1/ Nudge: Improving Decisions About Health, Wealth, and Happiness (Thaler, Sunstein)

"Small and apparently insignificant details (nudges) can impact people's behavior without forbidding any options or significantly changing economic incentives." (p. 6)

amazon.com/Nudge-Improvin…

"Small and apparently insignificant details (nudges) can impact people's behavior without forbidding any options or significantly changing economic incentives." (p. 6)

amazon.com/Nudge-Improvin…

2/ "To count as a nudge, the intervention must be easy and cheap to avoid. Nudges are not mandates. Putting the fruit at eye level counts as a nudge. Banning junk food does not.

"The power of these small details comes from focusing people's attention in a particular direction.

"The power of these small details comes from focusing people's attention in a particular direction.

3/ " “If a man sees a fly, he aims at it.” Kieboom, an economist, directs Schiphol’s building expansion. His staff conducted trials and found that etching images of house flies in urinals reduces urine spillage by 80%." (p. 4)

4/ "Drawing on well-established findings in social science, we show that in many cases, individuals make pretty bad decisions—ones they wouldn't have made if they'd paid full attention and had complete information, unlimited cognitive abilities, and complete self-control." (p. 5)

5/ "Hundreds of studies confirm that human forecasts and decision-making are flawed and biased.

"Consider what the “status quo bias,” a fancy name for inertia. For a host of reasons, which we shall explore, people have a strong tendency to go along with the default option.

"Consider what the “status quo bias,” a fancy name for inertia. For a host of reasons, which we shall explore, people have a strong tendency to go along with the default option.

6/ "Whatever the default choices are, many people stick with them, even when the stakes are higher than choosing your phone's ringtone.

"Setting default options, and other similar seemingly trivial menu-changing strategies, can have huge effects on outcomes." (p. 7)

"Setting default options, and other similar seemingly trivial menu-changing strategies, can have huge effects on outcomes." (p. 7)

7/ "In many domains, including environmental protection, family law, and school choice, we will be arguing that better governance requires less in the way of government coercion and constraint, and more in the way of freedom to choose.

8/ "If incentives and nudges replace requirements and bans, government will be both smaller and more modest. To be clear, we are not for bigger government, just for better governance.

"Libertarian paternalism is neither left nor right, neither Democratic nor Republican." (p. 14)

"Libertarian paternalism is neither left nor right, neither Democratic nor Republican." (p. 14)

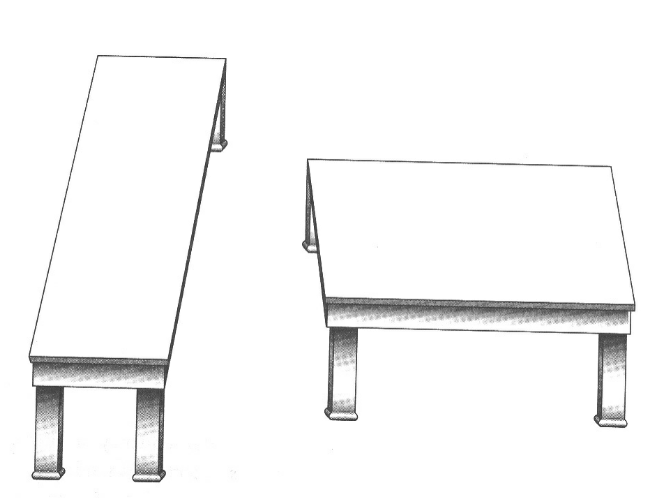

9/ "The two table tops have identical measurements.

"If you see the left table as longer and thinner, you are certifiably human. Both the legs and orientation facilitate the illusion.

"Knowing about cognition has helped discover systematic biases in the way we think." (p. 18)

"If you see the left table as longer and thinner, you are certifiably human. Both the legs and orientation facilitate the illusion.

