Interpretation of Financial Statements - preliminary filters.

1. Looking for sustainable competitive advantage:

When looking for sustainable moat, you wanna see consistency - in earnings, in having low debt, in having growing earnings, low spending in capital expenditures, etc.

1. Looking for sustainable competitive advantage:

When looking for sustainable moat, you wanna see consistency - in earnings, in having low debt, in having growing earnings, low spending in capital expenditures, etc.

The longer the company has existed, and if it sells you the same product for years (like Coca Cola), it reduces production costs and other costs (R&D, Training, marketing) slowly as the company ages.

When costs are reduced, margins and profits increase.

When costs are reduced, margins and profits increase.

2. What to look for in an income statement:

Let's take a look at Apple:

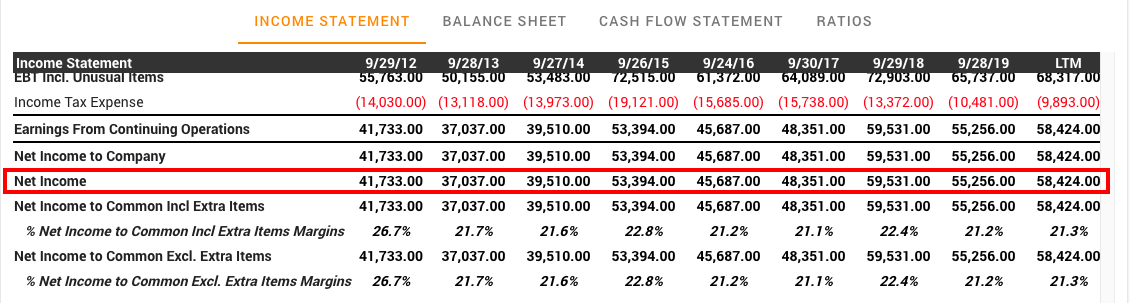

i) You want to see earnings grow at a steady pace. Take a look at the net income below.

Let's take a look at Apple:

i) You want to see earnings grow at a steady pace. Take a look at the net income below.

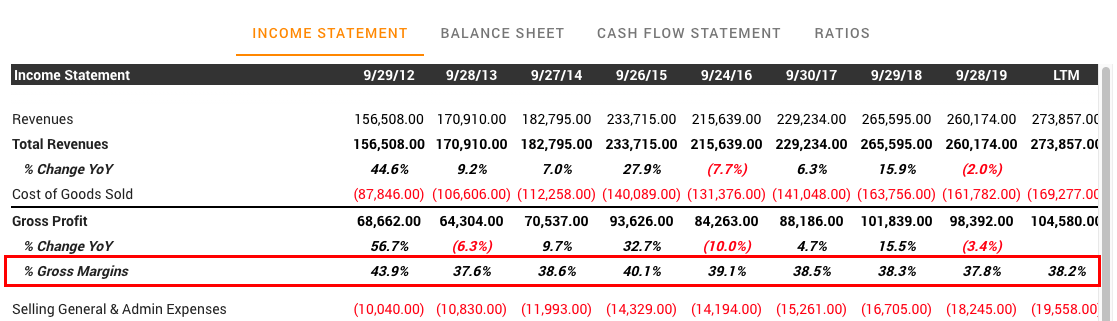

ii) Another thing that's important is a consistent and high gross margin.

As a thumb rule, Warren Buffett wants to see a gross margin of around 40% or above.

Although not quite 40%, it's around that range with respect to Apple.

As a thumb rule, Warren Buffett wants to see a gross margin of around 40% or above.

Although not quite 40%, it's around that range with respect to Apple.

