What is the difference between Dividend and Buyback ? Which is important ?

1/ Today's thread on Dividend vs Buyback. What is the difference?

You will understand:

- Dividend and Buyback

- Time frame

- Eligibility criteria with Important dates

- Tax implications

- Types and methods

- Reasons company opt for pay dividend or buyback

You will understand:

- Dividend and Buyback

- Time frame

- Eligibility criteria with Important dates

- Tax implications

- Types and methods

- Reasons company opt for pay dividend or buyback

2/ Dividend and Buyback are two main ways through which the company rewards its shareholders and also help to boost the shareholders returns. Let us understand dividend and buyback on various factors.

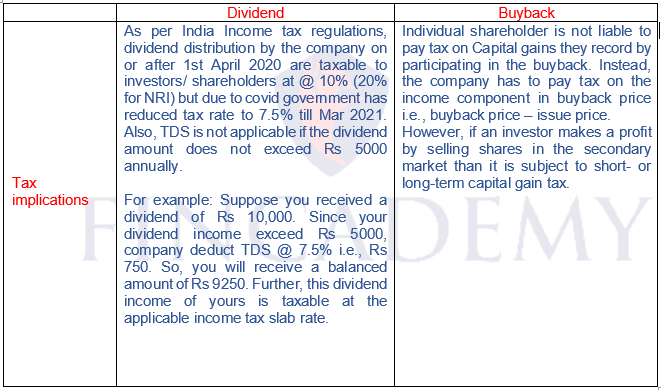

5/ Every investor should understand tax implication on dividend and share buyback – this is one of the most important aspect 👇

As you understood about the difference b/w Dividend and Buyback, we have launched our YouTube channel and will be posting videos soon. Do subscribe and also join our WhatsApp Broadcast List.

YouTube : bit.ly/3mldqVs

WhatsApp : wa.link/d3xxk8

BY : @Dharmangi_S

YouTube : bit.ly/3mldqVs

WhatsApp : wa.link/d3xxk8

BY : @Dharmangi_S

• • •

Missing some Tweet in this thread? You can try to

force a refresh