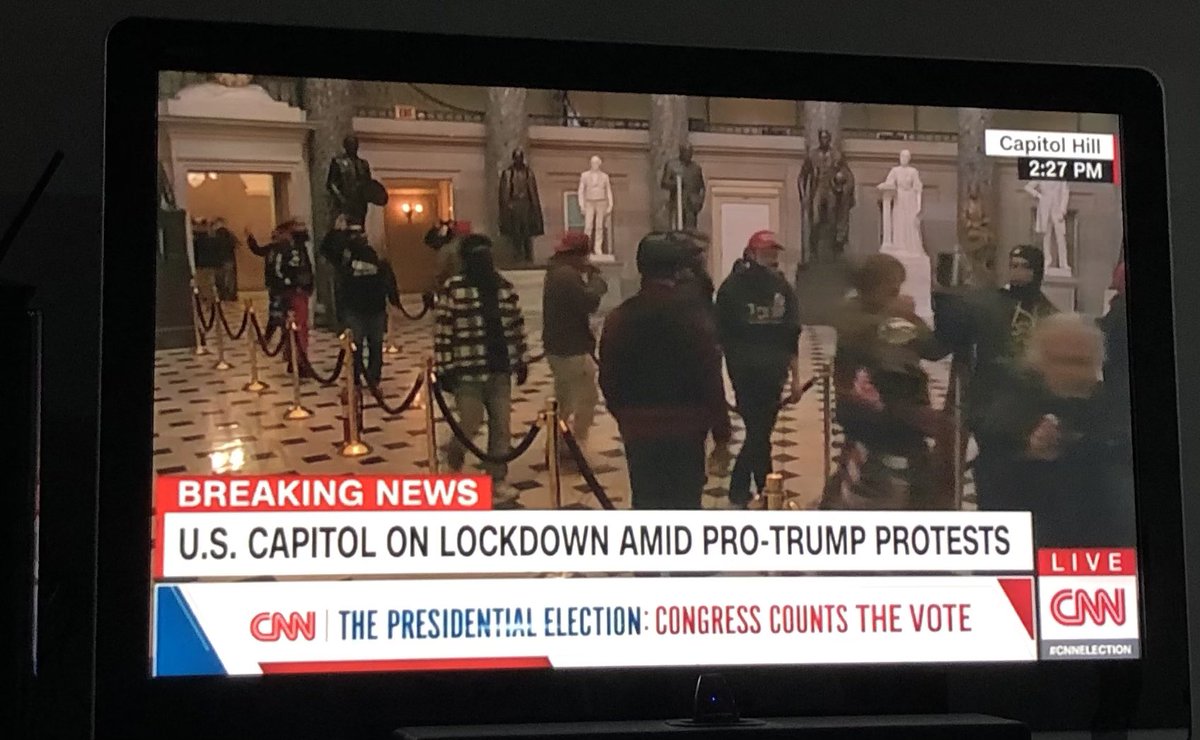

Things are kicking off around the US Capitol building, as thousands of Trump supporters pour in, and hundreds smash through the police barricades outside. CNN is covering it (Google "CNN Live" if you want to watch online).

Not looking good. 😬

Not looking good. 😬

Perhaps they should stop the election certification and instead invoke the 25th Amendment to force Trump out of office?!

en.wikipedia.org/wiki/Twenty-fi…

en.wikipedia.org/wiki/Twenty-fi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh