$DMYD to merge w/ @GeniusSports - The Index for Sports Betting with Strong Tail Winds.

A thread.

@MarkLockeGSG @NiccoloDeMasi @spac_insider

A thread.

@MarkLockeGSG @NiccoloDeMasi @spac_insider

1) Genius Sports is going public through a SPAC merger with $DMYD, which is led by @NiccoloDeMasi, the former CEO of Glu Mobile. The man has consummated +25 mergers and has a keen focus on gaming. His first SPAC, $DMYT is taking Rush Street Interactive, in the next two months.

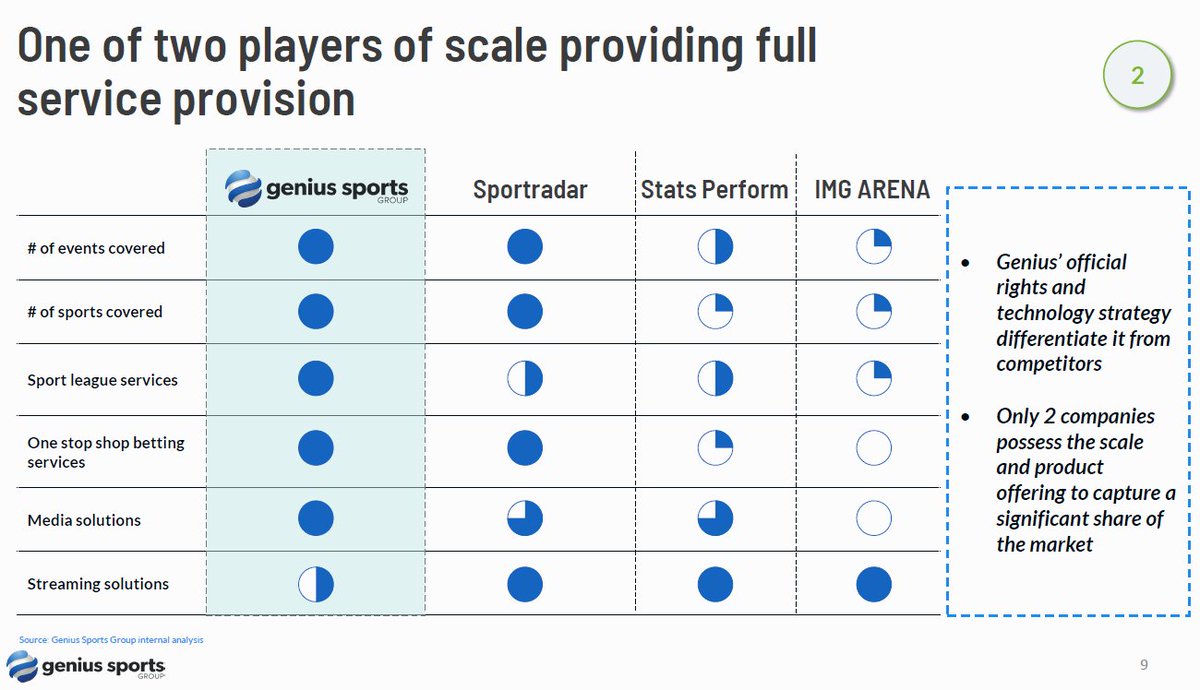

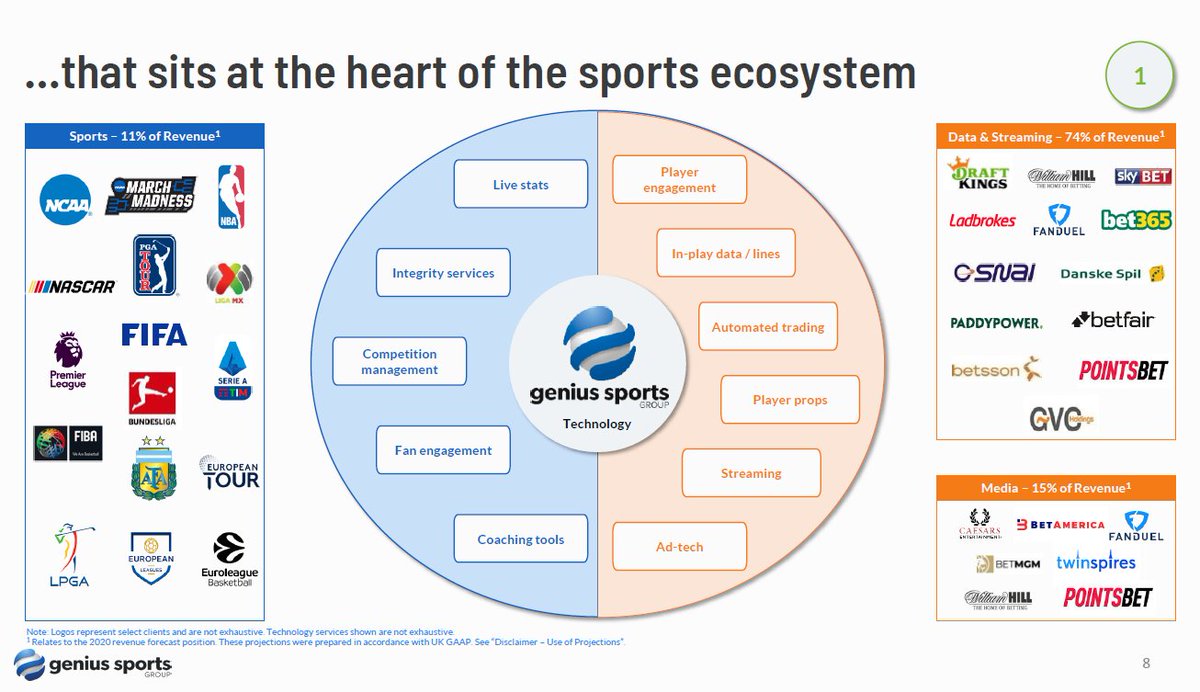

2) Who is Genius Sports? It's one of 2 large sports data providers (duopoly) that works closely with leagues to collect and sell live game data to sportsbooks. This is incredibly important as live betting needs constantly updated stats to adjust prop bets and lines in real time.

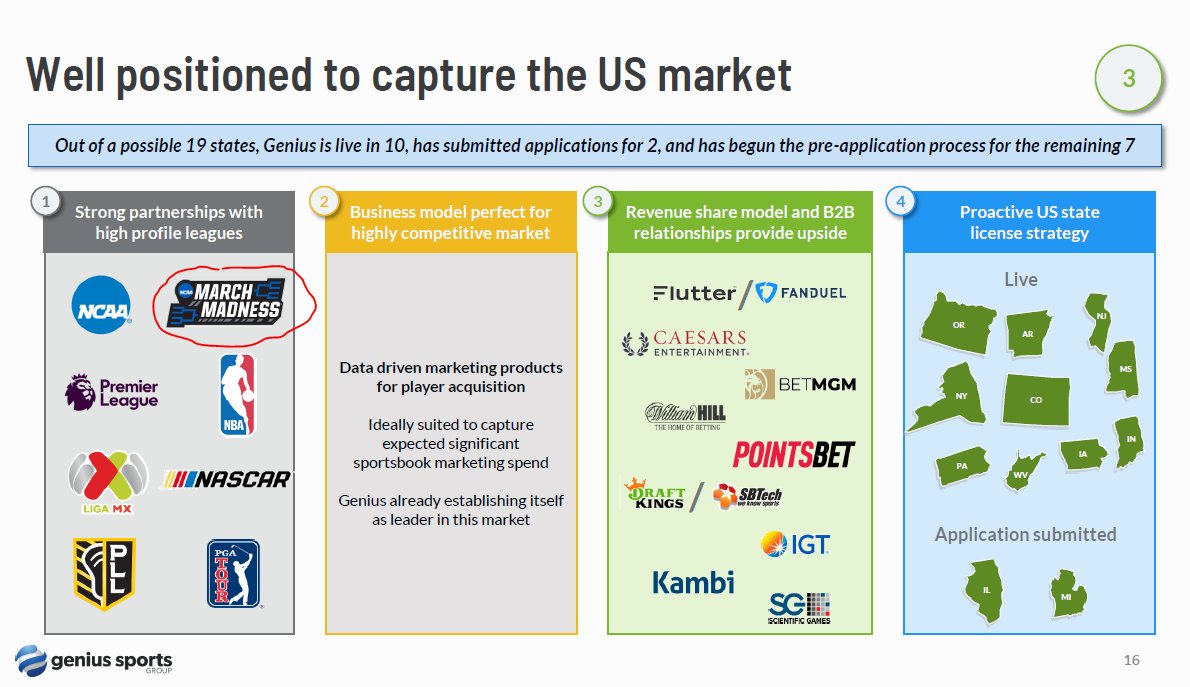

3) Genius currently has long-term contracts with NBA, NCAA, PGA, NASCAR, Premier League, FIBA, and many others to be the sole or primary data provider. These partnerships have staying power, as Genius helps develop data capture technology in exchange for rights.

4) Genius has 220 customers, including Draftkings, Fanduel, WilliamHill, MGM, PointsBet, and Caesars. Not only does Genius get minimums in their contracts which count for 60% of projected revenue, Genius takes 5% of revenues of events they cover from ALL sportsbooks.

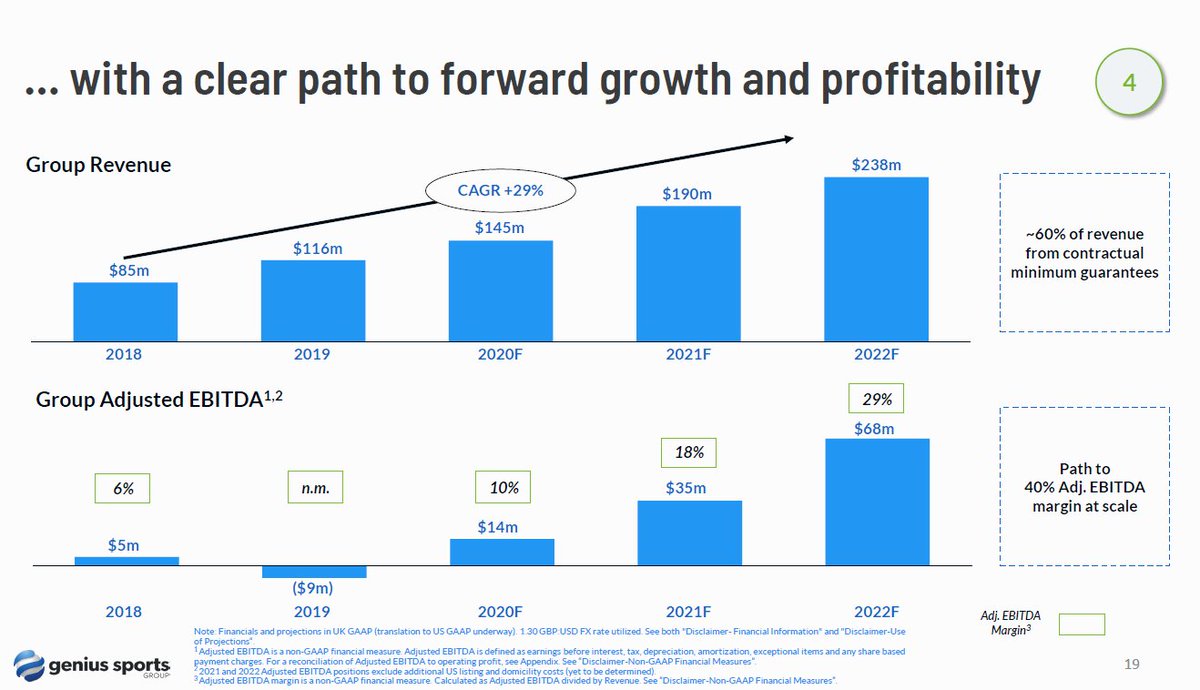

5) Genius has been growing at a 29% CAGR over last several years with revenue increasing 250% from 2016 to 2020. As stated before, 60% of revenue is from multi-year contract guaranteed minimums and top 10 customers only account for 10% of revenue.

6) Genius is already EBITDA positive with 10% margins this year and anticipates $68M in adj EBITDA at 29% margings in 2022E. In COVID hit 2020, Genius STILL grew revenue from $116M to $145M. They also resigned their multi-year contract with NBA.

7) Genius's technological prowess led to an interesting agreement with the NCAA. Until 2018, live data with college sports was incredibly inefficient. Genius signed a contract with NCAA to create new software: NCAA Livestats geniussports.com/sports/sports-…

8) This software is used across all divisions of college sports and is powered by Genius! As a former college athlete told me, they reached out to their athletic support staff for feedback. The staff raved about how Genius has improved efficiency and accuracy for collecting data.

9) NCAA Livestats transformed the entire industry. NCAA also provides an upside catalyst as the $DMYD merger is about to close in Feb - MARCH MADNESS. This event was canceled last year due to COVID-19. Betters placed $4.8B in bets on the tourny in 2019.

10) Who has a monopoly on NCAA data? Genius. Who gets a 5% revenue share from ALL sportsbooks for NCAA events? Genius. With the number of states legalized betting doubling from 2018 to 2020, we could see upwards of $10B spent on March Madness this year.

11) Vaccine rollouts are going to unlock massive pent up demand for sports and sports betting ... and remember, Genius revenues GREW during the 2020 pandemic. 2021 should be a strong year indeed.

12) Genius is valued at $2B EV or 8.6x 2022E rev, a player in duopolistic market with high CAGR and industry with massive tailwinds. This seems cheap compared to much higher multiple sportsbooks like Golden Nugget, Draftkings, and Penn - lower margin and face growing competition.

13) $DMYD and Genius quietly announced their merger in late October, during a tumultuous market leading into the presidential election, thus getting overlooked. While investors have been chasing the latest hot EV SPAC, Genius has quietly gone from $10 to it's current price of $13

14) $DMYD continues to fly under the radar and is the sleeper pick of 2021 as it goes public just before March Madness. Genius will trade at a premium to sportsbook companies once the broader market realizes they can invest in the data behind the sports betting industry.

15) One more thing, follow @GeniusSports - these guys are literally adding several leagues a month as partners. Also just won Best Sports Data provider & Live Betting Product. $DMYD #SPACS

https://twitter.com/Betgenius/status/1337333121050697728

16) Remember this thread from December 2020 when I said @GeniusSports is adding several leagues a month? Well they just added @NFL and @MLB. Many @Sportradar bulls would point to its lock of the "Big Four" to justify a $10B valuation. $DMYD $GENI $HZON #spacs #spacsquad

17) @GeniusSports now has NFL, MLB and NBA on top of NCAA and Premier League. Genius is the new juggernaut of sports data and analytics that will power the explosive growth of sports betting in the US and worldwide. $DMYD $GENI $HZON #spacs #spacsquad

18) @GeniusSports paid up for @NFL by offering what will likely be $120M / year of which half will be paid in equity (total 5%). To put this in context, Genius was projected to do $190M and $35M of revenue and ebitda for 2021E. $DMYD $GENI $HZON

sportico.com/leagues/footba…

sportico.com/leagues/footba…

19) How big could the opportunity be for Genius? Well we know at the end of 2019, Sportradar was asking for 1.5% of net profits from in game NFL betting from sportsbooks. Contrast that w/ Genius which gets 5% of gross revenue for its sporting events from sportsbooks. $DMYD $GENI

20) Sportradar was "only" paying $40M / year to NFL, but that was before sports betting was legal in the US. 20 states have recently legalized it with many more coming. Global sports betting was $203 BILLION in 2020 and that is rapidly growing. $DMYD $GENI $HZON #spacs

21) Perhaps NFL viewed @GeniusSports as more technologically capable to effectively monetize its sports data. NFL press quotes and commitment by Genius and NFL to develop a joint technology and innovation center seem to suggest this. $DMYD $GENI $HZON #spacs #spacsquad

22) So what will revised projections look like for @GeniusSports w/ NFL & MLB? I don't know. But looking at Genius's old projections I think it should trade inline with $DKNG in the mid $20s based on 2022E rev until we get revised projections. $DMYD $GENI $HZON

23) Genius did lay out their long-term opportunity. If the company expected $238M / $68M for 2022E Rev / EBITDA, how quickly does NFL and MLB bring forward $1.5B of Rev and $600M of EBITDA?

Bottom Line: I'M NOT SELLING.

$DMYD $GENI @NiccoloDeMasi

Bottom Line: I'M NOT SELLING.

$DMYD $GENI @NiccoloDeMasi

• • •

Missing some Tweet in this thread? You can try to

force a refresh