"Knowing about cognition has helped discover systematic biases in the way we think." (p. 18)

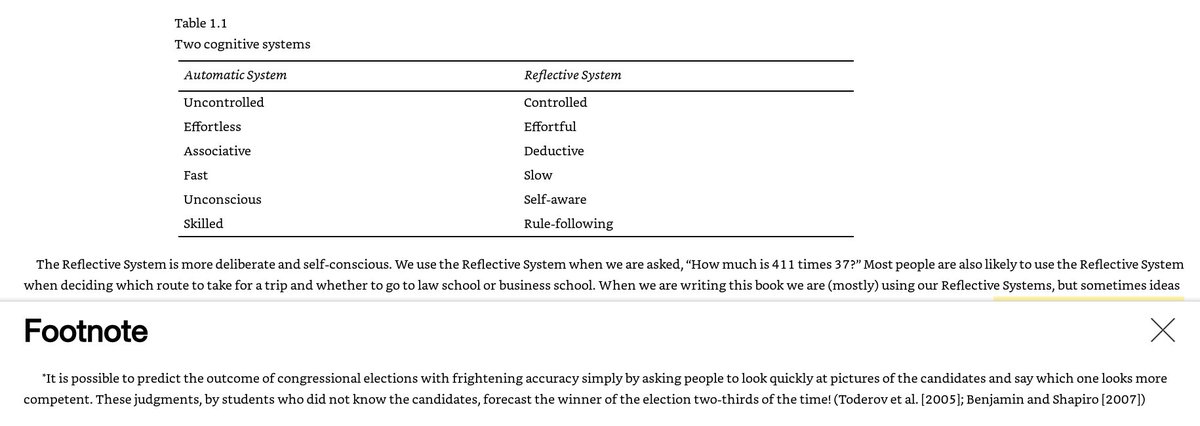

10/ Automatic System = System 1

Reflective System = System 2

"Voters seem to rely primarily on their Automatic System. A candidate who makes a bad first impression or who tries to win votes by complex arguments and statistical demonstrations may well run into trouble.)" (p. 19)

Reflective System = System 2

"Voters seem to rely primarily on their Automatic System. A candidate who makes a bad first impression or who tries to win votes by complex arguments and statistical demonstrations may well run into trouble.)" (p. 19)

11/ Links to the papers:

Inferences of Competence from Faces Predict Election Outcomes (Todorov et. al, Science magazine)

uvm.edu/pdodds/teachin…

Thin-Slice Forecasts of Gubernatorial Elections (Benjamin and Shapiro, Review of Economics and Statistics)

brown.edu/Research/Shapi…

Inferences of Competence from Faces Predict Election Outcomes (Todorov et. al, Science magazine)

uvm.edu/pdodds/teachin…

Thin-Slice Forecasts of Gubernatorial Elections (Benjamin and Shapiro, Review of Economics and Statistics)

brown.edu/Research/Shapi…

12/ Automatic System: “The airplane is shaking; I’m going to die”

Reflective System: “Planes are very safe!”

Automatic System: “That big dog is going to hurt me”

Reflective System: “Most pets are quite sweet.”

"The former can be re-trained with repetition, time, and effort.

Reflective System: “Planes are very safe!”

Automatic System: “That big dog is going to hurt me”

Reflective System: “Most pets are quite sweet.”

"The former can be re-trained with repetition, time, and effort.

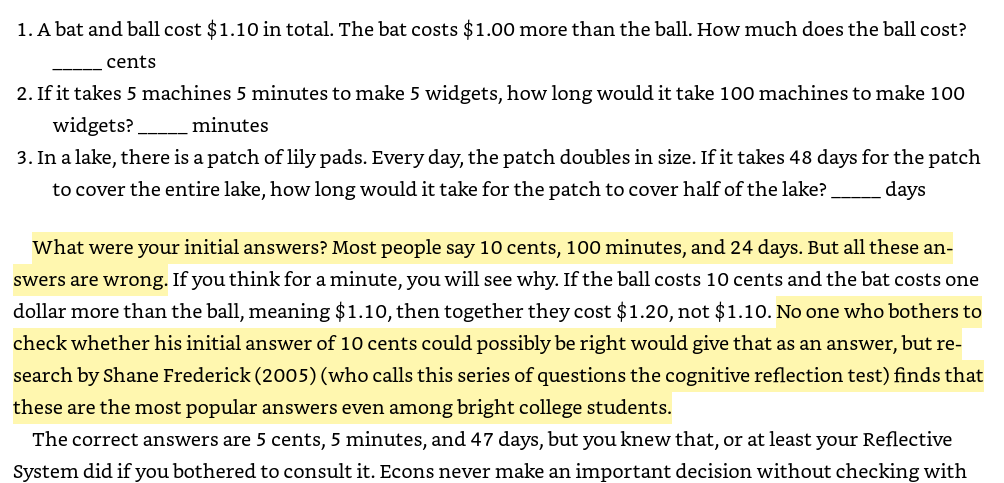

13/ "No one who bothers to check whether his initial intuition of 10¢ would give that as an answer, but Shane Frederick (who calls this series of questions the cognitive reflection test) finds that these are the most popular answers even among bright college students." (p. 21)

14/ "(a) How happy are you? (b) How often are you dating?

"In this order, the correlation was quite low (.11). But when the dating question was asked first, the correlation jumped to 0.62.

"Similar results obtain from married couples if the dating is replaced by lovemaking.

"In this order, the correlation was quite low (.11). But when the dating question was asked first, the correlation jumped to 0.62.

"Similar results obtain from married couples if the dating is replaced by lovemaking.

15/ "We can influence the figure you will choose by subtly suggesting a starting anchor for your thought process.

"Lawyers who sue cigarette companies often win astronomical amounts, in part because they have successfully induced juries to anchor on multimillion-dollar figures.

"Lawyers who sue cigarette companies often win astronomical amounts, in part because they have successfully induced juries to anchor on multimillion-dollar figures.

16/ "Clever negotiators often get amazing deals for their clients by producing an opening offer that makes their adversary thrilled to pay half that very high amount.

"The more you ask for, the more you tend to get." (p. 24)

"The more you ask for, the more you tend to get." (p. 24)

17/ Availability heuristic: "If people can easily think of relevant examples, they are far more likely to be concerned. A risk that is familiar, like terrorism in the aftermath of 9/11, will be seen as more serious than the risks associated with sunbathing or hotter summers.

18/ "Easily imagined causes of death (tornadoes) receive inflated probabilities compared to asthma attacks, though the latter occur 20 times more often." (p. 24)

The risk of dying from a car accident is 500x greater than for all storm types *combined*:

iii.org/fact-statistic…

The risk of dying from a car accident is 500x greater than for all storm types *combined*:

iii.org/fact-statistic…

19/ "So, too, recent events have a greater impact on our behavior, and on our fears, than earlier ones.

"In the aftermath of an earthquake, purchases of new earthquake insurance policies rise sharply—but purchases decline steadily from that point, as vivid memories recede.

"In the aftermath of an earthquake, purchases of new earthquake insurance policies rise sharply—but purchases decline steadily from that point, as vivid memories recede.

20/ "If floods have not occurred recently, people who live on flood plains are far less likely to purchase insurance.

"People who know someone who has experienced a flood are more likely to buy flood insurance for themselves, regardless of the flood risk they actually face.

"People who know someone who has experienced a flood are more likely to buy flood insurance for themselves, regardless of the flood risk they actually face.

21/ "Such misperceptions can affect policy: governments are likely to allocate resources in a way that fits with people’s fears rather than in response to the most likely danger.

"Decisions may be improved if judgments can be nudged back in the direction of true probabilities.

"Decisions may be improved if judgments can be nudged back in the direction of true probabilities.

22/ Nudging ≈ belief manipulation??

"A good way to increase people’s fear is to remind them of a related incident in which things went wrong; a good way to increase people’s confidence is to remind them of a similar situation in which everything worked out for the best." (p.26)

"A good way to increase people’s fear is to remind them of a related incident in which things went wrong; a good way to increase people’s confidence is to remind them of a similar situation in which everything worked out for the best." (p.26)

23/ "Overconfidence is pervasive. 90% of all drivers think they are above average behind the wheel.

"Nearly everyone thinks he has an above-average sense of humor.

"94% of professors at a large university were found to believe they were better than the average professor.

"Nearly everyone thinks he has an above-average sense of humor.

"94% of professors at a large university were found to believe they were better than the average professor.

24/ "About 50% of marriages end in divorce; this is a statistic most people have heard. But around the time of the ceremony, almost all couples believe that there is approximately zero chance that their marriage will end in divorce—even those who have already been divorced!

25/ "(a) What do you think is the chance of success for a typical business like yours?

"(b) What is your chance of success?

