1/ In this thread, I'll cover the things you do regularly during trading in terms of **execution** and how to approach execution from the perspective of automation.

#TradingAutomation

#TradingAutomation

https://twitter.com/theBuoyantMan/status/1333831678255456257

2/ You may think execution is easy.

But that is only because you are attuned to it and you don't pay mindful attention to the sheer number of actions and decisions you take throughout the trading day, in terms of execution.

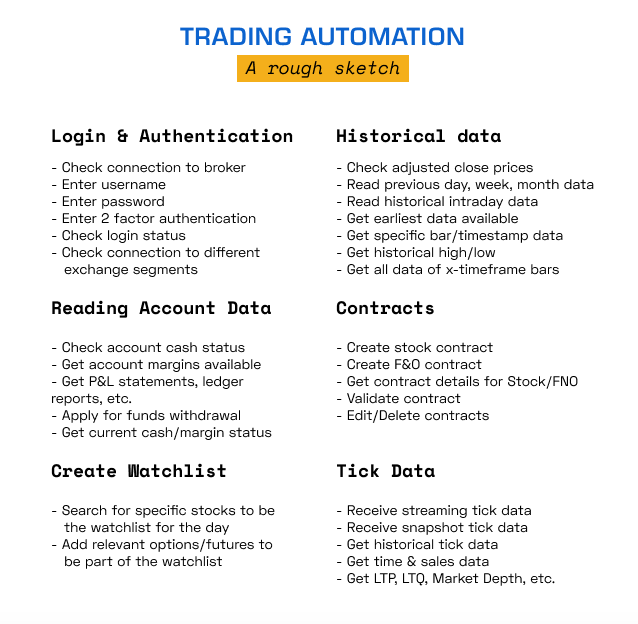

The following are some of the actions you do.

But that is only because you are attuned to it and you don't pay mindful attention to the sheer number of actions and decisions you take throughout the trading day, in terms of execution.

The following are some of the actions you do.

3/ Once your strategy says you've to put on a position

- you pick the relevant scrip to put on a trade

- you decide the required qty/lot size to trade

- based on the signal, it has to be a buy or sell order

- based on the strategy, it has to be a market or limit order.

- you pick the relevant scrip to put on a trade

- you decide the required qty/lot size to trade

- based on the signal, it has to be a buy or sell order

- based on the strategy, it has to be a market or limit order.

4/ You also decide on

- whether you should attach a stop loss to the order

- whether you should attach a target to the order

- whether the order has to be intraday/MIS or overnight/NRML.

- whether you should attach a stop loss to the order

- whether you should attach a target to the order

- whether the order has to be intraday/MIS or overnight/NRML.

5/ While attaching the stop loss to the actual order, you have to decide

- if the stop loss is going to be fixed or trailing

- if the stop loss is going to be executed as a market order or a limit order

- if it is a fixed stop loss, is it price based or % based?

- if the stop loss is going to be fixed or trailing

- if the stop loss is going to be executed as a market order or a limit order

- if it is a fixed stop loss, is it price based or % based?

6/ If you use a trailing stop loss

- do you trail based on price?

- do you trail based on %?

- do you trail based on some condition? (1h low/high, trail on every 5m close, etc.)

- do you trail based on some indicator? (ATR, Moving Average, etc.)

- do you trail based on price?

- do you trail based on %?

- do you trail based on some condition? (1h low/high, trail on every 5m close, etc.)

- do you trail based on some indicator? (ATR, Moving Average, etc.)

7/ If you have to set a target for exit,

- is it price based / percentage based / "R" based / any other condition?

- is it dynamic and moving (split exit at 1R, 2R, 3R, etc.)

- is it based on any indicator?

- is it price based / percentage based / "R" based / any other condition?

- is it dynamic and moving (split exit at 1R, 2R, 3R, etc.)

- is it based on any indicator?

8/ Essentially, when the SL order executes,

- you need to check whether a target order is open, and close it.

- you need to check if the SL order actually got executed in full or only partially

Same applies for target order too (close the SL order if not automatically closed).

