For the last year at @OSAMResearch, we’ve been building.

Excited to share this new post that shares the lessons we've learned. We now believe the future of asset management will be defined by a new category: "custom indexing."

More in this thread...

canvas.osam.com/Commentary/Blo…

Excited to share this new post that shares the lessons we've learned. We now believe the future of asset management will be defined by a new category: "custom indexing."

More in this thread...

canvas.osam.com/Commentary/Blo…

@OSAMResearch When we launched Canvas (canvas.osam.com), we followed the advice of @chetanp to find a small, great set of partners and then stop taking new ones for a long time.

A year ago we did so, partnering with 9 RIA firms, and building out the platform based on their needs...

A year ago we did so, partnering with 9 RIA firms, and building out the platform based on their needs...

@OSAMResearch @chetanp This "go slow to go fast" mentality has paid off.

We had a theory that people would want deeply tailored strategies for individual clients.

Yesterday, we opened our 500th account. 70% of them are totally unique in their settings.

We had a theory that people would want deeply tailored strategies for individual clients.

Yesterday, we opened our 500th account. 70% of them are totally unique in their settings.

@OSAMResearch @chetanp We are more confident than ever that if you squint and look out 5 years, EVERYONE will manage their index strategies this way: customized for the needs, circumstances, and preferences of the individual.

I think often of what @wolfejosh calls "directional arrows of progress"...

I think often of what @wolfejosh calls "directional arrows of progress"...

@OSAMResearch @chetanp @wolfejosh Just like commission costs for trading marched towards zero, indexing is marching towards custom indexing: owning your own securities directly, rebalanced following a ruleset that adjusts for your individual tax situation, income needs, risk preferences, and so on.

@OSAMResearch @chetanp @wolfejosh A key insight is that custom indexing is fundamentally a TECHNOLOGY story.

It must be delivered via cutting edge, web-based software. And it relies on other technology (like zero trading costs, the advance of fractional share trading, and so on).

It must be delivered via cutting edge, web-based software. And it relies on other technology (like zero trading costs, the advance of fractional share trading, and so on).

@OSAMResearch @chetanp @wolfejosh We've been amazed at the use cases.

Tax customization is near the top, including managing around concentrated stock positions.

Factors of all types (include income focus) are used in many ways

ESG is deeply personal and often customized for specific issues...

Tax customization is near the top, including managing around concentrated stock positions.

Factors of all types (include income focus) are used in many ways

ESG is deeply personal and often customized for specific issues...

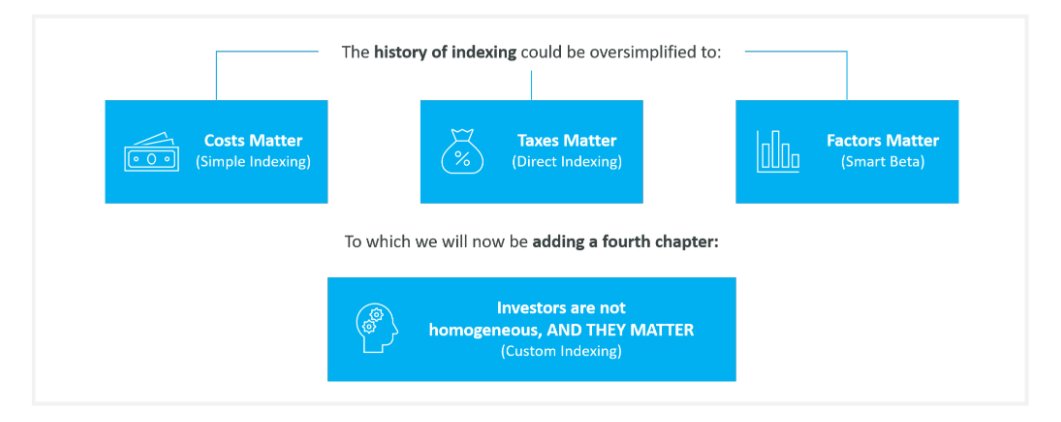

@OSAMResearch @chetanp @wolfejosh Indexing history could be summed up as four steps:

1. Costs matter (Bogle, index funds)

2. Taxes matter (direct indexing)

3. Factors matter (Smart Beta)

4. Investors are not homogenous, and they matter (custom indexing).

We are excited to lead the way in this new category.

1. Costs matter (Bogle, index funds)

2. Taxes matter (direct indexing)

3. Factors matter (Smart Beta)

4. Investors are not homogenous, and they matter (custom indexing).

We are excited to lead the way in this new category.

• • •

Missing some Tweet in this thread? You can try to

force a refresh