"The most common answers were 50% and 90%, respectively. Many said 100% to the second question.

"(b) What is your chance of success?

"The most common answers were 50% and 90%, respectively. Many said 100% to the second question.

26/ "Smokers are aware of the statistical risks and often even exaggerate them, but most believe that they are less likely to be diagnosed with lung cancer and heart disease than most nonsmokers.

"Unrealistic optimism characterizes most people in most social categories." (p. 31)

"Unrealistic optimism characterizes most people in most social categories." (p. 31)

27/ "Loss aversion + mindless choosing implies that the default designed option will attract a large market share. Default options thus act as powerful nudges.

"Consumers may also feel that default options come with an implicit endorsement from an employer/government." (p. 34)

"Consumers may also feel that default options come with an implicit endorsement from an employer/government." (p. 34)

28/ "Even experts are subject to framing. When doctors are told “90 of 100 are alive,” they are more likely to recommend the operation than for “10 of 100 are dead.”

"Busy people try to cope in a complex world when they cannot afford to think deeply about every choice." (p. 36)

"Busy people try to cope in a complex world when they cannot afford to think deeply about every choice." (p. 36)

29/ "In many situations, people put themselves into an “automatic pilot” mode.

"Eating turns out to be one of the most mindless activities we do. Many of us simply eat whatever is put in front of us.

"Large plates and large packages mean more eating; they work as major nudges.

"Eating turns out to be one of the most mindless activities we do. Many of us simply eat whatever is put in front of us.

"Large plates and large packages mean more eating; they work as major nudges.

30/ "If you would like to lose weight, get smaller plates, buy small packages of food, and don’t keep tempting food lying around.

"Millions of Americans still smoke in spite of evidence of terrible health consequences; almost all of them say they would like to quit." (p. 42)

"Millions of Americans still smoke in spite of evidence of terrible health consequences; almost all of them say they would like to quit." (p. 42)

31/ "David Gross and Nick Souleles (2002) found that the typical household in their sample had more than $5,000 in liquid assets (typically in savings accounts earning less <5% a year) and nearly $3,000 in credit card balances, carrying a typical interest rate of 18%+.

32/ "Using savings to pay off credit card debt is an arbitrage that the vast majority of households fail to take advantage of.

"This might not be as stupid as it looks. They may realize that if they paid off the credit cards, they would run up the cards to their limits again.

"This might not be as stupid as it looks. They may realize that if they paid off the credit cards, they would run up the cards to their limits again.

33/ "Credit card companies, aware of this, are willing to extend more credit to those who have reached the limit. Keeping the money in the separate accounts is thus a costly self-control strategy... a mental (or real) account where spending is not too big a temptation." (p. 52)

34/ "The typical Republican (Democratic) federal judge appointee shows liberal (conservative) voting patterns when sitting with two Democratic (Republican) appointees. Both vote far more moderately when sitting with at least one judge appointed by the other party's president.

35/ "Recent brain-imaging work has suggested that when people conform in Asch-like settings, they literally see the situation as everyone else does.

"People become more likely to conform when they know that other people will see what they have to say.

"People become more likely to conform when they know that other people will see what they have to say.

36/ "Sometimes people will go along with the group even when they think, or know, that everyone else has blundered. Unanimous groups are able to provide the strongest nudges—even when the question is an easy one, and people ought to know that everyone else is wrong." (p. 57)

37/ "A small pinpont of light was positioned at some distance in front of people. The light was actually stationary, but because of a perceptual illusion called the autokinetic effect, it appeared to move. Sherif asked people to estimate the distance that the light had moved.

38/ "When polled individually, subjects did not agree with one another, and their answers varied significantly from one trial to another (random error).

"But Sherif found big conformity effects when people were asked to act in small groups and to make their estimates in public.

"But Sherif found big conformity effects when people were asked to act in small groups and to make their estimates in public.

39/ "Here the individual judgments converged. A group norm, establishing the consensus distance, developed. Over time, the norm remained stable within particular groups, leading to a situation in which different groups made, and were strongly committed to, different judgments.

40/ "There is a clue here about how seemingly similar groups, cities, and even nations can converge on very different beliefs simply because of modest, arbitrary variations in starting points.

"In some experiments, he added a secret ally, unbeknownst to the people in the study.

"In some experiments, he added a secret ally, unbeknownst to the people in the study.

41/ "If the ally spoke confidently and firmly, his judgment had a strong influence on the group. If the ally’s estimate was much higher (lower) than those initially made by others, the group’s judgment would rise (fall).

"Unwavering people can move groups' beliefs.

"Unwavering people can move groups' beliefs.

42/ "The group’s judgments became thoroughly internalized: people would adhere to them even on their own, even a year later, and even when in new groups whose members offered different judgments.

"The initial judgments were also found to have effects across “generations.”

"The initial judgments were also found to have effects across “generations.”

43/ "When fresh subjects were introduced and others retired so that all participants were new, the judgment tended to stick, though the person originally responsible was long gone.

"A practice (like wearing ties) is likely to be perpetuated, even if there is no basis for it.

"A practice (like wearing ties) is likely to be perpetuated, even if there is no basis for it.

44/ "We may follow a tradition not because we like it or even think it defensible, but merely because we think most other people like it.

"Communism in the former Soviet bloc lasted partly because people were unaware how many others despised the regime." (p. 59)

"Communism in the former Soviet bloc lasted partly because people were unaware how many others despised the regime." (p. 59)

45/ "People are paying less attention to you than you believe. If you have a stain on your shirt, don’t worry, they probably won’t notice. But in part because people do think that everyone has their eyes fixed on them, they conform to what they think people expect." (p. 62)

46/ "Individuals were more likely to download songs that had been previously downloaded. Success was unpredictable: songs that did well or poorly in the control group, where people did not see other people’s judgments, could perform very differently in “social influence worlds.”

47/ "In those worlds, most songs could become popular or unpopular, with much depending on the choices of the first downloaders. The identical song could be a hit or a failure simply because other people, at the start, were seen to choose to have downloaded it or not." (p. 62)

48/ "Be wary of herd behavior. When your neighbor tells you that you can’t lose money, that is probably a good sign to get out.

"When people are influencing one another, dramatic upward market movements may produce serious risks for investors and the economy itself." (p. 66)

"When people are influencing one another, dramatic upward market movements may produce serious risks for investors and the economy itself." (p. 66)

49/ "Asking people whether they intend to vote increases the probability of their voting by 25%.

"A study of a nationally representative sample of 40,000 people asked, 'Do you intend to buy a new car in the next six months?' The very question increased purchase rates by 35%.

"A study of a nationally representative sample of 40,000 people asked, 'Do you intend to buy a new car in the next six months?' The very question increased purchase rates by 35%.

50/ "If people are asked how often they expect to floss, they floss more. If asked whether they intend to consume fatty foods, they consume less.

"Making objects salient can affect behavior. Seeing briefcases and boardroom tables makes people more competitive and less generous.

"Making objects salient can affect behavior. Seeing briefcases and boardroom tables makes people more competitive and less generous.

51/ "Exposure to the scent of an all-purpose cleaner makes people keep their environment cleaner while they eat. In both cases, people were not consciously aware of the effect of the cue on their behavior.

"The power of social influence can promote good (and bad) causes." (p.71)

"The power of social influence can promote good (and bad) causes." (p.71)

52/ "People need nudges for decisions that are difficult/rare, have delayed feedback, and have aspects that are hard to translate into easily-understood terms.

"For all their virtues, markets can give companies a strong incentive to cater to (and profit from) human frailties.

"For all their virtues, markets can give companies a strong incentive to cater to (and profit from) human frailties.

53/ "Self-control issues are most likely to arise when choices and their consequences are separated in time. At one extreme are what might be called investment goods, such as exercise, flossing, and dieting.

"Most of life's choices are not structured to provide good feedback.

"Most of life's choices are not structured to provide good feedback.

54/ "We usually get feedback only on the options we select, not those we reject.

"If you take the long route home every night, you may never learn of a shorter one.

"Someone can eat a high-fat diet for years without having any warning signs until the heart attack." (p. 77)

"If you take the long route home every night, you may never learn of a shorter one.

"Someone can eat a high-fat diet for years without having any warning signs until the heart attack." (p. 77)

55/ "When people have a hard time predicting how their choices will end up affecting their lives, they have less to gain by numerous options and perhaps even by choosing for themselves. A nudge might be welcomed." (p. 78)

56/ "Insurance products may have these fraught features. Benefits are delayed, the probability of having a claim is hard to analyze, consumers do not get useful feedback regarding returns, and the connecting what they are buying to what they are actually getting can be ambiguous.

57/ "If people realized that they were paying $20 for $2 expected value of insurance, they would not buy.

"Competition will not drive the price down: (1) it takes the salesperson time to persuade someone to overpay, and (2) it is difficult for third parties to enter this market.

"Competition will not drive the price down: (1) it takes the salesperson time to persuade someone to overpay, and (2) it is difficult for third parties to enter this market.

58/ "Firms may have more incentive to cater to consumers' irrational beliefs than to eradicate them.

"When people were still afraid of flying, it was common to see flight insurance sold at airports at exorbitant prices. There were no booths advising people not to buy it." (p.81)

"When people were still afraid of flying, it was common to see flight insurance sold at airports at exorbitant prices. There were no booths advising people not to buy it." (p.81)

59/ "We believe in supply and demand, but incentive conflicts can arise.

"In the U.S. health care system, services are chosen by the physician and paid for by the insurance company, with equipment manufacturers, drug companies, & malpractice lawyers taking a piece of the action.

"In the U.S. health care system, services are chosen by the physician and paid for by the insurance company, with equipment manufacturers, drug companies, & malpractice lawyers taking a piece of the action.

60/ "The most important modification that must be made to a standard analysis of incentives is salience. Do the choosers actually notice the incentives they face?

"Once someone purchases a car, he tends to forget about the $10,000 instead of seeing the opportunity cost.

"Once someone purchases a car, he tends to forget about the $10,000 instead of seeing the opportunity cost.

61/ "A taxi's cost is noticeable, with the meter clicking every few blocks.

"People may underweight the opportunity costs and depreciation and overweight the salient costs of the taxi.

"Good choice architects can take steps to properly direct people’s attention to incentives.

"People may underweight the opportunity costs and depreciation and overweight the salient costs of the taxi.

"Good choice architects can take steps to properly direct people’s attention to incentives.

62/ "Suppose your thermostat could tell you the cost per hour of lowering the summer temperature a few degrees. This could affect your behavior more than would quietly raising the price of electricity, a change experienced only at the end-of-month when the bill comes." (p. 101)

63/ "Madrian and Shea (2001): retirement plan participation rates under the opt-in approach were barely 20% after 3 months of employment, increasing to 65% after 36 months.

"With automatic enrollment, enrollment of new employees jumped to 90% and increased to 98% in 36 months.

"With automatic enrollment, enrollment of new employees jumped to 90% and increased to 98% in 36 months.

64/ "One company switched from an opt-in regime to active decisions [forcing all employees to check a box] and found that participation rates increased by 25 percentage points.

"A related strategy is to simplify the enrollment process.

"A related strategy is to simplify the enrollment process.

65/ "The more options in the plan, the lower the participation rates. The process becomes more confusing, and some people refuse to choose anything.

"Save More Tomorrow invites participants to commit in advance to contribution increases timed to coincide with pay raises.

"Save More Tomorrow invites participants to commit in advance to contribution increases timed to coincide with pay raises.

66/ "By synchronizing pay raises and savings increases, participants never see their take-home amounts go down,

"Most who enrolled stuck with it for the full four raises, whereupon the increases were halted because the employees had reached the maximum allowable contribution.

"Most who enrolled stuck with it for the full four raises, whereupon the increases were halted because the employees had reached the maximum allowable contribution.

67/ "The few employees who left the program did not ask that their savings rates be dropped back to the earlier low levels. Instead, they just stopped increasing their contribution rates.

"Automatic enrollment in Save More Tomorrow increases enrollment rates from 23% to 78%.

"Automatic enrollment in Save More Tomorrow increases enrollment rates from 23% to 78%.

68/ "These initiatives have been entirely a private-sector phenomenon: automatic enrollment without any nudging from the government.

"The primary role government needed to play was getting out of the way by reducing the barriers to adoption of these programs." (p. 117)

"The primary role government needed to play was getting out of the way by reducing the barriers to adoption of these programs." (p. 117)

69/ "Financial economist and Nobel laureate Harry Markowitz (one of the founders of modern portfolio theory) confessed: “I should have computed the historic covariances and drawn an efficient frontier. Instead, I split my contributions 50:50 between bonds and equities.” " (p.124)

70/ On naïve diversification: "University employees were asked how they would invest their retirement money if they had just two funds to choose from. In one condition, one of the funds invested entirely in stocks, the other in bonds. Most of the participants chose half and half.

71/ "Another group could choose between a stock fund and a “balanced” fund (half stocks, half bonds). They followed 1/n and divided their money evenly—effectively mostly stocks.

"A third group could choose between a balanced fund and a bond fund. You can guess what they did.

"A third group could choose between a balanced fund and a bond fund. You can guess what they did.

72/ "For the retirement saving plans of 170 companies, the more stock funds offered, the greater the percentage of participants’ money invested in stocks.

"One study investigated the behavior of participants in a plan that offered three lifestyle funds and six other funds.

"One study investigated the behavior of participants in a plan that offered three lifestyle funds and six other funds.

73/ "Participants who invested in the conservative lifestyle fund allocated 31% to that fund, dividing the rest among the other funds. Because the menu was dominated by stock funds, the resulting stock exposure was 77%: a fairly aggressive portfolio." (p. 127)

74/ "Prestwood was loyal to the bitter end. When he retired in 2000, he had accumulated $1.3 million of Enron shares. Then, at age sixty-eight, Prestwood suddenly lost his entire Enron nest egg. He now survives on a previous employer’s pension of $521/month and Social Security.

75/ "He lives on a three-acre farm north of Houston willed to him as a baby after his mother died. Now he’ll sell his family’s land. Has to, he says. He is still paying off his mortgage.

"Five million Americans have more than 60% of their retirement savings in company stock.

"Five million Americans have more than 60% of their retirement savings in company stock.

76/ "Despite a high level of awareness of the Enron experience, half of respondents thought their own company stock carried ≤ risk than a money market fund. Only 1/3 of the respondents who owned company stock realized that it is riskier than a fund with many different stocks.

77/ "You might think that employees have especially good information about their firm’s future prospects, but a careful study by Shlomo Benartzi (2001) finds otherwise. Specifically, there is no correlation between the allocation to company stock and subsequent stock performance.

78/ "Employees who receive an employer’s matching contribution in company stock view that contribution as implicit advice. Those who are required to take the employer’s match in the form of company stock allocate 29% of their discretionary contributions to company stock.

79/ "By contrast, those who have the option, but not the requirement, to take the employer’s match in the form of company stock allocate only 18% of their own funds to company stock.

"Workers would be much better off with a diversified mutual fund." (p. 129)

"Workers would be much better off with a diversified mutual fund." (p. 129)

80/ "More options can make borrowers better off, but only if they are able to do a good job of picking the loan that is best suited to their situation and preferences.

"Woodward studied which kinds of borrowers got the best deals after controlling for other factors.

"Woodward studied which kinds of borrowers got the best deals after controlling for other factors.

81/ "Borrowers who live in neighborhoods where adults have only a high school education pay more for their loans.

"Loans made by mortgage brokers are more expensive than those made by direct lenders.

"Loans made by mortgage brokers are more expensive than those made by direct lenders.

82/ "Sources of loan complexity, such as points and seller contributions to closing costs (which can make comparing loans more difficult), are expensive for borrowers, and the additional cost is greater on brokered loans than on direct loans.

83/ "When markets get more complicated, unsophisticated and uneducated shoppers will be especially disadvantaged. Unsophisticated shoppers are also more likely to be given bad or self-interested advice by people serving in roles that appear to be helpful and purely advisory.

84/ "Risky borrowers pay higher rates to compensate lenders; this does not make loans “predatory.”

"The microfinance loans in developing countries that led to a Nobel Peace Prize for Muhammad Yunus often come with interest rates of 200%+, yet the borrowers are made better off.

"The microfinance loans in developing countries that led to a Nobel Peace Prize for Muhammad Yunus often come with interest rates of 200%+, yet the borrowers are made better off.

85/ "So subprime lending is neither all good nor all bad. It makes it possible for some poor or high-risk families to become homeowners or business owners.

