1/ Empty Set Dollar ($ESD) [@emptysetsquad]

The first such asset to simultaneously serve as a Store of Value (SOV), stablecoin and a speculative asset

An incredibly asymmetric and reflexive opportunity

The first such asset to simultaneously serve as a Store of Value (SOV), stablecoin and a speculative asset

An incredibly asymmetric and reflexive opportunity

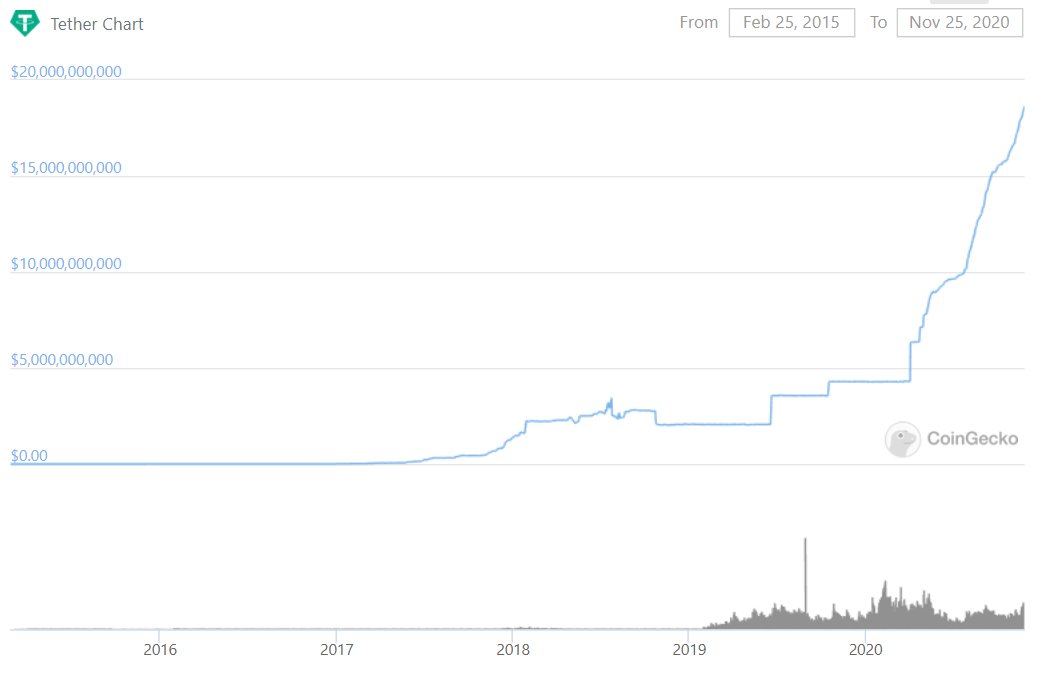

2/ Stablecoins were the first crypto products that achieved product-market fit at scale after Bitcoin

Stablecoin growth is currently parabolic (USDT alone approaching $20B) and will be the first crypto sector to achieve mass adoption

Stablecoin growth is currently parabolic (USDT alone approaching $20B) and will be the first crypto sector to achieve mass adoption

3/ So we're all bullish on stablecoins, but traditionally it's been very difficult to gain exposure to their growth

- Tether (USDT) and Circle (USDC) are private companies whose shares trade extremely thinly OTC

- $MKR is a poor proxy of DAI growth (DAI up, MKR sideways)

- Tether (USDT) and Circle (USDC) are private companies whose shares trade extremely thinly OTC

- $MKR is a poor proxy of DAI growth (DAI up, MKR sideways)

4/ Enter $ESD, a decentralized elastic supply stablecoin where supply growth directly translates into returns for $ESD stakeholders

i.e. if the market cap of $ESD increases from $100M to $1B, the $900M increase is reflected in the increased portfolio value of stakers

i.e. if the market cap of $ESD increases from $100M to $1B, the $900M increase is reflected in the increased portfolio value of stakers

5/ Why is this important?

$ESD would potentially be the first scalable censorship resistant stablecoin built for exchange

The two closest candidates would be $DAI and $sUSD but they don't cut it

This is a multi-billion dollar opportunity ($10B-$100B+)

$ESD would potentially be the first scalable censorship resistant stablecoin built for exchange

The two closest candidates would be $DAI and $sUSD but they don't cut it

This is a multi-billion dollar opportunity ($10B-$100B+)

6/ $DAI is now backed by centralized collateral (USDC, wBTC, etc)

$sUSD is censorship resistance, but if it was widely used as a medium of exchange (MoE) are, that weakens the system it is built off of (@synthetix_io) as the synth supply needs to be actively traded through sX

$sUSD is censorship resistance, but if it was widely used as a medium of exchange (MoE) are, that weakens the system it is built off of (@synthetix_io) as the synth supply needs to be actively traded through sX

7/ $ESD may seem similar to other elastic supply stablecoins such as $AMPL and Basis, but it better in many ways. Namely:

- Stable portfolio value

- Two token system

- Composable / Superfluid Collateral

- Distributed Supply (Satoshi style launch)

- Stable portfolio value

- Two token system

- Composable / Superfluid Collateral

- Distributed Supply (Satoshi style launch)

8/ $AMPL achieves its $1 target via system wide state modifications (rebases). The issue is that even if $AMPL trades close to $1, your portfolio value can go down even when just holding making it not so stable

9/ $ESD fixes this by replacing rebases with a system of coupons and rewards

Speculators that play the coupon game can risk more to win more. Those that don't want to take risk can simply bond $ESD and have their portfolio value either stay the same or increase (w/ rewards)

Speculators that play the coupon game can risk more to win more. Those that don't want to take risk can simply bond $ESD and have their portfolio value either stay the same or increase (w/ rewards)

10/ $ESD was actually inspired by the Basis design but implemented many protocol improvements leading to greater efficiency. For example the three token system moving to a two token system where the stablecoin serves as both the MOE and speculative asset and shortened cycles

11/ One of the biggest advantages of $ESD since it doesn't rebase is that it can easily serve as a money lego to be plugged into other protocols (all AMMs, money markets, etc.) This is smth $AMPL has struggled with.

A vote has already passed to create a Curve Metapool

A vote has already passed to create a Curve Metapool

12/ This was by far the most voted on proposal for @CurveFinance so far. With it's potential to become premium collateral, it can serve as one of the foundational building blocks within DeFi

gov.curve.fi/t/scip-11-add-…

gov.curve.fi/t/scip-11-add-…

13/ The most exciting thing is the quantity and quality of DeFi gigabrains that have been very involved: @will__price @delitzer @rleshner @scott_lew_is @_wilbur4ce_ @LewisFreiberg etc

The current design might not be perfect, but this is the community that could get it there

The current design might not be perfect, but this is the community that could get it there

14/ Not only is the community iterating on the protocol but building a fascinating ecosystem of tools and projects around it

I've always been skeptical of algorithmic stablecoins but $ESD has the highest potential of any I've seen and the first time I've been excited about one

I've always been skeptical of algorithmic stablecoins but $ESD has the highest potential of any I've seen and the first time I've been excited about one

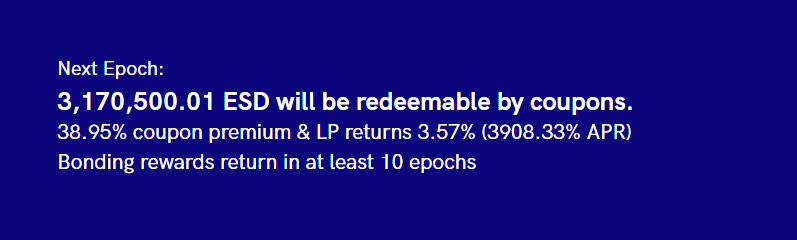

15/ Of course we can't forget what everyone cares about - the absurd farming yields:

During max expansions, this works out to around 3% / epoch (8 hours) - 5000%+ APY

Currently, the yield is 1.66%/epoch. Still not bad.

During max expansions, this works out to around 3% / epoch (8 hours) - 5000%+ APY

Currently, the yield is 1.66%/epoch. Still not bad.

16/ Learn more or miss out:

Website: emptyset.finance/#/

EIPs: emptyset.xyz/t/eip-1-improv…

Medium: medium.com/@emptysetsquad

Discord: discord.com/invite/vPws9Vp

ESD Tools: esd.tools

Dune: explore.duneanalytics.com/dashboard/empt…

Website: emptyset.finance/#/

EIPs: emptyset.xyz/t/eip-1-improv…

Medium: medium.com/@emptysetsquad

Discord: discord.com/invite/vPws9Vp

ESD Tools: esd.tools

Dune: explore.duneanalytics.com/dashboard/empt…

17/ Articles/Video:

- soligo.substack.com/p/the-empty-se…

- medium.com/@lewisfreiberg…

- complementcap.substack.com/p/the-empty-se…

-

- soligo.substack.com/p/the-empty-se…

- medium.com/@lewisfreiberg…

- complementcap.substack.com/p/the-empty-se…

-

18/ ESD 2.0 featuring zero-coupon bond system by @will__price and @scott_lew_is

medium.com/@scott_lew_is/…

medium.com/@scott_lew_is/…

Discord: discord.com/invite/vPws9Vp

• • •

Missing some Tweet in this thread? You can try to

force a refresh