Thread: Bull Case on $FSRV

$FSRV is a great investment due to strong balance sheet, incredible growth in both earnings and revenue, and serve a competitive niche within this fintech market. I am very excited to be apart of this, undervalued, long term investment opportunity:

$FSRV is a great investment due to strong balance sheet, incredible growth in both earnings and revenue, and serve a competitive niche within this fintech market. I am very excited to be apart of this, undervalued, long term investment opportunity:

What does Katapult do?

They’re a fintech lending, e-commerce focused, service that allows nonprime customers to borrow money and purchase durable goods such as: Fridge’s, Tables, Couches, etc

They’re a fintech lending, e-commerce focused, service that allows nonprime customers to borrow money and purchase durable goods such as: Fridge’s, Tables, Couches, etc

Why they are competitive?

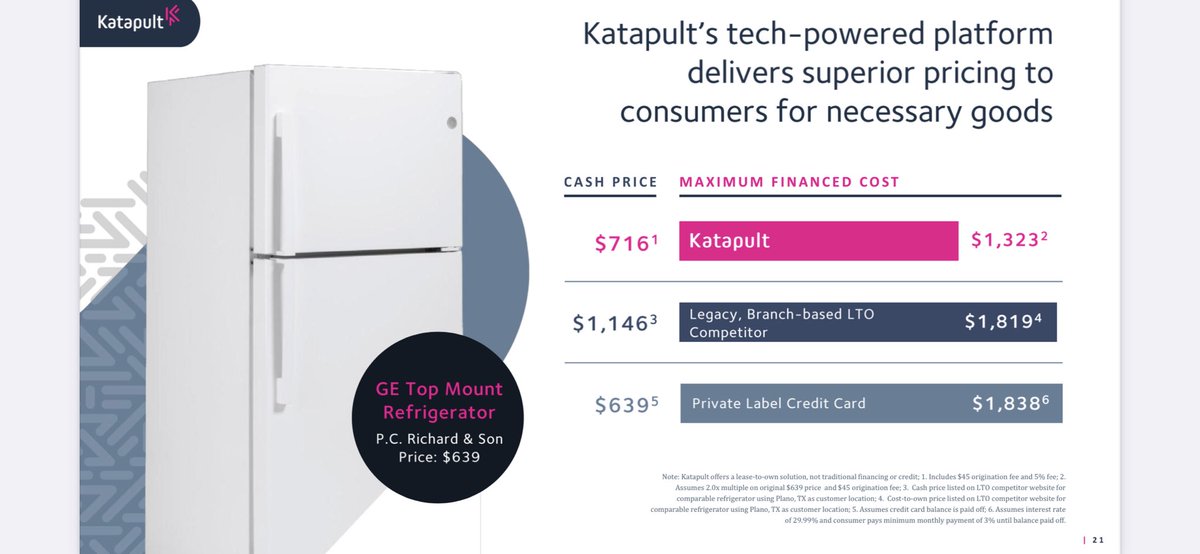

Some consumers with little to no credit often times don’t get approved, and it can be costly. Katapult leverages AI and ML to allocate money to them CHEAPER and faster than ever before.

Some consumers with little to no credit often times don’t get approved, and it can be costly. Katapult leverages AI and ML to allocate money to them CHEAPER and faster than ever before.

Has this been profitable?

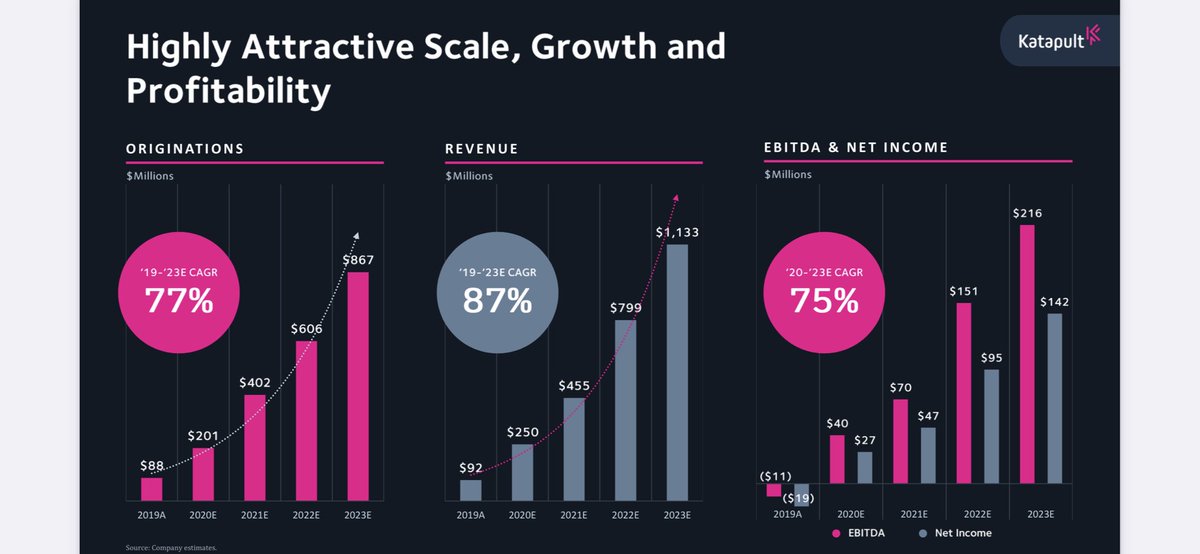

They have both grown revenue AND EBITDA at astounding rates. They hit profitability this year and grew 171% YoY. They project they will have a CAGR of EBITDA and Net Income at 75% 🤯🤯

This is a profit and growth monster, an investors dream!