"But subprime borrowers are often unsophisticated and are sometimes exploited by brokers.

"But subprime borrowers are often unsophisticated and are sometimes exploited by brokers.

86/ "Points allow borrowers to pay a fee (which is added to the total amount borrowed) in exchange for a lower interest rate, but few borrowers are capable of figuring out whether the points are worth paying. (Hint: usually they are not.)" (p. 136)

87/ "The combination of loan guarantee and subsidy by the government makes student loans exceptionally profitable.

"Lenders have engaged in rent-seeking: if there are high profits to be made, suppliers are willing to spend a lot of time and money to get that business.

"Lenders have engaged in rent-seeking: if there are high profits to be made, suppliers are willing to spend a lot of time and money to get that business.

88/ "Because excess profits are available to the lenders who snag the student loan business, there are temptations to do whatever it takes to get to the head of the line.

"As with mortgages, this example illustrates the problem with directing people to seek “expert” advice.

"As with mortgages, this example illustrates the problem with directing people to seek “expert” advice.

89/ "The adviser they consult has a treasure—confused customers. The opportunity to fleece confused customers is valuable.

"If borrowers could compare loans more easily, then the price competition that was hoped for might actually emerge." (p. 143)

"If borrowers could compare loans more easily, then the price competition that was hoped for might actually emerge." (p. 143)

90/ On home-country bias: "When it comes to investing, buying what you think you know does not necessarily make sense. As we saw in the previous chapter, employees buying shares of the company for which they work show no ability to make profitable trading decisions." (p. 152)

91/ "Only a small proportion of fund advertising can be construed as directly informative about characteristics relevant for rational investors, such as funds’ fees.

"Nevertheless, fund advertising strongly affected investors’ portfolio choices.

"Nevertheless, fund advertising strongly affected investors’ portfolio choices.

92/ "Fund advertising steered people into portfolios with lower expected returns (because of higher fees) and higher risk (through a higher exposure to equities, more active management, more “hot” sectors, and more home bias)." (p. 156)

93/ "The invisible hand works best when products are simple and purchased frequently. A dry cleaner who loses shirts or doubles prices will not be in business long.

"It may be different for a mortgage broker who fails to point out that the teaser rate will suddenly disappear.

"It may be different for a mortgage broker who fails to point out that the teaser rate will suddenly disappear.

94/ “From the point of view of liberty, there is a serious danger of overreach, and therefore grounds for caution. Politicians, after all, are hardly strangers to the art of framing the public’s choices and rigging its decisions for partisan ends.“

95/ "We should be worried about all choice architects, public and private alike.

"We would love to see similar principles used to monitor governments. Require government officials to put all their votes, earmarks, and contributions from lobbyists on their Web sites." (p. 242)

"We would love to see similar principles used to monitor governments. Require government officials to put all their votes, earmarks, and contributions from lobbyists on their Web sites." (p. 242)

96/ "One of the main lessons from psychology is that it is impossible for informational and educational campaigns to be “neutral,” regardless of how scrupulously designers try to achieve that goal." (p. 245)

97/ "Asymmetric paternalism designs policies that help the least sophisticated people while imposing the smallest possible costs on the most sophisticated. (Libertarian paternalism is a form in which the costs imposed on the sophisticated are kept close to zero.)" (p. 252)

98/ "We designed a plan to discipline people who make outrageously confident statements: Following any factual claim, another member of the group can challenge it. The initiator has to either withdraw his claim or accept a $50 “standard bet” predetermined by the group." (p. 265)

99/ Related reading:

The Undoing Project (Lewis)

Superforecasting: The Art and Science of Prediction (Tetlock, Gardner)

Thinking in Bets: Making Smarter Decisions When You Don't Have All the Facts (Duke)

The Undoing Project (Lewis)

https://twitter.com/ReformedTrader/status/1317876706414227457

Superforecasting: The Art and Science of Prediction (Tetlock, Gardner)

https://twitter.com/ReformedTrader/status/1326234446668812288

Thinking in Bets: Making Smarter Decisions When You Don't Have All the Facts (Duke)

https://twitter.com/ReformedTrader/status/1302337159303540737

• • •

Missing some Tweet in this thread? You can try to

force a refresh