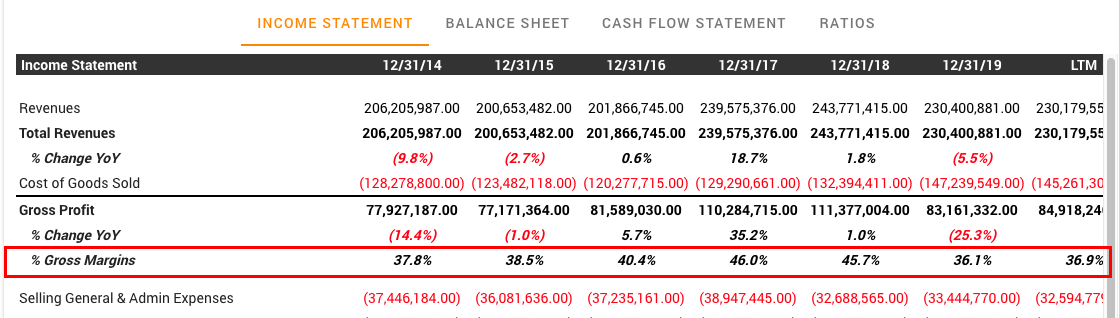

Compare this to Apple's competitors.

Samsung's gross margins are around similar range, highest being 45.7% in 2018, and Huawei had a gross margin of 38.6%.

Samsung's gross margins are around similar range, highest being 45.7% in 2018, and Huawei had a gross margin of 38.6%.

Having a high gross margin indicates the scalability of the business. The more the company sells, the greater the profitability becomes. Such a trait is what you want to see in a business you want to own.

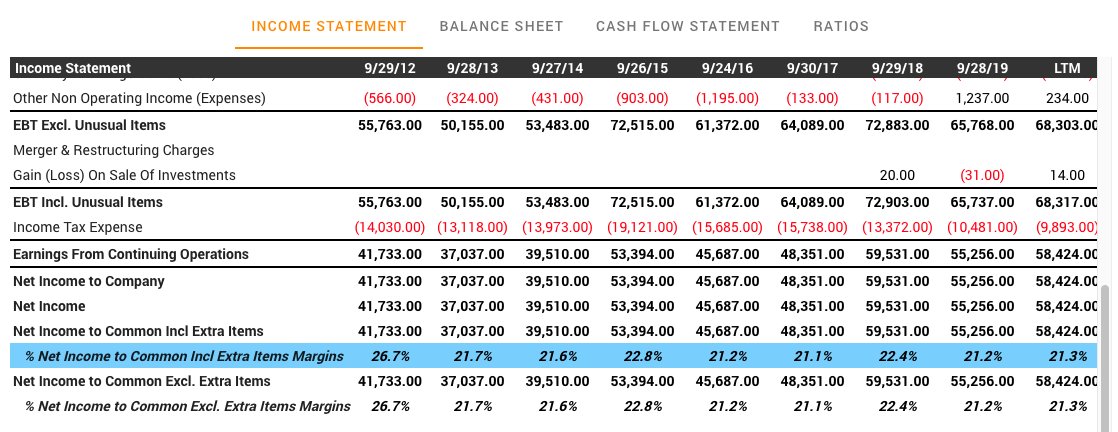

iii) You also want to note the net margin.

Gross margin = (revenue - cost of goods sold) / revenue

Net margin = net income / revenue.

You want to see the company having higher net margin compared to their competitors.

Gross margin = (revenue - cost of goods sold) / revenue

Net margin = net income / revenue.

You want to see the company having higher net margin compared to their competitors.

Apple's net margin is around 22%. Samsung's net margin is around 18% and Huawei's net margin is around 8.5%.

Typically, net margin above 20% is a very strong one, indicating that we are dealing with a smoothly run business.

Typically, net margin above 20% is a very strong one, indicating that we are dealing with a smoothly run business.

