Just under the wire again, but I continue my annual tradition -- my 10 favorite economics papers published in 2020, ordered alphabetically

[Was pretty tough this year; might have to do an "honorable mention" list in January...]

[Was pretty tough this year; might have to do an "honorable mention" list in January...]

1) @oagersnap, @AmalieJensen_ , & Henrik Kleven study whether immigration responds to the generosity of a country's welfare benefits aeaweb.org/articles?id=10…

[First time an AER-Insights paper has made my list; hope to see more in future years -- short(er) economics papers FTW!]

[First time an AER-Insights paper has made my list; hope to see more in future years -- short(er) economics papers FTW!]

Using administrative data from Denmark, paper reports large changes in flow of immigrants from outside the EU in response to policy that reduced welfare benefits for non-EU immigrants, but not EU immigrants

[Policy was introduced by a far-right, anti-immigration party in 2002]

[Policy was introduced by a far-right, anti-immigration party in 2002]

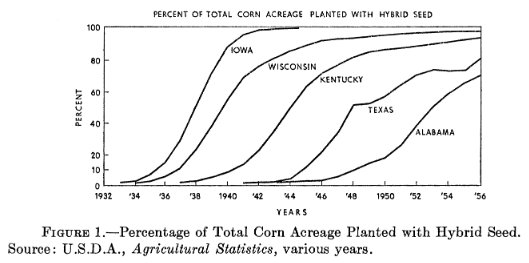

The paper provides clear visual evidence that the migration decisions of non-EU immigrants are very sensitive to the generosity of welfare benefits

And, strikingly, the authors find virtually symmetric responses when the policy was repealed (and then later reinstated)

And, strikingly, the authors find virtually symmetric responses when the policy was repealed (and then later reinstated)

2) Sebastian Bradley & Naomi Feldman study the economic effects of an increase in tax salience coming from a 2012 US DOT mandate that airline fares presented to consumers must incorporate all taxes & fees aeaweb.org/articles?id=10…

Prior to the DOT mandate, essentially all of the taxes & fees were passed on to consumers, but after the mandate pass-through falls by ~75%

Increasing tax salience thus led to a substantial reduction in the incidence of airline taxes on consumers

Increasing tax salience thus led to a substantial reduction in the incidence of airline taxes on consumers

The authors also find the mandate reduced demand & revenues along the most heavily-taxed itineraries

I am super excited this paper came out in AEJ-Policy; I think it's one of the best behavioral public economics papers I have read in the last several years

I am super excited this paper came out in AEJ-Policy; I think it's one of the best behavioral public economics papers I have read in the last several years

[Disclosure: I did not play any role in publication process for this paper; it was handled by different co-editor]

3) @amitabhchandra2 & Douglas Staiger study hospital-level variation in heart attack treatments & develop an empirical framework to separate expertise from inefficient overuse & underuse academic.oup.com/qje/article/13…

[Historical note: I discussed this paper at the **2012** AEAs]

[Historical note: I discussed this paper at the **2012** AEAs]

The authors develop a Roy model w/ individual treatment effect heterogeneity, and overuse & underuse is doing "too many" or "too few" treatments (at the margin), while expertise leads to better treatment outcomes for all patients (both marginal & infra-marginal patients)

One key finding is that many hospitals are overusing expensive heart attack treatments, and as a result there are marginal treated patients who would have had better outcomes if they had instead received less-intensive care

4) Paul Eliason, @benjaminheebsh, @ryanmcdevitt, & James Roberts study how the acquisition of independent dialysis facilities by larger chains affects patient treatment decisions and health outcomes academic.oup.com/qje/article/13…

[I'll give a favorite again this year; this is it]

[I'll give a favorite again this year; this is it]

Using a difference-in-differences research design, authors find:

- 🔼 in revenue (🔼 in drug doses & shifting to more lucrative drugs)

- 🔽 in costs (🔼 in patients per staff & replacing nurses w/ technicians)

- 🔽 in quality of care (🔼 in hospitalizations & 🔽 in survival rate)

- 🔼 in revenue (🔼 in drug doses & shifting to more lucrative drugs)

- 🔽 in costs (🔼 in patients per staff & replacing nurses w/ technicians)

- 🔽 in quality of care (🔼 in hospitalizations & 🔽 in survival rate)

Authors conclude "along almost every dimension we measure, patients fare worse at the target facility after acquisition"

At least in this setting, consolidation appears to have increased Medicare spending & decreased the quality of care patients received ("lose-lose" situation)

At least in this setting, consolidation appears to have increased Medicare spending & decreased the quality of care patients received ("lose-lose" situation)

5) @OlleFolke & @johannarickne study how job promotions affect the probability of divorce & find large increases for women, but not for men

They find a similar pattern of results for candidates who win mayoral elections & for promotions to CEO aeaweb.org/articles?id=10…

They find a similar pattern of results for candidates who win mayoral elections & for promotions to CEO aeaweb.org/articles?id=10…

I enjoyed meeting the authors & seeing them present this paper at the "Gender and the Labor Market" conference that @AlesVoena & I organized back in 2019 bfi.uchicago.edu/event/gender-a…

One thing I remember from their presentation is that many in audience were frustrated w/ the results, but some older women had very different reactions, including one who said "This isn't necessarily a bad outcome for the women; what if they are all divorcing loser men?"

