How to get URL link on X (Twitter) App

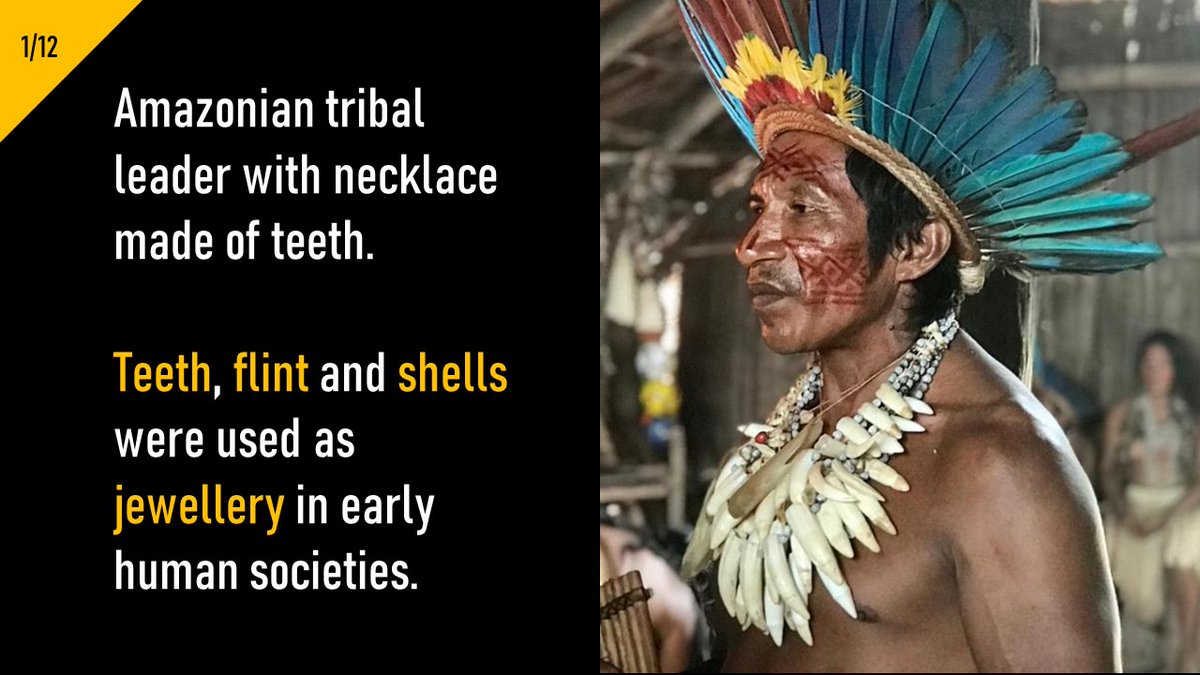

1/ Most hunter gatherers lived a precarious existence on the brink of starvation.

1/ Most hunter gatherers lived a precarious existence on the brink of starvation.

https://twitter.com/real_vijay/status/969591986662424576In 2008, Satoshi Nakamoto published a 9 page solution to a long-standing computer science puzzle known as the Byzantine General’s Problem.

BABYLONIA

BABYLONIA

Attempts to explain social phenomena by reference to objects, abstract nouns, or collectivist entities are ultimately futile.

Attempts to explain social phenomena by reference to objects, abstract nouns, or collectivist entities are ultimately futile.

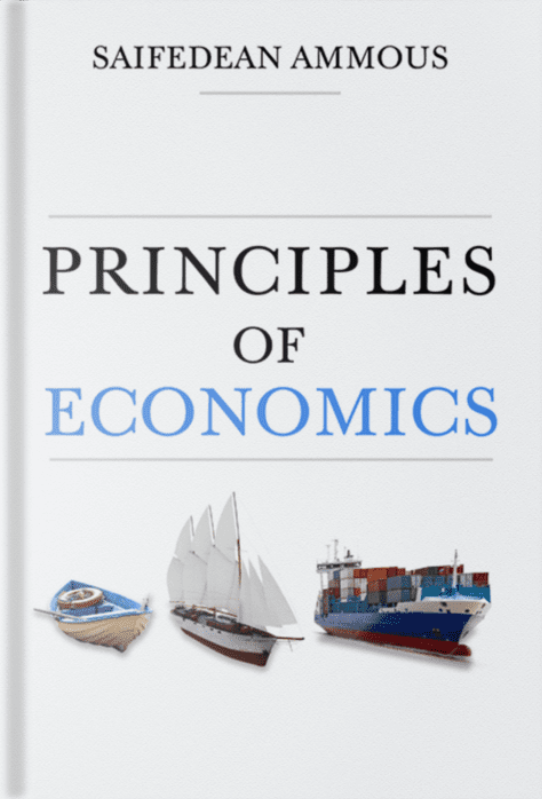

#TheSpiritLevel argues that income inequality leads to a range of bad social outcomes concerning life expectancy, obesity, mental health, homicide and child mortality.

#TheSpiritLevel argues that income inequality leads to a range of bad social outcomes concerning life expectancy, obesity, mental health, homicide and child mortality.

Lips argues that the confidence gold backing inspired in CHF helped transform landlocked and resource-poor Switzerland into one of the world's most prosperous countries. Switzerland enjoyed the benefits of sound money, high savings, strong growth and low unemployment.

Lips argues that the confidence gold backing inspired in CHF helped transform landlocked and resource-poor Switzerland into one of the world's most prosperous countries. Switzerland enjoyed the benefits of sound money, high savings, strong growth and low unemployment.

They blame Hoover’s “laissez faire” response to the crash of 1929 for the severity of the Great Depression.

They blame Hoover’s “laissez faire” response to the crash of 1929 for the severity of the Great Depression.