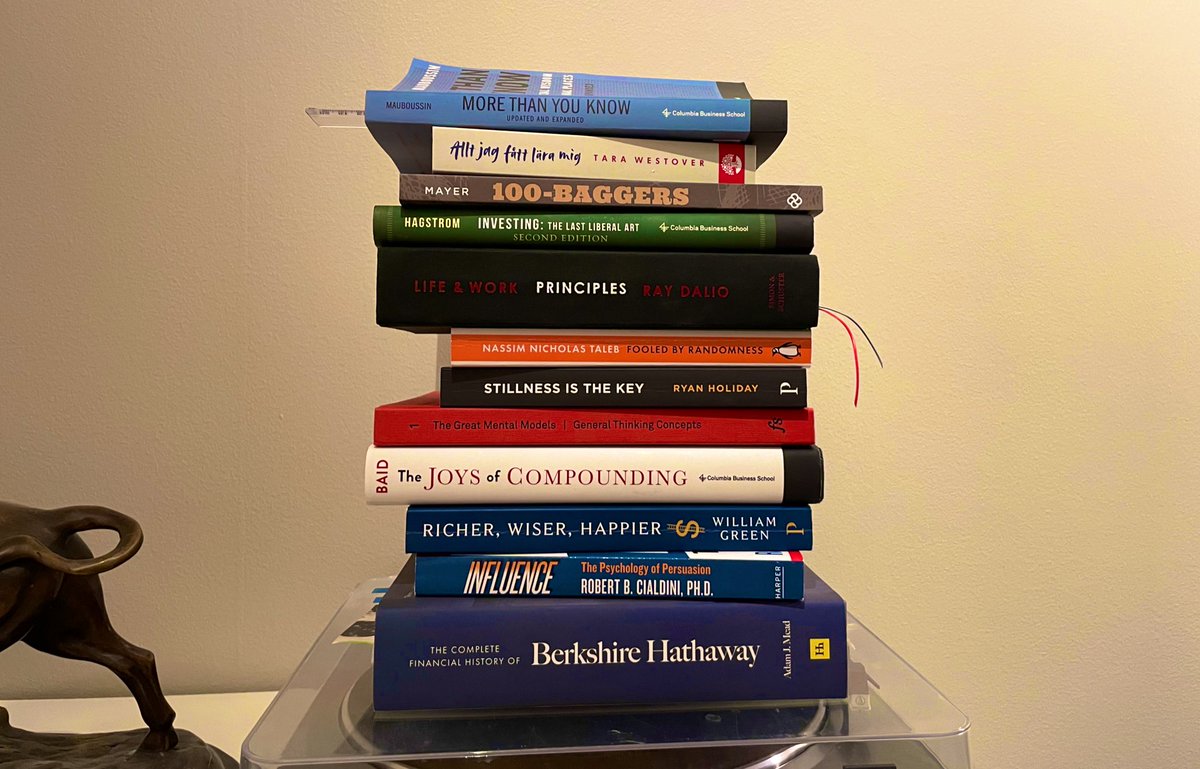

2/ This Taleb classic was on my 2020 list as well, but since I re-read it I couldn’t resist including it this year, too. It makes you both humble and skeptical (meaning; the good kind of skeptical).

2/ This Taleb classic was on my 2020 list as well, but since I re-read it I couldn’t resist including it this year, too. It makes you both humble and skeptical (meaning; the good kind of skeptical).

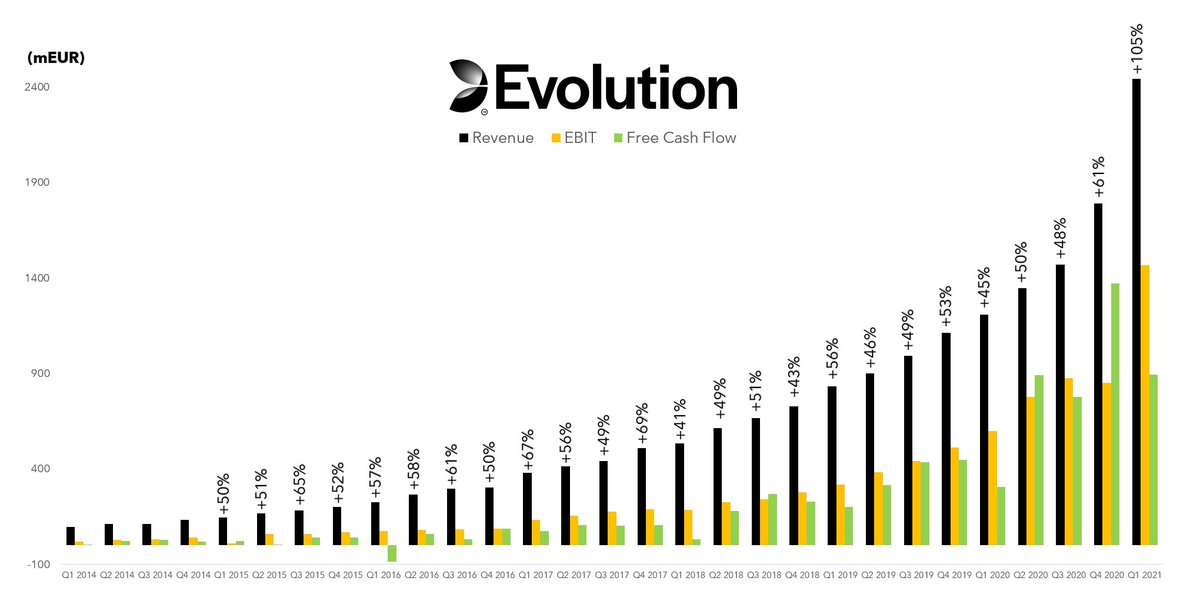

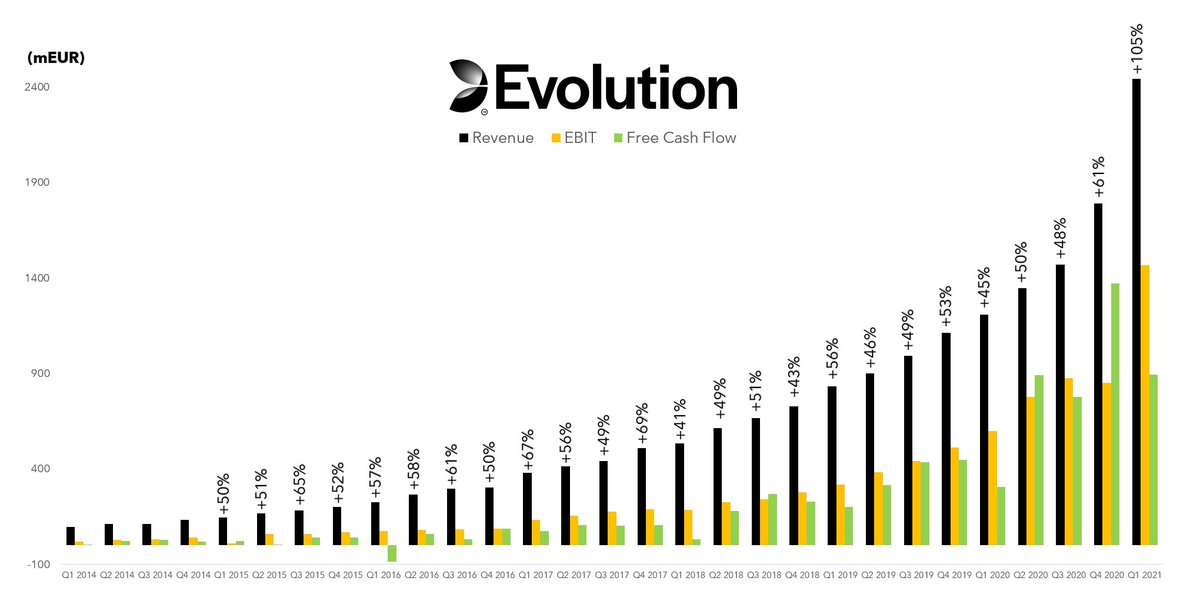

2/ $EVO har, mer eller mindre, avgudats sedan sin IPO, och det med all rätt. Det är ytterst få bolag i världen som kunnat leverera fundamentalt på deras nivå. Det komiska är, att just detta är något som skrämmer folk. En del tänker ”detta är för bra för att vara sant”.

2/ $EVO har, mer eller mindre, avgudats sedan sin IPO, och det med all rätt. Det är ytterst få bolag i världen som kunnat leverera fundamentalt på deras nivå. Det komiska är, att just detta är något som skrämmer folk. En del tänker ”detta är för bra för att vara sant”.

2/ Be wary of The Gambler's Fallacy* when things go against you.

2/ Be wary of The Gambler's Fallacy* when things go against you.

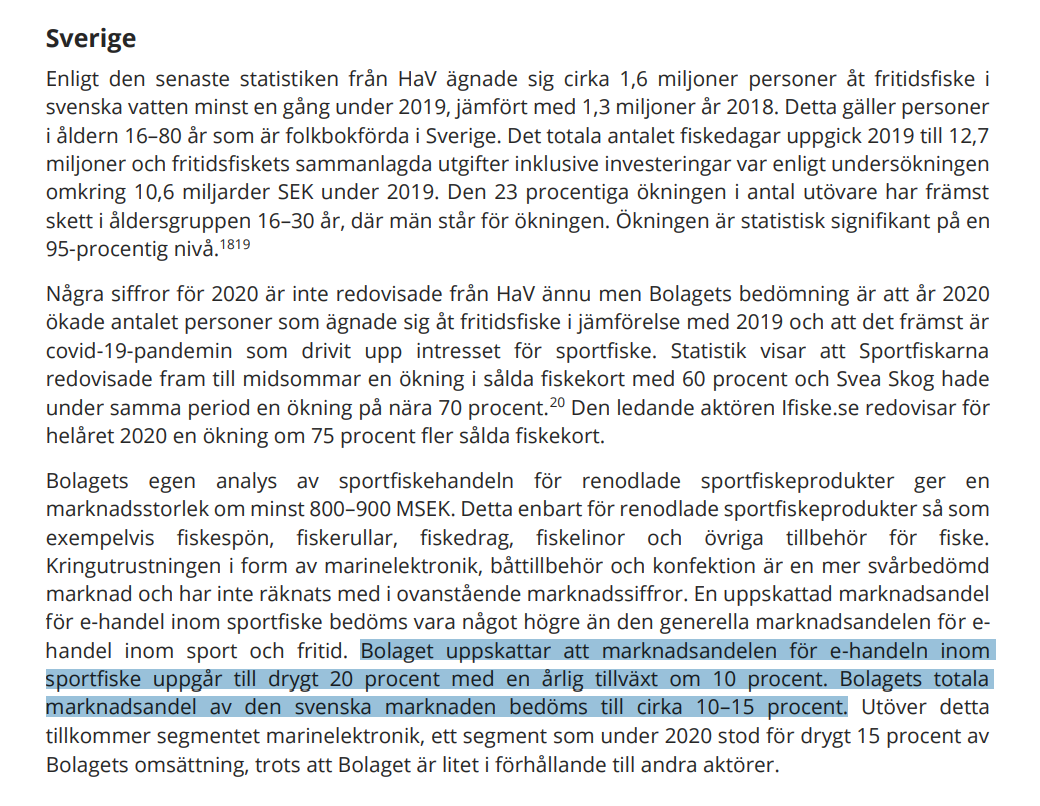

2/ Söder Sportfiske, idag ett bolag som får >80% (2020) av sina intäkter från e-handel, har sina rötter i den fysiska butiken på Södermalm i Stockholm. Av prospektet att döma är Sverige en e-handelsmarknad man har i ett järngrepp. Man är också en av de större aktörerna i Norden.

2/ Söder Sportfiske, idag ett bolag som får >80% (2020) av sina intäkter från e-handel, har sina rötter i den fysiska butiken på Södermalm i Stockholm. Av prospektet att döma är Sverige en e-handelsmarknad man har i ett järngrepp. Man är också en av de större aktörerna i Norden.

2/ I'm not the guy who creates the most exquisite models at all, and especially not for every quarter. It's no different this time, but I'm obviously always a little curious if expectations feels too high, or too low.. so here goes a few guesses👇🏼

2/ I'm not the guy who creates the most exquisite models at all, and especially not for every quarter. It's no different this time, but I'm obviously always a little curious if expectations feels too high, or too low.. so here goes a few guesses👇🏼

2/

2/

2/x Before Mike Cessario founded Liquid Death in 2017, he worked as a Creative Director over at Netflix on shows like House of Cards, Narcos and Stranger Things.

2/x Before Mike Cessario founded Liquid Death in 2017, he worked as a Creative Director over at Netflix on shows like House of Cards, Narcos and Stranger Things.

2/x In the first part he implicitly writes that he himself, and perhaps many others from his generation, maybe put a little too much emphasis on a company's history, and too little on their future.

2/x In the first part he implicitly writes that he himself, and perhaps many others from his generation, maybe put a little too much emphasis on a company's history, and too little on their future.