Did you know the average millionaire has seven flows of income?

Regardless of what people think or try to tell you, the easiest and most common way to get wealthy is to build multiple streams of income.

Tap into multiple income streams and grow!

How?

Read on:

//thread//

Regardless of what people think or try to tell you, the easiest and most common way to get wealthy is to build multiple streams of income.

Tap into multiple income streams and grow!

How?

Read on:

//thread//

[FIRST STREAM]

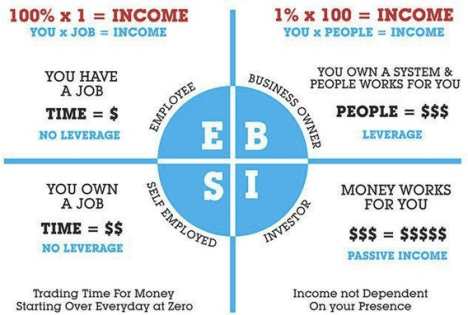

Most people are getting started earning income from a job. A job is selling your skills and time against money. Jobs can provide security, comfort, and to a certain extend satisfaction.

Peaceful, steady and not too wild.

That's that.

Most people are getting started earning income from a job. A job is selling your skills and time against money. Jobs can provide security, comfort, and to a certain extend satisfaction.

Peaceful, steady and not too wild.

That's that.

[SECOND STREAM]

If you’ve got a partner that is equally engaged in the workforce: Then you got two jobs filling your reservoir!

Engage in teamwork and optimize for two instead just one main stream of income.

If you’ve got a partner that is equally engaged in the workforce: Then you got two jobs filling your reservoir!

Engage in teamwork and optimize for two instead just one main stream of income.

[THIRD STREAM]

Big hurdle for most people!

Some like side-hustling, but I highly recommend NOT to sell more of your time.

Your time is the most constrained ressource you have.

Instead: Sell what you're doing anyways, your hobby, your passion project.

Monetize if you can!

Big hurdle for most people!

Some like side-hustling, but I highly recommend NOT to sell more of your time.

Your time is the most constrained ressource you have.

Instead: Sell what you're doing anyways, your hobby, your passion project.

Monetize if you can!

[FOURTH STREAM ONWARDS]

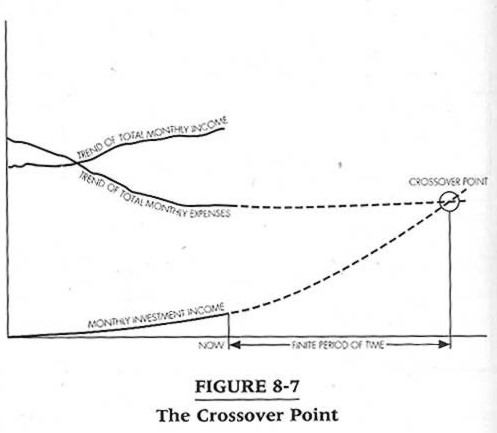

From this point on, make extra income passive!

Do AirBnB

Rent out a room

Rent out parking lots

Invest in appreciating and income producing assets

Key: Use your savings from active income streams and turn them into passive income streams!

From this point on, make extra income passive!

Do AirBnB

Rent out a room

Rent out parking lots

Invest in appreciating and income producing assets

Key: Use your savings from active income streams and turn them into passive income streams!

[GROW MORE STREAMS]

The more you familiarize yourself with this concept, the more you will learn and the better you will get.

Grow your income streams further.

Let the cash flow!

The more you familiarize yourself with this concept, the more you will learn and the better you will get.

Grow your income streams further.

Let the cash flow!

[FIREHOSE OF INCOME]

Bring a first additional income stream to fruition, stabilize it, only then move your focus to the next one and repeat.

Over time you will build an optimized system of well diversified passive and active income streams!

This is how it will feel like:

Bring a first additional income stream to fruition, stabilize it, only then move your focus to the next one and repeat.

Over time you will build an optimized system of well diversified passive and active income streams!

This is how it will feel like:

[FINANCIALLY IMAGINEER YOUR LIFE]

Don’t downgrade your dream to match your reality, upgrade your faith to match your destiny!

bit.ly/3ojaI4b

Don’t downgrade your dream to match your reality, upgrade your faith to match your destiny!

bit.ly/3ojaI4b

• • •

Missing some Tweet in this thread? You can try to

force a refresh