1/x Some additional thoughts on $CDON 💭

The more I think of it, the more interesting this whole situation becomes. For one, management's story ("Nordic Amazon", which has caught fire on fintwit) and the view held by Nordic investors (boomer brand on decline) is VERY different.

The more I think of it, the more interesting this whole situation becomes. For one, management's story ("Nordic Amazon", which has caught fire on fintwit) and the view held by Nordic investors (boomer brand on decline) is VERY different.

2/x The first thing that comes to mind is the importance of storytelling. One thing we have to credit management with is their ability to reframe the CDON story. Targeting investors outside Nordics and using very Wall Street friendly presentations (in English) was very smart.

3/x And with the zero interest rate environment + aggressive money printing, the ability to tell a compelling story and attract investors is basically what made $TSLA the monster that it is. Also $NFLX & $AMZN are amazing storytellers ofc (w/ a more connected share price..).

4/x This ability is sometimes underrated and might actually increase shareholder value over time (with the caveat that management has to deliver to stay funded). For example: without an attractive story $EMBRAC or $SECARE would not have had the same ability to accelerate growth.

5/x Storytelling aside, the situation also makes me reflect a lot on the importance "boots on the ground research". As I wrote in my piece yesterday, I admit the stock was very cheap at 100-200 SEK but my biases made not even consider it investable, to my detriment.

6/x Looking at some customer reviews (Trustpilot & whatnot) I was very surprised to see more than 2/5 stars. Maybe all of the bad anecdotal experiences I, people close to me and (what feels like) the whole Nordic fintwit have had using CDON is just some of the negative outliers?

7/x What I mean is that in some cases it might certainly be a huge advantage not knowing anything about the customer experience and/or products, to stay clear from biases that don't match the average experience.

8/x Even if your very individual customer preferences was recalibrated to figure match exactly what the masses want, your 1-3 times testing products/services out might not represent the average customer experience anyway. You might be fooled by randomness, so to speak.

9/x And since the CDON story still is a bit like Schrodinger's Cat we might as well flip it around. Let's say my intuition & "local knowledge" about the brand IS right: the story doesn't hold up and the company can't execute (the boomer brand on decline story), despite

10/x good looking numbers last Q and suprising customer ratings - All of a sudden you might become very paranoid about how badly skewed your view is of a brand/company in another part of the world, where it's hard for you to get a real feel for it on a human level.

11/x I mean, maybe millions of people in LATAM think it's insane for some reason that we even consider buying $PAGS $STNE or whatever, and that we outsiders are being fooled by the numbers short term. Some stuff is obviously hard to quantify and might not show up in the numbers.

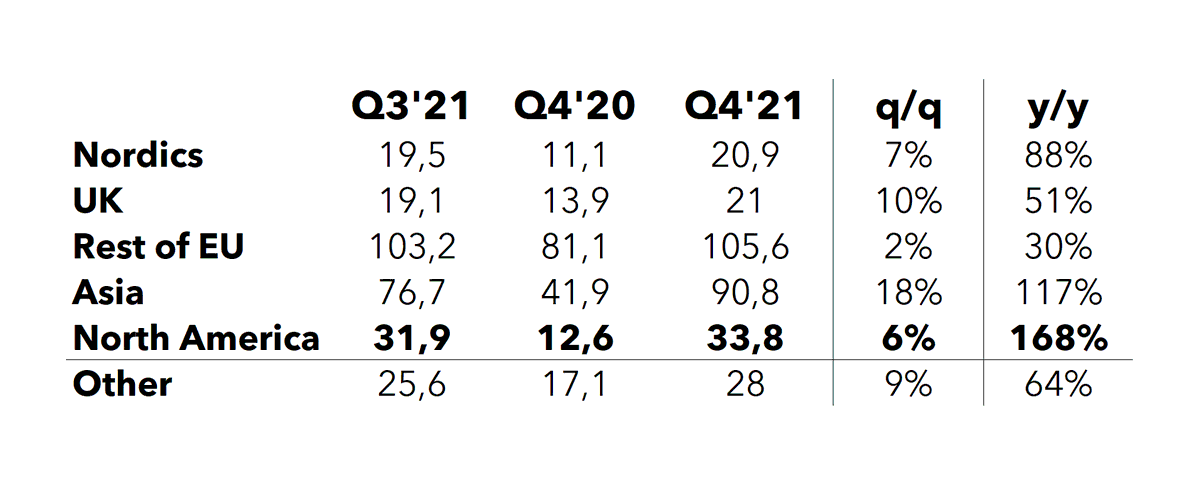

12/x But as always "money talks", and high growth is a good sign that the company is on the right path.. And with +100% GMV last Q it sure looks like I'm wrong about $CDON, but as always the future will tell. I'm really excited to see how this one plays out;

13/x Will our Nordic preconceptions about this old struggling internet relic prove to be right, or will it instead turn out that the bias free international fintwit crowd with lots of imagination had a big advantage in not knowing much about "the old CDON"?

14/x Either way, what got me so interested in this situation is that I have never before seen this type of discrepancy around a company I "know well". Fintwit is mostly in the same camp (with different valuation preferences ofc), but this time we're almost diametrically opposed.

15/x I will follow this name closely in the coming quarters and try to have an open mind about it, since I really believe in this mental model for investors (and life in general);

• • •

Missing some Tweet in this thread? You can try to

force a refresh