- you need to check whether a target order is open, and close it.

- you need to check if the SL order actually got executed in full or only partially

Same applies for target order too (close the SL order if not automatically closed).

9/ Then there are things like basket orders, where you create a basket and issue orders at the same time.

Here you have to check each order and whether each order got executed correctly, under multiple conditions.

Here you have to check each order and whether each order got executed correctly, under multiple conditions.

10/ Once positions are open and neither SL nor target get executed, you need to check the status near EOD after 3.15, and decide on whether

- you want to convert the order to an overnight position

- you want to close the position

- you want to convert the order to an overnight position

- you want to close the position

11/ These are some of the things you do in terms of execution.

While the above list may not be the exhaustive list of actions, it's a good list to start with in terms of thinking about what all actions you do regularly in execution.

While the above list may not be the exhaustive list of actions, it's a good list to start with in terms of thinking about what all actions you do regularly in execution.

12/ Now we come to the **ISSUES** part of the execution. While the list may not be exhaustive, we have all faced it at some point or the other.

First category of issues we face is related to connectivity.

This could be connectivity issues

- at broker's end

- at exchange end

First category of issues we face is related to connectivity.

This could be connectivity issues

- at broker's end

- at exchange end

13/ If you're using a data vendor, it could also be connection issues at the data vendor's end.

Essentially due to these connection issues you may face a host of errors/problems that interrupt/prevent an on-point execution.

Essentially due to these connection issues you may face a host of errors/problems that interrupt/prevent an on-point execution.

14/ Very first problem is something we are all familiar with: while trying to login for placing orders, you're not able to login.

Usually it's because of broker facing higher than normal load. It could be due to other reasons as well. When you can't login, you can't execute.

Usually it's because of broker facing higher than normal load. It could be due to other reasons as well. When you can't login, you can't execute.

15/ So you're logged in. Now you're trying to order, but your order is not getting accepted.

This issue is also quite prevalent.

If your strategy depends on timely execution, this could lead to a lot of slippage and even losses.

This issue is also quite prevalent.

If your strategy depends on timely execution, this could lead to a lot of slippage and even losses.

16/ You have successfully placed the order. The order got accepted.

But the order didn't get executed immediately.

It stays in pending for a while (could be 30s-1m) and then executes.

This is also something we have seen with few many brokers.

But the order didn't get executed immediately.

It stays in pending for a while (could be 30s-1m) and then executes.

This is also something we have seen with few many brokers.

17/ Your account is fine.

All the segments are activated.

Your market data is working fine too.

You have enough margin to execute the order you have created.

But your broker rejects your order.

This happened to me on Zerodha.

Broker side technical glitch.

All the segments are activated.

Your market data is working fine too.

You have enough margin to execute the order you have created.

But your broker rejects your order.

This happened to me on Zerodha.

Broker side technical glitch.

18/ Say your strategy requires for closing price (specific timeframe bar close) to be above or below a certain price for executing the order, or for executing stop loss.

If there are any connection/data issues, essentially you won't execute due to not seeing the required data.

If there are any connection/data issues, essentially you won't execute due to not seeing the required data.

19/ For instance, if 5m close has to be above 29550 for you to go long BNF and the 12:20 to 12:25 bar's last few ticks reach that high and actually closes around 29560.

But, the data connection wasn't right and the ticks didn't come through in your system, you'd not execute.

But, the data connection wasn't right and the ticks didn't come through in your system, you'd not execute.

If the very next bar is a breakout bar and price goes to 29700, there's a huge upswing, you have essentially missed the boat.

You'll essentially enter on close of next bar above 29700, at a slippage of 150+ points.

You'll essentially enter on close of next bar above 29700, at a slippage of 150+ points.

20/ Even if broker side has no issues, we can't guarantee that the exchange won't have issues.

There were few many days when data from exchange got interrupted, when exchange wasn't accepting orders - entry or exit, when exchange was rejecting fno orders.

There were few many days when data from exchange got interrupted, when exchange wasn't accepting orders - entry or exit, when exchange was rejecting fno orders.

21/ You enter an order and successfully manage to place the order. The order executes too. Now you're in the trade.

You get logged out. You aren't able to login.

Sometimes, near market closing.

You should close your position, but you aren't able to.

You get logged out. You aren't able to login.

Sometimes, near market closing.

You should close your position, but you aren't able to.

22/ Broker's own datastream is not building candles properly.

So you see the prices wrongly and place an order that shouldn't have gotten placed or vice versa.

Or your already placed order misses executing the stop loss or target orders because of this.

EOD you're at loss.

So you see the prices wrongly and place an order that shouldn't have gotten placed or vice versa.

Or your already placed order misses executing the stop loss or target orders because of this.

EOD you're at loss.

23/ Sometimes, price runs through your stop, and your stop order is not executed.

Happened to me in march crash with a stop loss.

I was long on open, market went circuit break down in a flash. That particular candle was fast, price went through SL, SL didn't execute.

Happened to me in march crash with a stop loss.

I was long on open, market went circuit break down in a flash. That particular candle was fast, price went through SL, SL didn't execute.

24/ Your order needs to be closed intraday.

You try to close your order by 3.15-3.25pm.

Only that, your broker's system is not allowing your exit.

Your exit orders are getting rejected, and aren't going through.

You try to close your order by 3.15-3.25pm.

Only that, your broker's system is not allowing your exit.

Your exit orders are getting rejected, and aren't going through.

25/ You entered an extra zero or some extra number in quantity.

The order got executed with higher than intended quantity.

Potential for losses is very high in this scenario.

Happens due to fat fingers, esp in option buying, cash buying.

In code, this is due to logic bugs.

The order got executed with higher than intended quantity.

Potential for losses is very high in this scenario.

Happens due to fat fingers, esp in option buying, cash buying.

In code, this is due to logic bugs.

26/ Each and every action written down in the list above that we perform regularly has associated issues.

These issues aren't rare events. We have seen these happen with Zerodha (and sometimes with other brokers too) time and time again.

These issues aren't rare events. We have seen these happen with Zerodha (and sometimes with other brokers too) time and time again.

27/ When automating our execution, it's not a simple buy and sell or a simple short and cover.

Behind the scenes, for your automation system to be robust enough, all these corner/edge cases need to be covered and handled properly.

Behind the scenes, for your automation system to be robust enough, all these corner/edge cases need to be covered and handled properly.

28/ Each issue is very much a regular event in terms of possibility.

Each execution step has potential issues associated with it.

While automating, we should put much more thought into different aspects of the execution of orders.

Each execution step has potential issues associated with it.

While automating, we should put much more thought into different aspects of the execution of orders.

29/ Timing matters. If orders aren't executed in a timely manner, you could literally blow up your entire capital away.

Especially if you are careless, and you automate and think your system will do everything, you'll be surprised.

You should always monitor and keep tabs.

Especially if you are careless, and you automate and think your system will do everything, you'll be surprised.

You should always monitor and keep tabs.

30/ Think about these steps we regularly make for trade execution.

For each of the actions mentioned, you'll write a function/module.

For each of the issues, you'll have to handle exceptions, edge cases, and put in place contingency measures that will prevent losses.

For each of the actions mentioned, you'll write a function/module.

For each of the issues, you'll have to handle exceptions, edge cases, and put in place contingency measures that will prevent losses.

31/ Before you think these things through, do not venture into full automation.

It's important you think in pseudocode first.

Understand your broker's API docs.

Understand the API's limitations.

Also understand no matter how much you try, you'll face issues.

It's important you think in pseudocode first.

Understand your broker's API docs.

Understand the API's limitations.

Also understand no matter how much you try, you'll face issues.

32/ Some brokers do not offer paper/test trading platform (unlike IBKR which offers a full featured demo receiving 15m delayed data, even for API testing).

With such broker APIs, you have to test in live trading only. So, it's best to check everything with lowest size possible.

With such broker APIs, you have to test in live trading only. So, it's best to check everything with lowest size possible.

• • •

Missing some Tweet in this thread? You can try to

force a refresh