Sustainable Turnaround #HFCL Ltd (CMP 32.25(M cap 4142 cr.)

After a prolonged downtrend or hibernation of a stock, if we see reversal on monthly chart with volume and Promoters buying shares from Open market, then it signifies a change in company fundamental and can give (cont)

After a prolonged downtrend or hibernation of a stock, if we see reversal on monthly chart with volume and Promoters buying shares from Open market, then it signifies a change in company fundamental and can give (cont)

disproportionate returns.

Case study of HFCL:

✅Reversal on Monthly chart

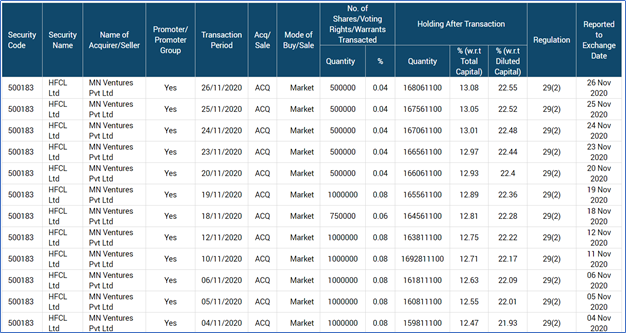

✅Promoters buying from open market (look at screen shot attached)-

Note – There are many other transactions of promoter buying, please go to BSE site and see SAST/Disclosure.

Case study of HFCL:

✅Reversal on Monthly chart

✅Promoters buying from open market (look at screen shot attached)-

Note – There are many other transactions of promoter buying, please go to BSE site and see SAST/Disclosure.

June , 2020 : Promoters holding - 38.64%

Sep, 2020 : Promoter holding-39.73%

Dec,2020 :Promoter holding -Note- Q3 SHP is not out yet, but based promoter entity buying, the new promoter holding at end of Q3 should be increased by 2.3% ( 22.55 – 20.2)- Total Promoter holding(cont)

Sep, 2020 : Promoter holding-39.73%

Dec,2020 :Promoter holding -Note- Q3 SHP is not out yet, but based promoter entity buying, the new promoter holding at end of Q3 should be increased by 2.3% ( 22.55 – 20.2)- Total Promoter holding(cont)

should be ~ 42.03%

✅Increased in Promoter holding in last 2 quarters = 3.39%

✅With avg price 17.5, this comes to a value of ~ 76.2 crore (which is significant for a small cap stock)

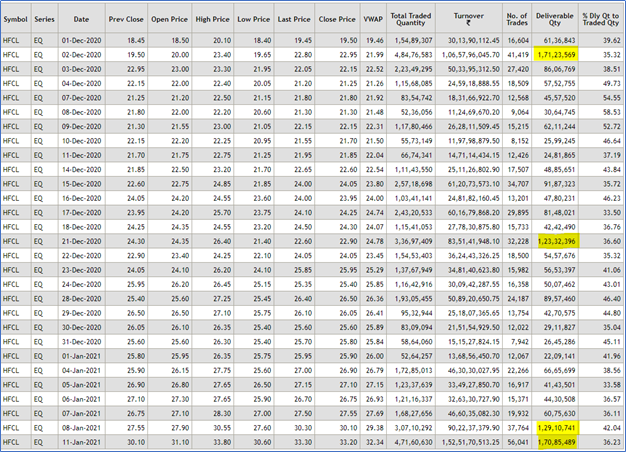

✅Stock has been strongly accumulated by big investors (evident from high volume) (cont)

✅Increased in Promoter holding in last 2 quarters = 3.39%

✅With avg price 17.5, this comes to a value of ~ 76.2 crore (which is significant for a small cap stock)

✅Stock has been strongly accumulated by big investors (evident from high volume) (cont)

even after promoters buying (last day promoter bought was 26th Nov, 2020).

These are strong signals of long-term turnaround for the underlying company’s business fundamentals. But now, let us analyze the HFCL company and see is it a real turnaround story or some operator play 😊

These are strong signals of long-term turnaround for the underlying company’s business fundamentals. But now, let us analyze the HFCL company and see is it a real turnaround story or some operator play 😊

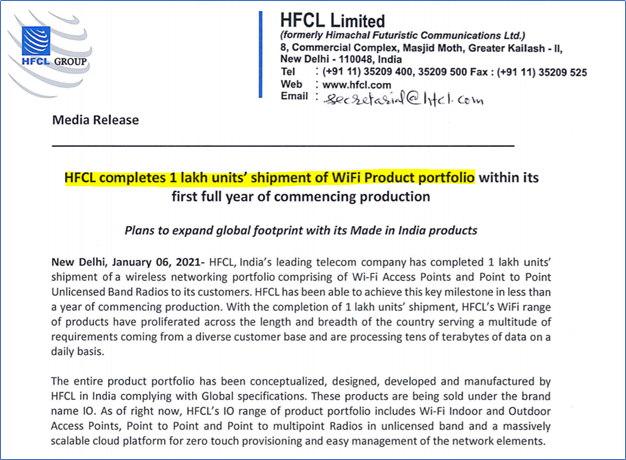

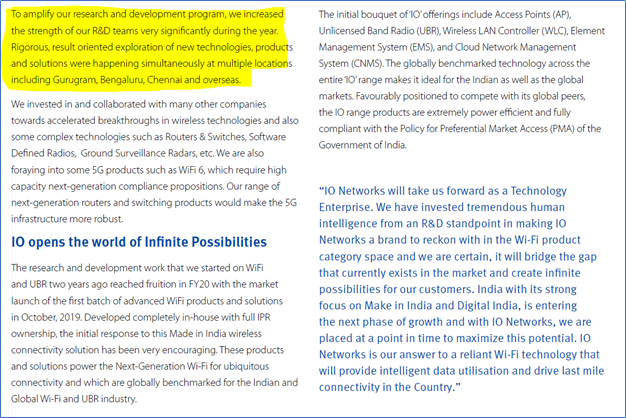

✅Change in Business Strategy–Company has changed is business strategy and started in-house research,design, development and marketing.The focus is more to do in-house product developments rather than third party contract,this should help with margin and long-term sustainability.

Company’s own designed Wi-Fi product backed by UBR(Unlicensed Band Radio) technology, has been sold to the tune of 1 Lakh units already, see exchange disclosure.

see attached screenshot

see attached screenshot

✅Brand Building - Company has developed its own brand called “IO”, dedicated website for it, says about the razor focus of the management.

IO brand link - ionetworks.in

Company website link - hfcl.com

IO brand link - ionetworks.in

Company website link - hfcl.com

✅Expansion & Focus on In-House R&D, innovation– New employees, including higher level personnel have been hired from the industry/competitors, for the R&D (more than 100 people in R&D), Center of Excellence have been formed. This has already started giving fruits

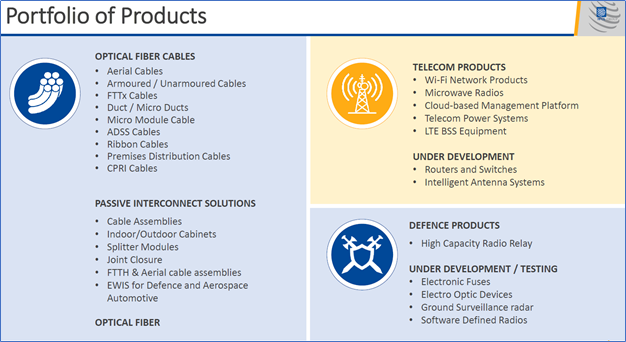

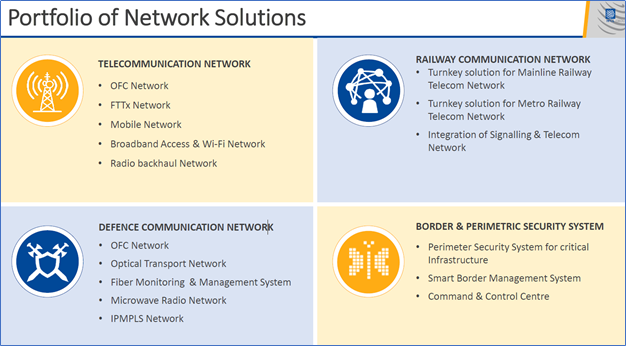

✅Product Portfolio – All verticals/end industry are doing well such as Telecom, Optical Fiber Cables, Defence, Railway communication and Smart City, Security & Surveillance.

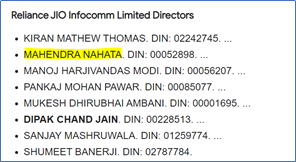

✅Diversified Customer Base (Domestic & International) – Exports to 30 to 40 countries. Reliance Jio is a customer of the company.

✅Association with Reliance Jio – Promoter and MD of HFCL, Mr. Mahendra Nahata is also in the board of Reliance Jio, hence he should be getting the latest developments of Jio and overall industry and stay ahead of the curve than the competitors.

✅Backward integration – The key raw material for Optical Fiber cable is Optical Fiber. Company has developed plant for producing Optical Fiber for captive use, thus improving margins and working capital management.

✅Fiber To The Home (FTTH)-Due to the new Work-from-Home culture developed from Covid-19 lock down, many employees have been taking the high-speed Optical Fiber broadband connections to their home (including me 😊 ). This will increase further demand of various products of the

the company – OFC, Wi-Fi access points etc. Company is increasing the capacity by 33%.

✅5G in India - 5G is the future and it will come to India very soon due its superior data speed and computation capability, trials to start in Delhi. Jio is already working on it.

✅5G in India - 5G is the future and it will come to India very soon due its superior data speed and computation capability, trials to start in Delhi. Jio is already working on it.

5G will need more tower and fiber connectivity and hence it will increase the demand of the products multi-fold.

✅BharatNet phase-II – Every village in the country (6 lakh +) would be connected with optical fiber network within 1,000 days or less than 3 years,

✅BharatNet phase-II – Every village in the country (6 lakh +) would be connected with optical fiber network within 1,000 days or less than 3 years,

Prime Minister Narendra Modi said at the ramparts of Red Fort on India's 74th Independence Day. This should increase the demand of company product as well.

✅Defence Equipment – Government has been pushing for “Make in India” initiative in the Defence sector and encouraging domestic players. HFCL has some Defence products (Electronic Fuse, Electro Optic Devices, Ground Surveillance radar, Software Defined Radios etc.),

at different stages and they should help with incremental growth over time.

✅Railway communication network – Railway expansion, including Freight corridor, are having large contract to players like L&T, which in turn provides the network communication related contract to

✅Railway communication network – Railway expansion, including Freight corridor, are having large contract to players like L&T, which in turn provides the network communication related contract to

HFCL/peers in form of Turnkey projects.HFCL already working on L&T contract in Bangladesh and Mauritius

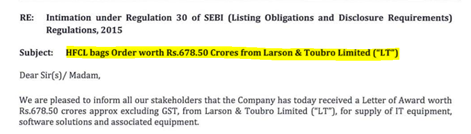

✅Healthy Order book–Overall order book is ~7,500 cr. (almost 2 years visibility) and few big orders in progress. HFCL got 678.5 cr. order from L&T i.e. L&T has faith on HFCL

✅Healthy Order book–Overall order book is ~7,500 cr. (almost 2 years visibility) and few big orders in progress. HFCL got 678.5 cr. order from L&T i.e. L&T has faith on HFCL

✅Smart City, Security & Surveillance – Company has been conscious about necessity of more network security solutions with increasing threats over time and hence it has developed the Security products backed with relevant software. Smart city projects will also need many products

Thus, the opportunity size is huge, and company can achieve exponential growth, with its innovation-led technology products that too being cost-effective and competitive. Company focusing on these opportunities and planning ahead of time, with special focus on profitability.

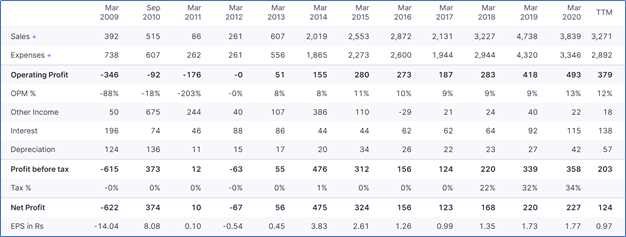

✅Possible Future – With all these opportunities and focused management and R&D team, the growth should be very good for the company. Unlike other turnaround story, this company has already making positive PAT from last many years, with moderate growth.

Debt to Equity ratio is manageable at .47, ROCE 21%, ROE 15.3%, TTM EPS/PE is not comparable due to Covid-19 affected Q1, Rating A- by CARE.

Stock price was in hibernation due to ignorance from investors due its controversial past (promoters’ involvement with Ketan Parekh/

Stock price was in hibernation due to ignorance from investors due its controversial past (promoters’ involvement with Ketan Parekh/

Shankar Sharma etc.), but those are external factors and there has been no doubt on the Books of Account of the company

Now, with renewed Govt initiative, transformation of the company culture, significant buying by promoters from open market, interest from big investors etc.

Now, with renewed Govt initiative, transformation of the company culture, significant buying by promoters from open market, interest from big investors etc.

have been supporting the sustainable turnaround for the company

Company is expected to come up with good Q3 results on 14th Jan for, 2021 and in successive quarters and that should help gain confidence of new investors, which should also help the stock price.

Company is expected to come up with good Q3 results on 14th Jan for, 2021 and in successive quarters and that should help gain confidence of new investors, which should also help the stock price.

Concerns –

• Promoters holding pledge–Promoters 47% holding pledged as on Q2 SHP. Promoters have clarified that no single rupee of loan was taken against these shares. The pledge was related to T&C of new plant and pledging should get released when commercial production starts

• Promoters holding pledge–Promoters 47% holding pledged as on Q2 SHP. Promoters have clarified that no single rupee of loan was taken against these shares. The pledge was related to T&C of new plant and pledging should get released when commercial production starts

Promoters have already applied to release it and already it got reduced from 68% to 47% and further release should be done in near future.

• Receivable & Cash Flow – Receivable has grown recently and that has put pressure on working capital management. Management said, part of

• Receivable & Cash Flow – Receivable has grown recently and that has put pressure on working capital management. Management said, part of

it was due to Covid-19 related lock down and part due to BSNL (company has good revenue from Govt, , in form of secondary orders from BSNL). With Govt’s focus on Digital India and revival package to BSNL and other PSUs, the cash collection should improve in near future).

✅Conclusion – Company is at inflection point and next few years could be very exciting with 5G, BharatNet phase-II etc. and company can clock huge revenue growth and profits. Roughly, company can do 150-200 cr. PAT per quarter in 5 years, i.e. 600 to 800 cr. PAT annually.

With high growth and being in the niche technology space and renewed investors interest, it can get a good PE and thus the stock can become a 5X from current market price within 5 years of time.

Disclaimer – I am not a SEBI registered analyst, and these are my personal analysis of the stock based on information available in public domain. Please consult your Financial advisor and do self-analysis before making any investment decision. It is safe to assume I am invested.

• • •

Missing some Tweet in this thread? You can try to

force a refresh