A thread about my thoughts on the market:

$SPX has a rising wedge, looks really weak.

$DXY is bottoming with the short interesting going higher and higher.

$UVXY building a big base. Last time we saw this was in February.

$RUT has hit respected trendline from 1998.

$SPX has a rising wedge, looks really weak.

$DXY is bottoming with the short interesting going higher and higher.

$UVXY building a big base. Last time we saw this was in February.

$RUT has hit respected trendline from 1998.

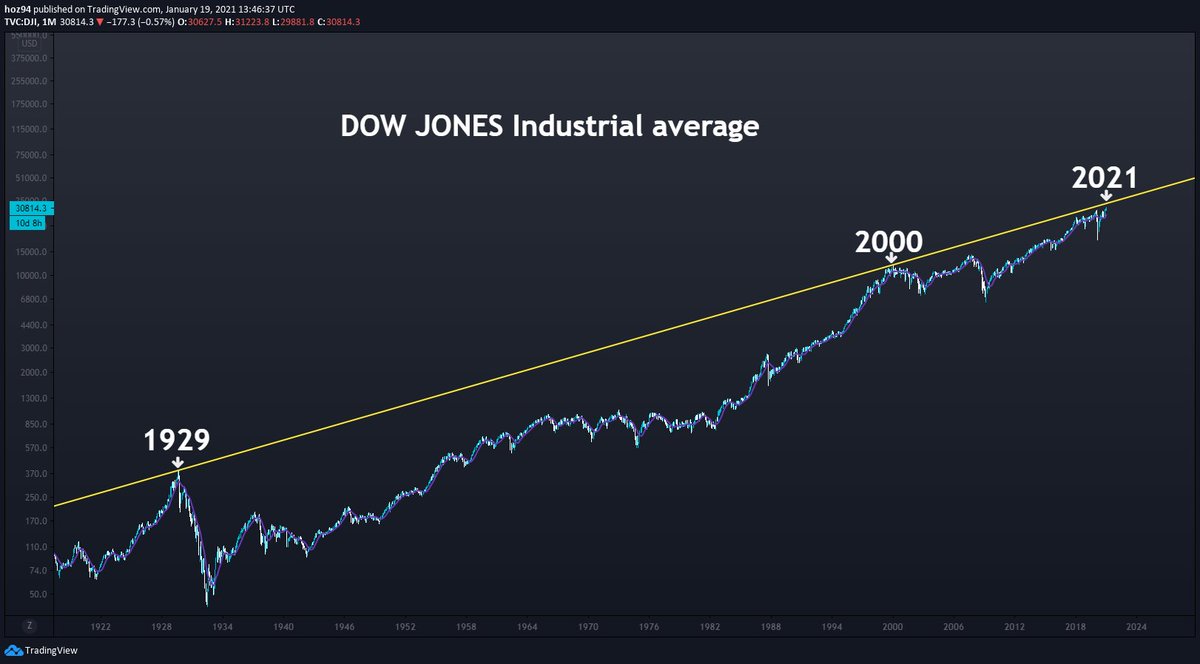

$DJI about to hit the respect trendline from 1929 and 2000. These were two secular bull markets that ended.

Big tech looking really weak.

$NVDA about to break down.

$MSFT had a breakout failure, which is usually very bearish.

$FB has already broken down.

$APPL looks to have a double top. Also went outside of bull channel.

$NVDA about to break down.

$MSFT had a breakout failure, which is usually very bearish.

$FB has already broken down.

$APPL looks to have a double top. Also went outside of bull channel.

Back in 2000, there was a late rotation into $RUT and it broke out of a base and this spelled the top for the $NDX.

We are seeing the similar pattern here in 2021.

We are seeing the similar pattern here in 2021.

Short interest for $DXY is sky-rocketing. Such an extreme positioning has led to a rally in the past. A $DXY rally is a big threat to equities and precious metals.

R/T

@MacroCharts

R/T

@MacroCharts

Governments all around the world are spending at a record pace but they are unable to generate inflation, which further proves that we will have a deflationary crash before run-away inflation.

Equity PUT/CALL ratio is almost at record low levels. Nearing Dotcom bubble levels. Keep in mind that this is in a deep recession.

The market breadth looks quite strong here. If the markets don't top here, there might be one last rally left before the this secular bull market ends.

• • •

Missing some Tweet in this thread? You can try to

force a refresh