eComm and D2C will be acutely impaired by the ATT opt-in mechanic coming to iOS (rumored made mandatory in March). ATT doesnt exclusively impact app advertisers, & in fact may disproportionately damage eComm and D2C. Some thoughts on how those advertisers should prepare (1/X)

2/ In the @MobileDevMemo 2020 mobile advertising predictions post, I posit that D2C ad spend may drop by as much as 50% in Q2 2020. FB revealed in December that app-to-web campaigns will be governed by ATT opt in, severely limiting campaign efficiency mobiledevmemo.com/2021-predictio…

3/ FB had only previously discussed ATT in terms of app campaign relevance. This new revelation likely stemmed from further instructions from Apple following FB's initial guidance mobiledevmemo.com/understanding-…

4/ FB affirmed in Dec that app-to-web campaigns will be: conversion event limited, aggregated at campaign level, and limited wrt attribution windows (default: 7-day click). This effectively replicates the privacy treatment of app campaigns on app-to-web campaigns

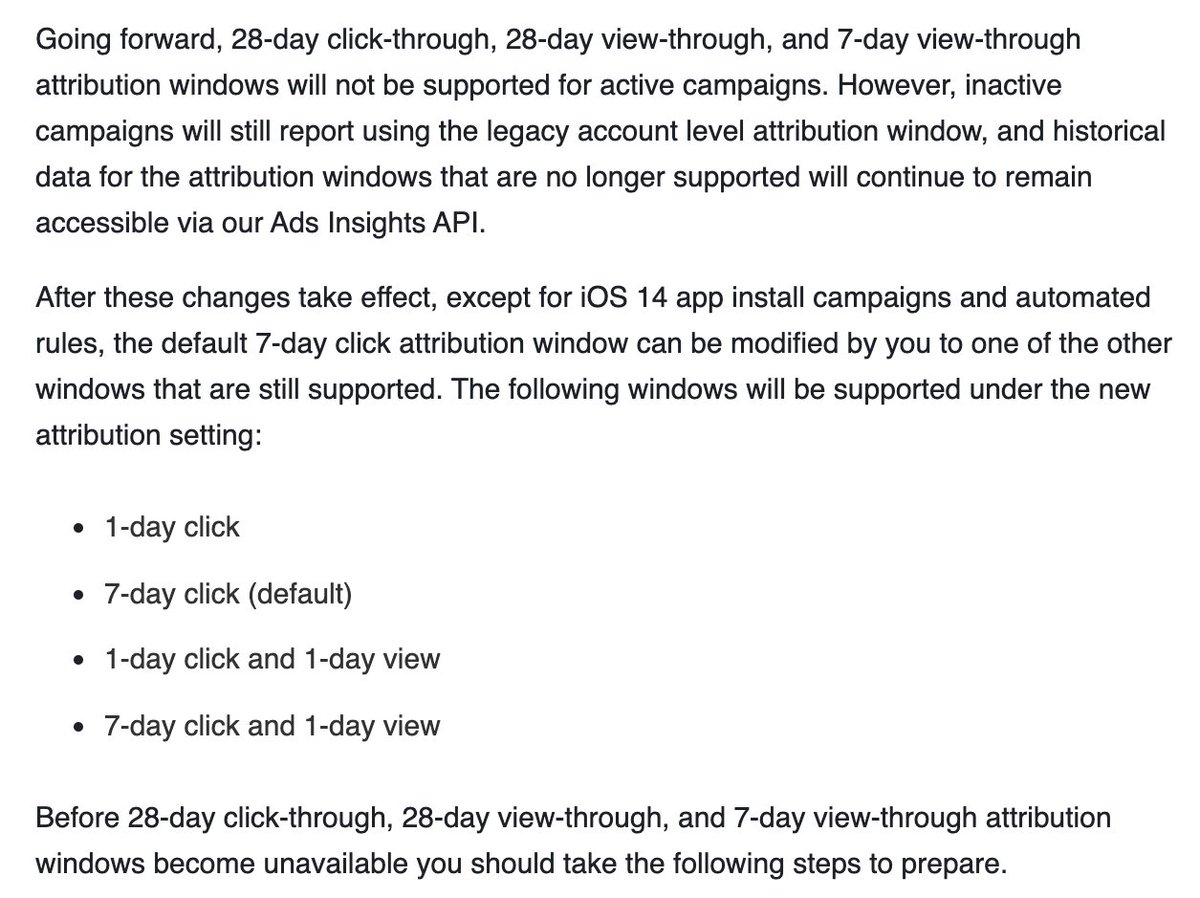

5/ Adam Lovallo from Grow.co describes 28-day click / 1-day view the "gold standard" for D2C. Why would FB change the default to 7-day? Because it is aggregating conversions at the campaign level -- universally, with what it is calling Aggregated Event Measurement

6/ This means that the intel that many D2C / ecomm consultants and agencies are dispensing around the conversions API (CAPI) being a panacea here for conversions collection / targeting is invalid unless the user opts in. Conversions are being aggregated at the campaign level

7/ Why is this important? Few reasons. First -- just as with for apps -- the user-centric monetization behavior data that drives campaign performance through personalization will be severely diminished. How much is that worth? FB says 50% of CPM mobiledevmemo.com/facebook-has-k…

8/ Second: 7-day click will simply drop a lot of conversions. So not only is targeting losing a substantial amount of precision (bc FB will lose visibility into who spends money on D2C ads & thus should be targeted) but measurement will suffer from loss of data

9/ How should D2C and ecomm advertisers prepare? There are no "quick tips" or clever tricks here: this is a tectonic shift in digital advertising. Sure, implement CAPI -- why not. But pivoting through this requires making fundamental changes to advertising strategy

10/ Understanding the impact of these changes requires acknowledging that the D2C category really only rose to prominence as a result of directly-attributable campaigns on FB & other channels that provided for user-centric monetization profiles / targeting mobiledevmemo.com/power-peril-fa…

11/ When that evaporates w campaign-level aggregation, so does much of the opportunity. eComm & D2C advertisers must wrap their arms around as much first party data as possible to preserve the link. This article from Common Thread provides helpful guidance commonthreadco.com/blogs/coachs-c…

• • •

Missing some Tweet in this thread? You can try to

force a refresh