Sorry got the name wrong, it's not cup and handle, it's a cup (sideways pattern) after a run-up of probably 50%+ before it's occurrence. This set up is called powerplay.

Will also post some examples of this.

Will also post some examples of this.

https://twitter.com/Traderknight007/status/1334087413774348288

The power play setup.

some traits that are required for a valid power-play setup are-

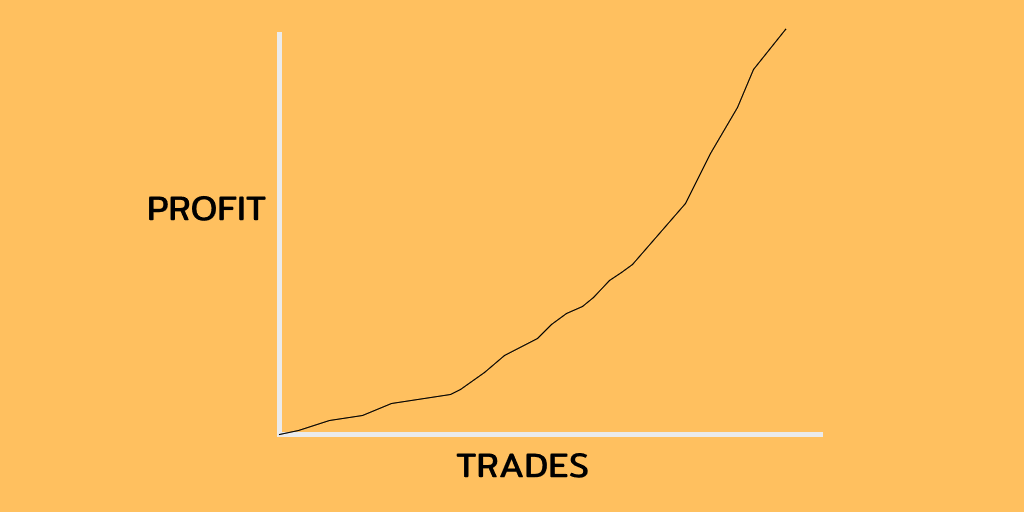

1.Stock should be up more than 50% from the lows.

2. The rise period should be less than 4-6 weeks.

3.Pullback (sideways pattern or cup) should be less than 0.38 retracement level. the deeper

some traits that are required for a valid power-play setup are-

1.Stock should be up more than 50% from the lows.

2. The rise period should be less than 4-6 weeks.

3.Pullback (sideways pattern or cup) should be less than 0.38 retracement level. the deeper

the pullback the worse it gets.

4. 7-10 days of sideways action is required for this pattern to be valid.

5.Buying level is above the midpoint of the cup.

7.The reason for saying that a pullback less than 38% is better because it shows that there is demand even at high levels.

4. 7-10 days of sideways action is required for this pattern to be valid.

5.Buying level is above the midpoint of the cup.

7.The reason for saying that a pullback less than 38% is better because it shows that there is demand even at high levels.

8.If the stock pullbacks more than 0.38 retracement, then it has less chance of giving good returns.

9. Sl will be twice of 20 day ATR.

There is also another form of this pattern which is called squat entry which I will talk about on some other day.

9. Sl will be twice of 20 day ATR.

There is also another form of this pattern which is called squat entry which I will talk about on some other day.

Shallow pullbacks are preferred in this setup because it shows that the stock has demand even on high prices, and because we are not waiting for the cup to complete, so using shallow pullback will increase the chance of success for the trade.

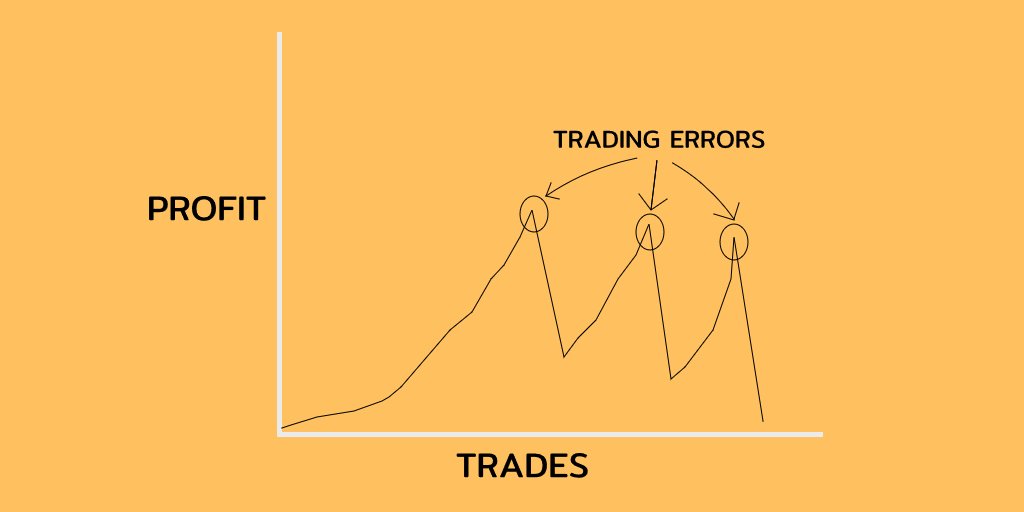

Failed trade also attached.

Failed trade also attached.

• • •

Missing some Tweet in this thread? You can try to

force a refresh