I came out of semi-retirement to start this my present venture journey in mid-2012, as a grocery ecommerce endeavor to capture the vertical opportunity in the rapidly expanding ecommerce landscape in Nigeria & SSA, which I founded a month b4 Konga/Jumia & launched 2 months after.

And we were on track @Gloo_ng in this regard, until the recession of 2016/17 landed that essentially took out every single ecommerce company of that era—except Jumia and us....

The most enduring lesson I took from those first 5 years of this journey was that physical products-based *consumer* tech startups in Nigeria and sub-Saharan Africa would be losing—or at best, middling—venture-backed propositions for at least the next 10years, or thereabout.

Consequently, every single thing I have done in steering my journey on this SSA venture landscape since then, and till date, has been to steer this venture journey off 100% *sole* dependence on business models completely moored to making margin off physical goods...

...because there is no margin the SSA market would allow a *consumer* tech venture to charge on top of physical goods that would ever make venture-backed digital consumer ecommerce, as traditionally modeled in other markets, a winning proposition for the next 10yrs.

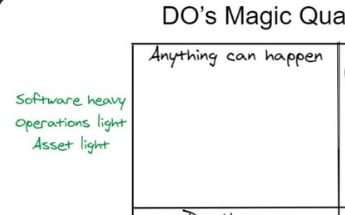

I even took the time to crystallize my thinking into writing here: fcafrica.substack.com/p/dmqa-dos-mag….

There were 2 ways open to us then to attain this: hard or soft pivot. We chose soft pivot, A => B => C rather than A => C for very obvious reasons. The former represented a much less riskier approach to getting to C, paid for in the additional time, compared to the latter...

...which has a very much higher probability for failure. The approach we took also represented the more cash-efficient one, something we were in dire need of at that time. Our public launch of our Gloopro brand and website in March 2019...

...and concurrent shutting down of our @Gloo_ng ecommerce brand and website represented the completion of our A -> B pivot phase. The remainder of 2019 into 2020, for me, as a founder & CEO, was focused on devising the means with which to achieve the B -> C phase of the pivot.

Well, things didn’t play out *exactly* like I’d imagined. Yes, @gloopro is winning quietly: we became profitable in 2019FY and will continue on traction path in below tweet till we hit milestone w/ which we want to do our planned @gloopro listing on London AIM in a few years.

https://twitter.com/docolumide/status/1335029787006554114

BUT...also, yes! We’ve now successfully devised the means of getting to C: my venture journey has now arrived at the “Tanwa” quadrant in my DMQA. Hurray!!!

But not as a pivot...😉

Some news coming out late this year/early next year in this regard. Watch this space!

But not as a pivot...😉

Some news coming out late this year/early next year in this regard. Watch this space!

• • •

Missing some Tweet in this thread? You can try to

force a refresh