A THREAD:

BEST OPTIONS STRATEGY FOR CONSISTENT INCOME -

OPTIONS WHEEL STRATEGY

Everything to know about this strategy I'm posting in this thread.

(1/12)

BEST OPTIONS STRATEGY FOR CONSISTENT INCOME -

OPTIONS WHEEL STRATEGY

Everything to know about this strategy I'm posting in this thread.

(1/12)

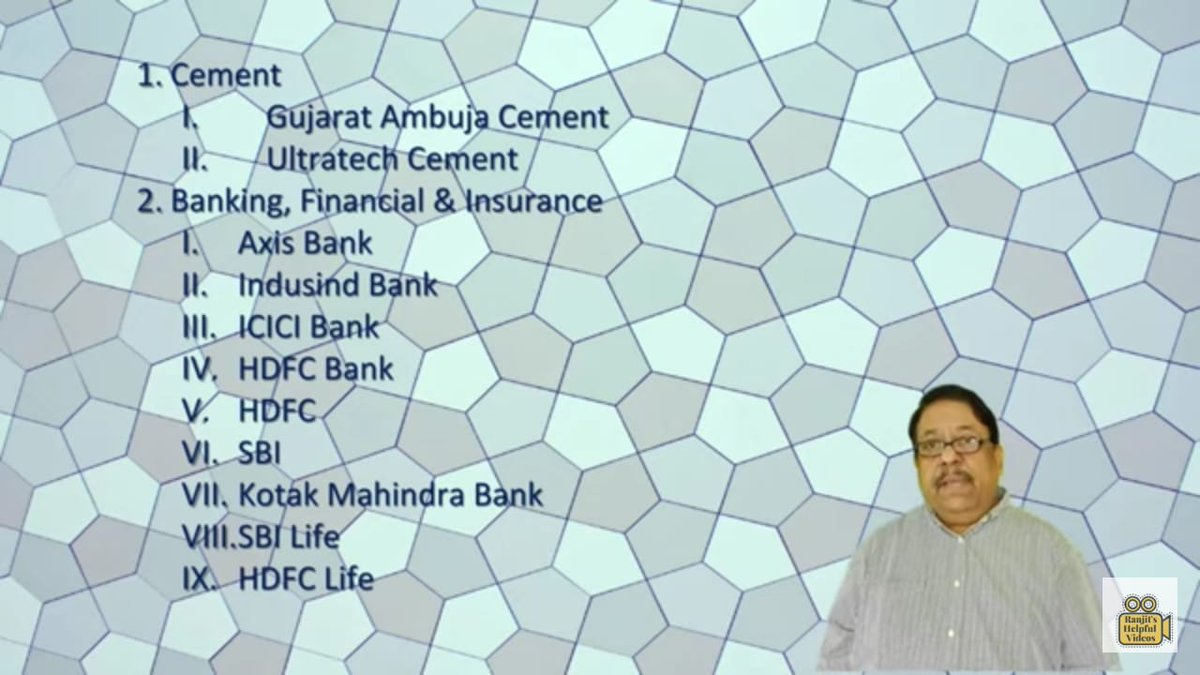

Step 1: Stock Selection

1. For this strategy you're going to have to choose some stocks that you think will be doing well in the future/long term.

2. Stock must be in an uptrend.

3. Stock options should be liquid enough to trade in.

4. List of stocks attached

(2/12)

1. For this strategy you're going to have to choose some stocks that you think will be doing well in the future/long term.

2. Stock must be in an uptrend.

3. Stock options should be liquid enough to trade in.

4. List of stocks attached

(2/12)

Step 2: Which option to sell?

