Red-bean filled bread man. Posts are ideas and opinions, not investment advice. #forsteve

3 subscribers

How to get URL link on X (Twitter) App

2/ $ASTS: "FutureG Priority Efforts for 2024"

2/ $ASTS: "FutureG Priority Efforts for 2024"

https://twitter.com/KZagaris/status/1936087960891560384

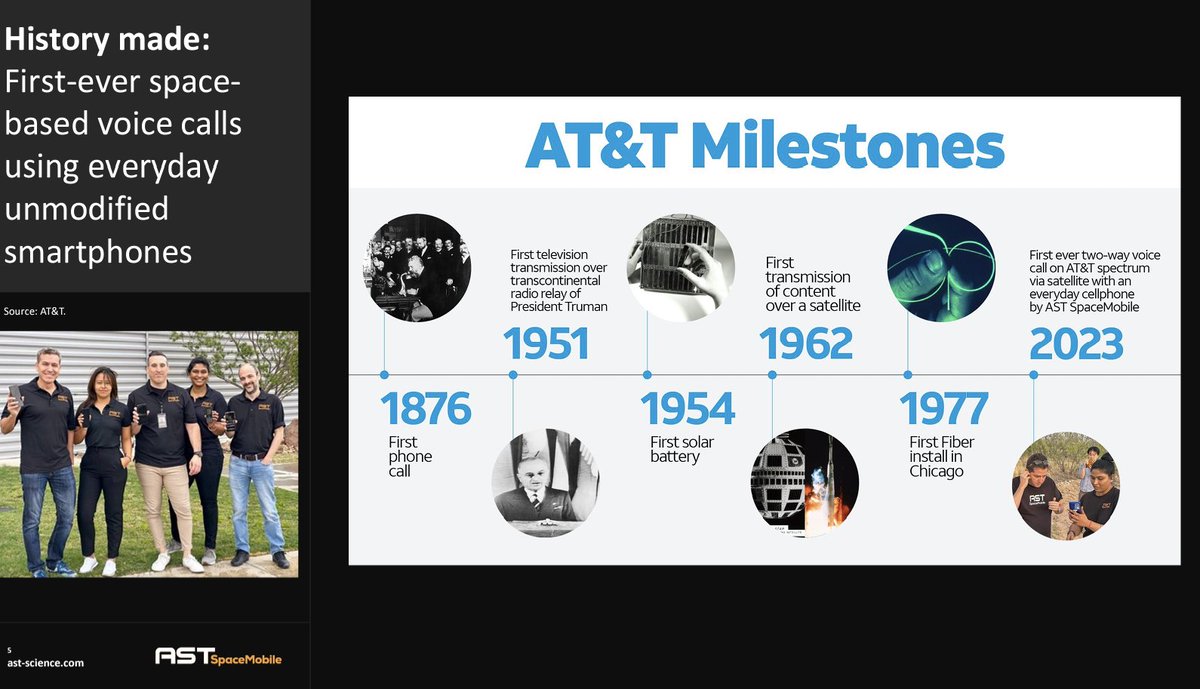

2/ $ASTS: AT&T FirstNet Presentation Slides 1

2/ $ASTS: AT&T FirstNet Presentation Slides 1

@ATT 2/ $ASTS added 5 more MNOs bringing the total to 40 globally representing well over 2 billion potential customers for service. These sophisticated MNOs are undertaking their own due diligence and are choosing AST over other potential competitors like Lynk and Starlink.

@ATT 2/ $ASTS added 5 more MNOs bringing the total to 40 globally representing well over 2 billion potential customers for service. These sophisticated MNOs are undertaking their own due diligence and are choosing AST over other potential competitors like Lynk and Starlink.

2/ First, let's discuss the negatives. (1) Testing is taking longer than expected. Initially the co gave guidance of T+6 mos and then Q1. It's important to understand that testing is an ongoing process and will continue throughout the life of BlueWalker-3.

2/ First, let's discuss the negatives. (1) Testing is taking longer than expected. Initially the co gave guidance of T+6 mos and then Q1. It's important to understand that testing is an ongoing process and will continue throughout the life of BlueWalker-3.

2/ $ASTS: On 1/31, AT&T's Defense Business Lead, posts details on how AST+AT&T are working to provide the Department of Defense w/ seamless and reliable terrestrial + space-based mobile network. READ EVERY SINGLE WORD.

2/ $ASTS: On 1/31, AT&T's Defense Business Lead, posts details on how AST+AT&T are working to provide the Department of Defense w/ seamless and reliable terrestrial + space-based mobile network. READ EVERY SINGLE WORD.

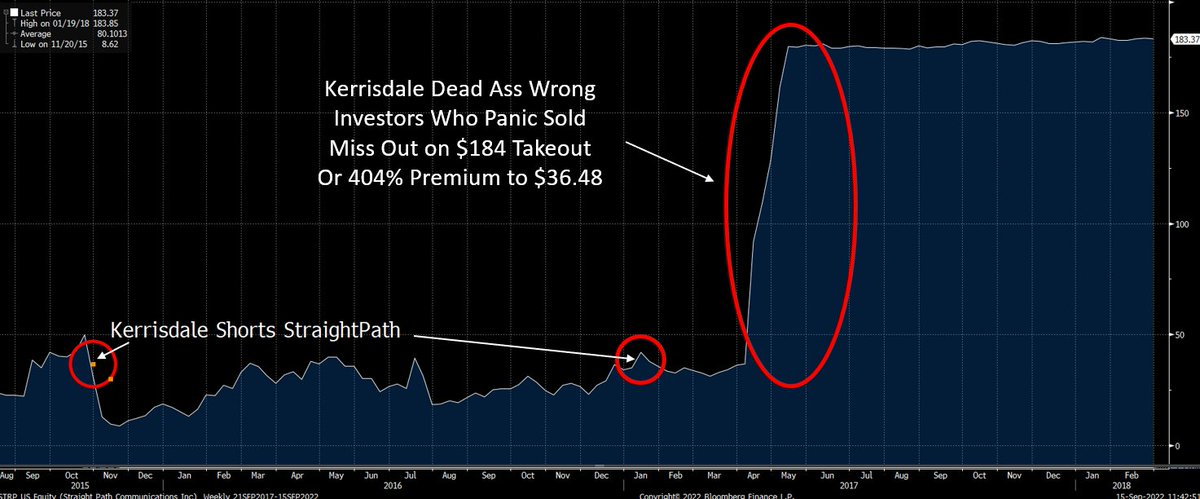

2/ However a short 3 months after Kerrisdale's last report, AT&T agreed to buy $STRP for $95.35/share and then lost out to Verizon in a bidding war for $184/share a 404% premium!

2/ However a short 3 months after Kerrisdale's last report, AT&T agreed to buy $STRP for $95.35/share and then lost out to Verizon in a bidding war for $184/share a 404% premium!

2/ $ASTS First, what @ast_spacemobile is trying to accomplish is very difficult. When I started diligencing AST in late 2020, there were skeptics that said satellites communicating directly to unmodified mobile phones was not possible.

2/ $ASTS First, what @ast_spacemobile is trying to accomplish is very difficult. When I started diligencing AST in late 2020, there were skeptics that said satellites communicating directly to unmodified mobile phones was not possible.

https://twitter.com/SpaceX/status/1562476038235377665

$ASTS Makes a ton of sense for $TMUS to offer Starlink internet for home service in areas where they don't have the towers/coverage for their own 5G/LTE Home Internet.

$ASTS Makes a ton of sense for $TMUS to offer Starlink internet for home service in areas where they don't have the towers/coverage for their own 5G/LTE Home Internet.

2/ What is smash & grab activist short selling? It's when a scumbag like Ben Axler makes outright lies, false claims, and sensationalistic statements about a company with the hope creating panic selling so he can then cover his short position for a near riskless profit.

2/ What is smash & grab activist short selling? It's when a scumbag like Ben Axler makes outright lies, false claims, and sensationalistic statements about a company with the hope creating panic selling so he can then cover his short position for a near riskless profit.

2/ $ASTS Q2 Business:

2/ $ASTS Q2 Business:

2/ $TPGY Carveout transactions are notoriously complex. When you're taking a division public, trying to separate CLEAN financials from the parent can be very difficult. Add on top that EVBox is European: translating IFRS to GAAP accounting adds more complexity!

2/ $TPGY Carveout transactions are notoriously complex. When you're taking a division public, trying to separate CLEAN financials from the parent can be very difficult. Add on top that EVBox is European: translating IFRS to GAAP accounting adds more complexity!