1. Should you contribute to an IRA or a SEP IRA to 'save taxes'?

It's the end of the year, and you can contribute to one of these pretty much right up until you file your taxes.

And, for many of you, this is the ONLY tax advice your accountant will give you.

It's the end of the year, and you can contribute to one of these pretty much right up until you file your taxes.

And, for many of you, this is the ONLY tax advice your accountant will give you.

2. But, like my mom used to say 'just because you CAN do something, Ronnie, doesn't mean you SHOULD.'

(I usually did anyways....and whenever I got called Ronnie, my legal name, I knew I was in trouble).

Anyway, you guys know I like math so let's get to the math!

(I usually did anyways....and whenever I got called Ronnie, my legal name, I knew I was in trouble).

Anyway, you guys know I like math so let's get to the math!

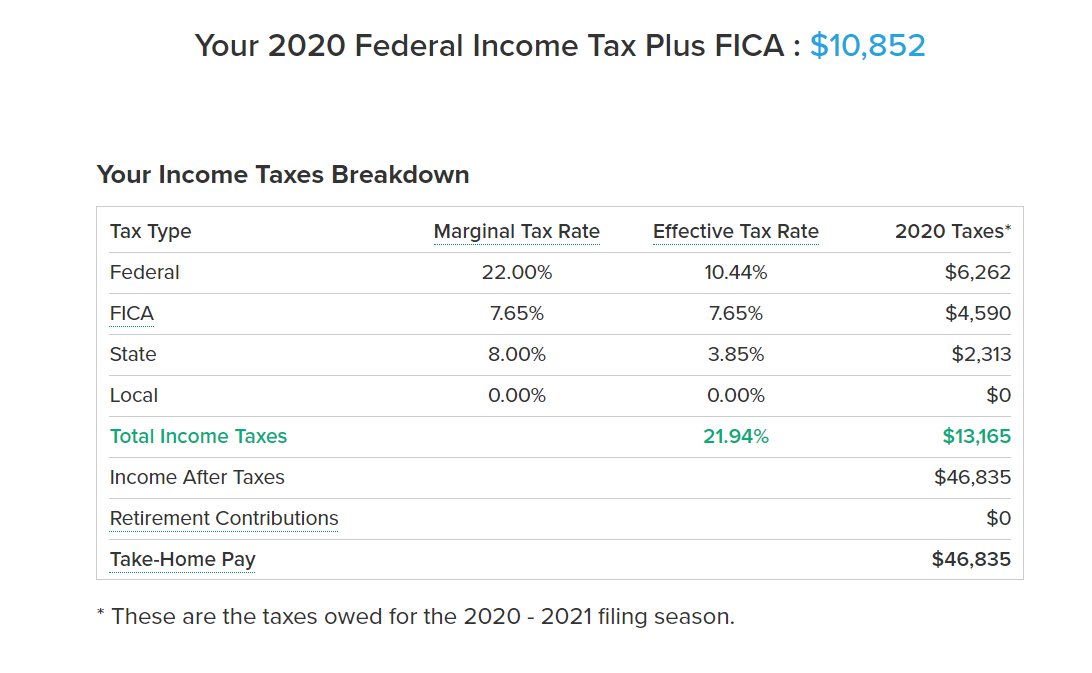

3. So, let's say you're a single guy or gal making 60k a year.

And you're taking the standard deduction, which is $12,400

Your 'take home' pay will be about $46,835.

That means you're paying $13,165 in taxes (including state and FICA taxes,)

Or, roughly 22% of your income.

And you're taking the standard deduction, which is $12,400

Your 'take home' pay will be about $46,835.

That means you're paying $13,165 in taxes (including state and FICA taxes,)

Or, roughly 22% of your income.

4. BTW, my single person lives here in CA.

OK, so NOW she (I decided to make her a she, so I don't have to keep typing he/she/zer) listens to the accountant and 'saves taxes' by contributing to a traditional IRA.

The taxes now went down to $11,467.

So she 'saved' $1,698.

OK, so NOW she (I decided to make her a she, so I don't have to keep typing he/she/zer) listens to the accountant and 'saves taxes' by contributing to a traditional IRA.

The taxes now went down to $11,467.

So she 'saved' $1,698.

5. Or DID she?

No...she merely POSTPONED paying taxes on that $6,000 until a later date.

Now here is where the problem comes in:

The IRS doesn't WANT tax on the 6k.

They want taxes on the 6k & WHATEVER THE 6K MADE.

So, let's say she's 30.

And not going to retire until 65.

No...she merely POSTPONED paying taxes on that $6,000 until a later date.

Now here is where the problem comes in:

The IRS doesn't WANT tax on the 6k.

They want taxes on the 6k & WHATEVER THE 6K MADE.

So, let's say she's 30.

And not going to retire until 65.

6. So, if she earns 7%, by age 65, that ONE contribution is now worth $64,059.

And THAT is what they now want to tax, and pay attention here....

..not at her rate NOW, but at WHATEVER THE TAX RATE IS IN 35 YEARS.

BTW, now multiply that by her doing that for the next 35 years.

And THAT is what they now want to tax, and pay attention here....

..not at her rate NOW, but at WHATEVER THE TAX RATE IS IN 35 YEARS.

BTW, now multiply that by her doing that for the next 35 years.

7. She'd have 'saved' $59,430 in taxes because she deferred (postponed) taxes on $210,000.

But just THIS account is now worth $829,421....

...and that is what the IRS wants taxes on.

But wait, there's more....and it's worse.

Let's go back to just our one contribution.

But just THIS account is now worth $829,421....

...and that is what the IRS wants taxes on.

But wait, there's more....and it's worse.

Let's go back to just our one contribution.

8. Remember, she made ONE $6,000 contribution, and it' will be worth $64,059.

Let's say she took it all at once, and, in fact, her taxes WERE lower....15%.

She owes $9,609.

That's almost 6 TIMES what she originally 'saved'.

But, what if taxes go higher?

Let's say she took it all at once, and, in fact, her taxes WERE lower....15%.

She owes $9,609.

That's almost 6 TIMES what she originally 'saved'.

But, what if taxes go higher?

9. Not even a lot higher, just a little bit.

At 25%, she owes $16,015 in taxes, or almost 10 TIMES (!!!) what she supposedly saved.

But, wait, there's more.

It gets even worse for her.....

At 25%, she owes $16,015 in taxes, or almost 10 TIMES (!!!) what she supposedly saved.

But, wait, there's more.

It gets even worse for her.....

10. Likely she will NOT take the money all at once.

Let's say she takes it over 20 years.

On top of her other income, like Social Security (which they currently tax up to 85% of!)

She would receive $6,136 a year for 20 years, if she kept earning 7% on the money.

Let's say she takes it over 20 years.

On top of her other income, like Social Security (which they currently tax up to 85% of!)

She would receive $6,136 a year for 20 years, if she kept earning 7% on the money.

11. So, she actually withdrew $122,725 over the 20 years.

Again, if she did, in fact, have a lower tax rate of 15%, she still paid out $18,409.

And if taxes do go up to 25%, she'll have paid $30,681 over 20 years.

All because she wanted to 'save' $1,698 today.

Again, if she did, in fact, have a lower tax rate of 15%, she still paid out $18,409.

And if taxes do go up to 25%, she'll have paid $30,681 over 20 years.

All because she wanted to 'save' $1,698 today.

12. Also, don't forget that if she wants to touch HER money, she has to pay taxes on it AND a 10% penalty.

Oh, and if she gets forgetful when she's older and forgets to take the distribution that the government requires when she turns 72, they slap her with a 50% (!!!) penalty

Oh, and if she gets forgetful when she's older and forgets to take the distribution that the government requires when she turns 72, they slap her with a 50% (!!!) penalty

13. PLUS the tax she would have owed on the distribution.

So, there's that.

So, just remember: everytime you see 'your' retirement grow, Dongress is watching THEIR retirement grow as well.

So, there's that.

So, just remember: everytime you see 'your' retirement grow, Dongress is watching THEIR retirement grow as well.

14. I just saw the typo, but liked it and decided to leave it in.

That's going to be my new slogan for them

Dongress: Screwing you one bloated budget with giveaways to every country but yours at a time

That's going to be my new slogan for them

Dongress: Screwing you one bloated budget with giveaways to every country but yours at a time

15. Now, finally, are there EVER circumstances where I would recommend postponing paying your taxes?

Sure, if you're in a really high tax state and have a really high income and you KNOW you're going to move to a lower tax state in the future.

Sure, if you're in a really high tax state and have a really high income and you KNOW you're going to move to a lower tax state in the future.

16. AND, you're contributing at least HALF your money to tax-free or tax favorable accounts, then why not?

BUT, don't for one second kid yourself.

You WILL pay more in taxes on that money later.

/end

BUT, don't for one second kid yourself.

You WILL pay more in taxes on that money later.

/end

17. And if you start calling them Dongress too, don't forget to give your boy Ron C a shoutout!

• • •

Missing some Tweet in this thread? You can try to

force a refresh