A thread on the ultra viral thread by @wiredmau5

My take based on reading/learning health insurance policies, helping customers with comparison, claims for 15 years now.

My take based on reading/learning health insurance policies, helping customers with comparison, claims for 15 years now.

https://twitter.com/wiredmau5/status/1313718353370857477?s=20

This is right. *However*, most health insurance plans today do not have a room rent limit unless you are buying a cover of Rs. 4 lakhs or less.

Yes, be careful and keep an eye on the room rent limit, but there is more to it, read on.

Yes, be careful and keep an eye on the room rent limit, but there is more to it, read on.

https://twitter.com/wiredmau5/status/1313718690089558016?s=20

Some insurers may, however, have a cap on room category - which means they only allow a particular category of room. If you ever opt for a room above this category, u have to bear the difference and proportionate charges for the entire bill.

Never trade coverage for room rent limit. You must have best of both

Room Rent - Never opt for a policy with room limit. A 10L policy with limit of 10K may look adequate today, but the cover will degrade with inflation. (At 8% infln, 10K=2.1K in 20yrs)

Room Rent - Never opt for a policy with room limit. A 10L policy with limit of 10K may look adequate today, but the cover will degrade with inflation. (At 8% infln, 10K=2.1K in 20yrs)

https://twitter.com/wiredmau5/status/1313718843534049280?s=20

Sum Insured/Cover*: 10L cover is not enough.

Health Insurance is a cover for a lifetime of hospitalization expenses. Buy coverage not for today but for your old age.

If 5K looks good today, you need ~ 20L at 8% inflation after 20 yrs.

Health Insurance is a cover for a lifetime of hospitalization expenses. Buy coverage not for today but for your old age.

If 5K looks good today, you need ~ 20L at 8% inflation after 20 yrs.

https://twitter.com/wiredmau5/status/1313718843534049280?s=20

But I buy a low cover today and upgrade later, someone said?

My take: You should never, I repeat never bet on future upgrades (unless you have genuine budget constraints) - since insurers might decline upgrades based on your age and health condition at the time of your request.

My take: You should never, I repeat never bet on future upgrades (unless you have genuine budget constraints) - since insurers might decline upgrades based on your age and health condition at the time of your request.

You must worry about the pre-existing disease waiting period - ONLY if you have disease while buying the policy.

If u don't, this waiting period is not applicable for u.

In fact, u must be aware of the 2 yrs waiting period for specified illnesses.

If u don't, this waiting period is not applicable for u.

In fact, u must be aware of the 2 yrs waiting period for specified illnesses.

https://twitter.com/wiredmau5/status/1313719993666691072?s=20

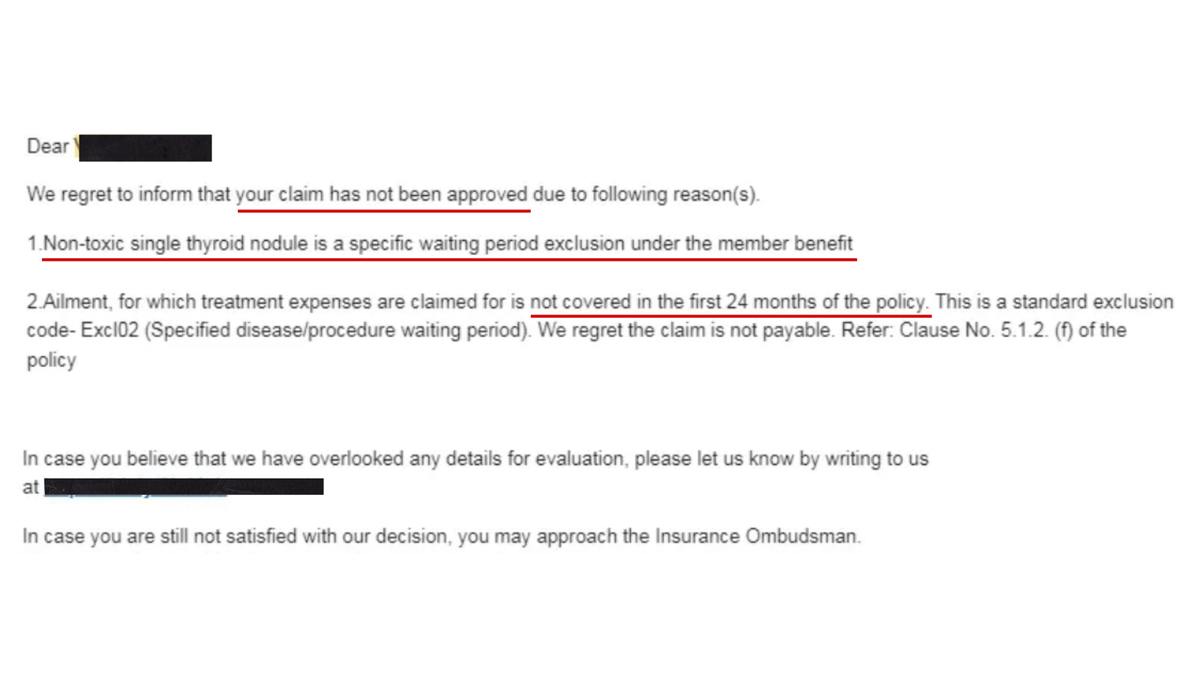

2 yrs waiting period for a list of specified illnesses is applicable despite you not having such diseases when you bought the policy.

Yes, you read it right.

You must be aware of this if you are young and healthy today.

Wrote about it here: beshak.org/insurance/heal…

Yes, you read it right.

You must be aware of this if you are young and healthy today.

Wrote about it here: beshak.org/insurance/heal…

Always note, that apart from a) existing diseases before buying the policy, and b) specified listed illnesses c) permanently excluded treatments listed in the policy, all diseases that are diagnosed after the policy issuance are covered from day zero.

This is not right.

Most group insurance policies from employers do not have a waiting period for pre-existing diseases. They cover pre-existing diseases from day zero. The problem is different and explained in the next tweet.

Most group insurance policies from employers do not have a waiting period for pre-existing diseases. They cover pre-existing diseases from day zero. The problem is different and explained in the next tweet.

https://twitter.com/wiredmau5/status/1313720565195177984?s=20

Migration from group to individual insurance when you quit your job is never easy - especially for old aged parents, especially if they had claimed.

NEVER depend on employer policy or migration for your parent's health insurance coverage. Please.

NEVER depend on employer policy or migration for your parent's health insurance coverage. Please.

https://twitter.com/wiredmau5/status/1313720628260663301?s=20

Important:

- The policy does not cease to exist when the primary policyholder dies.

- The policy continues with remaining members without any change in cover or waiting periods. You simply have to make another family member the proposer. So chill.

- The policy does not cease to exist when the primary policyholder dies.

- The policy continues with remaining members without any change in cover or waiting periods. You simply have to make another family member the proposer. So chill.

https://twitter.com/wiredmau5/status/1313721161956511744?s=20

Never buy a Topup, which is what seems to have been bought here.

Always look for a Super Topup. A topup works only on a single instance of hospitalization, while a Super Topup works on an aggregate of multiple hospitalizations during a year.

Always look for a Super Topup. A topup works only on a single instance of hospitalization, while a Super Topup works on an aggregate of multiple hospitalizations during a year.

https://twitter.com/wiredmau5/status/1313721845623918593?s=20

Yes, buy a topup with a deductible equal to the SI of your base policy.

Pro-tip: try buying the super topup from the same company you bought the base policy - will help during a cashless claim for a major hospitalization.

Pro-tip: try buying the super topup from the same company you bought the base policy - will help during a cashless claim for a major hospitalization.

https://twitter.com/wiredmau5/status/1313721865911693318?s=20

Apart from this, ensure the following:

1) All Daycare procedures (that take less than 24 hrs are covered)

2) Organ Donor cover without limits

3) Understand each financial limit in the policy.

4) Fill the proposal form, make disclosures like you are making your will :)

1) All Daycare procedures (that take less than 24 hrs are covered)

2) Organ Donor cover without limits

3) Understand each financial limit in the policy.

4) Fill the proposal form, make disclosures like you are making your will :)

Summary

1 Always remain covered

2 Opt for cover u will need at 50+yrs

3 Do not opt for policy with room limit

4 Ensure all Daycare procedures are covered

5 Ensure Organ Donor is covered sans limits

6 Understand limits, exclusions before signing up

7 Fill proposal form diligently.

1 Always remain covered

2 Opt for cover u will need at 50+yrs

3 Do not opt for policy with room limit

4 Ensure all Daycare procedures are covered

5 Ensure Organ Donor is covered sans limits

6 Understand limits, exclusions before signing up

7 Fill proposal form diligently.

There is no doubt that insights from real users are extremely valuable. More and more aware buyers who read wordings should share. So not taking away anything from the effort.

The effort here is only to clarify, give a better understanding.

Do RT if you found this valuable.🙏

The effort here is only to clarify, give a better understanding.

Do RT if you found this valuable.🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh