1/ My Mission: To Spread Financial Wellness (thread)

Here’s what "financial wellness" means to me

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Here’s what "financial wellness" means to me

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

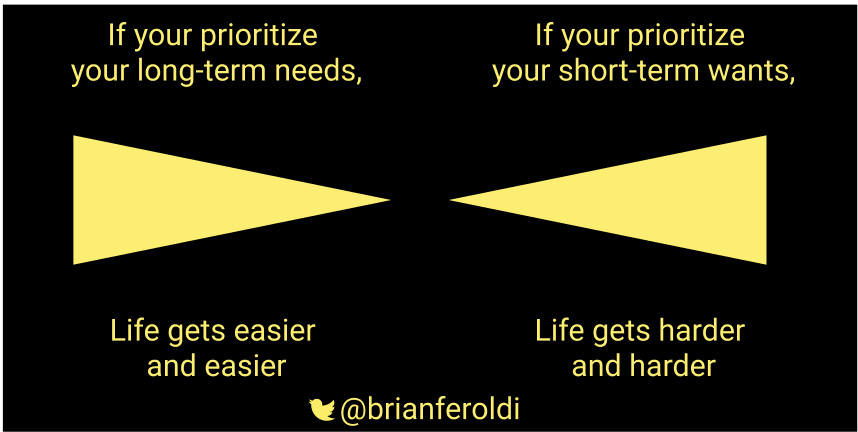

2/ Mindset

Humans are programmed to think short-term

Evolutionary, thinking short-term makes sense. It helps with survival.

Financial wellness is all about training yourself to develop a long-term mindset

Not easy -- it takes practice

Humans are programmed to think short-term

Evolutionary, thinking short-term makes sense. It helps with survival.

Financial wellness is all about training yourself to develop a long-term mindset

Not easy -- it takes practice

3/ Mindset

If you join the right tribes, you can’t help but improve

My favs:

@AffordAnything

@ChooseFiFI

FinTwit

@MicroCapClub

@themotleyfoolFool

@visualizevalue

Twitter / Podcasts / Blogs / YouTube -- when used correctly -- are amazing resources

If you join the right tribes, you can’t help but improve

My favs:

@AffordAnything

@ChooseFiFI

FinTwit

@MicroCapClub

@themotleyfoolFool

@visualizevalue

Twitter / Podcasts / Blogs / YouTube -- when used correctly -- are amazing resources

https://twitter.com/BrianFeroldi/status/1325081638397759495?s=20

4/ Mindset

Educate yourself - constantly!

Especially about:

1⃣Money

2⃣Relationships

3⃣Health

These 3 categories have an outsized influence on all areas of your life

Books help

Educate yourself - constantly!

Especially about:

1⃣Money

2⃣Relationships

3⃣Health

These 3 categories have an outsized influence on all areas of your life

Books help

https://twitter.com/BrianFeroldi/status/1329583081527930887?s=20

5/ Career

In the beginning, focus on growing your income

Do more than what is expected

Become a lynchpin

Find a career that you ENJOY (<- important!) that also has high-income potential

Start a side hustle (<- important!)

Build your talent stack

In the beginning, focus on growing your income

Do more than what is expected

Become a lynchpin

Find a career that you ENJOY (<- important!) that also has high-income potential

Start a side hustle (<- important!)

Build your talent stack

https://twitter.com/BrianFeroldi/status/1322898518995017728?s=20

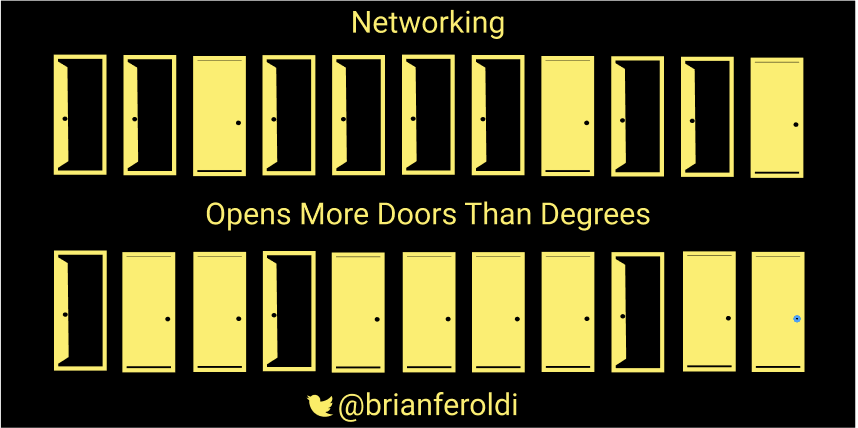

6/ Career

Network!

@JordanHarbinger’s course is great

Ask co-workers you don’t know out to lunch. Pick their brain. Don’t ask for anything in return.

Just focus on developing relationships

Network!

@JordanHarbinger’s course is great

Ask co-workers you don’t know out to lunch. Pick their brain. Don’t ask for anything in return.

Just focus on developing relationships

7/ Personal Finances

You don’t get rich at work — you get rich at home

Its YOUR responsibility to become wealthy, not your employers

You don’t get rich at work — you get rich at home

Its YOUR responsibility to become wealthy, not your employers

8/ Personal Finances

Track your spending!

@mint / @PersonalCapital / @ynab / Excel / Google Sheets

I don’t care how, just do it!

Track your spending!

@mint / @PersonalCapital / @ynab / Excel / Google Sheets

I don’t care how, just do it!

9/ Personal Finances

Attack ALL costs

Big 4 especially

1⃣Housing

2⃣Transport

3⃣Food

4⃣Education

Eliminate all luxuries - You can always add them back if you truly miss them

Use @FrugalWoods / @mrmoneymustache / @ChooseFi as guides

Attack ALL costs

Big 4 especially

1⃣Housing

2⃣Transport

3⃣Food

4⃣Education

Eliminate all luxuries - You can always add them back if you truly miss them

Use @FrugalWoods / @mrmoneymustache / @ChooseFi as guides

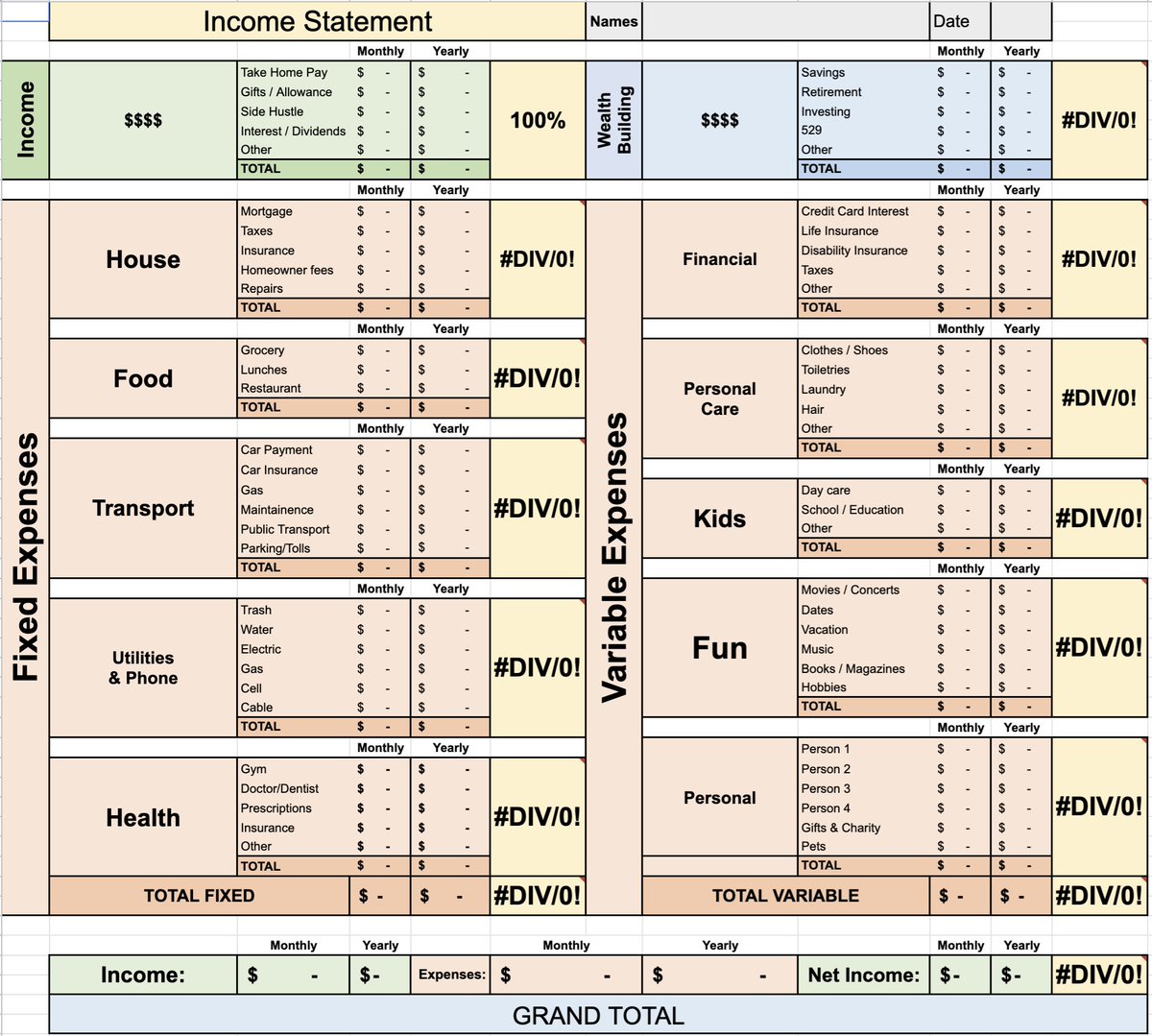

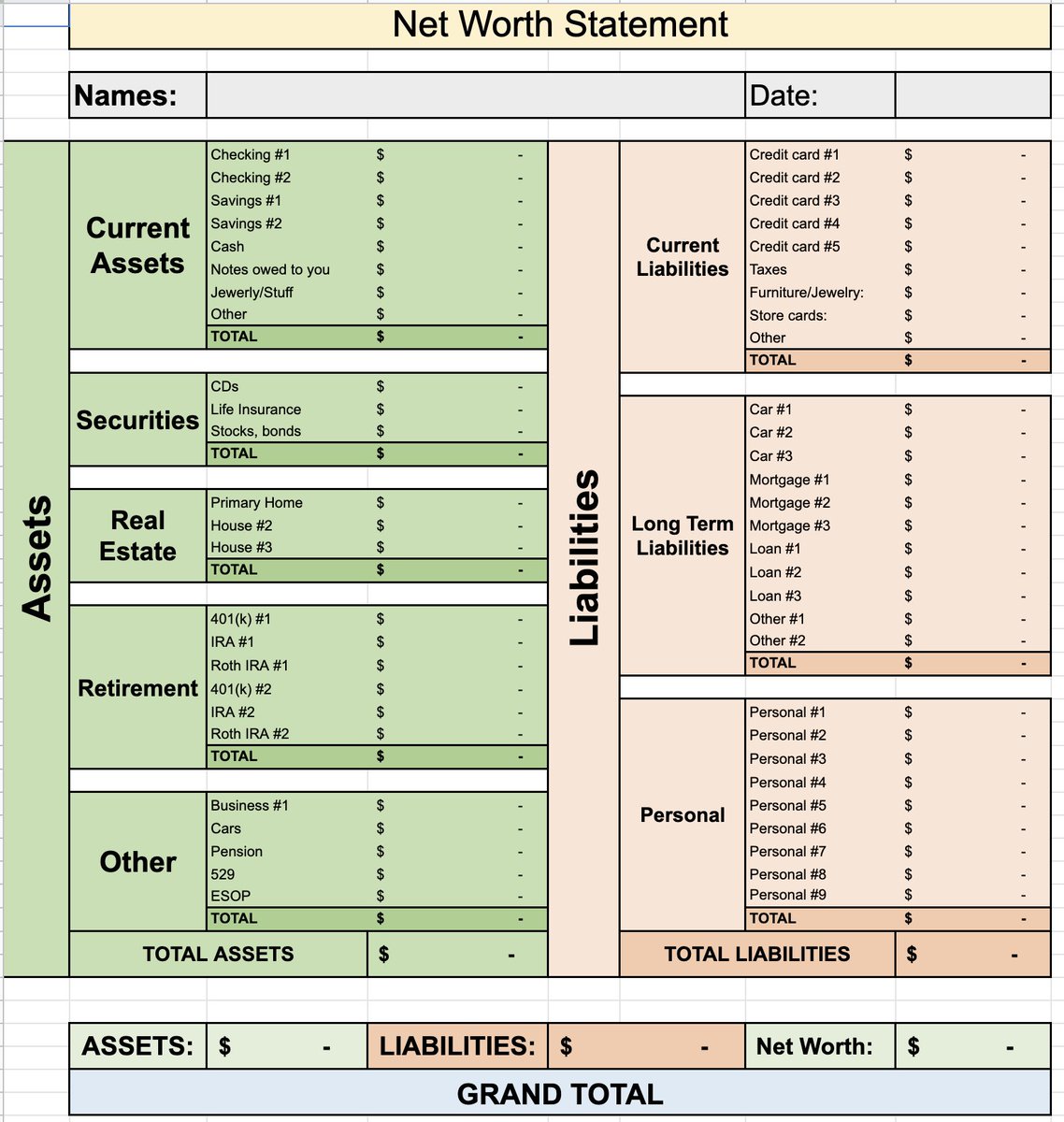

10/ Personal Finances

You need to know where you stand today

Create an:

1⃣Income Statement

2⃣Net Worth Statement

You need to know where you stand today

Create an:

1⃣Income Statement

2⃣Net Worth Statement

https://twitter.com/BrianFeroldi/status/1333044127794163713?s=20

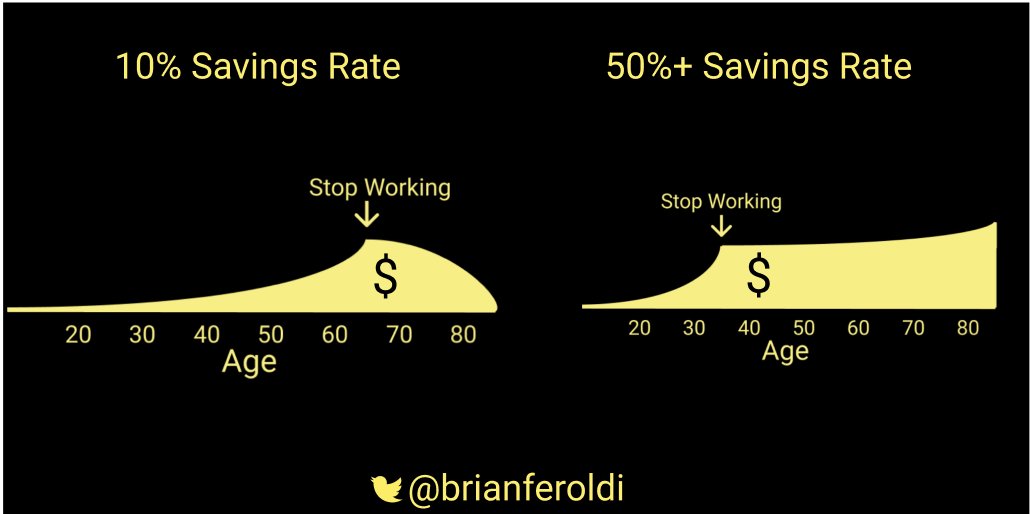

12/ Personal Finances

Boost your savings rate

10% is the minimum

20% is achievable for most

50%+ is hard, but not impossible

Go hardcore for a few years, especially in the beginning

It makes a huge difference

Boost your savings rate

10% is the minimum

20% is achievable for most

50%+ is hard, but not impossible

Go hardcore for a few years, especially in the beginning

It makes a huge difference

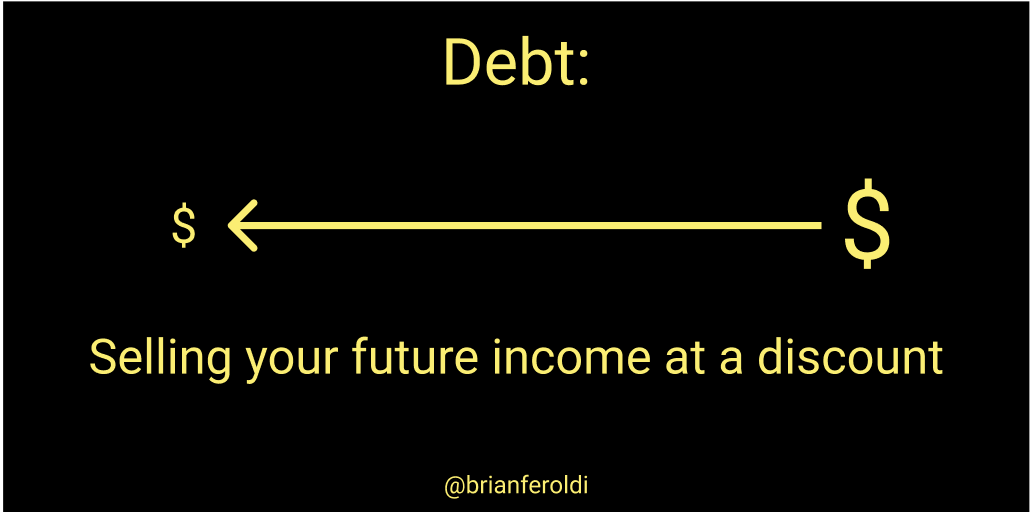

13/ Personal Finances

Use your savings to eliminate ALL non-mortgage debt

Then, build an emergency fund of 3+ months of expenses

Use your savings to eliminate ALL non-mortgage debt

Then, build an emergency fund of 3+ months of expenses

14) Personal Finances

Max out all retirement accounts

401(k) / 403 (b) / IRA / ROTH IRA / HSA.....etc

Broad-based, low-cost index funds are a great choice

Max out all retirement accounts

401(k) / 403 (b) / IRA / ROTH IRA / HSA.....etc

Broad-based, low-cost index funds are a great choice

16/ Investing

Once your personal finances are rock-solid, you can focus on growing your wealth

If stock investing bores you, just buy broad-based, low-cost index funds

If stock investing interests you, learn how to invest

Once your personal finances are rock-solid, you can focus on growing your wealth

If stock investing bores you, just buy broad-based, low-cost index funds

If stock investing interests you, learn how to invest

17/ Investing

I highly recommend subscribing to @TMFStockAdvisor and @TMFRuleBreakers

I'm biased, but this is where I learned almost everything that I know about investing

Free podcasts:

@AnswersPodcast

@MotleyFoolMoney

@MFIndustryFocus

@MarketFoolery

@RBIPodcast

I highly recommend subscribing to @TMFStockAdvisor and @TMFRuleBreakers

I'm biased, but this is where I learned almost everything that I know about investing

Free podcasts:

@AnswersPodcast

@MotleyFoolMoney

@MFIndustryFocus

@MarketFoolery

@RBIPodcast

18/ Investing

What I wish I knew when I first started

What I wish I knew when I first started

https://twitter.com/BrianFeroldi/status/1333152044581089282?s=20

18/ Investing

Use checklists, journals, and watchlists!

Use checklists, journals, and watchlists!

https://twitter.com/BrianFeroldi/status/1336317136181071875?s=20

19/ Investing

Invest in high-quality businesses Part 1

Invest in high-quality businesses Part 1

https://twitter.com/BrianFeroldi/status/1324324314053791744?s=20

20/ Investing

Invest in high-quality businesses part 2

Invest in high-quality businesses part 2

https://twitter.com/BrianFeroldi/status/1324359239469588485?s=20

21/ Investing

How to build positions

How to build positions

https://twitter.com/BrianFeroldi/status/1275752033325330433?s=20

22/ Investing

It's OK to suck in the beginning

I sure did!

It's OK to suck in the beginning

I sure did!

https://twitter.com/BrianFeroldi/status/1322518238014615553?s=20

23/ Investing

Connect with other smart investors on Twitter

Every Friday, I share a list of follows that made me smarter that week

Follow them!

Connect with other smart investors on Twitter

Every Friday, I share a list of follows that made me smarter that week

Follow them!

24/ Investing

Share!

The key to learning faster is to publically share your wins and losses

Peer review is a powerful resource

Share!

The key to learning faster is to publically share your wins and losses

Peer review is a powerful resource

• • •

Missing some Tweet in this thread? You can try to

force a refresh