(Thread) With Kotak launching its International REIT Fund of Fund NFO, it is worth revisiting our old thread on Real Estate Investment Trust (#REIT). The Idea is to educate readers on REIT & share our view on the Kotak #NFO

Do ‘re-tweet’ & help us educate more investors (1/n)

Do ‘re-tweet’ & help us educate more investors (1/n)

What’s a REIT?

Lets say I am a RE developer, K Raheja. I like a land in Mumbai & Hyderabad 4 some commercial development. I decide to buy it. Where will I get the monies 2 buy & construct it?

1. Self

2. Bank, NBFC, MF - Debt

3. Partner – someone else investing as Equity (2/n)

Lets say I am a RE developer, K Raheja. I like a land in Mumbai & Hyderabad 4 some commercial development. I decide to buy it. Where will I get the monies 2 buy & construct it?

1. Self

2. Bank, NBFC, MF - Debt

3. Partner – someone else investing as Equity (2/n)

So I invest some monies, got some 4m banks & MF’s & I also got Blackrock to invest 2 buy the land & make the business park called 'Mindspace'. I constructed around 23-mn sq ft with multiple building & I started leasing them out to companies who wanted rented office premises (3/n)

There comes a point where I needed more monies to build new building, pay off the loans etc., where do I get the monies? So I decide to do an #IPO. Not of the entire company K Raheja but only this project called Mindspace. So I formed a trust or corporation (4/n)

I commit to payout 90% of my rent income to the shareholders proportionately as dividends & I will use this IPO money to invest a minimum 80% in completed real estate, which is generating rent & will use 20% in constructing new Real Estate or lend to some other developer (5/n)

Is the IPO a win-win?

(a) K Raheja gets more money 2 pay off debt, investment in more commercial real estate

(b) Investors will receive dividends semi annually (from the rent income) which is tax free + as its listed on the exchange the stock prices can go up (6/n)

(a) K Raheja gets more money 2 pay off debt, investment in more commercial real estate

(b) Investors will receive dividends semi annually (from the rent income) which is tax free + as its listed on the exchange the stock prices can go up (6/n)

Why will the stock price go up?

(a) Rents increase year after year

(b) The value of the land increases

(c) New construction means more business (7/n)

(a) Rents increase year after year

(b) The value of the land increases

(c) New construction means more business (7/n)

Why invest in a REIT?

(a) G-Sec is at 6% and the rent yield in commercial RE is roughly 7% - 7.5%

(b) Diversification – It’s a combination of Debt (rent income) & Equity (listed so prices can move)

(c) Investment in RE with just 50K (8/n)

(a) G-Sec is at 6% and the rent yield in commercial RE is roughly 7% - 7.5%

(b) Diversification – It’s a combination of Debt (rent income) & Equity (listed so prices can move)

(c) Investment in RE with just 50K (8/n)

Tax Structure 2 the investor?

There are 3 types of income,

a. Rent–Tax-free

b. Interest – REIT’s can also loan money 2 another developer & receive interest. If u receive interest 4m the REIT, It will be taxed at the slab rate. Practically this is very less or zero (9/n)

There are 3 types of income,

a. Rent–Tax-free

b. Interest – REIT’s can also loan money 2 another developer & receive interest. If u receive interest 4m the REIT, It will be taxed at the slab rate. Practically this is very less or zero (9/n)

(c) Capital Gain on the stock exchange – 15% Short Term Capital Gains Tax if you sell the REIT before 3 years and 10% Long Term Capital Gains Tax if you sell the REIT units after 3 years (10/n)

What to look for before investing in a REIT?

(a) Weighted Average Lease Expiry – Higher the better

(b) Vacancy Rate – Lower the better

(c) Concentration of top 10 tenants – Lower the better

(d) Sector Concentration – Lower the better (11/n)

(a) Weighted Average Lease Expiry – Higher the better

(b) Vacancy Rate – Lower the better

(c) Concentration of top 10 tenants – Lower the better

(d) Sector Concentration – Lower the better (11/n)

REITs operate exactly like MF’s

(a) Sponsor – K Raheja and Blackstone

(b) Manager – K Raheja (receives AMC fees for managing the properties)

(c) And a Trustee

BUT

REIT & REIT mutual funds are not the same (12/n)

(a) Sponsor – K Raheja and Blackstone

(b) Manager – K Raheja (receives AMC fees for managing the properties)

(c) And a Trustee

BUT

REIT & REIT mutual funds are not the same (12/n)

What are REIT Mutual Funds?

