In anticipation of @JoeBiden cancelling all federal student loans, I just consolidated all of my FFEL loans into direct loans.

@Navient is now showing that my total amount of debt is DOUBLE. They are counting both the old FFEL loans and the new consolidated Direct Loans.

@Navient is now showing that my total amount of debt is DOUBLE. They are counting both the old FFEL loans and the new consolidated Direct Loans.

Every single part of our system is broken and cruel. All the more reason to cancel ALL student debt.

This debt never should have existed in the first place and the system cannot be reformed or fixed. It just shouldn't exist anymore at all.

This debt never should have existed in the first place and the system cannot be reformed or fixed. It just shouldn't exist anymore at all.

@Navient also is listing the due date for the new consolidated direct loans as 01/01/2021 even though the moratorium is extended through 01/31/2021

Maybe what they mean here is that there is $0 due on that date, but even so highly confusing and anxiety inducing.

Maybe what they mean here is that there is $0 due on that date, but even so highly confusing and anxiety inducing.

The official status of these new direct loans is "in repayment." Before consolidating I called Navient to get multiple assurances from them that the in school deferment status on the old FFEL loans would also be applied from the beginning with the new direct consolidation loans.

I was anticipating this exact problem. They reassured me this wouldn't be a problem, yet here we are. The new direct loan status is "in repayment" and apparently the next due date is 01/01/2021 in violation of the moratorium.

Navient never ever does things correctly.

Navient never ever does things correctly.

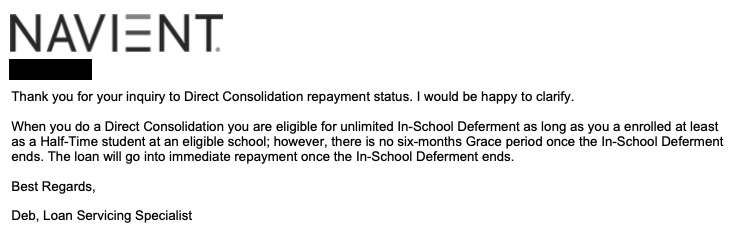

ALWAYS get everything in writing. Deb confirmed that an in school deferment status would be automatically applied to a new consolidated Direct Loan. Yet that is not what happened.

What would we do with our time if it wasn't spent on hold with @Navient?

@millennial_debt @sethfrotman

@millennial_debt @sethfrotman

• • •

Missing some Tweet in this thread? You can try to

force a refresh