Time for another $YFL thread 🧵

It has been a wild past couple of weeks, lots of ups and downs, but the stars are aligning and things are more bullish than ever.

Read on 👇👇👇

It has been a wild past couple of weeks, lots of ups and downs, but the stars are aligning and things are more bullish than ever.

Read on 👇👇👇

As everyone knows, #LINKSWAP launched roughly a week ago following a couple delays, but so far all the data is extremely promising.

I’m going to walk through a few key metrics as well as some key macro factors to consider below...

I’m going to walk through a few key metrics as well as some key macro factors to consider below...

Metric 1: Total Value Locked

V2 Staking Vault: ~10,000 $YFL (20% of the supply)

V1 Staking Vault: 890 YFL

Liquidity Pools: $11,600,000+

Total USD TVL = ~$16,200,000

V2 Staking Vault: ~10,000 $YFL (20% of the supply)

V1 Staking Vault: 890 YFL

Liquidity Pools: $11,600,000+

Total USD TVL = ~$16,200,000

$16m+ TVL in a week is incredible, especially considering that the team still needs to:

1. Get #LINKSWAP data listed on CoinGecko etc.

2. Fix some front end issues

3. Launch the community-built marketing campaign

4. Launch the info.linkswap site

All coming this week.

1. Get #LINKSWAP data listed on CoinGecko etc.

2. Fix some front end issues

3. Launch the community-built marketing campaign

4. Launch the info.linkswap site

All coming this week.

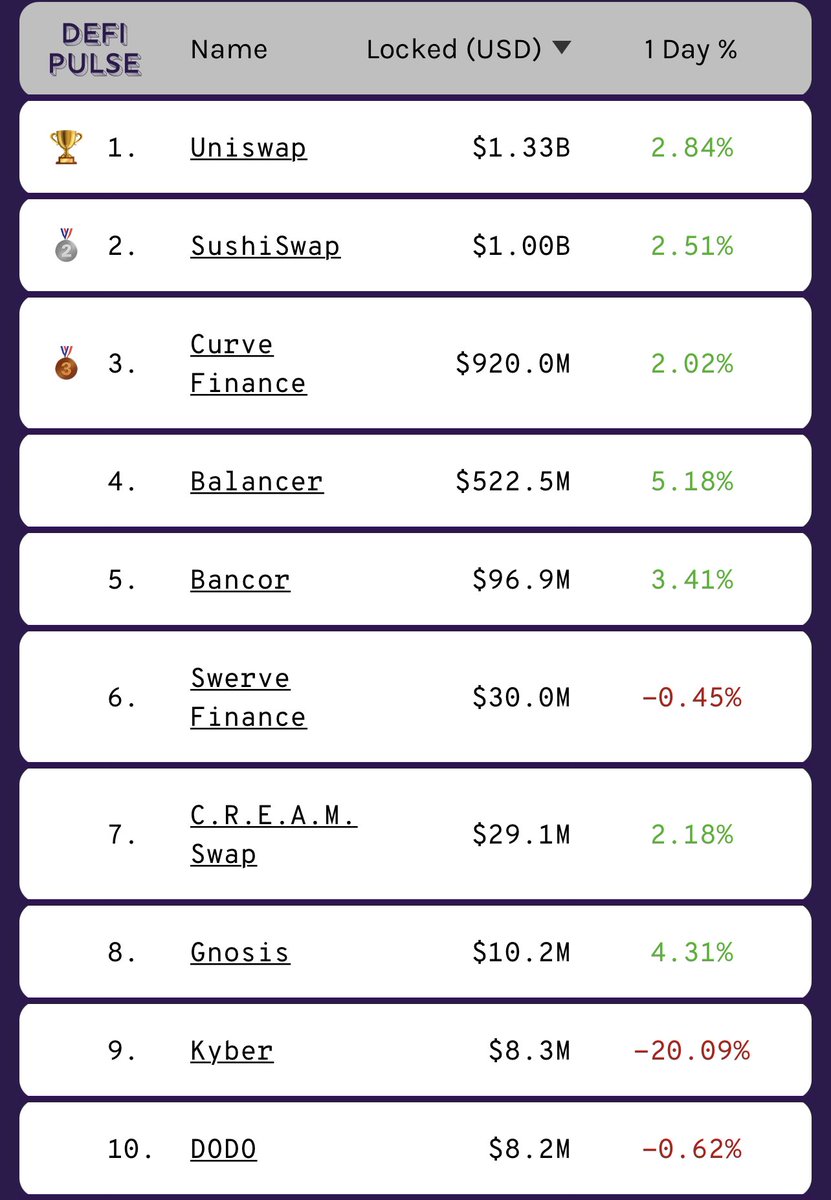

Currently, despite it only being a week old, #LINKSWAP is the 8th largest DEX by TVL, right behind @CreamdotFinance and @SwerveFinance

And it’s growing by millions every single day thanks to the support of large whales like @0x_b1

And it’s growing by millions every single day thanks to the support of large whales like @0x_b1

Once all the aforementioned tasks are completed, initiatives like @linkcheckio (still to be formally announced!) will be able to kick off and start boosting the platform’s volume

Metric 2: Volume

So far volume is averaging at over $800,000 per day since launching.

This is pretty good considering that liquidity is just starting to build, mobile users won’t be able to use the site until this week, and only a few exclusive listings have been added.

So far volume is averaging at over $800,000 per day since launching.

This is pretty good considering that liquidity is just starting to build, mobile users won’t be able to use the site until this week, and only a few exclusive listings have been added.

A few catalysts for volume:

• $YFL trading alone should give LS a solid $2-5m+ per day in volume once it migrates from Uni

• GSR’s marketing making (arbitrage) bots will provide likely millions more once activated

• Exclusive listings

• Aggregator volume (1inch, etc)

• $YFL trading alone should give LS a solid $2-5m+ per day in volume once it migrates from Uni

• GSR’s marketing making (arbitrage) bots will provide likely millions more once activated

• Exclusive listings

• Aggregator volume (1inch, etc)

I also expect that the profitability of farming $YFL using the various $LINK pairs will also lead to inflows of volume once farmers take notice.

I predict that #LINKSWAP will see a solid $5m+ daily volume towards the end of the year, rising to $15m+ by February of 2021.

This will make LS roughly the 10th largest DEX by volume

From here I expect stable upwards growth as it gains market share.

This will make LS roughly the 10th largest DEX by volume

From here I expect stable upwards growth as it gains market share.

So, what does all this mean for $YFL?

Based on the current data, it’s fair to think LINKSWAP will rank around #10 amongst DEXs in the coming weeks.

This would make Balancer and Kyber some of its closest peers (purely by volume and TVL)

Based on the current data, it’s fair to think LINKSWAP will rank around #10 amongst DEXs in the coming weeks.

This would make Balancer and Kyber some of its closest peers (purely by volume and TVL)

Now, each of these platforms have their own unique features that drive value to the token.

For $YFL, we have:

• Staking rewards

• @linkpadio

• @linkcheckio

• Governance rights

^ these all provide YFL with inherent, non-speculative value.

For $YFL, we have:

• Staking rewards

• @linkpadio

• @linkcheckio

• Governance rights

^ these all provide YFL with inherent, non-speculative value.

I also have to mention all the great features that will be activated on #LINKSWAP soon to give it an edge over other platforms:

• Auto-pooling

• Limit orders for LP tokens thanks to @cyberfi_tech

• Rug Lock

• Slip Lock

• Something being announced soon 👀

• Auto-pooling

• Limit orders for LP tokens thanks to @cyberfi_tech

• Rug Lock

• Slip Lock

• Something being announced soon 👀

The launch of LINKSWAP was off to a rough start due to a couple delays and some minor front end bugs.

However, after this week, all of that will be in the past.

We’re about to enter a new era of growth for $YFL, get ready frogs!

However, after this week, all of that will be in the past.

We’re about to enter a new era of growth for $YFL, get ready frogs!

Tagging some long-time $YFL supporters for exposure :)

@Josh_Rager @fonship @scottmelker @gMAKcrypto @Coin_Shark @fomosaurus

@Josh_Rager @fonship @scottmelker @gMAKcrypto @Coin_Shark @fomosaurus

• • •

Missing some Tweet in this thread? You can try to

force a refresh