How to capture the gene- editing and therapy market? In my view, one company offers a unique opportunity to play the immense growth within the field - the American company MaxCyte $MXCT, listen on London AIM

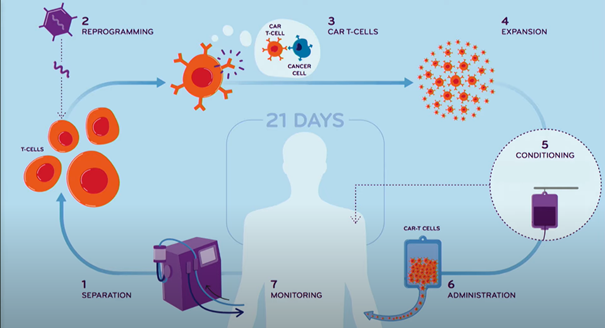

MaxCyte sells its ExPERT machine and platform to cell therapy and drug discovery companies. They have 120+ cell therapy partner programs with 90+ being licensed for clinical use and 20 out of the 25 largest pharma companies are their customers within drug-discovery.

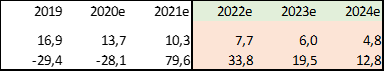

Their gross margins are ≈90% with more than 70% of revenues being recurring, with a 3-year CAGR of 20%, showing strong signs of accelerating. To understand the strength of the business we have to dig a little deeper into the market and technology.

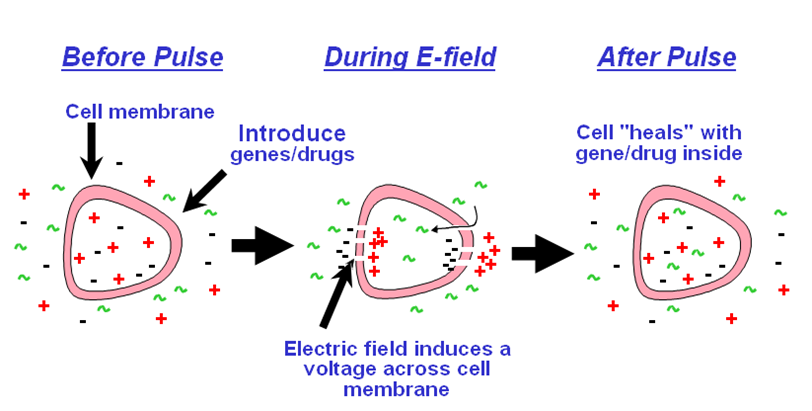

To successfully edit a gene you have to insert molecules into the cell, transfection, this can be done with a lentivirus or by using chemical- or physical transfection, or electroporation - the latter being what MaxCyte does.

So why electroporation? It has some great upsides for commercial use, especially as we try to manufacture an off-the-shelf treatment for cancer. It can handle billions of cells in a cheap, repeatable, and efficient way. Something chemical or physical transfection struggles with.

The viral method is great for in-vivo treatment, but it is less scalable, the gene-editing is permanent, takes time to manufacture, and is very expensive. Kymriah and Yescarta are the two approved CAR-T treatments today and have both failed to become commercial success stories.

Electroporation also has the added benefit of allowing quite large molecules to be inserted into the cell. This is an advantage in CRISPR/CAS9 treatments as those molecules are large. Compared to chemical transfection, electroporation offers much higher efficacy & efficiency.

MaxCyte is the only electroporation company today that is approved for clinical use by the FDA. Leaving them with basically a monopoly within electroporation. Competitors include Thermo Fischer, BioRad, and Lonza - in my view, competitors are nowhere close to MaxCyte's offering.

Electroporation has been seen as a blunt instrument in the past with low efficiency and efficacy. MaxCyte's ExPERT machines change this and allow for repeatable, replicable, and efficient transfection of cells.

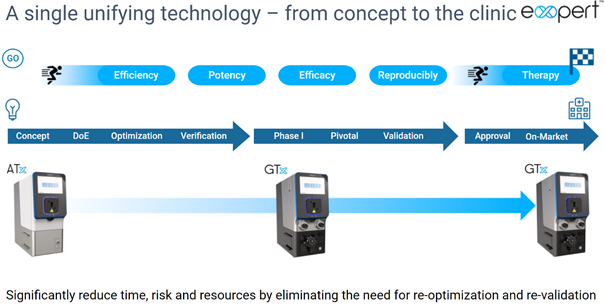

MaxCyte spends a lot of time and effort in researching the best way (settings for the machines) for each molecule, saving the customers time - something that is immensely valuable for a customer burning tens of millions of dollars each month.

Some PE firms actively seek MaxCyte's help before making investments in pharmaceutical and cell therapy companies. Once the MaxCyte platform is used, changing to a competitor's machine is a 4-6 month process. And again, time is of the essence for their customers.

MaxCyte offers the same type of machines to both drug discovery and cell therapy companies with two very different pricing models.

The DD company pays a one-time fee of $125k and then consumables for $200-1,500 per use. The cell therapy companies lease a license for $150k/year and machine. Once the company enters the clinic the price is bumped to $250k/year. On top of this, they too have to buy consumables.