They have both grown revenue AND EBITDA at astounding rates. They hit profitability this year and grew 171% YoY. They project they will have a CAGR of EBITDA and Net Income at 75% 🤯🤯

This is a profit and growth monster, an investors dream!

Can they maintain this growth?

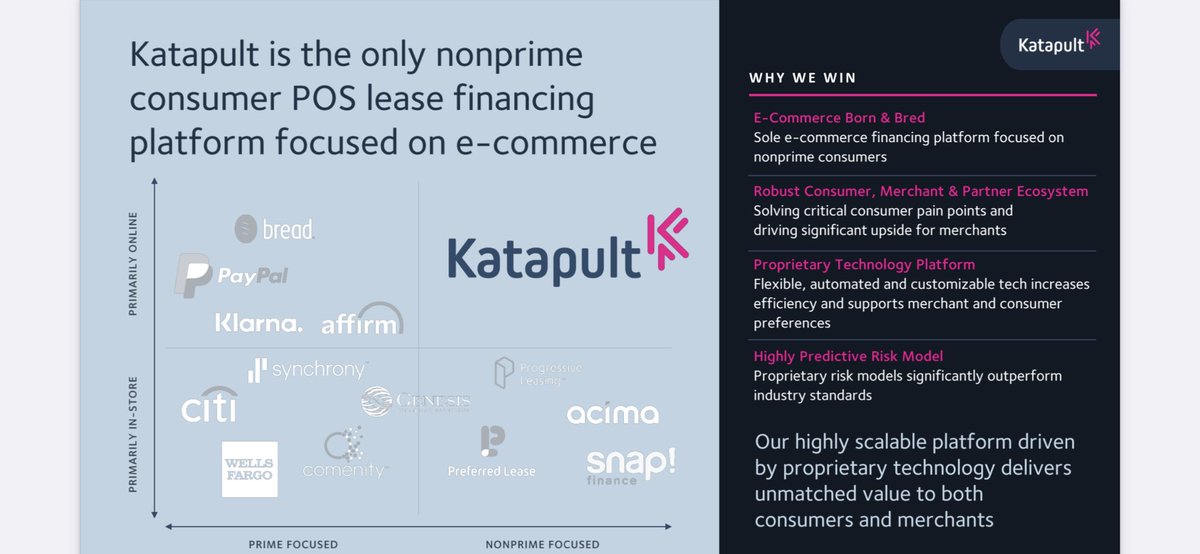

Lending isn’t a new service, and neither is leveraging AI/ML. But Katapult’s customer segment is niche, as nobody else wants to do it. They stand in their own quadrant, providing a long runway for niche growth.

Lending isn’t a new service, and neither is leveraging AI/ML. But Katapult’s customer segment is niche, as nobody else wants to do it. They stand in their own quadrant, providing a long runway for niche growth.

Do they have a plan to continue growing?

They’re very forward looking and also a younger company. They still have not penetrated their total market or brought awareness to their solution for their total market. They have a clear strategy to do this and diversify their product.

They’re very forward looking and also a younger company. They still have not penetrated their total market or brought awareness to their solution for their total market. They have a clear strategy to do this and diversify their product.

How does the overall balance sheet look?

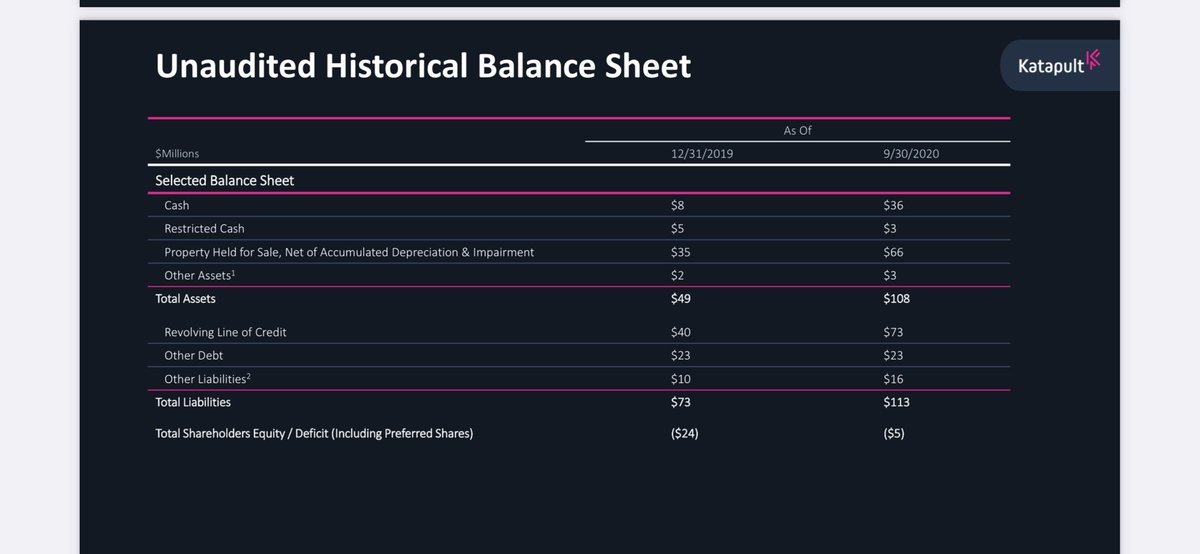

This is one where I’ve seen a few investors stumble up on when they see that big ‘liabilities’ number. But one must understand what “revolving line of credit” means. Once you do, one can assume they’re using the liquidity to lend more.

This is one where I’ve seen a few investors stumble up on when they see that big ‘liabilities’ number. But one must understand what “revolving line of credit” means. Once you do, one can assume they’re using the liquidity to lend more.

Are they a good buy at today’s price?

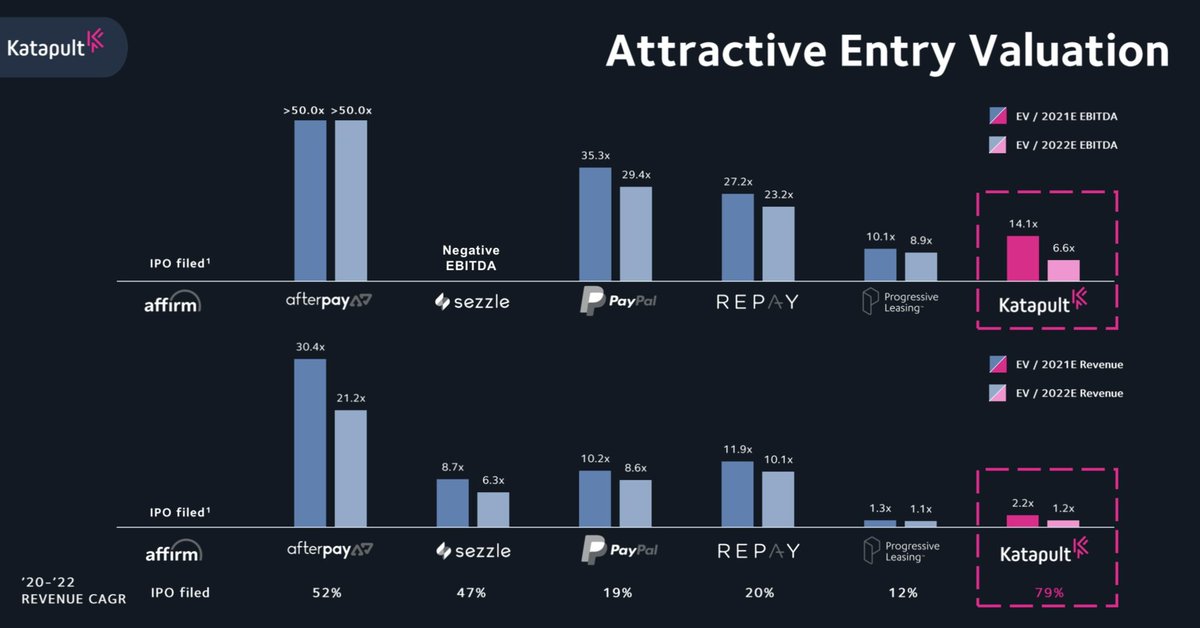

YES! 1,000x over yes. Affirm, their competitors/partner, will be going the IPO route soon and will, without a doubt, be over valued. With a high CAGR, attractive EBITDA valuation, and attractive revenue valuation. This is a buy.

YES! 1,000x over yes. Affirm, their competitors/partner, will be going the IPO route soon and will, without a doubt, be over valued. With a high CAGR, attractive EBITDA valuation, and attractive revenue valuation. This is a buy.

Conclusion: $FSVR aka Katapult provides a very rare, high growth (both revenue and profit) opportunity that is nearly the holy grail of SPAC‘s. At today’s valuations, it’s still a screaming buy. The biggest risk at the moment is managements ability to continue to handle the

riskier investments they are making on subprime borrowers. They are also, obviously, using borrowed cash to lend to other people. This is a risk, as some people may not be able to it pay back and this is a balancing act.

However, this risk can be mitigated through appropriate

However, this risk can be mitigated through appropriate

execution of their set in place frame work and strategy moving forward.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh