QCP Market Update 22 Jan

1/ The broad price puke from yesterday has been blamed on some negative headlines out of Biden's new "crypto unfriendly" administration. However, we think that the market was already due for a correction

1/ The broad price puke from yesterday has been blamed on some negative headlines out of Biden's new "crypto unfriendly" administration. However, we think that the market was already due for a correction

2/ We've always been most worried about the US regulatory hammer from this new administration - but Yellen's & Powell's remarks on crypto regulation sounded less draconian than we had initially feared, although many observers seemed to have been taken by surprise by it

3/ We think this dip is largely the result of market positioning. Long crypto has been become a crowded consensus trade and a correction was bound to happen, the negative headlines were just an excuse for longs to unwind

4/ BofA Hartnett's publication on Tuesday officially showed BTC overtaking US Tech as the hottest consensus trade in the market. While we’re not expecting a crash similar to 2018 this time, we see this as further evidence that price is likely to be capped at least until end of Q1

5/ Signs of institutional exhaustion:

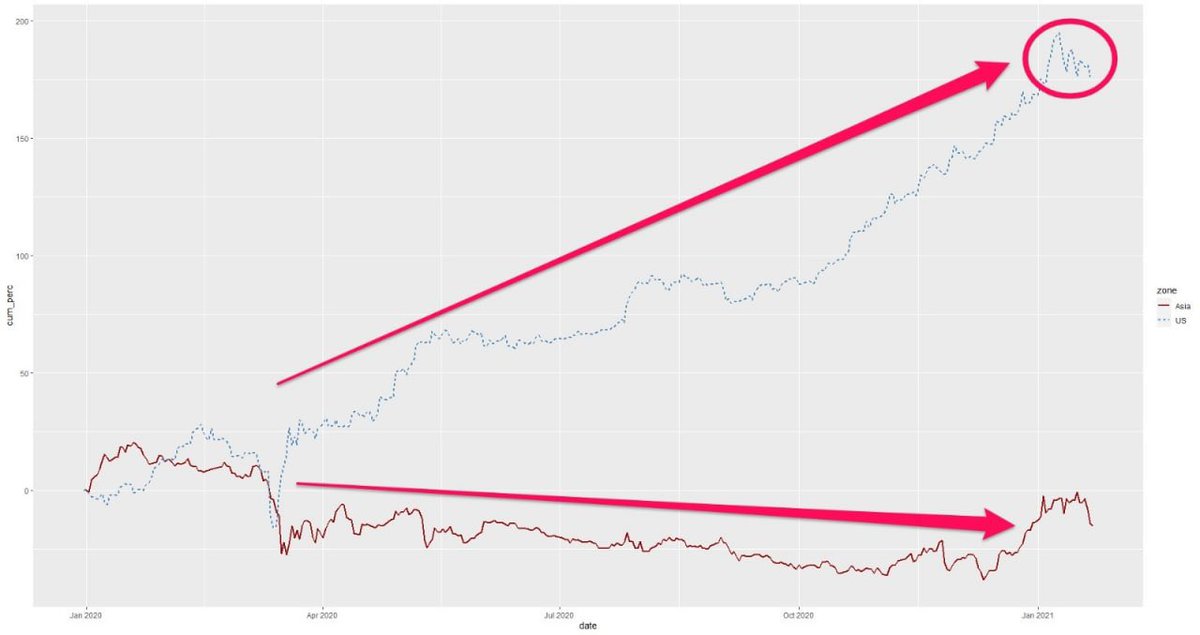

We've done a timezone analysis which breaks down BTC moves into Asia hours vs. US hours (12 hours each). Since March last year, the clear pattern has been relentless US buying while Asian whales and miners have been on the offer

We've done a timezone analysis which breaks down BTC moves into Asia hours vs. US hours (12 hours each). Since March last year, the clear pattern has been relentless US buying while Asian whales and miners have been on the offer

6/ However after the BTC top 2 weeks ago, the strength in US hours has lost momentum for the first time. This is a clear sign of exhaustion in demand from the US institutions and corporates who have been the primary drivers of this bull run

7/ Weakening of retail fervour:

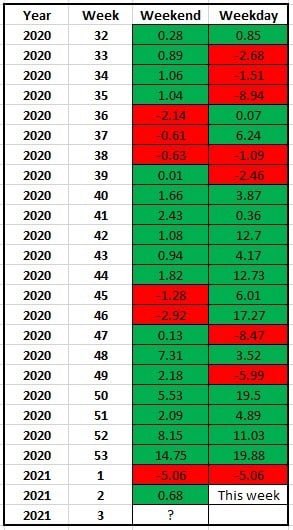

We pay close attention to weekend price action and the leveraged perp funding rates to gauge retail interest. The exponential move higher in the last weeks of Dec was marked by strong weekend price gains which created strong momentum into the week

We pay close attention to weekend price action and the leveraged perp funding rates to gauge retail interest. The exponential move higher in the last weeks of Dec was marked by strong weekend price gains which created strong momentum into the week

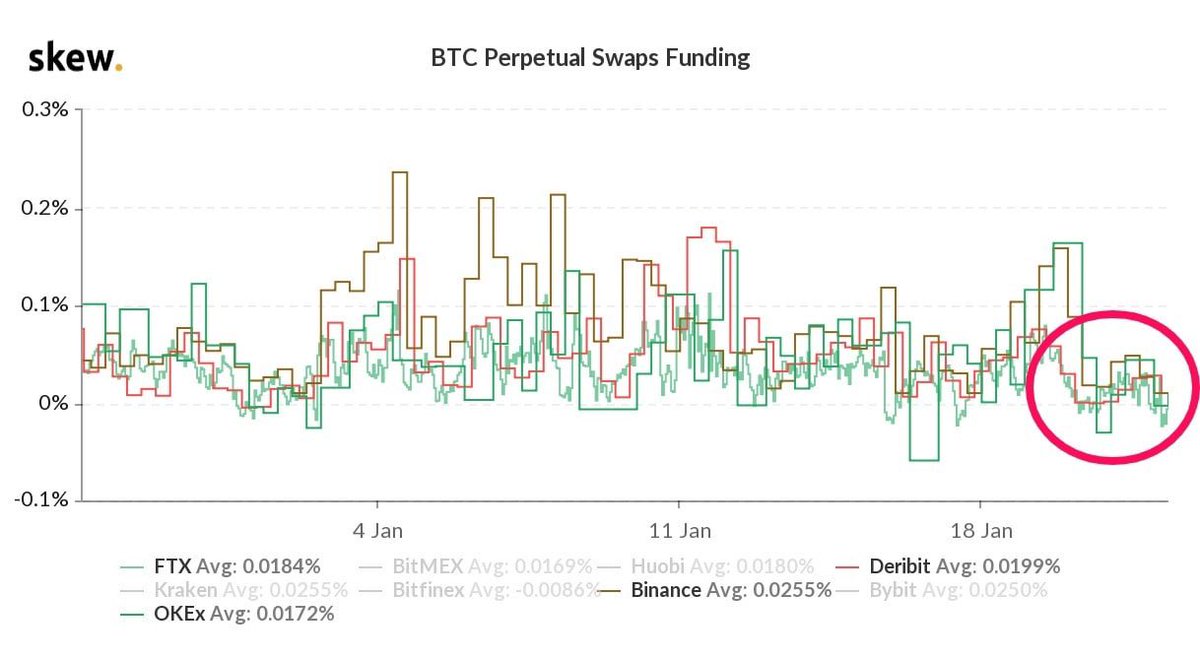

8/ Jan 9&10 this year was the first weak weekend in awhile also marking the recent high. So pay close attention to price action in the coming weekends. Looking at leveraged funding rates, all price dips this year were followed by a surge in funding as retail rushed in to buy dips

9/ However, last night funding turned negative instead - a sign to us that the retail demand (at roughly US$10bn BTC open interest & US$3.2bn ETH open interest) has lost some strength as price stagnates

10/ In the near-term, we're expecting a key battle at the 30k spot level and are waiting to see how much US can come in and lift us into the close tonight. This battle for the 30k weekly close will be key

11/ Disappointment over the ECB last night was also partly to blame for this move - other key liquidity proxies such as Gold took a further hit

12/ After the mini taper tantrum last week on the back of hawkish taper comments from typically dovish Fed officials and the ECB (who are usually proactive) standing pat last night, it is clear that central banks are firmly in a wait & see mode

13/ The absence of central bank signals will be a bane for pure liquidity proxies such as BTC and Tesla (which to us is as good a liquidity proxy as BTC)

14/ We are watching for a significant reversal in Tesla which has also been the poster child for BofA's next most consensus US Tech trade (Chart : BTC vs TSLA). A coordinated move lower by BTC, Gold & Tesla will signal to us a liquidity worry for the market

15/ Full update here. qcpcapital.medium.com/market-update-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh