$Gold $XAU bull market over?

Think it is possible we no longer see significant upside in Gold so long as rise in yields and labour market recovery continues and we are nearing/at the end of a bull market... 1/

Think it is possible we no longer see significant upside in Gold so long as rise in yields and labour market recovery continues and we are nearing/at the end of a bull market... 1/

Fed reiterated no increase WAM or change pace of purchases, still no intention of deploying yield caps, still some ways til tapering is consider, and with core CPI at 1.6% we are likely to see AIT policy stance to continue for some time till inflation is well above 2%. 2/

Meanwhile Biden's bold fiscal agenda is likely support labour market recovery and stronger inflation expectations, and should lead to more bear steepening in the curves and stronger real-yields as labour market improves. 3/

Reflation themed decline in $USD to continue but rising rates should decelerate the trend as differentials and confidence in USD improves somewhat. 4/

Also interesting is the past USD trends under Dem/Rep administrations and could point to a stronger USD later in the Biden tenure:

"USD tends to start at a high value for Republican presidents and then depreciates, while the opposite pattern is true for Democrats" 5/

"USD tends to start at a high value for Republican presidents and then depreciates, while the opposite pattern is true for Democrats" 5/

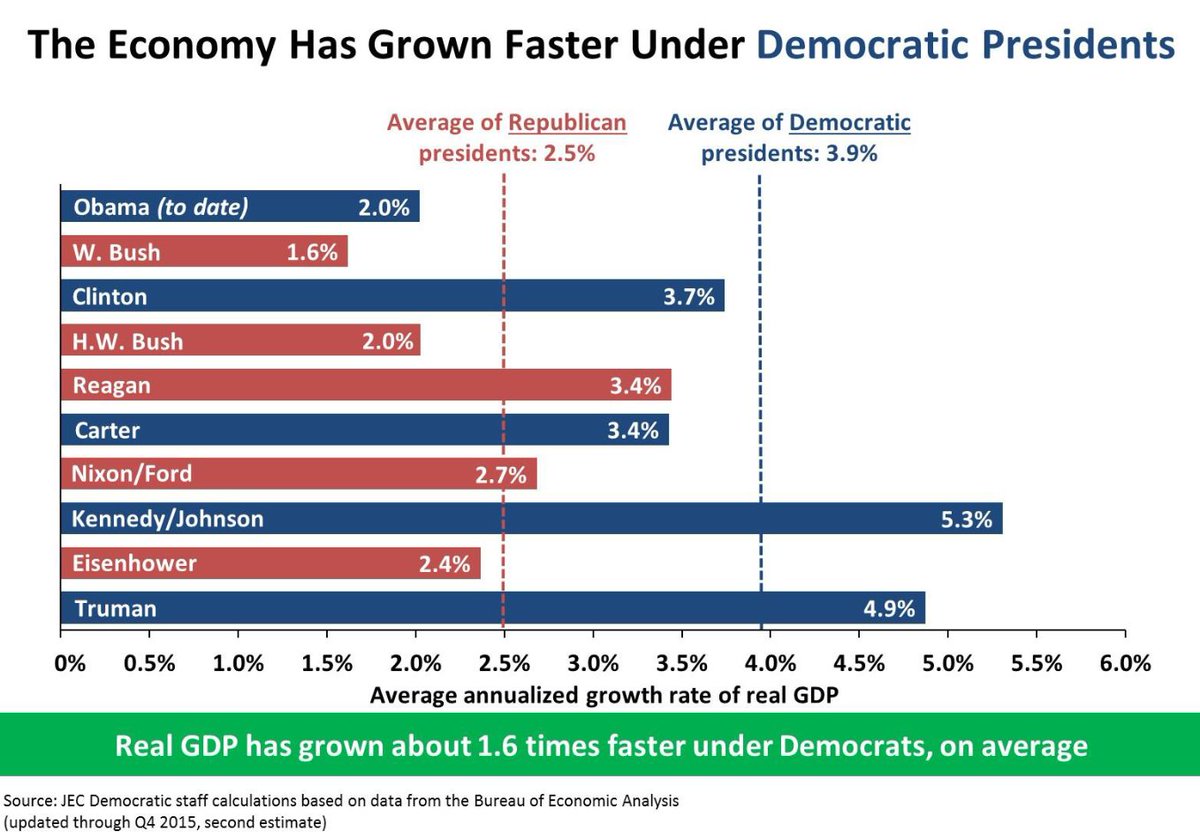

And on economic growth:

"almost all major economic indicators (e.g., GDP growth, employment, inflation, and total factor productivity) have more favorable values under Democratic presidents than Republicans.” 6/end

"almost all major economic indicators (e.g., GDP growth, employment, inflation, and total factor productivity) have more favorable values under Democratic presidents than Republicans.” 6/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh