An update post lockdown. Unfortunately, we don't have Google mobility data post-Oct 30th (start date of the lockdown) yet, so let's look at how hospital data changed since then. Quick thread.

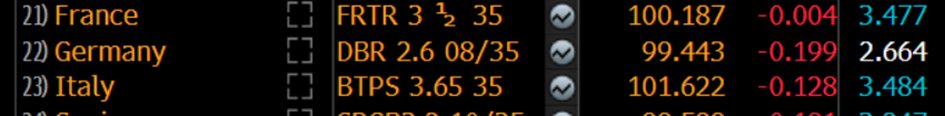

https://twitter.com/jeuasommenulle/status/1320682084973858816

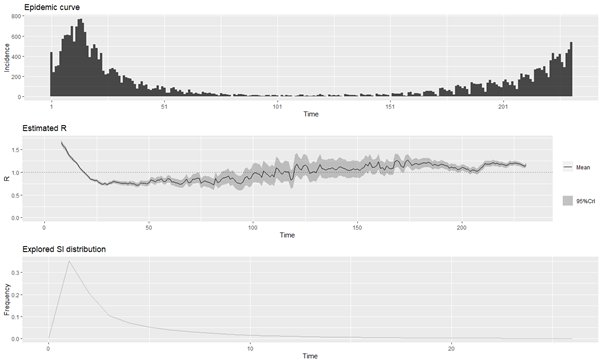

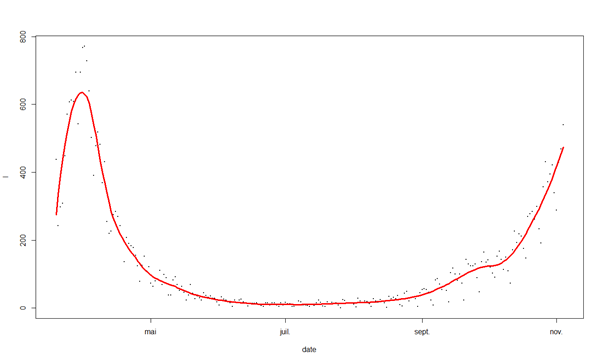

From worse to better, let's start with ICU. Incidence and non-parametric fit.

I certainly can't see any change.

I certainly can't see any change.

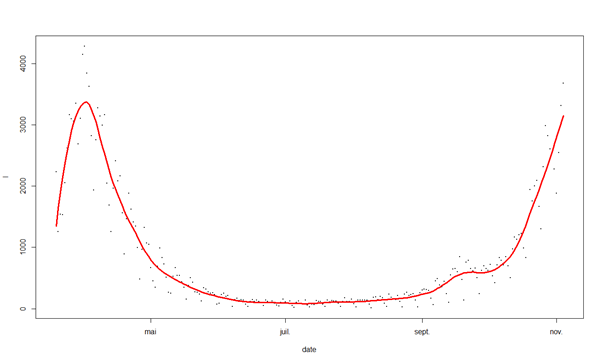

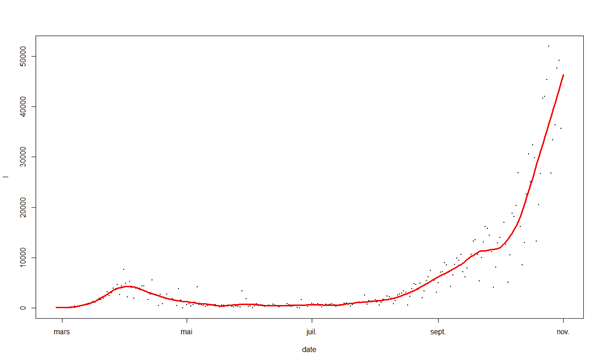

Now if you remember the original thread, I found that cases and ICU/Hospitals were lagged vs. cases and also that any impact on mobility would need 8-14 days to show in hospital data. So we should see more effects of lockdown in cases. What do we have? This.

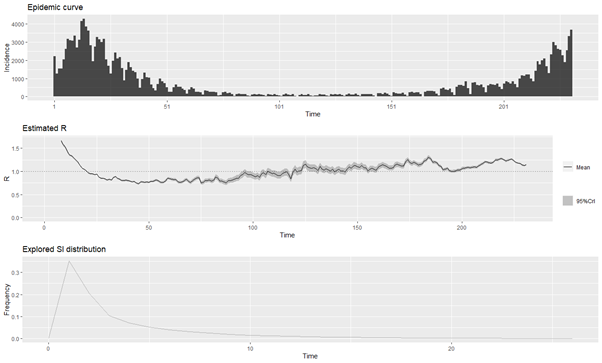

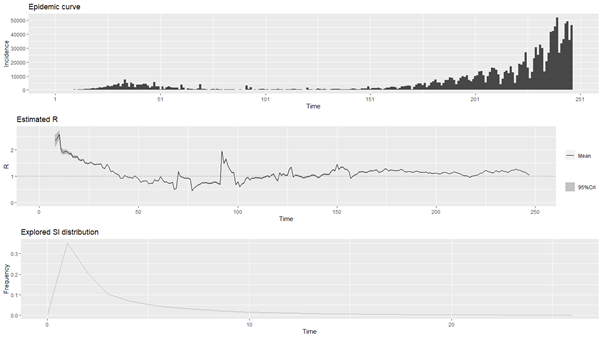

Ok, I realise it's not obvious, but the ugly exponential now looks slightly more like an ugly straight line. Not great, but is it better? R estimates for cases confirm it's better.

R is only slightly above 1 now.

BUT - and this is a BIG BUT (!) the drop in R is almost perfectly synchronized with school closures due to the school holidays.

So you have two ways of seeing this.

BUT - and this is a BIG BUT (!) the drop in R is almost perfectly synchronized with school closures due to the school holidays.

So you have two ways of seeing this.

1) the lockdown is working and we just need to wait a bit to see the impact on hospital data

2) the schools closing drove R down... reopening it during the lockdown means the whole thing will fail.

For now, I can't tell from the data which is right. Maybe Google data will help

2) the schools closing drove R down... reopening it during the lockdown means the whole thing will fail.

For now, I can't tell from the data which is right. Maybe Google data will help

• • •

Missing some Tweet in this thread? You can try to

force a refresh