Summer 20: investment co with a one holding - a REIT - gets rid of its directors after the REIT collapsed into a zombie.

Sep 20: new management, new investment: a software company with 23% pre-tax margins

Nov 20: 60% growth, big client wins

Implied valuation today <5x sales

Sep 20: new management, new investment: a software company with 23% pre-tax margins

Nov 20: 60% growth, big client wins

Implied valuation today <5x sales

There are no other numbers, this is everything there is.

The holdco is called Drumz #DRUM a £2.4M cap

The zombie is a listed REIT called KCR

The software company is called Acuity Risk Management

I have it at an implied trailing sales of ~4.9x ex £500K holdco cash and ex zombie

The holdco is called Drumz #DRUM a £2.4M cap

The zombie is a listed REIT called KCR

The software company is called Acuity Risk Management

I have it at an implied trailing sales of ~4.9x ex £500K holdco cash and ex zombie

Acuity's product is called STREAM, here's how they describe it:

STREAM is a cyber security and risk management software used by organizations globally for ISO 27001, GDPR, NIST and many other standards

In short, its not a nice-to-have for big companies

dataprotectionmagazine.com/?p=136

STREAM is a cyber security and risk management software used by organizations globally for ISO 27001, GDPR, NIST and many other standards

In short, its not a nice-to-have for big companies

dataprotectionmagazine.com/?p=136

The company is a tiddler but growing well and as you've seen, it's apparently scoring billion dollar cap clients.

Website: plenty of recognisable blue chips, testimonials from the likes of Capgemeni and the Welsh NHS.

It's a real company, elsewhere referenced by Gartner and can be found in industry press as a company to watch in its field.

information-age.com/top-uk-cyber-s…

threat.technology/compliance-mon…

It's a real company, elsewhere referenced by Gartner and can be found in industry press as a company to watch in its field.

information-age.com/top-uk-cyber-s…

threat.technology/compliance-mon…

The story is as follows. Drum's REIT fell on hard times, did a placing, diluted and Drum's directors left.

New management brought in, main events are as below

Management have a successful history in the sector, successful rescues and trade sales. They want to IPO / Sale here

New management brought in, main events are as below

Management have a successful history in the sector, successful rescues and trade sales. They want to IPO / Sale here

Meanwhile, Acuity's management appears to be recognised in the field and has built and sold companies before - namely, to Siemens

Given the scarcity of financial information available I'm going to concentrate here on Angus Forrest, the head of Drumz and 20% owner of Acuity to look at what he did in his prior two roles.

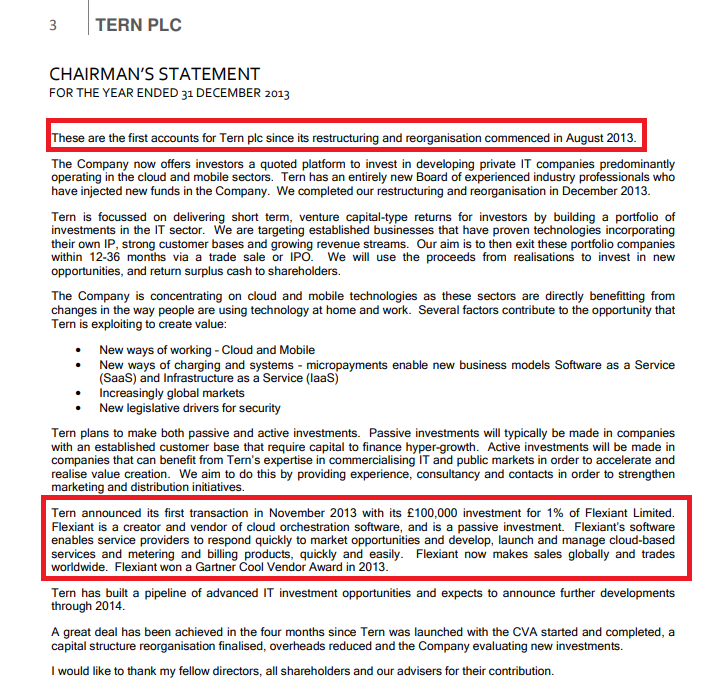

LinkedIn: He started / joined Tern PLC in August 2013

LinkedIn: He started / joined Tern PLC in August 2013

It tallies with contemporaneous reports from Tern: a re-org, a first investment. Note how he's already into tech.

Director dealing from the start of his tenure shows prices of 0.1p rising to sales at 0.9p at the time of his exit. I'll call that a 10x for cash.

Following that: Abal, which had previously been called Imaginitik. As you can see below and from the numbers if you link through to the report - the company has fallen on hard times: he comes in, steadies the ship and gets it sold

supplymecapital.com/wp-content/upl…

supplymecapital.com/wp-content/upl…

I took notes on a 10 minute September interview linked below: customers don't leave when they raise prices, he wants to sell or IPO within two to three years

Note, more deals are planned besides Acuity

share-talk.com/angus-forrest-…

Note, more deals are planned besides Acuity

share-talk.com/angus-forrest-…

Lastly, this. He comments in the spoken interview how small companies tend not to sell well - and in context with the below it makes clear he is in full playbook mode: now he's on the board, drive sales and growth, then exit

That's most of what I know: how much growth is from price, the % amount of "predominantly SaaS", IDK. Companies House shows balance sheets for Accuity, no gremlins; Forrest seems like a decent jockey and Accuity seems successful - and cheaply priced for the growth and optionality

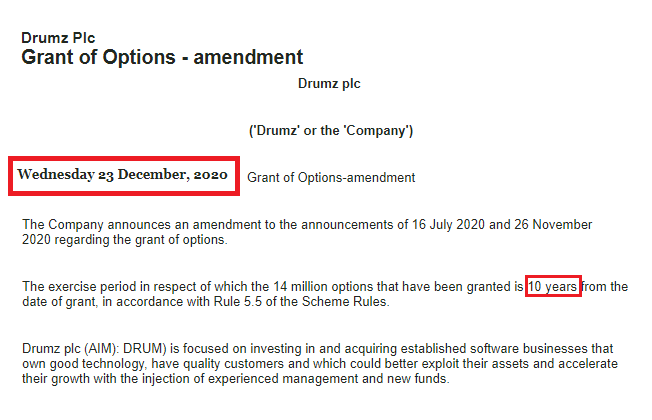

And one last curious thing that I don't know how to interpret.

I'd already noticed the warrants were priced quite far out from the price but here we see management options suddenly extended to 10 years, from 3

I'd already noticed the warrants were priced quite far out from the price but here we see management options suddenly extended to 10 years, from 3

It's the same date. What it means, why they've got it pinned and whether it's a coincidence, I have no idea.

Along with the launch of the enterprise-level product, new website has gone up. Channel 4 appears to be a new customer here.

It's almost as if the company is describing exactly what they're doing and how it's going. Contract wins starting to add up for #DRUM Drumz

• • •

Missing some Tweet in this thread? You can try to

force a refresh