Forgiving US student debt is a no-brainer: as a nation, America has saddled its best-educated young people with a lifetime of debt whose interest serves the parasitic rentier economy while suppressing their ability to use those education to our collective benefit.

1/

1/

The pathetic argument that opponents have mustered is that forgiving student debt is unfair to the people who paid off their debts through sacrifice and hard work - in the same way that a covid treatment is unfair to people who recovered through sheer immunoresponse.

2/

2/

In his analysis, "The Student Debt Crisis is a Crisis of Non-Repayment," @Econ_Marshall demonstrates the hollowness of this objection. First, he observes that we are already forgiving student debt, at unprecedented levels, in the worst way possible.

phenomenalworld.org/analysis/crisi…

3/

phenomenalworld.org/analysis/crisi…

3/

As more and more people are unable to repay their student loans after years - decades - of struggle and misery, lenders are erasing those debts at levels never seen before. But the "lucky duckies" on the receiving end of this forgiveness pay a dire price.

4/

4/

Student debts are effectively impossible to discharge through bankruptcy. Congress consistently failed to fix this - whenever they've acted, they've made it worse. If you hold someone's student debt, you hold all the cards - you can even go after their social security.

5/

5/

So when you learn that a student debtor has managed to default on their loans, what you're learning is that they have arrived at a place of such manifest, helpless hardship that not even the student loan arm-breakers think they can get another nickel out of them.

6/

6/

But that's not all: when you get your student loans forgiven, it's a taxable benefit! So if you really, really can't pay back your loans, your prize is getting stuck with a giant tax bill you really, really can't pay.

7/

7/

In other words, America has an active, giant, terribly run, ad-hoc, cruel student debt forgiveness program that kicks in only after you've had your life destroyed, then punches you in the face on your way out the door.

8/

8/

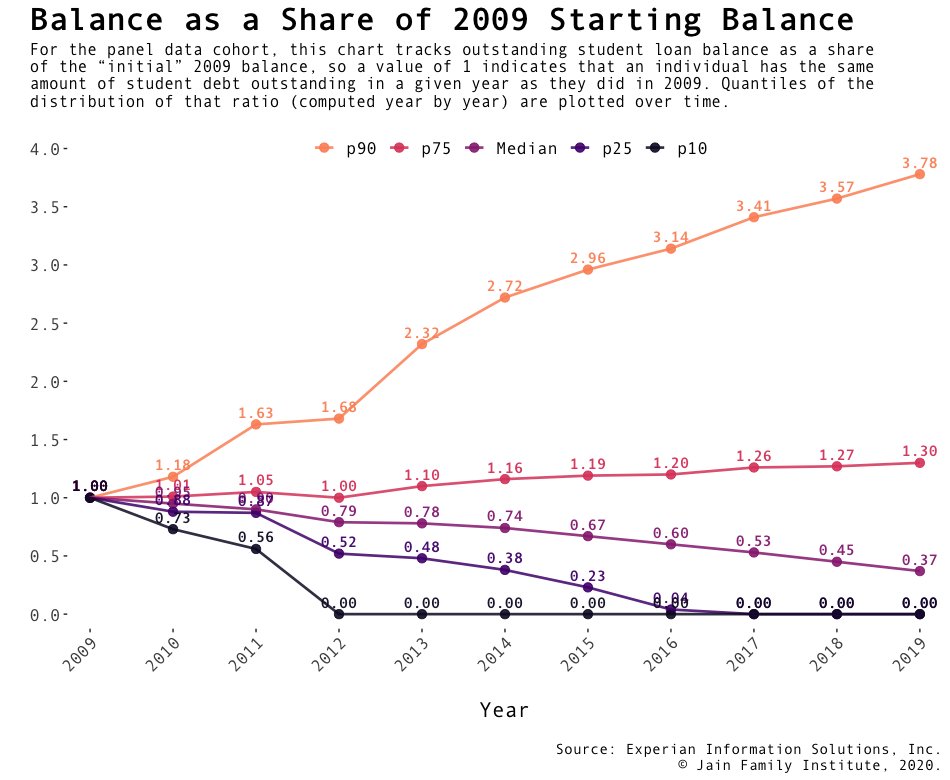

Steibaum uses the latest figures from the Millennial Student Debt project to zero in on how the shadow debt-forgiveness program works, and who is in line to win the booby prize of being so badly tormented by debt that they qualify:

phenomenalworld.org/analysis/mille…

9/

phenomenalworld.org/analysis/mille…

9/

It will not surprise you to learn that the people suffering most from college debt are brown and Black, and that they are older than at any time in history, because it is taking longer than ever to pay back your student loans.

10/

10/

Steinbaum has an explanation for how this happened: the rise of income-driven repayment (IDR) programs that indexed your monthly student loan payments to your income.

11/

11/

These addressed student debt as a LIQUIDITY problem. That is, treating recent grads as though all they needed was a little breathing room until they got good jobs.

But those good jobs didn't appear.

12/

But those good jobs didn't appear.

12/

Workforces (including professionals with four-year degrees) have been increasingly squeezed by "monopsony" (like monopoly, but referring to a lack of competition in buyers). As industries have grown consolidated, they can rope workers into lower wages.

13/

13/

That means that even after a grad gets a "good industry job," their income is so low that their IDR-based repayment is so low that they will NEVER pay off their student debts, as interest mounts ahead of repayment.

14/

14/

Student debtors aren't ILLIQUID. They're INSOLVENT. Their total liabilities exceed their lifetime ability to pay. As Michael Hudson says, "Debts that can't be paid, won't be paid."

But that's not the whole story. IDRs are also a moral hazard.

15/

But that's not the whole story. IDRs are also a moral hazard.

15/

As IDRs expanded, so did tuition. Universities conned students into taking on unsustainable debt, promising them that IDRs meant no matter how much debt they had, their payments wouldn't gobble their whole paycheck. It was true! Also true: they will never pay off that debt.

16/

16/

Student debt should be forgiven. Now. And state college tuition should be free. The main beneficiaries of these measures would be Black and brown people, who are also the disproportionate targets of university predatory lending.

17/

17/

As Steinbaum writes, the alternative - capping loans - leads to discrimination (excluding poor kids from top schools). The students with best prospects will evade loan caps by taking out even higher-priced private loans, while others will be excluded from postsecondary ed.

eof/

eof/

• • •

Missing some Tweet in this thread? You can try to

force a refresh