[I'm going to follow the Chatham House Rule & not give woman's name since I don't have permission. Additionally, I am going to speculate that the different reactions by age that I observed in seminar are not a coincidence & reflect different expectations of men by generation]

6) @p_ganong & @pascaljnoel study the effects of different types of mortgage modifications on default & consumption aeaweb.org/articles?id=10…

[This paper represents the kind of consumer/household finance research that I want to be doing over the next few years]

[This paper represents the kind of consumer/household finance research that I want to be doing over the next few years]

The paper's main finding is that "liquidity effects >> wealth effects" for distressed borrowers

This means that principal reductions that do not include short-term payment reductions are unlikely to be effective in reducing mortgage defaults

This means that principal reductions that do not include short-term payment reductions are unlikely to be effective in reducing mortgage defaults

Hopefully we don't have a housing crisis again anytime soon, but when such a crisis inevitably happens again, this paper provides a very useful roadmap for thinking about policy

7) @paulgp, Isaac Sorkin, & Henry Swift formalize the "folk wisdom" in labor economics that identification using a "Bartik instrument" can be achieved by assuming exogeneity of initial industry employment shares aeaweb.org/articles?id=10…

[For background, the "Bartik instrument" is a widely-used approach to estimating the effects of local labor demand shocks using pre-existing variation in local industry employment shares]

I use term "folk wisdom" b/c while I'd never seen the simple proof the authors provide in this paper before, I nevertheless had the intuition that the exogeneity of initial shares was an important assumption back in 2009 when I was working on my JMP journals.uchicago.edu/doi/full/10.10…

In particular, in my JMP I carried out a sensitivity analysis where I excluded the industries that I was most concerned might violate exogeneity assumption (such as manufacturing), & I took comfort in the fact that I found similar results excluding these industries from Bartik IV

This paper is already very(!) highly cited, and I think this is partly b/c the paper is very clearly written, and also b/c the authors propose a useful sensitivity analysis when using Bartik instruments

The sensitivity analysis they propose turns out to be a special case of the Andrews-Gentzkow-Shapiro (2017) paper from one of my previous top 10 lists

Fun fact:

This paper's Google Scholar citations = 549

AGS GS citations = 128

https://twitter.com/profnoto/status/938414739616620546

Fun fact:

This paper's Google Scholar citations = 549

AGS GS citations = 128

My explanation is that even though this paper's sensitivity analysis is a special case of AGS, it's presented in a clearer and simpler way, and that has led to greater "take-up". I still think AGS paper is terrific, but I have found it harder to use in my own research

8) Katrine Jakobsen, Kristian Jakobsen, Henrik Kleven, & @gabriel_zucman study the effects of wealth taxes in Denmark using a difference-in-differences design to study a 1989 wealth tax reform academic.oup.com/qje/article/13…

The paper presents clear graphical evidence of the short-to-medium-term responses to wealth taxes, and the authors use a dynamic model to recover the longer-term consequences of wealth taxes

The main finding is that wealth taxes have substantial effects on taxable wealth, especially at the top of the wealth distribution, with a long-run elasticity of taxable wealth (with respect to the after-tax rate) of 0.77 for the moderately wealthy & 1.15 for the very wealthy

It seems like we will be debating wealth taxes in the US for the next several years, and I expect these estimates will be useful for thinking about the behavioral responses & the amount of revenue that can be raised from such a tax

9) @MartaLachowska, Alexandre Mas, & Stephen Woodbury study the classic labor topic of the earnings losses of displaced workers using matched employer-employee data from the state of Washington aeaweb.org/articles?id=10…

The novelty of this paper is its emphasis on the role of employer-specific pay premiums in accounting for displaced workers' earnings losses

Surprisingly, the authors find only 17% of workers' earnings losses come from employer-specific pay premiums (i.e., from losing job at a high-wage firm), and they find that most displaced workers eventually move to employers paying similar (or higher) wage premiums

As a result, most of the earnings losses from displacement come from reductions in wages rather than from not ending up back in the same kinds of firms

This paper really surprised me -- all of the main results are the exact opposite of what I would have expected

This paper really surprised me -- all of the main results are the exact opposite of what I would have expected

[Of course, research doesn't have to be surprising to be important, but I think these results were surprising to many labor economists, as well, not just me]

10) @juliana_londono, Catherine Rodríguez, & Fabio Sánchez study a large-scale financial aid program in Colombia (Ser Pilo Paga) that targeted extremely high-achieving students in poor households & they find large increases in college enrollment aeaweb.org/articles?id=10…

[Disclosure: I was co-editor who handled this paper at AEJ-Policy, and it was one of the first papers I accepted for publication as a co-editor. This paper was one of the papers that led to my view that econ of education is such a strong field right now]

https://twitter.com/ProfNoto/status/1055476658994601984

The program virtually eliminated the SES-enrollment gradient among high-achieving students in the top decile of the test score distribution

Looking forward to seeing this paper's results extended to longer-term outcomes such as college graduation, occupation choice, & earnings

Looking forward to seeing this paper's results extended to longer-term outcomes such as college graduation, occupation choice, & earnings

That's my list -- happy new year!

</thread>

</thread>

• • •

Missing some Tweet in this thread? You can try to

force a refresh