1/ “Bitcoin is better at being gold than gold” - SkyBridge Capital

@Scaramucci 's SkyBridge Capital released their investment thesis for their new Bitcoin Fund LP. They go a step further than other investors in why they are actively choosing bitcoin over gold

A thread 👇

@Scaramucci 's SkyBridge Capital released their investment thesis for their new Bitcoin Fund LP. They go a step further than other investors in why they are actively choosing bitcoin over gold

A thread 👇

2/ SkyBridge Capital’s main fund, with $9.3B AUM, had invested ~$182M in BTC. In Dec., they announced they were raising a new, separate Bitcoin only fund and already transferring ~$25M of BTC into it

3/ Today they opened to accredited investors w/ min invstmnt of at $50K. This Bitcoin LP won’t trade BUT you only pay 0.75% annual fee and no premium, the portfolio is priced by Bloomberg’s fixed rate (XBT). In contrast, GBTC trades OTC, a 2% yr fee, and a premium to BTC’s price

4/ Their website is a vast library of info. Not just their Offering Memo, pres. & investment thesis. It also includes:

- FAQ videos (Michael Saylor features and Scaramucci has cited him as a major influence)

- Readings on Bitcoin (@real_vijay The Bullish Case for Bitcoin)

- FAQ videos (Michael Saylor features and Scaramucci has cited him as a major influence)

- Readings on Bitcoin (@real_vijay The Bullish Case for Bitcoin)

5/ Towards the bottom of the page, they also take a dig at GBTC’s premium and offer to walk through a “GBTC swap” to their fund. They understand the hurdles that many traditional investors face in investing into BTC and lean into it

skybridgebitcoin.com

skybridgebitcoin.com

6/ But more enjoyable than reading digs at GBTC, is reading the digs on Gold. Because, as other large institutional investors have recently bought Bitcoin, they have largely done so while also still holding gold

7/ An example - Ruffer’s $775M bitcoin ($27B AUM) buy through their multi strat fund (~2.5% of the portfolio) was a huge step...but still small compared to their gold and inflation linked bonds holdings…

8/ Another example - The head of global equities at Jefferies cut the gold exposure in the long-only pension funds in favor of Bitcoin...but BTC remains 5% allocation vs. 65% Gold bullion/mining

9/ With a Bitcoin only LP, there’s no getting around the question of “why BTC vs. gold?.” SkyBridge needs to tackle it head on, and they do. Their investment thesis is 10 pages (not including legal disclaimers) and ~1/3 are why gold is inferior to BTC and how BTC will be gold 2.0

10/ They quickly establish that there is a need for a deflationary asset - increasing debt, increasing money supply, low interest rates

They then quickly ask is “Gold to the rescue?”

No.

They then quickly ask is “Gold to the rescue?”

No.

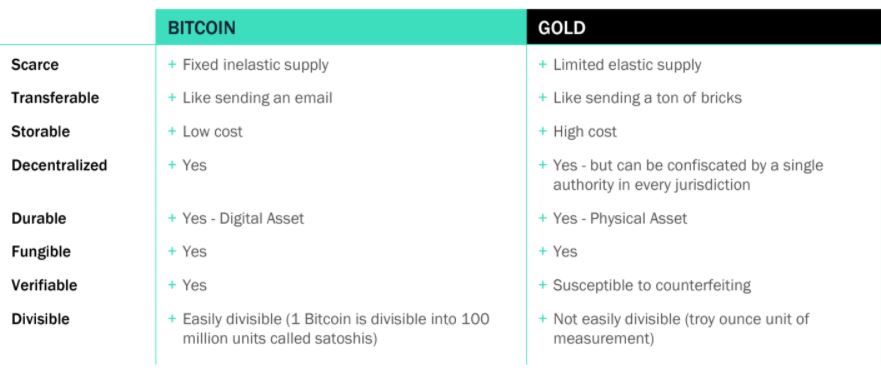

11/ The major points for pro BTC vs. gold?

- Fixed vs. limited supply (G increases ~1.25%/yr)

- Tech industry will be primary driver of marginal wealth creation(a digital asset fits)

- More wealth is being transferred to Millennials- transferability/storage of BTC fits this demo

- Fixed vs. limited supply (G increases ~1.25%/yr)

- Tech industry will be primary driver of marginal wealth creation(a digital asset fits)

- More wealth is being transferred to Millennials- transferability/storage of BTC fits this demo

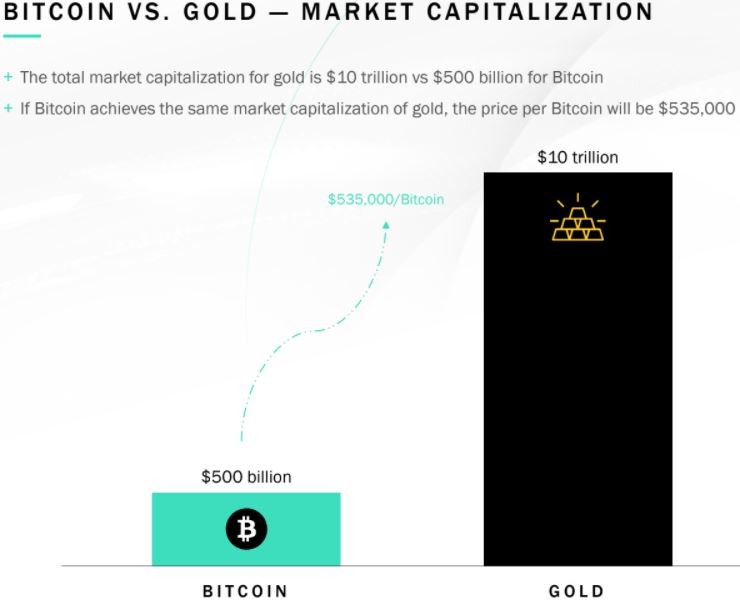

13/ The SkyBridge presentation expands on Gold 2.0 even further - why Bitcoin is superior and uses gold as an example of potential growth

As they say in the opening page, “Bitcoin is better at being gold than gold”

As they say in the opening page, “Bitcoin is better at being gold than gold”

14/ The presentation and thesis continue with covering the halvings, growing adoption and bitcoin as a portfolio diversifier, but my favorite part remains an institutional investor directly addressing the question of why Bitcoin over gold?

15/ TL;DR: The launch of the SkyBridge Bitcoin LP is another strong step in Bitcoin’s adoption by investors

1) They address the problematic premium w/ GBTC for investors

2) They address head on why an institutional investor would choose Bitcoin over gold

1) They address the problematic premium w/ GBTC for investors

2) They address head on why an institutional investor would choose Bitcoin over gold

• • •

Missing some Tweet in this thread? You can try to

force a refresh