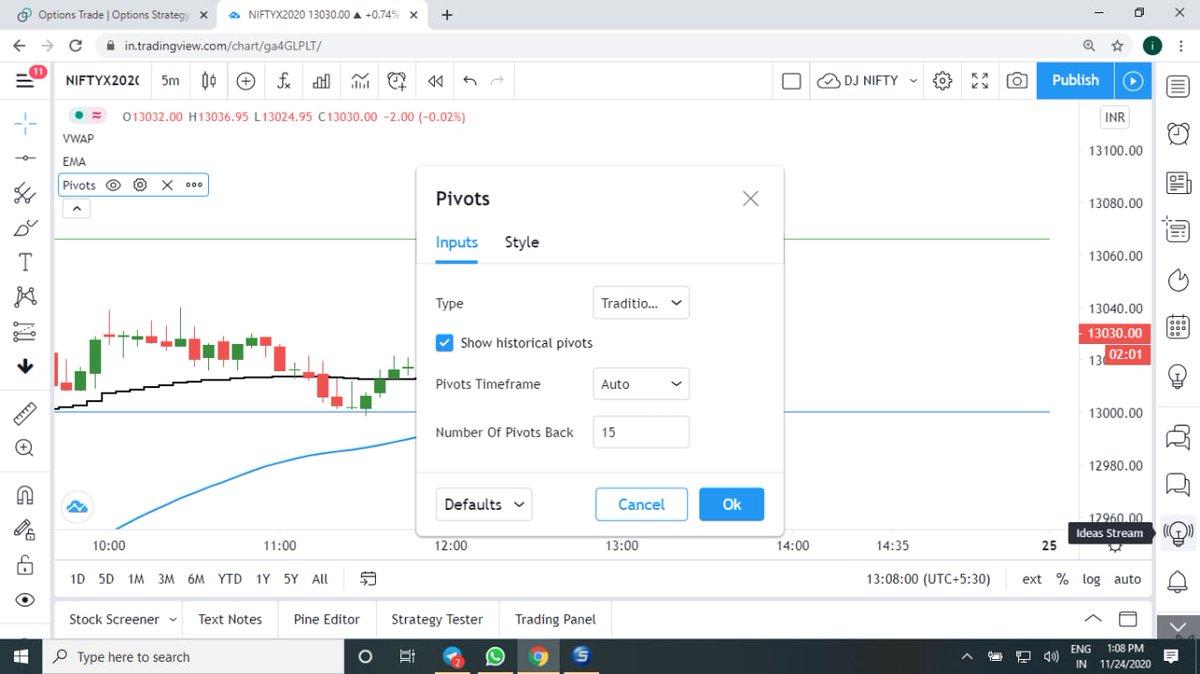

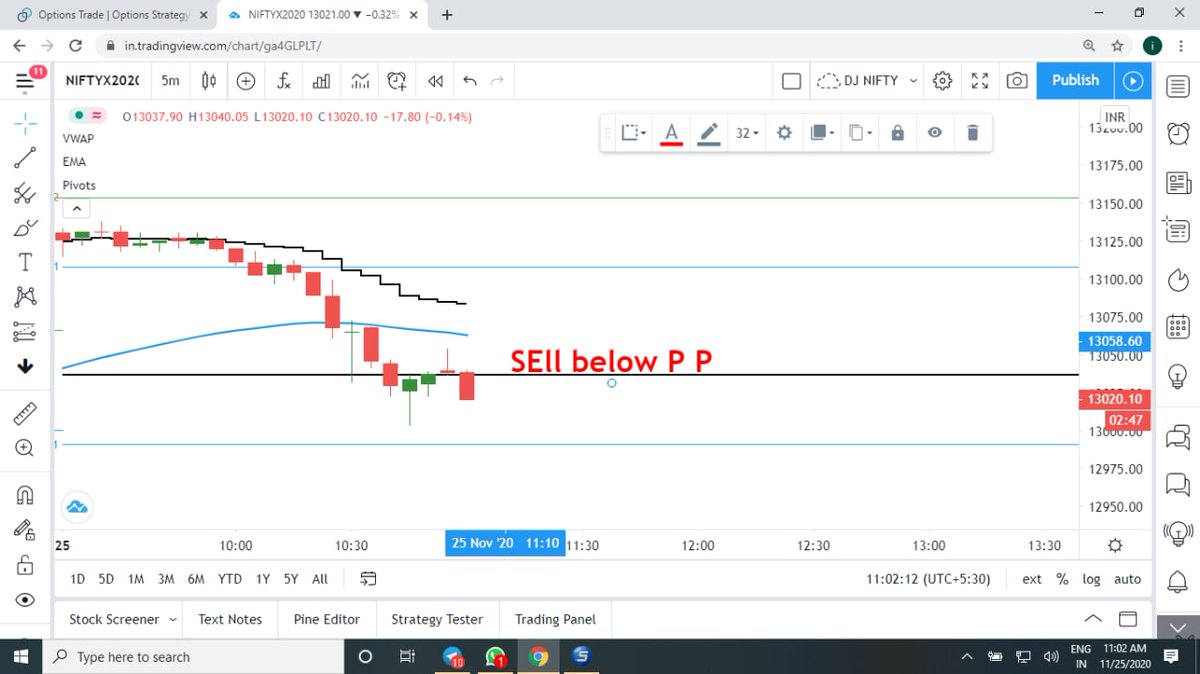

1. Sell put at a support according to charts.

2. Sell put at a strike far away from the spot where you think the probability of the stock falling will be very very low.

3. Sell put at a price where you're willing to buy the stock at.

(3/12)

1. Sell put at a support according to charts.

2. Sell put at a strike far away from the spot where you think the probability of the stock falling will be very very low.

3. Sell put at a price where you're willing to buy the stock at.

(3/12)

Step 3: What to do when in profit/loss?

1. If in profit you can just roll up the puts thereby increasing the ROI or shift to other stocks to make more profit.

2. If in loss take delivery of the shares equivalent to the lot size in cash market.

(4/12)

1. If in profit you can just roll up the puts thereby increasing the ROI or shift to other stocks to make more profit.

2. If in loss take delivery of the shares equivalent to the lot size in cash market.

(4/12)

Step 4: What to do after taking the delivery?

1. Sell calls to lower your cost price of the stock. For eg, you took delivery of Reliance at 1900, sell 2100 CE which is about 10% away.

2. Keep doing this till your CE expires ITM and then give delivery of your stock away

(5/12)

1. Sell calls to lower your cost price of the stock. For eg, you took delivery of Reliance at 1900, sell 2100 CE which is about 10% away.

2. Keep doing this till your CE expires ITM and then give delivery of your stock away

(5/12)

Step 5: Repeat the process across multiple stocks

1. The probability of all stocks giving you loss will be very very low. So the more stocks you do this in the higher chances of profit.

This whole process functions just like a wheel.

(6/12)

1. The probability of all stocks giving you loss will be very very low. So the more stocks you do this in the higher chances of profit.

This whole process functions just like a wheel.

(6/12)

Step 6: Best person to follow?

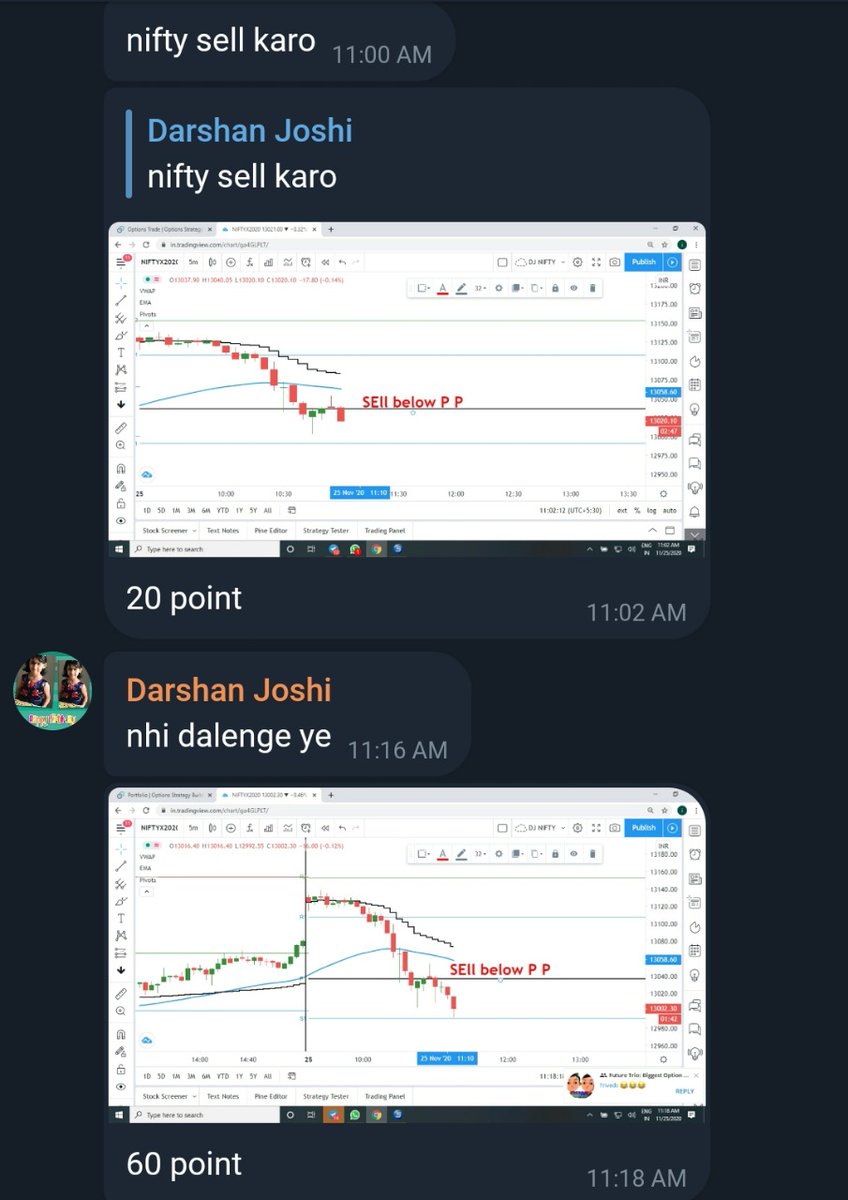

The best person to follow in my opinion is Ranjit Sir for this strategy. He regularly shares his positions on telegram and YouTube for everyone to see and makes very good ROI per month doing only this strategy.

(7/12)

The best person to follow in my opinion is Ranjit Sir for this strategy. He regularly shares his positions on telegram and YouTube for everyone to see and makes very good ROI per month doing only this strategy.

(7/12)

Step 7: Where to follow?

1. His twitter - Take a look at Ranjit Mohanty (@myranjit): twitter.com/myranjit?s=08

2. Telegram - Search for "ranjitoptions"

3. YouTube - youtube.com/user/ronni1861

(8/12)

1. His twitter - Take a look at Ranjit Mohanty (@myranjit): twitter.com/myranjit?s=08

2. Telegram - Search for "ranjitoptions"

3. YouTube - youtube.com/user/ronni1861

(8/12)

Money with Mason -

Talks about dividend investing and option wheel trading

(10/12)

youtube.com/channel/UCAPnW…

Talks about dividend investing and option wheel trading

(10/12)

youtube.com/channel/UCAPnW…

Justin Talks money -

Makes 3% per month just doing the option wheel strategy.

(11/12)

youtube.com/channel/UCpjOZ…

Makes 3% per month just doing the option wheel strategy.

(11/12)

youtube.com/channel/UCpjOZ…

These resources should be more than enough for you to execute this strategy by yourself and know what to do if stuck.

Good luck to everyone for regular income through this strategy.

______________________________

THE END

(12/12)

Good luck to everyone for regular income through this strategy.

______________________________

THE END

(12/12)

• • •

Missing some Tweet in this thread? You can try to

force a refresh