A super awesome thread on megatrend that is shifting the world in drastic way...

What's that??

These are platform businesses....

What is platform business? How is it changing our lives? How does it matter to me as an investor??

READ ON TILL THE END..This is powerful..

(1/n)

What's that??

These are platform businesses....

What is platform business? How is it changing our lives? How does it matter to me as an investor??

READ ON TILL THE END..This is powerful..

(1/n)

First of all let's look at industrial age...what was happening with tata motors, bajaj electricals, reliance etc.??

You have PIPELINE model of business.

Raw material >> Components >> Assembly >> Distribution

What was the focus? >> How to make this supply chain efficient

(2/n)

You have PIPELINE model of business.

Raw material >> Components >> Assembly >> Distribution

What was the focus? >> How to make this supply chain efficient

(2/n)

You had all these part of your life...Bajaj, Tata, Aditya Birla, Pidilite, Asian paints, colgate etc.

And they created huge wealth for shareholders...MOST IMPORTANT RIGHT...

And they were able to scale in right way..

(3/n)

And they created huge wealth for shareholders...MOST IMPORTANT RIGHT...

And they were able to scale in right way..

(3/n)

Now look around you....you take Uber/Ola cabs, order food from zomato, get shopping done from amazon/flipkart, your kids play games on xbox, you use twitter, FB etc

What are these? These are platform businesses?

These are businesses which do not own any product generally

(4/n)

What are these? These are platform businesses?

These are businesses which do not own any product generally

(4/n)

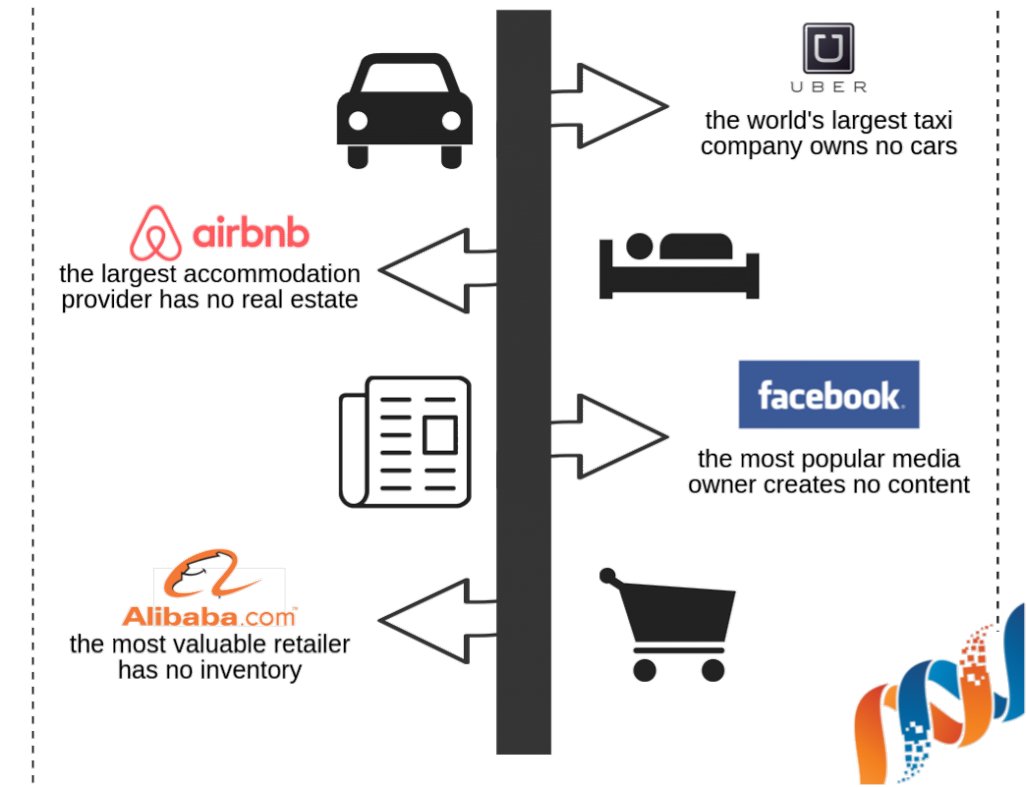

Look at these...unlike traditional businesses which own factories and warehouses...these businesses do not own any of that...still they became NO. 1

Airbnb has no real estate

Uber doesn't own any car

FB doesn't create any content

Alibaba has no inventory

(5/n)

Airbnb has no real estate

Uber doesn't own any car

FB doesn't create any content

Alibaba has no inventory

(5/n)

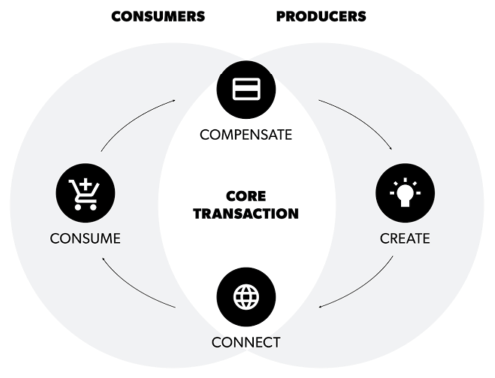

What they do...? Very simple...4 Cs

Facilitates core transaction....by enabling CONNECTIONS...

And this is what happens around these core transactions

1. Create

2. Connect

3. Consume

4. Compensate

That's it and they get cut out of it...

(6/n)

Facilitates core transaction....by enabling CONNECTIONS...

And this is what happens around these core transactions

1. Create

2. Connect

3. Consume

4. Compensate

That's it and they get cut out of it...

(6/n)

Imagine business like Naukri....

1. HR creates jobs and posts it

2. Naukri connects it to right pool of candidates

3. Candidates consume that

4. On hire - Naukri gets a cut and both parties are compensated

So platforms are just like brokers?

(7/n)

1. HR creates jobs and posts it

2. Naukri connects it to right pool of candidates

3. Candidates consume that

4. On hire - Naukri gets a cut and both parties are compensated

So platforms are just like brokers?

(7/n)

Kind of in some cases like exchanges but many provide tools and ancillary services and some like android gives entire development platform...

So what's special about it?

(8/n)

So what's special about it?

(8/n)

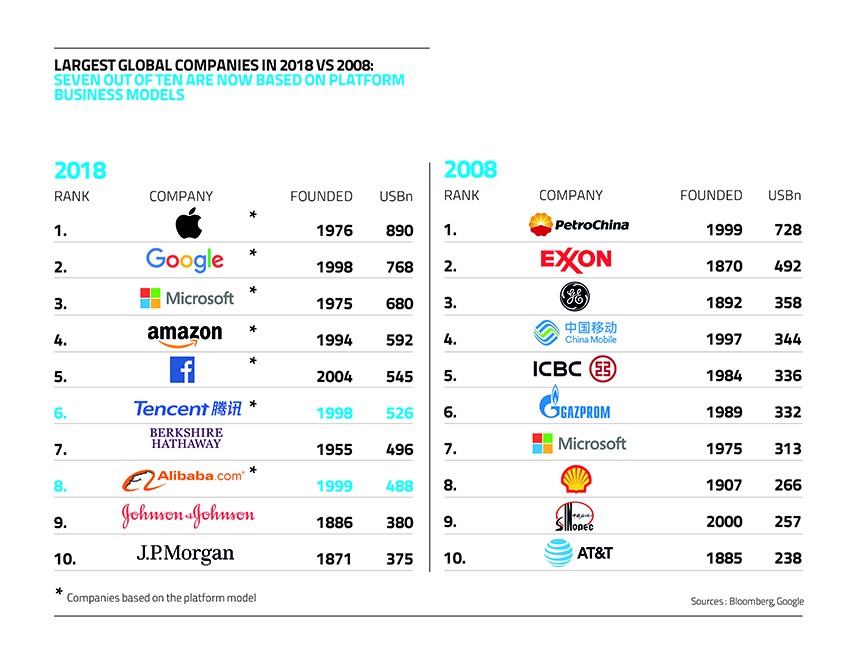

Look at this ....some of the top companies in the world are now platforms..

Great thing about these are..

1. They are generally digital

2. Asset light and very few employees

3. SCALES VERY FAST - most important..

4. Has very high entry barriers

(9/n)

Great thing about these are..

1. They are generally digital

2. Asset light and very few employees

3. SCALES VERY FAST - most important..

4. Has very high entry barriers

(9/n)

And best part is that instead of supply side economies of scale like traditional businesses, they have buyer side economies of scale as well

What does that mean.?

Means each incremental user on the platform adds great value to existing users without any cost to platform

(10/n)

What does that mean.?

Means each incremental user on the platform adds great value to existing users without any cost to platform

(10/n)

Example: One new user on FB or tweeter can add lot more value to entire network...one new user on amazon/airbnb can add lot of value through reviews

And most of the times this creates NETWORK EFFECTS...which is very powerful moat and creates huge barriers to entry

(11/n)

And most of the times this creates NETWORK EFFECTS...which is very powerful moat and creates huge barriers to entry

(11/n)

And these are very powerful...and creates WINNER TAKES IT ALL EFFECT

So think about businesses around you & create wealth riding this megatrend...

References: technofunda.co/platforms

To learn more with me, join my upcoming masterclass: technofunda.co/webinar

(n/n)

So think about businesses around you & create wealth riding this megatrend...

References: technofunda.co/platforms

To learn more with me, join my upcoming masterclass: technofunda.co/webinar

(n/n)

It's great to see how it has panned out since few months...some of the platform or quasi platform businesses have done great and I believe should do well..

Examples:

- IndiaMART

- CDSL

- MCX

- MSTC

- IEX

- BSE

- Matrimony etc. And many more..

It's all about riding MEGATRENDS

Examples:

- IndiaMART

- CDSL

- MCX

- MSTC

- IEX

- BSE

- Matrimony etc. And many more..

It's all about riding MEGATRENDS

And many more..

- Infoedge

- IGL

- Gujarat Gas

- Affle

- MCX

- Just Dial

....

What else?

- Infoedge

- IGL

- Gujarat Gas

- Affle

- MCX

- Just Dial

....

What else?

• • •

Missing some Tweet in this thread? You can try to

force a refresh