MaxCyte has full control over the licensed machines and their customer can't change settings etc without MaxCyte's knowledge or input.

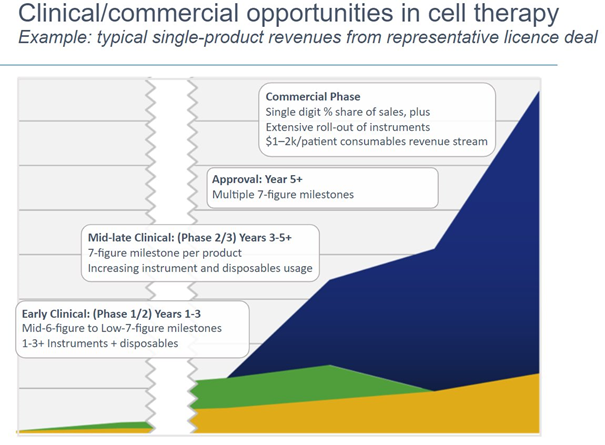

This brings us to deserts. On top of this, MaxCyte currently has 11 commercial licenses with large therapeutic companies such as CRISPR Therapeutics and Allogene. These commercial licenses include milestone revenue for MaxCyte when one of the licensed drugs moves through...

... the clinical stages. This revenue stream is 99% going to the bottom line for MaxCyte. In addition, MaxCyte also has royalty deals on top of the milestones. Show me a company with a better business model!

Keep in mind that as the clinical process progresses the partner needs more machines equalling more $250k/year licensing fees for MaxCyte and more consumables - if commercialized the need for machines and consumables could easily increase by 5-10 times.

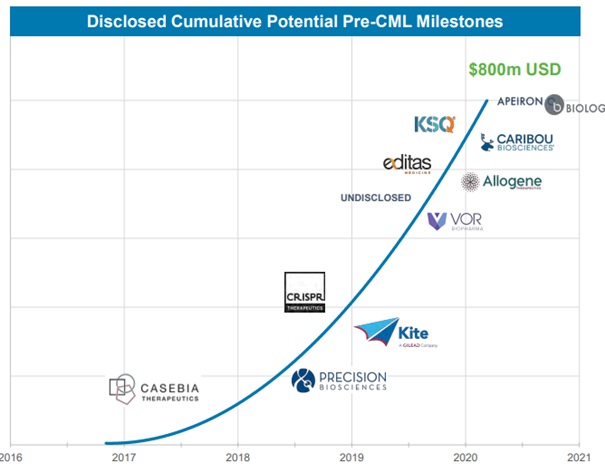

Currently, cumulative potential pre-commercial milestones sit at more than $800m, and as you can seen, most of them have been reached during the last 2 years. Same about partnerships, in the past two years they have increased from 55+ to 120+.

So, we have a clear market leader with little competition. ✅

Gross margins of slightly below 90%. ✅

Revenue growth >30%, accelerating going forward ✅

Active in the very "hot" cell therapy space ✅

What is the caveat?

Gross margins of slightly below 90%. ✅

Revenue growth >30%, accelerating going forward ✅

Active in the very "hot" cell therapy space ✅

What is the caveat?

First of all, it is listed on the London Aim stock market, which I think has reduced interest or hindered institutions from buying into the stock. The liquidity is awful...

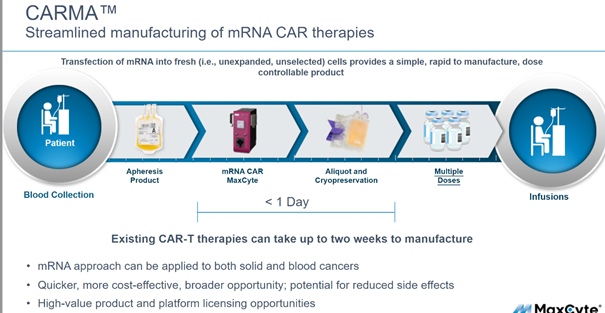

Secondly, they have invested heavily in their own CAR-T platform called CARMA. It currently has one treatment in the discovery phase, one in preclinical, and the final one, MCY-M11 IP for ovarian & peritoneal mesothelioma cancer. This has covered their profitability.

The London Aim stock market will be fixed as the company has stated its ambition to (parallel)list on the NASDAQ US during H1'21. They raised money from excellent investment firm Casdin Capital, among others, for this exact purpose. This is a clear trigger going forward.

The CARMA division is going to be self-financed by the end of the year and the company is expected to release information on the matter before years end. In my view, buyers are already lined up and awaiting data from MY-11 before finalizing the deal.

I expect CARMA will give MaxCyte substantial milestones and much more generous royalties than their "low single digits". However, I have seen some believing it could be worth $50-100m in cash - remains to be seen but MaxCyte has been clear they want to keep some of the upside.

With CARMA out of the books, MaxCyte will become profitable (I think they could be this year excluding CARMA) and then grow their business with >30% CAGR fora very long time and with really nice incremental margins. My personal view is that $MXCT is the best bet in gene therapy!

• • •

Missing some Tweet in this thread? You can try to

force a refresh