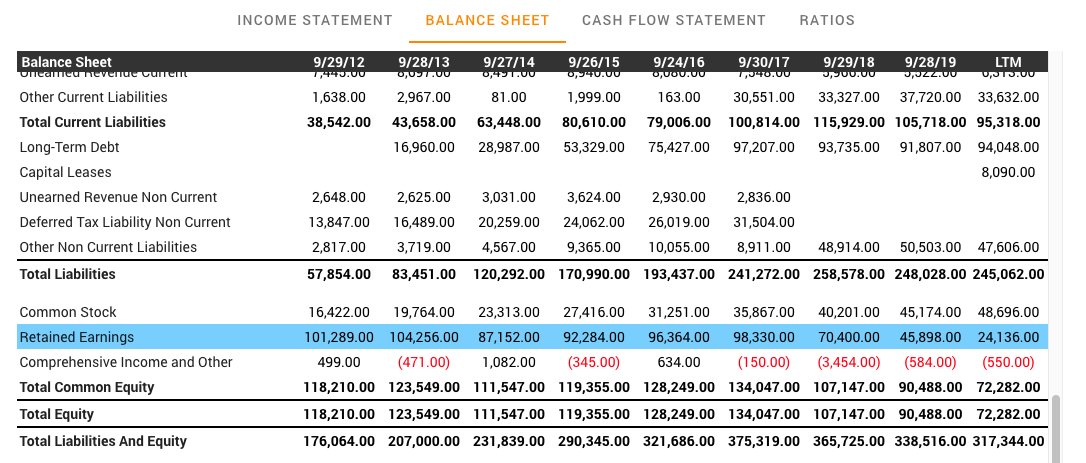

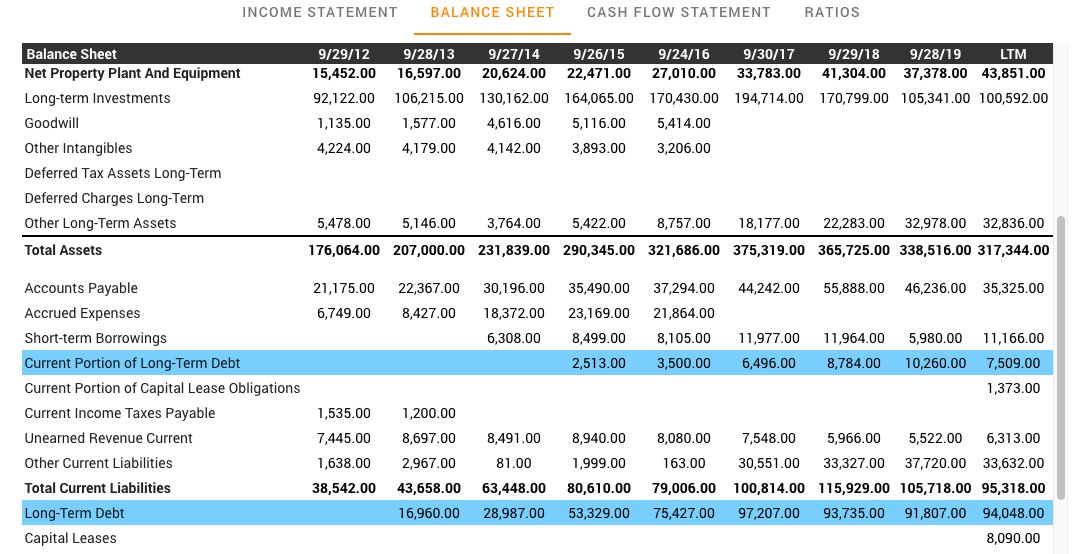

3) In the balance sheet:

Look at the figure - "Retained Earnings".

Using retained earnings, you can find out if a company is reinvesting its income or not. A steady growth in this number means the business is profitable, and that it's identifying good investing opportunities.

Look at the figure - "Retained Earnings".

Using retained earnings, you can find out if a company is reinvesting its income or not. A steady growth in this number means the business is profitable, and that it's identifying good investing opportunities.

Apple doesn't fulfill the criteria regarding retained earnings. But that's because in 2013, Apple started a rigorous dividends and share repurchase program.

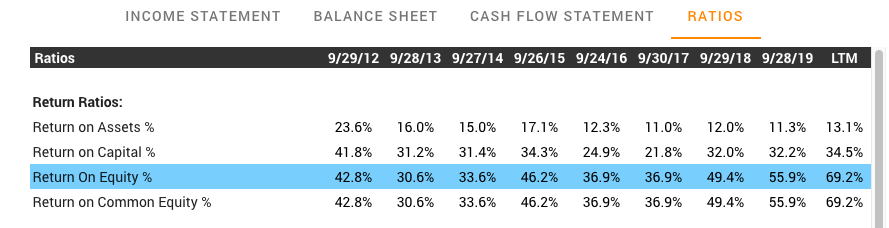

To measure how efficiently a company is using these retained earnings, Return on Equity (ROE) is used.

To measure how efficiently a company is using these retained earnings, Return on Equity (ROE) is used.

To calculate ROE, compare Net income to the Total Equity of the company.

Apple looks quite strong in this aspect. It's partly an effect of distributing a lot of their earnings to shareholders. It also signifies the sustainable competitive moat.

Apple looks quite strong in this aspect. It's partly an effect of distributing a lot of their earnings to shareholders. It also signifies the sustainable competitive moat.

Compare this with Samsung (ROE:18.3%) and Huawei (ROE:25.3%), Apple shows significant strength.

4) Exceptional businesses seldom require a lot of debt to expand (except maybe banks/NBFCs). Instead, they can just use the strong cashflow from the business.

4) Exceptional businesses seldom require a lot of debt to expand (except maybe banks/NBFCs). Instead, they can just use the strong cashflow from the business.

So, look for businesses with little to no long term debt. If a company can pay off with all its long term debt with less than 4 years of earnings, it signifies a good position for the company. Apple fulfills this criterion. Samsung and Huawei do too.

5) In a cashflow statement:

This is where you see the actual in's and out's of money.

Look at "Capital Expenditures" on the cashflow statement.

This is the money being spent on properties, plant, and equipment.

This is where you see the actual in's and out's of money.

Look at "Capital Expenditures" on the cashflow statement.

This is the money being spent on properties, plant, and equipment.

Look at what percentage of net income the capital expenditures are. You want it to be as low as possible, lower than 25% over a period of time is considered very good. Less than 50% is okay-ish.

Exceptions: One time payment to grow the business in some capex activity.

Exceptions: One time payment to grow the business in some capex activity.

Look at Apple's CAPEX spendings. Compare that with their net income, and you can see that their average capex spending is less than 25% of their net income. Samsung (around 65%) and Huawei (around 45%) aren't even close.

Also, in Apple's cash flow statement, we can see the reasons why the retained earnings from the balance sheet haven't been growing from 2012. Apple has been distributing a lot of cash to its shareholders.

Apple's Augmented Payout Ratio (includes share buybacks and dividends) has been higher than 100% in some years. This basically means Apple's distributing more money than it earns.

5) When to sell?

3 instances when you could consider selling the stock.

i) You need money for a better investments. This is more so applicable in a bear market, for you to switch from something great to something exceptional.

3 instances when you could consider selling the stock.

i) You need money for a better investments. This is more so applicable in a bear market, for you to switch from something great to something exceptional.

ii) When a company loses its competitive advantage. Times change, and once monopolistic companies are constantly being disrupted. If your investment faces such a risk, cut it loose.

iii) During crazy raging bull market. Even if a company runs a fantastic business, it could be a bad investment if you have to pay insane price. At such times, at such price, you could selling a fantastic business if you already have held onto it for a long time.

At a PE of 40 or higher, you should start considering selling your stocks, even if you believe in the underlying economics of the company.

This may not always apply to all markets, all stocks. But with anything above 40PE, tread carefully and cautiously.

This may not always apply to all markets, all stocks. But with anything above 40PE, tread carefully and cautiously.

So, key takeaways:

- Competitive advantage and scale

- Consistently high net income, return on equity

- Requires very little debt

- Retained earnings has steady growth

- Capital expenditures should be < 25%

- Sell a company if prices are crazy, or a better opportunity comes up.

- Competitive advantage and scale

- Consistently high net income, return on equity

- Requires very little debt

- Retained earnings has steady growth

- Capital expenditures should be < 25%

- Sell a company if prices are crazy, or a better opportunity comes up.

The Swedish Investor YT channel has some interesting playlists on financial statements. Check it out. These insights I gathered are from one of his videos.

youtube.com/c/TheSwedishIn…

youtube.com/c/TheSwedishIn…

For learning Valuation, nothing better than Aswath Damodaran's course. Find his courses here:

youtube.com/c/AswathDamoda…

youtube.com/c/AswathDamoda…

• • •

Missing some Tweet in this thread? You can try to

force a refresh