Are you planning on handing over your money to an algo trading platform?

Maybe you want to subscribe to a strategy or two and make insane returns.

Here's why you shouldn't do it, and save your money instead.

Maybe you want to subscribe to a strategy or two and make insane returns.

Here's why you shouldn't do it, and save your money instead.

1/ Maybe you want to have a strategy development company deploy such algorithms on your account with respective brokers.

Or the service itself has strategies that you just subscribe to and authorize your trading account with, and it will automatically trade your money.

Or the service itself has strategies that you just subscribe to and authorize your trading account with, and it will automatically trade your money.

2/ When it comes to @Tradetron1 there are a slew of issues.

Let's keep aside the lack of transparency and the total regulatory non-compliance for a moment.

First off, with most of the strategies, the backtests are BOGUS.

Let's keep aside the lack of transparency and the total regulatory non-compliance for a moment.

First off, with most of the strategies, the backtests are BOGUS.

3/ Any systematic trader with even a little bit of experience will look at the strategies and tell you which ones are baloney.

Most of them are.

Don't take my word for it. Do your own due diligence.

And, those backtests aren't even for 10+ yrs. Some were done only for months.

Most of them are.

Don't take my word for it. Do your own due diligence.

And, those backtests aren't even for 10+ yrs. Some were done only for months.

4/ Secondly, SEBI has put rules in place on parameters like

- minimum net worth of the company

- qualifications of the fund manager

- minimum number of clients

- minimum amount to start with

and so on, for qualifying people who want to manage other people's money.

- minimum net worth of the company

- qualifications of the fund manager

- minimum number of clients

- minimum amount to start with

and so on, for qualifying people who want to manage other people's money.

5/ There are only 3 structures offered by SEBI where people can manage other people's money.

- Mutual Funds

- Portfolio Management Service (PMS)

- Alternative Investment Funds (AIF)

- Mutual Funds

- Portfolio Management Service (PMS)

- Alternative Investment Funds (AIF)

6/ If the company/person you hand over money to don't have one of these licenses, you're essentially stepping into the grey area.

There's no LEGAL way to manage other people's money outside of these three structures offered by SEBI.

There's no LEGAL way to manage other people's money outside of these three structures offered by SEBI.

7/ There are few other ways in which you can manage other people's money.

Most popular one:

- Become a sub broker to a large broker

- Get terminal access

- Add clients

- Place trades for all your clients together

Most popular one:

- Become a sub broker to a large broker

- Get terminal access

- Add clients

- Place trades for all your clients together

8/ In this method, you can open/close/modify orders in clients' accounts. You can't touch their funds.

To do this, you should

- Enter into an agreement with the client that you will be investing/trading their account

- Have an Associated Persons SEBI license

To do this, you should

- Enter into an agreement with the client that you will be investing/trading their account

- Have an Associated Persons SEBI license

9/ You should also take client's approval for EVERY SINGLE TRADE YOU PUT ON and for EVERY SINGLE TRADE YOU CLOSE.

Even if you don't take permission for one trade also, that's considered fraud.

But that's how most people operate.

Even if you don't take permission for one trade also, that's considered fraud.

But that's how most people operate.

10/ Some get clients to automate email approval for each trade.

This is not entirely legal and won't be valid if push comes to stove.

Phone call recording + non-automated emails should be legal.

But nobody does that.

This is not entirely legal and won't be valid if push comes to stove.

Phone call recording + non-automated emails should be legal.

But nobody does that.

11/ Essentially, since nobody follows the letter of the law/SEBI, they are all taking unauthorized trades as every trade requires authorization.

This again, is the most popular way with which people who have capital of < 25c operate.

This again, is the most popular way with which people who have capital of < 25c operate.

12/ Also, when you're a MF, PMS, AIF, there are so many things you CAN and CAN'T do.

There are things you should do regularly in terms of reporting.

You will definitely need a well-qualified compliance officer also.

Small guys aren't ready to invest in all this overhead.

There are things you should do regularly in terms of reporting.

You will definitely need a well-qualified compliance officer also.

Small guys aren't ready to invest in all this overhead.

13/ What can small guys do LEGALLY then?

RIA - Registered Investment Advisor.

It's usually a fixed fee format (although there are some who get a % profit based on agreement).

You take the trades on your own.

Usually does well for long term investing & positional trading.

RIA - Registered Investment Advisor.

It's usually a fixed fee format (although there are some who get a % profit based on agreement).

You take the trades on your own.

Usually does well for long term investing & positional trading.

14/ But, even RIA has a lot of regulations, you need to get the certification and proper licensing done.

There are certain limitations as to what an RIA can and can not do.

So many RIAs breach those rules too and act in a grey area.

There are certain limitations as to what an RIA can and can not do.

So many RIAs breach those rules too and act in a grey area.

15/ Now, coming to Tradetron and similar services, ask these questions:

i) Are their strategy creators SEBI registered?

ii) Is the company's entire modus operandi legal?

iii) How are their backtests vetted?

iv) Are the backtests vetted and verified or anyone can post anything?

i) Are their strategy creators SEBI registered?

ii) Is the company's entire modus operandi legal?

iii) How are their backtests vetted?

iv) Are the backtests vetted and verified or anyone can post anything?

16/ Ask these additional questions too.

i) What are the underlying technical issues people face? (Lots of people have faced execution issues, slippages, etc.)

ii) How are the backtests conducted? (full test, out of sample, walk forward, and then monte-carlo, etc., is required)

i) What are the underlying technical issues people face? (Lots of people have faced execution issues, slippages, etc.)

ii) How are the backtests conducted? (full test, out of sample, walk forward, and then monte-carlo, etc., is required)

17/ You'll most likely draw a blank from all of them.

For some reason (valid one) I can't see a SEBI registration number on the websites of TradeTron or similar services.

One step further, Tradetron buries this information in their "terms of use" page.

For some reason (valid one) I can't see a SEBI registration number on the websites of TradeTron or similar services.

One step further, Tradetron buries this information in their "terms of use" page.

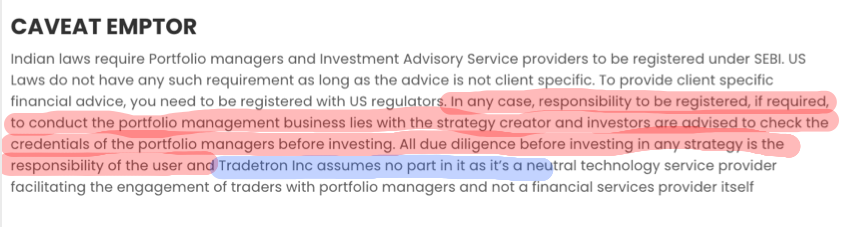

18/ The screenshot above says you have to do your own due diligence on whether the person creating the strategy is SEBI registered or not.

For ex: Is @__paperstreet__ SEBI registered? Nobody knows. Nobody even knows who he is. But so many people are subscribed to his strategy.

For ex: Is @__paperstreet__ SEBI registered? Nobody knows. Nobody even knows who he is. But so many people are subscribed to his strategy.

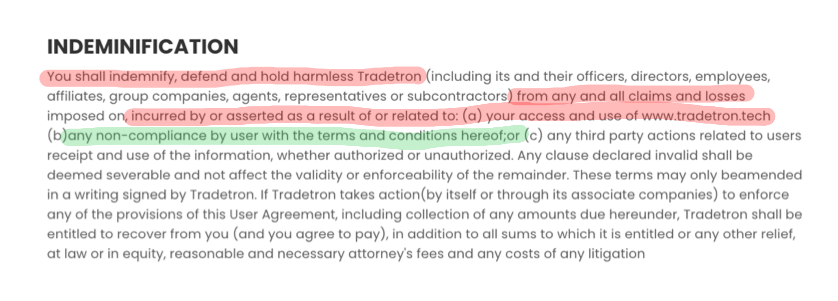

19/ Also, if you don't do your due diligence and your money is blown up by someone who isn't SEBI registered, you can't seek any relief from TradeTron.

Refer to the screenshot below.

Refer to the screenshot below.

20/ They wash their hands of any and all responsibility to

i) Screening strategy creators

ii) Screening backtest legitimacy

iii) Screening strategy legitimacy

iv) Making sure creators are SEBI registered and licensed, and that their license/regn hasn't expired.

i) Screening strategy creators

ii) Screening backtest legitimacy

iii) Screening strategy legitimacy

iv) Making sure creators are SEBI registered and licensed, and that their license/regn hasn't expired.

21/ Now, let's come to the problems with many of those strategies.

Most of the strategies are half baked. Looks like people testing something on stockmock for a year or two and creating that as strategy on tradetron to make money.

Most of the strategies are half baked. Looks like people testing something on stockmock for a year or two and creating that as strategy on tradetron to make money.

22/ Check this thread for a discussion on the most basic thing.

100% ROI in a year with 10-20% drawdown is possible. But not over a period of 10 years.

Cherry picking a good year and posting that as entire backtest result is dangerous.

https://twitter.com/TraderLogical/status/1330017766913368066

100% ROI in a year with 10-20% drawdown is possible. But not over a period of 10 years.

Cherry picking a good year and posting that as entire backtest result is dangerous.

23/ Tradetron does indulge in favoritism towards few creators, some shady practices, which if you talk to all the strategy subscribers, you'd begin to understand.

You can see that they have deleted the -ve comments in some strategies.

https://twitter.com/theBuoyantMan/status/1320313644970725376?s=20

You can see that they have deleted the -ve comments in some strategies.

24/ But, they withhold the right to do that. This again, is buried in "terms of use".

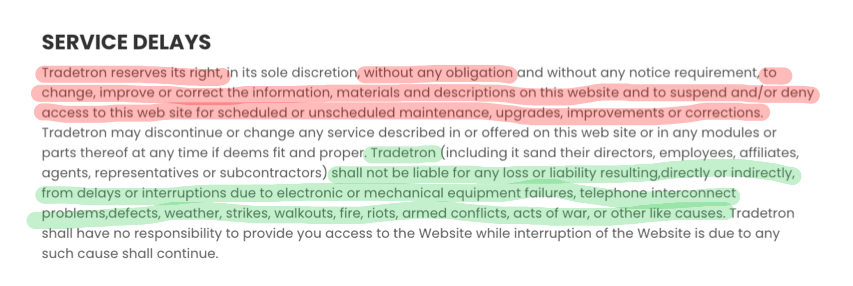

Also, if you face huge slippages and execution issues at their end, they can always wash their hands off any responsibility by saying it's an internet/server issue, and show you these terms.

Also, if you face huge slippages and execution issues at their end, they can always wash their hands off any responsibility by saying it's an internet/server issue, and show you these terms.

25/ Now, several users have quoted the following in their reviews/comments.

- Grossly misleading backtests

- Backtest / live trades huge discrepancies

- Some accounts blown out

- Backtests done only for few months

- Huge slippage and execution delays

- Loss due to outages

- Grossly misleading backtests

- Backtest / live trades huge discrepancies

- Some accounts blown out

- Backtests done only for few months

- Huge slippage and execution delays

- Loss due to outages

26/ This is not just particular to tradetron.

You pick any similar service. You check for the following things.

- SEBI/legal registration/compliance of the company

- SEBI registration of strategy creators

- Backtest methodology

- No of years tested for

You pick any similar service. You check for the following things.

- SEBI/legal registration/compliance of the company

- SEBI registration of strategy creators

- Backtest methodology

- No of years tested for

27/ Also check for the following:

- Backtest / Actual live trades differentiation

- How many years backtest was conducted for

- How long the strategy has been active, and what its actual live returns are (after costs)

- Whether backtests are pre/post comms/spread/slippages

- Backtest / Actual live trades differentiation

- How many years backtest was conducted for

- How long the strategy has been active, and what its actual live returns are (after costs)

- Whether backtests are pre/post comms/spread/slippages

28/ This applies to any and all companies offering to manage your money in some way without your intervention or active effort.

Use this as a checklist and protect your downside first by doing your due diligence.

Use this as a checklist and protect your downside first by doing your due diligence.

29/ Secondly, don't be naive enough to believe that you can double your money in a year or two, or that these strategy creators with backtests showing CAGR of 40-50% will get you such returns.

More often these claims are only a bag of farts. You'll be left holding just those.

More often these claims are only a bag of farts. You'll be left holding just those.

30/ Third, most often, you'll put money in the hands of such people whose greed knows no bounds, blow up your capital, and realize you'd have done way better had you invested in a regular conservative mutual fund also.

So, save yourself all the trouble and go SIP in MFs.

So, save yourself all the trouble and go SIP in MFs.

31/ Two or maximum three mutual fund schemes, with an index fund, invested regularly with discipline using SIP, will create more wealth than any of these fake strategy creators can, for you.

32/ If you must definitely go for such high returns, it's not impossible.

Spend a year or two, learn python, backtest different ideas/systems yourself, and automate them.

Amazon EC2 or Azure + Broker's API, code in python and automate your strategies.

Spend a year or two, learn python, backtest different ideas/systems yourself, and automate them.

Amazon EC2 or Azure + Broker's API, code in python and automate your strategies.

33/ Books, Links, Courses, Data - recommended for doing exactly the above is all in this link -

notion.so/Recommended-by…

notion.so/Recommended-by…

34/ I have summarized whatever I know about systematic trading in the following webinar.

Ignore the first and last 20-25 mins (about me in the intro, and about my course and the QNA in the outro) and watch the remaining 3 hours, for a head start.

Ignore the first and last 20-25 mins (about me in the intro, and about my course and the QNA in the outro) and watch the remaining 3 hours, for a head start.

35/ To conclude, don't chase quick returns.

You're better off putting money in an index fund and compounding/getting rich slowly.

Don't fall prey to someone else's greed, and lose your money due to your own greed.

You're better off putting money in an index fund and compounding/getting rich slowly.

Don't fall prey to someone else's greed, and lose your money due to your own greed.

36/ Also, remember one thing finally.

With these untested, half-baked platforms, you're being treated like beta testers when their service itself is not proper or reliable.

They should pay you, and not the other way around.

Skip them altogether, save your hard earned money.

With these untested, half-baked platforms, you're being treated like beta testers when their service itself is not proper or reliable.

They should pay you, and not the other way around.

Skip them altogether, save your hard earned money.

• • •

Missing some Tweet in this thread? You can try to

force a refresh