In 1997, "The Sovereign Individual" made predictions about the ways in which the internet will radically alter society.

Many of those predictions, including the rise of "cybercash", are playing out before our eyes.

This illustrated thread summarises the book in 12 Tweets.👇

Many of those predictions, including the rise of "cybercash", are playing out before our eyes.

This illustrated thread summarises the book in 12 Tweets.👇

1/ Humans have passed through three societal epochs:

1. Hunter-Gatherer Society

2. Agricultural Society

3. Industrial Society

Now, looming over the horizon, is something entirely new, a fourth age characterised by the rise of the microprocessor: Information Society.

1. Hunter-Gatherer Society

2. Agricultural Society

3. Industrial Society

Now, looming over the horizon, is something entirely new, a fourth age characterised by the rise of the microprocessor: Information Society.

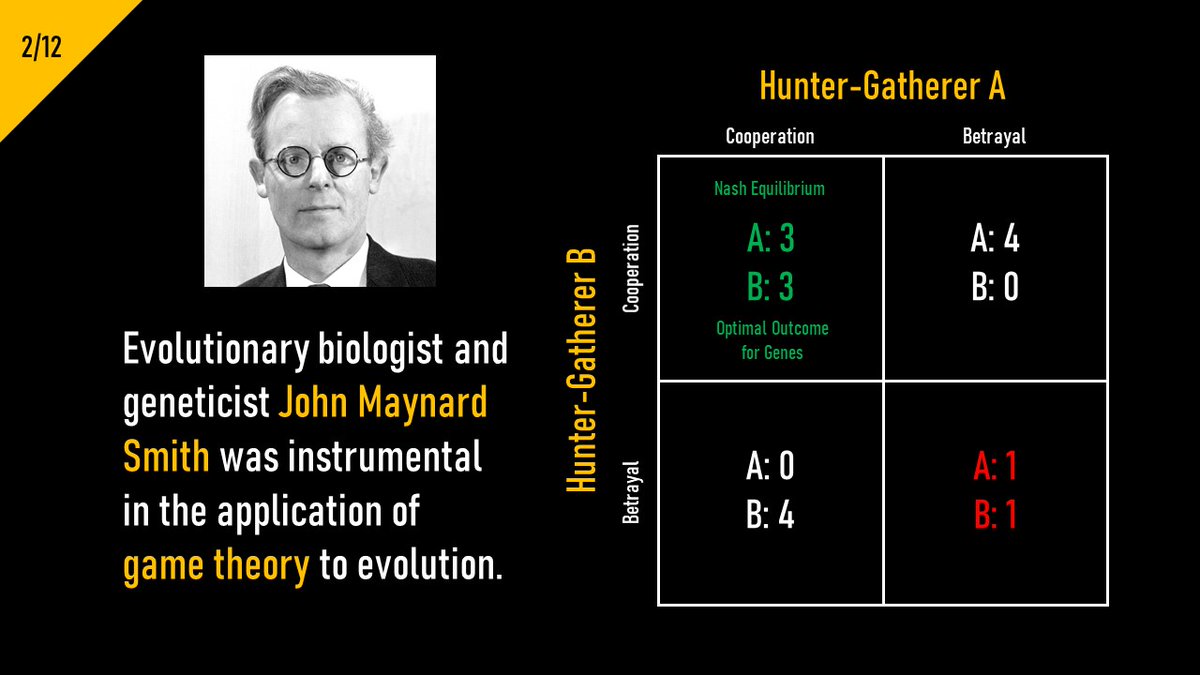

2/ During the industrial era, in order to realise economies of scale, populations clustered around large factories.

Production clustering made it easier for governments to increase taxes on those operating within their territory, allowing the state to grow in size and power.

Production clustering made it easier for governments to increase taxes on those operating within their territory, allowing the state to grow in size and power.

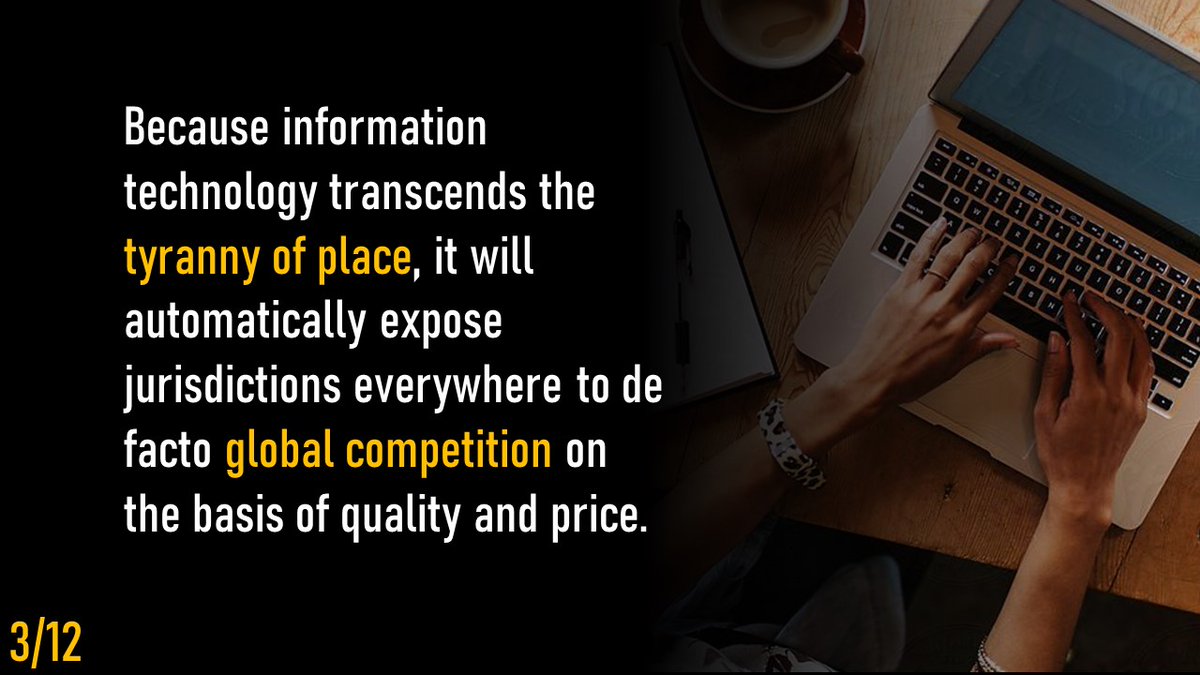

3/ But the internet, with its ability to transfer information seamlessly across the world, stands to reverse this trend.

People employed in the information economy will be freed from the “Tyranny of Place”, becoming increasingly able to operate from any jurisdiction they like.

People employed in the information economy will be freed from the “Tyranny of Place”, becoming increasingly able to operate from any jurisdiction they like.

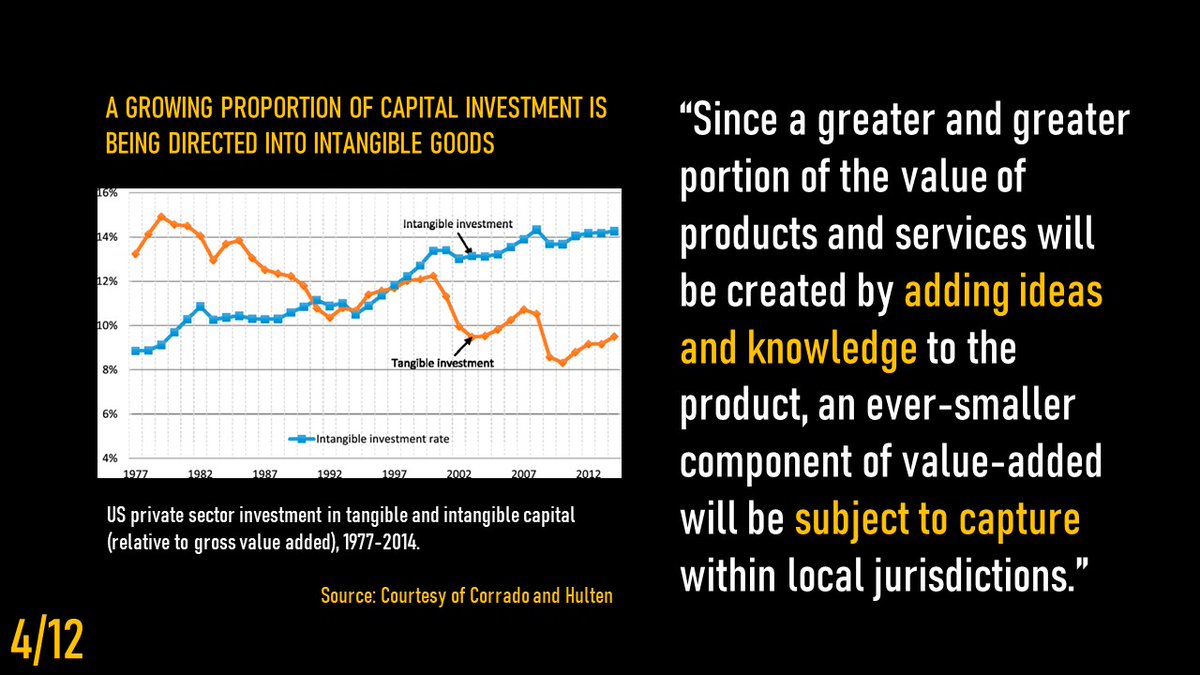

4/ At the same time, businesses will be able to draw on a global pool of talent, contracting flexibly across multiple continents.

With employees around the world and agile operations in cyberspace, the value businesses create will be less subject to government capture.

With employees around the world and agile operations in cyberspace, the value businesses create will be less subject to government capture.

5/ This changing business environment will reduce governments' power to tax income and capital.

Their power of compulsion over money will also weaken.

The rise of digital currencies will cause monetary control to migrate from the halls of power to the global marketplace.

Their power of compulsion over money will also weaken.

The rise of digital currencies will cause monetary control to migrate from the halls of power to the global marketplace.

6/ Cybercash will become the dominant medium of exchange for high value transactions.

Its existence is made possible by a mathematical truth: that it is trivial to multiply prime numbers into a larger product, but almost impossible to unravel a product into its simple primes.

Its existence is made possible by a mathematical truth: that it is trivial to multiply prime numbers into a larger product, but almost impossible to unravel a product into its simple primes.

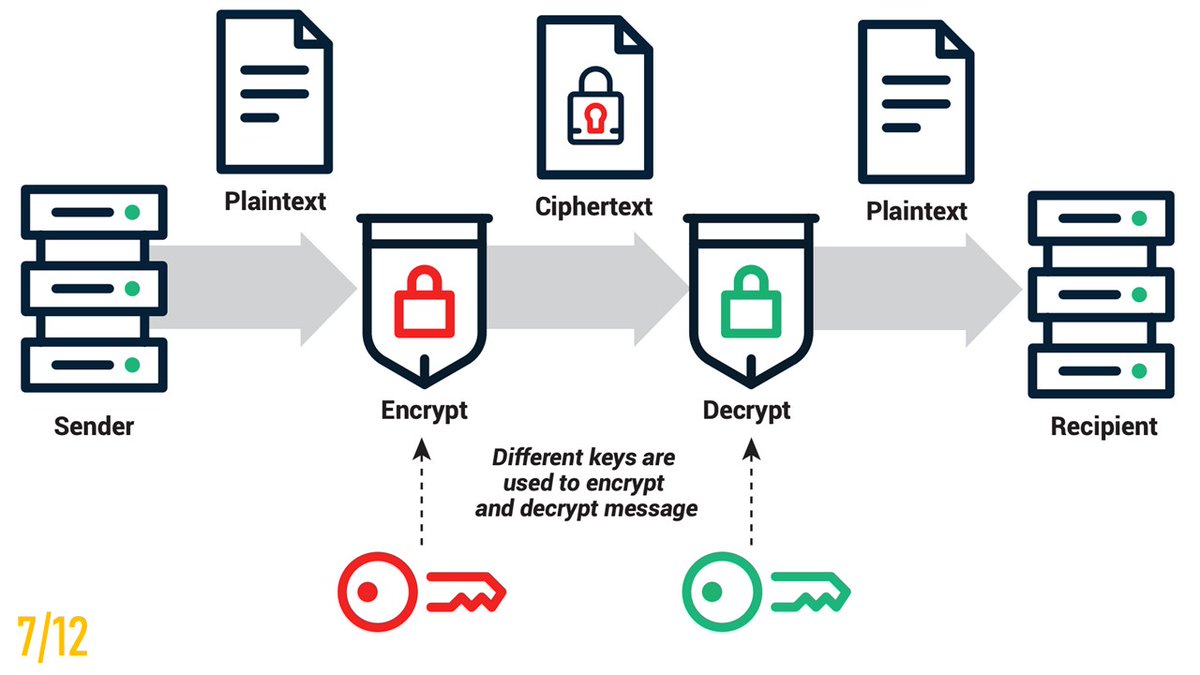

7/ The mathematical asymmetry of prime numbers underlies the design of public key-private key encryption technologies.

These technologies will support the architecture of digital money, making it almost impossible to counterfeit, and making monetary receipts verifiably unique.

These technologies will support the architecture of digital money, making it almost impossible to counterfeit, and making monetary receipts verifiably unique.

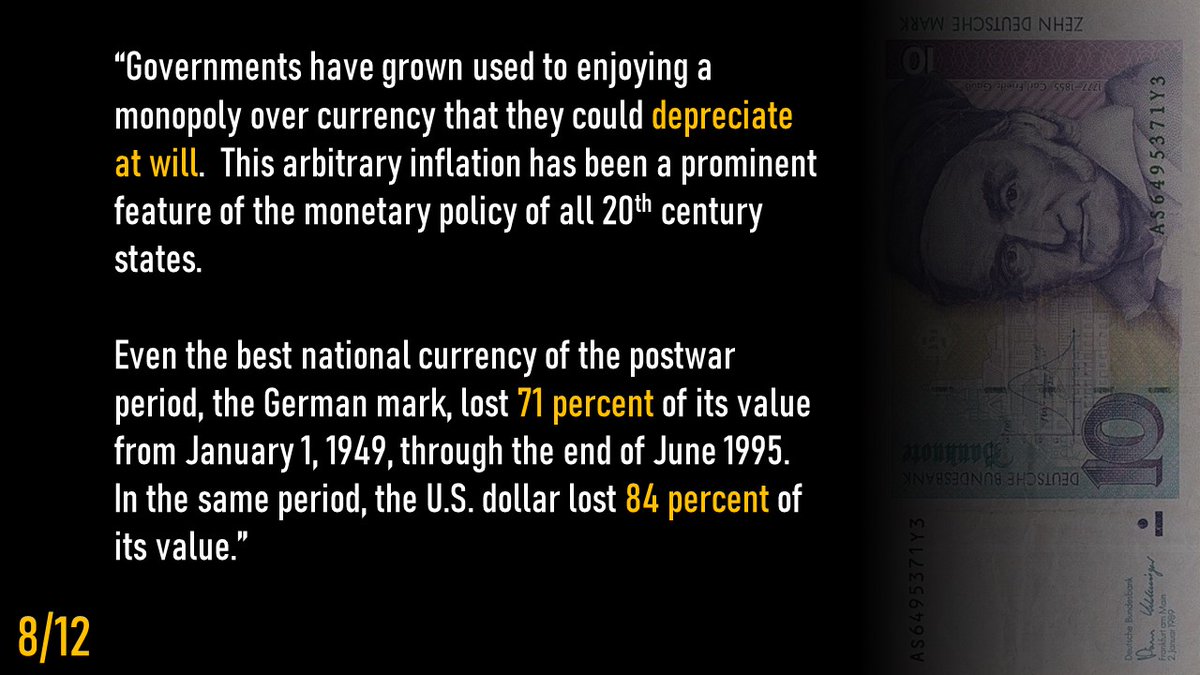

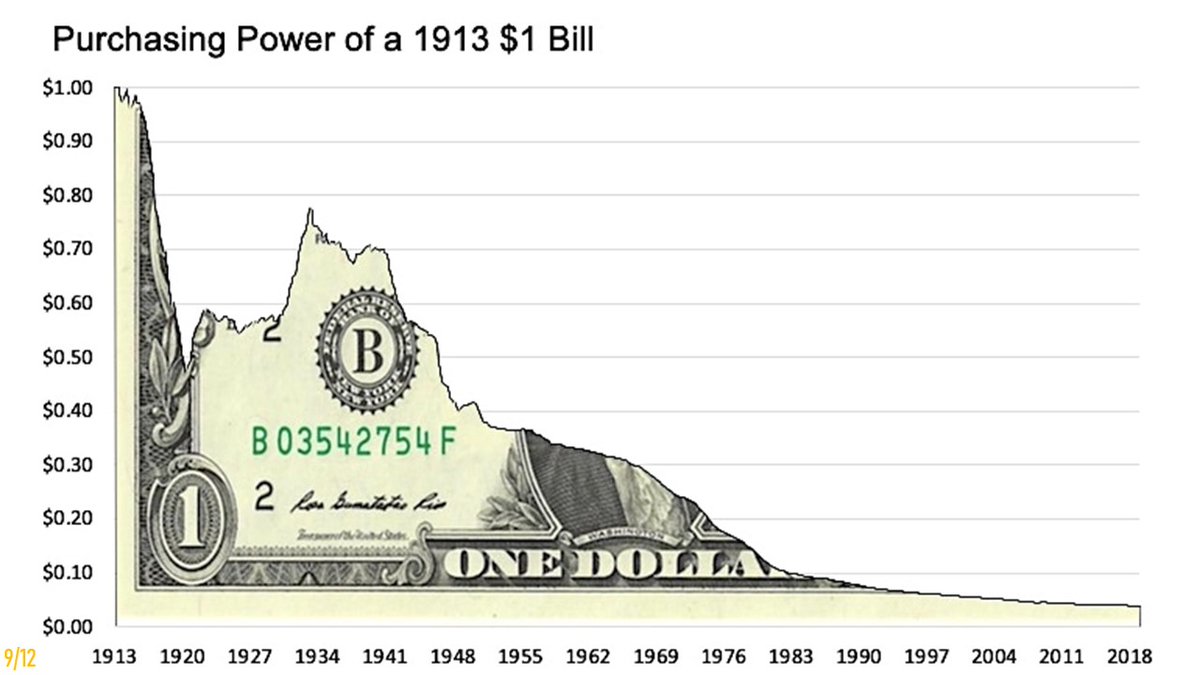

8/ This poses a further challenge for governments given that inflation of national currencies serves as a major source of their revenue.

The invention of cybercash will allow any individual or firm to easily shift out of any fiat currency that appears in danger of depreciation.

The invention of cybercash will allow any individual or firm to easily shift out of any fiat currency that appears in danger of depreciation.

9/ New monetary competition will undermine governments’ ability to expropriate wealth through inflation.

Digital money will return control of the medium of exchange to the owners of wealth, who wish to preserve it, rather than to nation states that wish to spirit it away.

Digital money will return control of the medium of exchange to the owners of wealth, who wish to preserve it, rather than to nation states that wish to spirit it away.

10/ The combination of these factors will diminish the revenue generation power of governments.

Rather than treating their citizens and resident companies like state assets, they will be forced to treat mobile “Sovereign Individuals" and businesses more like valued customers.

Rather than treating their citizens and resident companies like state assets, they will be forced to treat mobile “Sovereign Individuals" and businesses more like valued customers.

11/ This is not to say that states will disappear.

They will still provide services like defense and infrastructure.

However, increasing competition between states will make it harder for them to charge more in taxes than their services are worth to their residents.

They will still provide services like defense and infrastructure.

However, increasing competition between states will make it harder for them to charge more in taxes than their services are worth to their residents.

12/ We are in the early stages of a social transition.

Transitions are turbulent, but new technological forces will support longer-term human flourishing and limit the role of coercion in human exchange.

Those who understand this will be best placed to adapt to the new reality.

Transitions are turbulent, but new technological forces will support longer-term human flourishing and limit the role of coercion in human exchange.

Those who understand this will be best placed to adapt to the new reality.

Thank you for reading.

If you enjoyed this thread please re-Tweet to help its message reach a wider audience.

For more like this follow me at

@TheAustrian3.

You can find out more about me and access my collated threads on my medium page: theaustrian3.medium.com

If you enjoyed this thread please re-Tweet to help its message reach a wider audience.

For more like this follow me at

@TheAustrian3.

You can find out more about me and access my collated threads on my medium page: theaustrian3.medium.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh