How to get URL link on X (Twitter) App

Here's where it trades on a forward sales multiple against some of the big diversified defence majors - has lost much of the premium and now sits a little off the top end. Brits bottom of the pile.

Here's where it trades on a forward sales multiple against some of the big diversified defence majors - has lost much of the premium and now sits a little off the top end. Brits bottom of the pile.

The company isn't a pure play but it's good enough to say it's very shale exposed, towards the completion side vs the drilling side of things.

The company isn't a pure play but it's good enough to say it's very shale exposed, towards the completion side vs the drilling side of things.

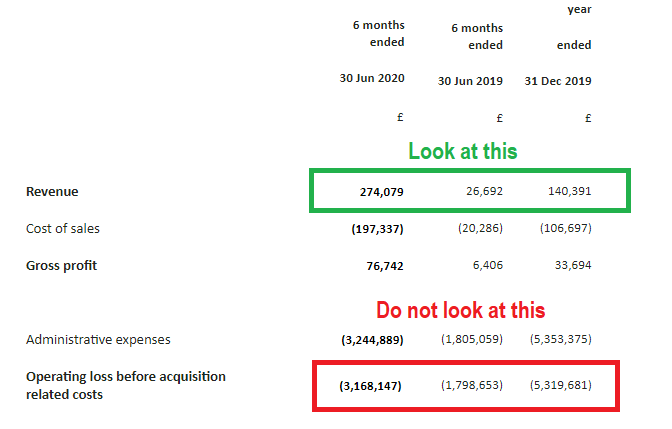

My basic premise with it is that the accounts are a complicated nightmare (CTRL+f for "adjust" is 232 hits in the last FY report) but most immediately, that this is right now a gross margin story - I think there are grounds to at least consider whether IG can be given a pass here

My basic premise with it is that the accounts are a complicated nightmare (CTRL+f for "adjust" is 232 hits in the last FY report) but most immediately, that this is right now a gross margin story - I think there are grounds to at least consider whether IG can be given a pass here

Story is that they're shrinking. 1500+ stores 2 years back, to 1050 by the end of FY21

Story is that they're shrinking. 1500+ stores 2 years back, to 1050 by the end of FY21

IOF produces Iodine in the US via O&G brine. Iodine is a beneficiary of industrial recovery generally and covid specifically - the largest use is used as x-ray contrast which may benefit demand from catch up on delayed hospital treatment.

IOF produces Iodine in the US via O&G brine. Iodine is a beneficiary of industrial recovery generally and covid specifically - the largest use is used as x-ray contrast which may benefit demand from catch up on delayed hospital treatment.

https://twitter.com/hareng_rouge/status/1303624978336755714First is the RNS from earlier this month announcing their MTF (investopedia.com/terms/m/multil…) had achieved 6.2% market share. Across the €53.6B traded on AQXE in July, this came out to €1.7B a day.

https://twitter.com/CasinoCapital/status/1400510479328595974Company has cash of $80M + new debt of $99M (pink) repays difference on prior debt of $129M with cash on hand (green) so $50M cash + debt $99M

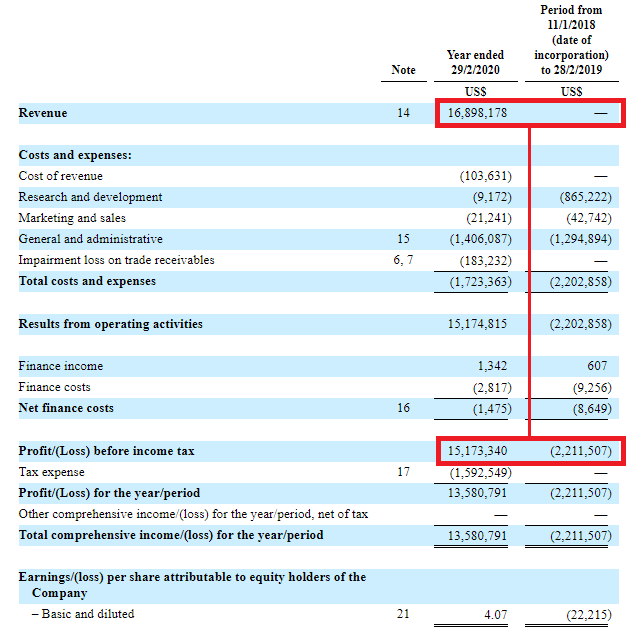

Revenues explain the chart well enough. Growth stalls, the starch comes out of the shares and then suddenly everyone notices a lack of profitability and cost capitalisation all along. Results released today, the last column, pretty much what you'd expect.

Revenues explain the chart well enough. Growth stalls, the starch comes out of the shares and then suddenly everyone notices a lack of profitability and cost capitalisation all along. Results released today, the last column, pretty much what you'd expect.

When I mentioned to Munger and Buffett the other day that I was reading up on LendingClub this was the reaction - and they're not too wrong: LC is crap

When I mentioned to Munger and Buffett the other day that I was reading up on LendingClub this was the reaction - and they're not too wrong: LC is crap

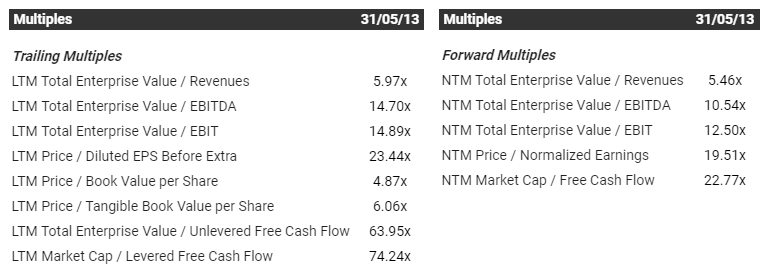

I first bought $SLP in April 2013. I mention this to make the point that was long before the current bubble in futuristic healthcare stocks, or before SaaS was a thing, this was already a punishingly expensive sector.

I first bought $SLP in April 2013. I mention this to make the point that was long before the current bubble in futuristic healthcare stocks, or before SaaS was a thing, this was already a punishingly expensive sector.

https://twitter.com/hareng_rouge/status/1326895581462208513?s=20

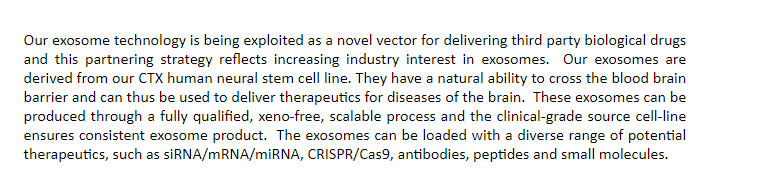

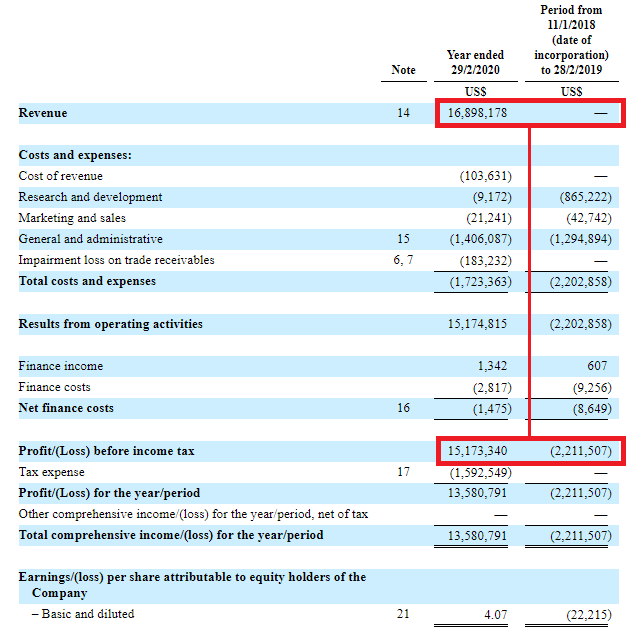

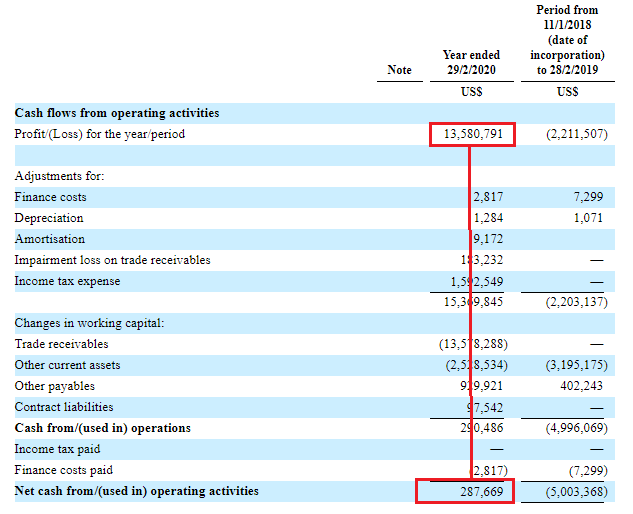

There are no other numbers, this is everything there is.

There are no other numbers, this is everything there is.

https://twitter.com/hareng_rouge/status/1339479766827712515"May" and also:

https://twitter.com/icebergdevalor/status/1344931424298741761Don't worry, not going on a bender with filings

You fix the stranger in your gaze

You fix the stranger in your gaze

It's a German maker of high end capital goods for solar, semi and life sciences: glass and wafer deposition / polishing, that kind of area.

It's a German maker of high end capital goods for solar, semi and life sciences: glass and wafer deposition / polishing, that kind of area.