Did a tour through the RBLX S1, and couldn’t resist jotting down what I learned about an amazing business and company that I think is among the most interesting in gaming: (1/x)

First, not going to rehash the Metaverse thesis and what Roblox does - a lot of ink has already been spilled here. Needless to say Roblox is one of a few current companies that has a real shot on the Metaverse goal and is a deeply interesting social gaming space.

In particular, I think what Roblox gets really right is how easily it empowers users to create both gaming content and experiences. Decentralization of content creation is a huge part of how we get to the metaverse, and in this respect, Roblox is ahead of Fortnite and MInecraft.

On to the numbers! Thanks to ASC 606, we can completely ignore reported revenue and margins. The right way to think about this business is that bookings = revenue and operating free cash flow = EBITDA. Been awhile since I've seen a business that distorted so badly by accounting.

On this basis, RBLX is likely going to finish 2020, assuming somewhat normal seasonality, at ~$1.85 bn in revenue, up 165% YoY, and about $550 million of EBITDA assuming 35% flow through.

So that’s a very big, very profitable business, growing very rapidly. How did they get here? Luckily, the S1 pulls back the curtain a bit on audience, engagement and monetization trends, which show a business in the middle of a clear upward inflection.

Using 3Q20 as the benchmark:

Audience: DAU is up 100% YoY to 36 million

Engagement: daily hours played per DAU hit 2.7, up 24% YoY

Stickiness: using MAU reported elsewhere, I estimate DAU/MAU at 22%, up from ~18% a year ago

Monetization: quarterly ABPDAU (yas!) is up 52% YoY.

Audience: DAU is up 100% YoY to 36 million

Engagement: daily hours played per DAU hit 2.7, up 24% YoY

Stickiness: using MAU reported elsewhere, I estimate DAU/MAU at 22%, up from ~18% a year ago

Monetization: quarterly ABPDAU (yas!) is up 52% YoY.

Few things stick out to me. First, monetization growth in excess of engagement growth is quite bullish -- those are usually correlated, but not usually to this degree. It’s a great sign that user monetization in the platform is in the early innings.

I suspect there is significant latent demand in the current user base as experiences available within the platform mature. At 15 cents a day, even given the audience demo, I think there are paths to drive this significantly higher over time.

Second, DAU/MAU at ~20% is surprisingly low. This measure has some limitations, but generally successful social games/social networks boast DAU/MAUs >50%. This is especially interesting with average daily playtime of 2.7 hours, which is a LOT.

Games with those sort of daily time spent metrics usually have significantly higher stickiness. I’m not totally clear on what’s happening here -- one possible interpretation is kids are going ham on the weekend, but not playing much during the week.

However, if that was the case, I probably would have expected stickiness to grow more significantly during Covid lockdown. The other interpretation is that there is a large halo of low-commitment users and a core of incredibly high-commitment users which are distorting metrics.

Anyone have any ideas? Either way, I would be very surprised if Roblox’s roadmap doesn’t include some key bets on improving stickiness, and any success here could further inflect audience meaningfully.

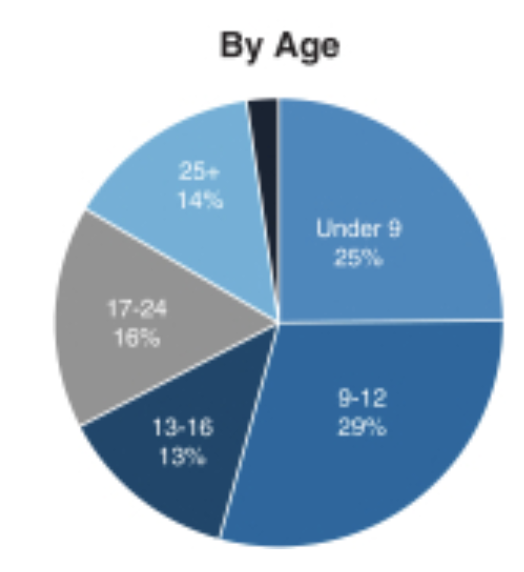

I'm surprised to see ~50% of both audience and time spent comes from ages 13+, and that the 13+ audience is growing faster than the 13- audience. This is bullish. I would bet Roblox can find a way to not only grow with their audience, but to take share in 18+ over time.

Sadly, no real disclosure on retention, other than an accounting driven disclosure of 23 months estimated customer life. I don't think this is real for a variety of reasons, not the least of which is 70% of their users only joined in the last 2 years!

https://twitter.com/pinchedforgrowf/status/1329623955389366273

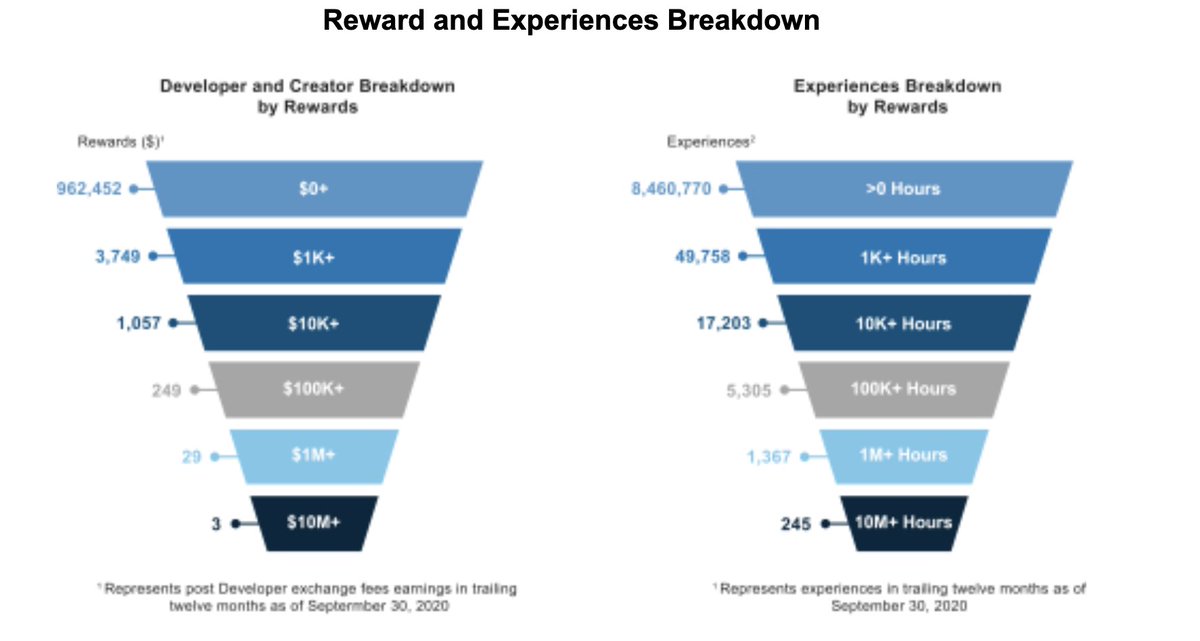

Moving onto the creator/developer ecosystem: the stats here suggest an ecosystem still in its infancy. Roblox will have paid out ~$250 million (~17% of bookings in the last 12 months to its ecosystem of almost a million devs/creators.

This is remarkable, but it’s so top-heavy: the top ~280 creators (0.03%) captured 35-40% of payouts. Moreover, of the 12 million accessed experiences, which cumulatively drove ~25 billion hours of content consumption, 245 experiences (0.002%) drove 10%+ of all content consumed.

It’s not really surprising - similar winner-take-all dynamics play out on most of the UGC platforms (and in gaming more broadly). That said, I would love to learn how these metrics compare to Youtube, Twitch, and other like platforms at similar maturity. Roblox seems extreme.

A single game (Adopt Me) occupied ~23% of CCU in October. The next 5 biggest games took another 30%. This is probably not ideal, though my bias is once you're invested in the platform, the composition of your playtime doesn't really matter ranmo.me/blog/the-algae…

Said differently, the explosive virality of product on Roblox is probably a feature, not a bug. The explosion grows TAM, and when the product's popularity wanes, other experiences will rush in to fill the void. The user doesn't stop playing on the platform.

Lot of examples of this in gaming, e.g. Nintendo's first party strategy, with attach rate of Zelda & Mario Kart on Switch at ~30%. On mobile, Candy Crush massively expanded the gaming TAM, and when its popularity decline, those users just found new games, etc., etc.

Back to RBLX for a few more thoughts: the valuation here could get pretty large -- even assuming growth moderates, this will be a significantly bigger and more profitable business next year. It’s not too hard to envision a path to $1bn in free cash flow.

The story is extremely sexy, and it's the only real pure play public Metaverse play. There is a scarcity of these sort of assets. Epic last raised at $17 billion. Once RBLX is public, that will look very low. This will create a halo effect on gaming valuations more broadly.

Looking forward to more takes on this one! @juliey4 @GavinSBaker @ballmatthew @eric_seufert @compound100x @mariodgabriele

• • •

Missing some Tweet in this thread? You can try to

force a refresh