Imagine a mutual fund investing in multiple REITs like Mindspace. Gives more diversification and the selection of which REIT to invest in is professionally managed by the Fund Manager. (13/n)

Imagine a mutual fund investing in multiple REITs like Mindspace. Gives more diversification and the selection of which REIT to invest in is professionally managed by the Fund Manager. (13/n)

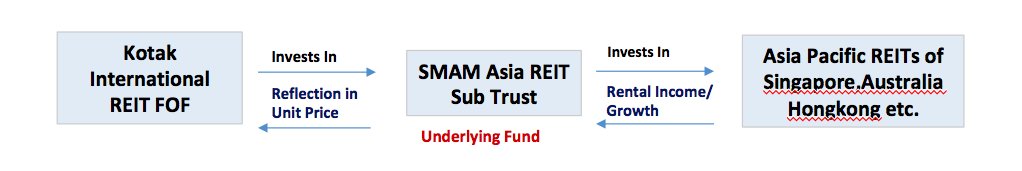

What is the Kotak NFO about?

The Kotak International REIT NFO is a Fund of Fund, which will invest in the units of an existing ‘SMAM Asia REIT Sub trust fund’ managed by Sumitomo Mitsui DS & is the largest Asia Pacific (ex-Japan) REIT fund (14/n)

The Kotak International REIT NFO is a Fund of Fund, which will invest in the units of an existing ‘SMAM Asia REIT Sub trust fund’ managed by Sumitomo Mitsui DS & is the largest Asia Pacific (ex-Japan) REIT fund (14/n)

Where am I investing? Kotak or SMAM?

The fund is an existing fund managed by SMAM. You will invest in Kotak and Kotak will invest in SMAM. This structure is called Fund of Fund (FOF) (15/n)

The fund is an existing fund managed by SMAM. You will invest in Kotak and Kotak will invest in SMAM. This structure is called Fund of Fund (FOF) (15/n)

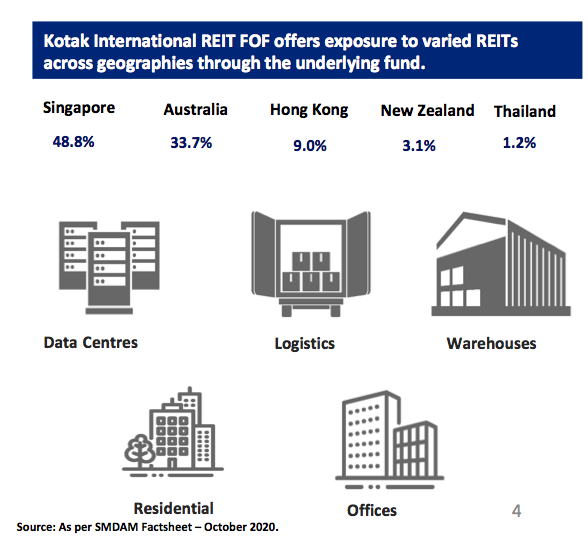

Where does the fund invest?

The underlying SMAM REIT fund invests in a basket of listed REITs across countries that include Singapore, Australia, Hong Kong, New Zealand, Thailand, India & Malaysia (16/n)

The underlying SMAM REIT fund invests in a basket of listed REITs across countries that include Singapore, Australia, Hong Kong, New Zealand, Thailand, India & Malaysia (16/n)

How is this MF different from the REIT example above?

a. MF’s don’t have a compulsion of distributing 90% rent like REITs. So the fund will receive rent from the various REIT’s it has invested in but may not distribute it and will accumulate it to increase the NAV (17/n)

a. MF’s don’t have a compulsion of distributing 90% rent like REITs. So the fund will receive rent from the various REIT’s it has invested in but may not distribute it and will accumulate it to increase the NAV (17/n)

b. Funds Taxation will be like a debt fund - Holding over 3 years will entail indexation benefit while gains less than 3 years will be taxed at your slab rate. (18/n)

Should u invest in the NFO?

Small allocation, YES!

Pros,

1. Diversification in Real Estate across geographies

2. Unlike India REIT’s which focus on only commercial Real Estate, this fund focuses on Residential, logistics, warehousing, data center(19/n)@NileshShah68 @Lakshmi1876

Small allocation, YES!

Pros,

1. Diversification in Real Estate across geographies

2. Unlike India REIT’s which focus on only commercial Real Estate, this fund focuses on Residential, logistics, warehousing, data center(19/n)@NileshShah68 @Lakshmi1876

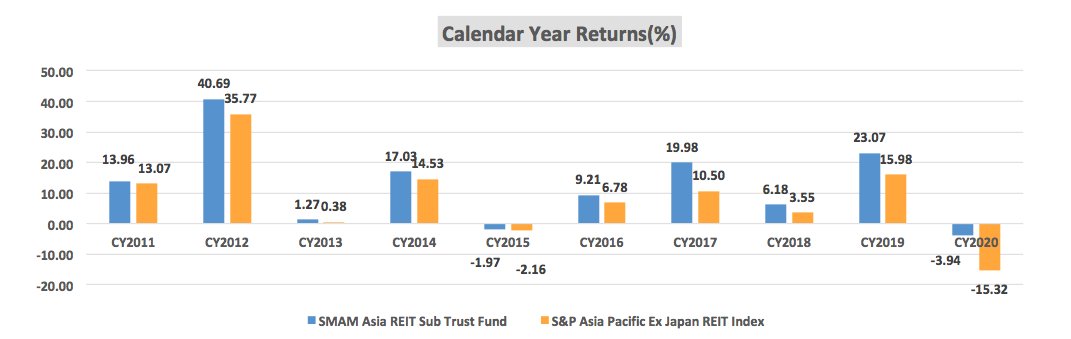

Pros continued,

3. Underlying fund will benefit from rupee depreciation. Rupee depreciates roughly 5% each year vs the major currencies & that is a straight return to the fund

4. As its a Fund of Fund, its technically not a new fund. Fund has been performing well (20/n)

3. Underlying fund will benefit from rupee depreciation. Rupee depreciates roughly 5% each year vs the major currencies & that is a straight return to the fund

4. As its a Fund of Fund, its technically not a new fund. Fund has been performing well (20/n)

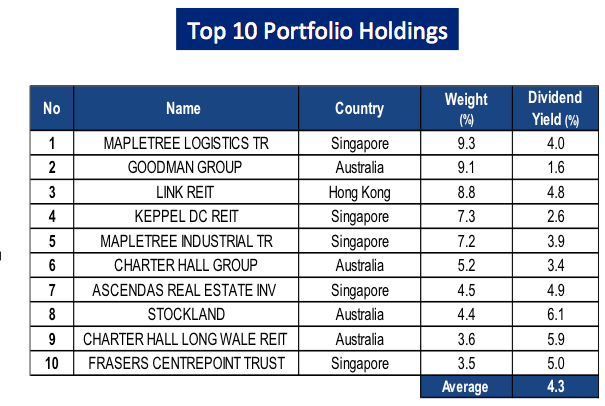

Cons,

1. Cost roughly 2% in regular plan

2. Rent yield is average 4.3%

3. Investing in REIT is nt same as renting a real estate, as REITs r listed, the volatility will be greater than tangible real estate asset

4. REIT is new for us & hence there are many unknown elements(END)

1. Cost roughly 2% in regular plan

2. Rent yield is average 4.3%

3. Investing in REIT is nt same as renting a real estate, as REITs r listed, the volatility will be greater than tangible real estate asset

4. REIT is new for us & hence there are many unknown elements(END)

REITs operate exactly like MF’s

(a) Sponsor – K Raheja and Blackstone

(b) Manager – K Raheja (receives AMC fees for managing the properties)

(c) And a Trustee

but

REITs and REIT mutual funds are not the same (12/n)

(a) Sponsor – K Raheja and Blackstone

(b) Manager – K Raheja (receives AMC fees for managing the properties)

(c) And a Trustee

but

REITs and REIT mutual funds are not the same (12/n)

What are REIT Mutual Funds?

Imagine a mutual fund investing in multiple REITs like Mindspace. Gives more diversification and the selection of which REIT to invest in is professionally managed by the Fund Manager. (13/n)

Imagine a mutual fund investing in multiple REITs like Mindspace. Gives more diversification and the selection of which REIT to invest in is professionally managed by the Fund Manager. (13/n)

What is the Kotak NFO about?

The Kotak International REIT NFO is a Fund of Fund, which will invest in the units of an existing ‘SMAM Asia REIT Sub trust fund’ managed by Sumitomo Mitsui DS & is the largest Asia Pacific (ex-Japan) REIT fund (14/n)

The Kotak International REIT NFO is a Fund of Fund, which will invest in the units of an existing ‘SMAM Asia REIT Sub trust fund’ managed by Sumitomo Mitsui DS & is the largest Asia Pacific (ex-Japan) REIT fund (14/n)

Where am I investing? Kotak or SMAM?

The fund is managed by SMAM. You will invest in Kotak and Kotak will invest in SMAM. This structure is called Fund of Fund (FOF) (15/n)

The fund is managed by SMAM. You will invest in Kotak and Kotak will invest in SMAM. This structure is called Fund of Fund (FOF) (15/n)

Where does the fund invest?

The underlying SMAM REIT fund invests in a basket of listed REITs across countries that include Singapore, Australia, Hong Kong, New Zealand, Thailand, India & Malaysia (16/n)

The underlying SMAM REIT fund invests in a basket of listed REITs across countries that include Singapore, Australia, Hong Kong, New Zealand, Thailand, India & Malaysia (16/n)

How is this MF different from the REIT example above?

a. MF’s don’t have a compulsion of distributing 90% rent like REITs. So the fund will receive rent from the various REIT’s it has invested in but may not distribute it and will accumulate it to increase the NAV (17/n)

a. MF’s don’t have a compulsion of distributing 90% rent like REITs. So the fund will receive rent from the various REIT’s it has invested in but may not distribute it and will accumulate it to increase the NAV (17/n)

(b) Funds Taxation will be like a debt fund - Holding over 3 years will entail indexation benefit while gains less than 3 years will be taxed at your slab rate. (18/n)

Should u invest in the NFO?

Yes, some allocation can be made.

Pros,

1. Diversification in Real Estate across geographies

2. Unlike India REIT’s which focus on only commercial Real Estate, this fund focuses on Residential, logistics, warehousing and data centers as well (19/n)

Yes, some allocation can be made.

Pros,

1. Diversification in Real Estate across geographies

2. Unlike India REIT’s which focus on only commercial Real Estate, this fund focuses on Residential, logistics, warehousing and data centers as well (19/n)

pro's continued ....

3. Underlying fund will benefit from rupee depreciation as generally rupee depreciates vs all major currencies

4. The NFO is a FOF and the underlying fund has been performing well. Its technically not an NFO (20/n) @NileshShah68

3. Underlying fund will benefit from rupee depreciation as generally rupee depreciates vs all major currencies

4. The NFO is a FOF and the underlying fund has been performing well. Its technically not an NFO (20/n) @NileshShah68

Cons,

1. Cost @ 2% 4 regular plan

2. Rent yield is average 4.3%

3. Investing in REIT is nt equivalent 2 renting a real estate, as REITs r listed, the volatility will be greater than tangible real estate asset

4. REITs is new for us and hence there are many unknow elements(END)

1. Cost @ 2% 4 regular plan

2. Rent yield is average 4.3%

3. Investing in REIT is nt equivalent 2 renting a real estate, as REITs r listed, the volatility will be greater than tangible real estate asset

4. REITs is new for us and hence there are many unknow elements(END)

2 new updates as per #Budget 2021

(a) No TDS on dividends received by REITs

(b) FPIs are allowed to do debt financing (invest as debt) to REITs

(a) No TDS on dividends received by REITs

(b) FPIs are allowed to do debt financing (invest as debt) to REITs

• • •

Missing some Tweet in this thread? You can try to

force a refresh