So, what is BTC doing right now? I don’t *know* what’s driving a lot of it directionally (I do have theories, of course, but I don’t exactly know), but given that “up” is the direction it’s chosen to go in general, there is some headway I can make in dissecting what’s going on.

So, first off, why “up”? There’s been a lot of discourse about this -- some reasons for BTC to go up I’ve seen postulated include lots of institutional buying, increased adoption, “whales,” outflows from faddish products back into BTC, influence from other markets, etc.

My take would be: eh probably a combination. I do think that Biden’s victory and the vaccines were net good for e.g. SPY which has both short- and long-term correlation to BTC in the COVID era, which contributed.

And there are also legit a lot of traditional companies / entities -- banks, hedge funds, random rich people, thought leaders, tech companies, Wyoming senators, etc. -- signaling support for BTC, which both directly (buying) and indirectly (sentiment) influences its price up.

(Either that, or, you know, SUSHI is secretly the best BTC leader around -- gold and SPY have both felt a little lacking on short timescales of late, after all.)

So, sure, it makes sense that BTC’s gone up. These effects at least explain why it started, anyway -- but man, it’s up a LOT. Do they tell the whole story? I think probably not -- I think that, as usual, liquidations and crypto’s landscape of high leverage tell the rest.

Look carefully at the graph for the past few days -- BTC isn’t sort of zig-zagging, going up a bit, down a bit, up a good amount, down a bit, up a bit, up a bit more, down a bit, up a bit, etc. No -- it’s going up a LOT (for hours), then down a LOT, then up a LOT.

This is referred to as momentum. In physics, momentum is the tendency of an object in motion to keep moving (in the same direction) -- the same is true in trading. If BTC is moving with momentum, then it’s tending to move a LOT in a given direction when it moves at all.

Which it is! It’s bounding %s and %s before reverting. Sometimes this movement is over many hours, like the run-up yesterday -- sometimes it’s over a few minutes, like the crash earlier today to 17200. But the moves are BIG, and they tend to compound.

Why’s that happening? The hours-long one is partially attributable to a FOMO effect, sure. But both that and the shorter-timescale ones are DEFINITELY partially from liquidations. The BitMEX BTC perps are involved, as usual, but other platforms have seen a TON, too.

(Liquidations lead to momentum because: BTC moves up, some shorts get liquidated, that triggers market buys, causing BTC to go up, causing shorts to get liquidated, causing BTC to go up, etc. etc.)

This was happening for the entire hours-long run-up yesterday -- levered shorts on BitMEX, Binance, OKEx, Huobi, etc. were all getting liquidated, causing what were already big gains upward to compound because of more forced buying.

And if there was FOMO, that would get compounded too! Because in addition to organic buying, lots of inorganic buying happened for any FOMOers to be jealous of. This kept happening *all* day -- millions and millions of dollars of shorts got “rekt.”

Now, you can see BTC leveled out around 17700 for a while before taking a momentum-driven ride to 18400. And all the while, a TON of new contracts were getting opened on all these platforms at REALLY aggressive prices -- buying, of course.

That led to a spot where, if those longs were really levered up and BTC fell down a bit, they’d get liquidated, too. And the same went for all the longs opened lower (say, on the way up from sub-17k) if things got low enough.

So, BTC did fall down a little from its peak, to 18250 or so -- and I guess some people were REALLY levered up, because this triggered a HUGE liquidation cascade. $70m USD of long positions got liquidated on BitMEX alone, and another $70m or so across more markets.

(This is rampant in crypto because of popular 100x leverage is -- you never see things like this in traditional finance.)

This sent BTC down FAST to 17200 -- as expected, if you were thinking about what happens after a ton of open interest arises. BTC then recovered some -- and contracts were opened on the way up, and AGAIN it fell pretty fast from liquidations!

And this time, on the way down -- slower this time -- you guessed it, lots of new short contracts got opened aggressively (this is on the way from 18200 to 17400, a few hours ago). And so … when BTC recovered a little, more liquidations happened, helping drive it back up.

(Though there were way fewer liquidations for the last few moves than for the huge fast crash -- as you’d guess, given the speed -- this recovery, e.g., seemed more driven by “sentiment” or FOMO, which is also momentum-y, but liquidations were in the mix.)

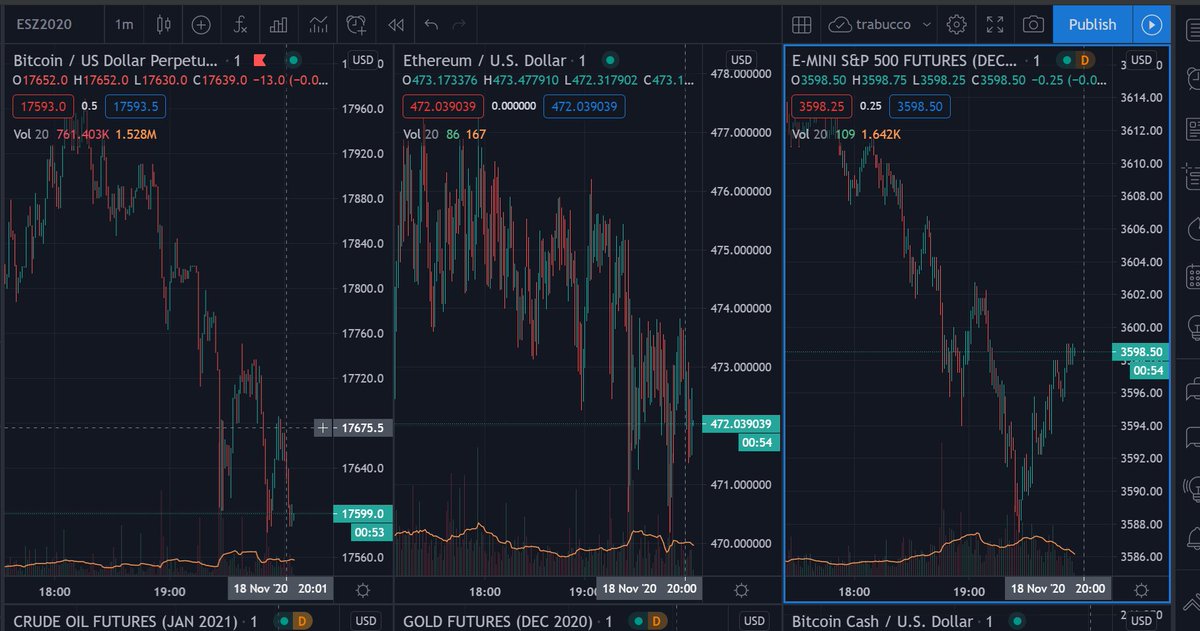

And now? It’s been calm for a few hours, and seemingly SPY or something has taken over again (BTC’s short-term beta from the traditional products has been picking up again for the past few hours, anyway).

So it’s really hard to say! I think BTC is still primed for a lot of potential volatility if things start moving again, though (as I’m writing this BTC did fall 1%, which actually feels really mundane at this point).

I mostly focused on BTC here -- DeFi surged before BTC did and has been muted during the BTC rally, while major alts have under-performed BTC but still performed OK, mostly. Hard to say what to expect from those products -- many are idiosyncratic.

You can do a deep-dive on some of them and see they had similar liquidation-driven moves to what I outlined here, in addition to broader crypto moves they followed to varying extents. I’ve seen speculation of an “alt season” coming post-BTC -- we’ll see!

I don’t have a strong opinion about it, or about what direction any particular coins are going in the short term. As usual, all I expect is for things to change fast, and for being vigilant / open to considering lots of possibilities to pay off -- as they did here and always do.

Update: SPY did in fact drive BTC down a bit into some liquidations which made it go down more than SPY, basically as you'd expect. Then BTC recovered -- as you'd expect from a narrative like "no one actually wanted to sell that low so people bought," and now it's wiggling a bit.

• • •

Missing some Tweet in this thread? You can try to

force a refresh