Hello, Ope is here 😊

There’s something you should know. In September, the CBN reduced the MPR (Monetary Policy Rate). Don’t leave me, I’ll explain what that means.

Simply put, it is the rate at which the Central Bank lends money to your regular banks. #MarketSlice (1/6)

There’s something you should know. In September, the CBN reduced the MPR (Monetary Policy Rate). Don’t leave me, I’ll explain what that means.

Simply put, it is the rate at which the Central Bank lends money to your regular banks. #MarketSlice (1/6)

Ideally, the higher it is the harder it is for banks to lend out money. The lower it is…(can you complete that?).

Great, I knew you were one smart person. So, a reduction is expected to push banks to lend businesses money at cheaper rates. 🤔

#MarketSlice (2/6)

Great, I knew you were one smart person. So, a reduction is expected to push banks to lend businesses money at cheaper rates. 🤔

#MarketSlice (2/6)

However, that is not big news. The news is in how this affects returns on a savings account, with your bank.

Before that decision, the CBN had also placed the minimum interest rate at 10% of the MPR. #MarketSlice

(3/6)

Before that decision, the CBN had also placed the minimum interest rate at 10% of the MPR. #MarketSlice

(3/6)

In essence, now that the MPR has gone from 12.5% to 11.5%, the minimum interest rate on a savings account, with your bank, is 1.15% per annum (10% of 11.5% is 1.15%). #MarketSlice

(4/6)

(4/6)

The Point?

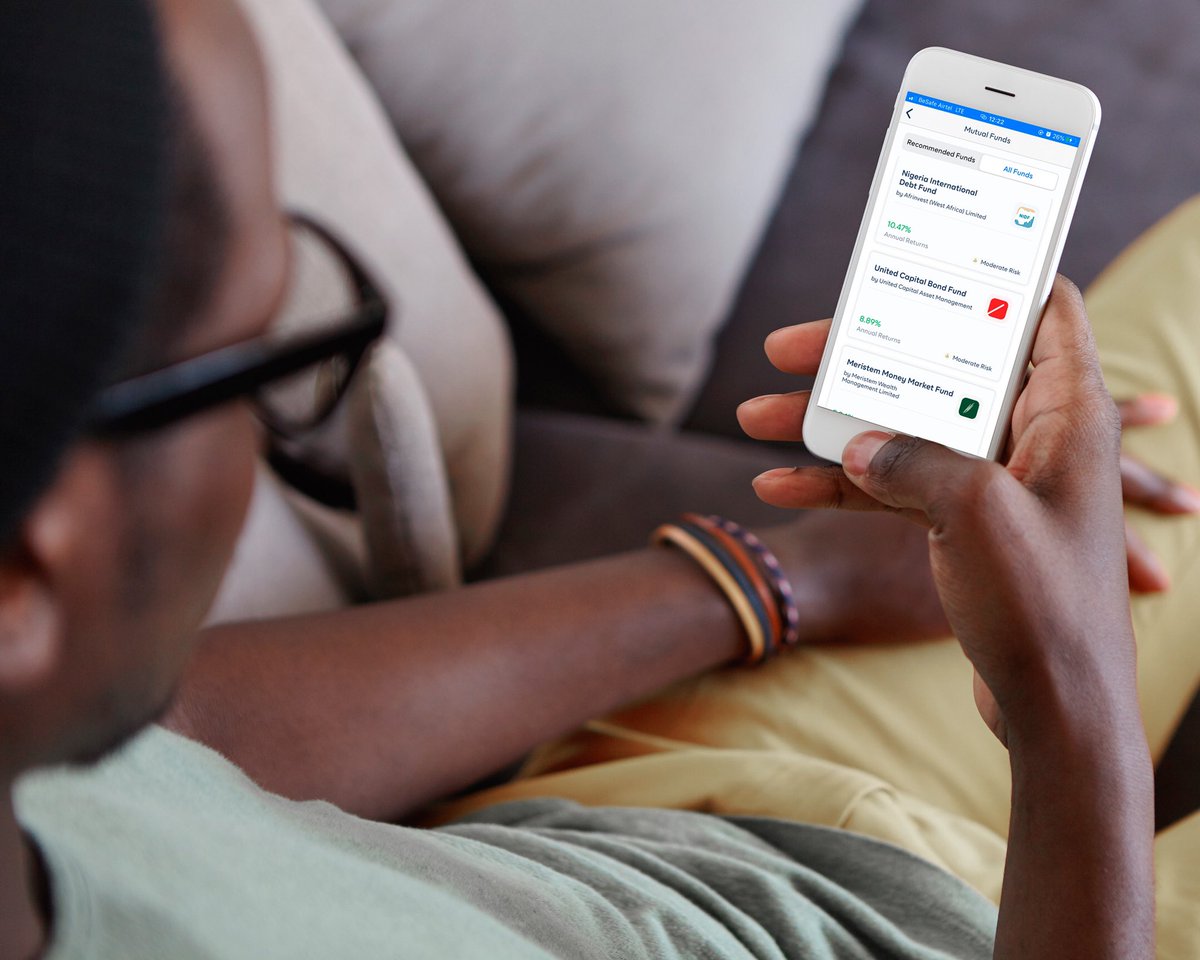

You can trust your bank to be generous and pay better than the minimum (as you would trust snow to fall in Nigeria 🌚), or you could check out our mutual funds here 👇🏾

#MarketSlice

(5/6)

cowrywise.com/mutual-funds

You can trust your bank to be generous and pay better than the minimum (as you would trust snow to fall in Nigeria 🌚), or you could check out our mutual funds here 👇🏾

#MarketSlice

(5/6)

cowrywise.com/mutual-funds

Read the full #MarketSlice report, for September, here: cowrywise.com/blog/mutual-fu…

___

October’s report will be out on the 6th of November, 2020. Keep investing smartly.

Your favourite advisor,

Ope 💙

___

October’s report will be out on the 6th of November, 2020. Keep investing smartly.

Your favourite advisor,

Ope 💙

• • •

Missing some Tweet in this thread? You can try to

force a refresh