Bajaj Auto (BA)’s Mcap today = ~2X of Hero.

Some obvious reasons:

~Mkt leader in 3W business

~Larger share of premium products

~Export Market

It’s not as simple as it looks.

Put on your seatbelts as we deep dive into the history of Bajaj Auto

Hit RT for wider reach.

Some obvious reasons:

~Mkt leader in 3W business

~Larger share of premium products

~Export Market

It’s not as simple as it looks.

Put on your seatbelts as we deep dive into the history of Bajaj Auto

Hit RT for wider reach.

1/

One of Rajiv Bajaj’s (RB) favourite movie scenes is the opening sequence from Troy. the Trojan and Greek armies decide to settle the fight through a duel between Achilles (played by Brad Pitt), the greatest of all Greek warriors, and Boagrius, a Trojan fighter.

One of Rajiv Bajaj’s (RB) favourite movie scenes is the opening sequence from Troy. the Trojan and Greek armies decide to settle the fight through a duel between Achilles (played by Brad Pitt), the greatest of all Greek warriors, and Boagrius, a Trojan fighter.

2/

As Achilles mounts his horse to take off for battle, the petrified young boy cautions the Greek that Boagrius was the biggest man he’d ever seen and he wouldn’t want to fight him. “That’s why no one will remember your name,” Achilles says in response and rides away.

As Achilles mounts his horse to take off for battle, the petrified young boy cautions the Greek that Boagrius was the biggest man he’d ever seen and he wouldn’t want to fight him. “That’s why no one will remember your name,” Achilles says in response and rides away.

3/

RB has shown this scene to many a colleague to coax them into pushing the envelope further. And much like Achilles’ quest to be remembered as the greatest warrior that ever lived, RB is obsessed with creating a great reputation for his company at the world stage.

RB has shown this scene to many a colleague to coax them into pushing the envelope further. And much like Achilles’ quest to be remembered as the greatest warrior that ever lived, RB is obsessed with creating a great reputation for his company at the world stage.

4/

Rajiv Bajaj & Bajaj Auto’s journey can be divided into 4 parts:

1.Teacher, Table & Balcony (1988-1995)

2.Flying Sparks (1995-2008)

3.Discovery (2008-2013)

4.The rise of the World’s Favourite Indian (2013-Present Day)

Rajiv Bajaj & Bajaj Auto’s journey can be divided into 4 parts:

1.Teacher, Table & Balcony (1988-1995)

2.Flying Sparks (1995-2008)

3.Discovery (2008-2013)

4.The rise of the World’s Favourite Indian (2013-Present Day)

5/

John F Wallace was a mentor to RB. He influenced Rajiv to come back to India. When Rahul Bajaj wanted to send Rajiv to Harvard, Wallace said: "If you send this boy for an MBA, there will not be a company left when he comes back."

John F Wallace was a mentor to RB. He influenced Rajiv to come back to India. When Rahul Bajaj wanted to send Rajiv to Harvard, Wallace said: "If you send this boy for an MBA, there will not be a company left when he comes back."

6/

At 23, RB started teaching at BA on efficient manufacturing. A lot of design and product planning-related discussion used to happen on a slightly wobbly wrought iron table on the balcony attached to Bajaj's office.

"Our beginning was a new beginning for the company.

At 23, RB started teaching at BA on efficient manufacturing. A lot of design and product planning-related discussion used to happen on a slightly wobbly wrought iron table on the balcony attached to Bajaj's office.

"Our beginning was a new beginning for the company.

7/

The physical entity of Bajaj Auto existed before. But with us came the end of scooters and start of motorcycles," RB.

By 2000, Bajaj began to become self-reliant in technology. The last motorcycle it built with Kawasaki's technology was the Eliminator in 1999.

The physical entity of Bajaj Auto existed before. But with us came the end of scooters and start of motorcycles," RB.

By 2000, Bajaj began to become self-reliant in technology. The last motorcycle it built with Kawasaki's technology was the Eliminator in 1999.

8/

Ironically, that was when the company also hit an all-time low. As the manufacturing slowdown engulfed the Indian industry, Bajaj Auto's two-wheeler business made a loss in 2000/01, it's first-ever. "It was a lifechanging experience," says Rajiv

Ironically, that was when the company also hit an all-time low. As the manufacturing slowdown engulfed the Indian industry, Bajaj Auto's two-wheeler business made a loss in 2000/01, it's first-ever. "It was a lifechanging experience," says Rajiv

9/

Bajaj launched the Pulsar in 2001. It created a new segment, one with high margins, and continues to be a cornerstone of Bajaj's market play.

Two years after its launch, the Pulsar was given two spark plugs, which was unheard of not only in India but anywhere in the world.

Bajaj launched the Pulsar in 2001. It created a new segment, one with high margins, and continues to be a cornerstone of Bajaj's market play.

Two years after its launch, the Pulsar was given two spark plugs, which was unheard of not only in India but anywhere in the world.

10/

"It is all about the 1st-mover advantage. I was an engineer. I thought if I made a better product, it would sell. If Hero had a bike that gave 80 Km/L, & I made one that gave 87, it should sell. But in reality, no one comes to buy it. This I didn't know earlier."- RB

"It is all about the 1st-mover advantage. I was an engineer. I thought if I made a better product, it would sell. If Hero had a bike that gave 80 Km/L, & I made one that gave 87, it should sell. But in reality, no one comes to buy it. This I didn't know earlier."- RB

11/

Why he shut down the scooter business

"One of the very few gyans I like coming out of a business school is what Michel Porter said, 'the presence of strategy in any organization is best indicated by what it decides not to do'.

Why he shut down the scooter business

"One of the very few gyans I like coming out of a business school is what Michel Porter said, 'the presence of strategy in any organization is best indicated by what it decides not to do'.

12/

So when someone says I do not play any sport except this, it inspires the feeling that he must be a champion in that sport. That is where perception starts."

So when someone says I do not play any sport except this, it inspires the feeling that he must be a champion in that sport. That is where perception starts."

13/

Bajaj had been into exports for years and closed 2006/07 with Rs1,690 crore in exports, which was under 20 % of the group turnover. In 2007, it poached Rakesh Sharma, who was heading ICI's ASEAN business, and started a structured approach to exports.

Bajaj had been into exports for years and closed 2006/07 with Rs1,690 crore in exports, which was under 20 % of the group turnover. In 2007, it poached Rakesh Sharma, who was heading ICI's ASEAN business, and started a structured approach to exports.

14/

BA has come a long way in the last 7-10 yrs in exports. In Q3FY21 results, they declared that Exports were over 687,000 units for the quarter.

That’s the highest ever. And despite a shortage of containers

In 2013, the highest quarterly export numbers used to be 3 lac

BA has come a long way in the last 7-10 yrs in exports. In Q3FY21 results, they declared that Exports were over 687,000 units for the quarter.

That’s the highest ever. And despite a shortage of containers

In 2013, the highest quarterly export numbers used to be 3 lac

15/

BA is the market leader in 3W space with a lion share of 65%. And from this business Bajaj draws most of its profit. As less R&D and brand-building efforts go into the 3w space, operating margins are quite high in the range of 25-30%.

BA is the market leader in 3W space with a lion share of 65%. And from this business Bajaj draws most of its profit. As less R&D and brand-building efforts go into the 3w space, operating margins are quite high in the range of 25-30%.

16/

COVID-19 has disrupted the 3 wheeler space at the moment. And the blockbuster results of Q3FY21 is despite the poor performance of the 3W space. With COVID fear receding now and 3W space is going to recover sharply in the next few quarters, the best is still ahead.

COVID-19 has disrupted the 3 wheeler space at the moment. And the blockbuster results of Q3FY21 is despite the poor performance of the 3W space. With COVID fear receding now and 3W space is going to recover sharply in the next few quarters, the best is still ahead.

17/

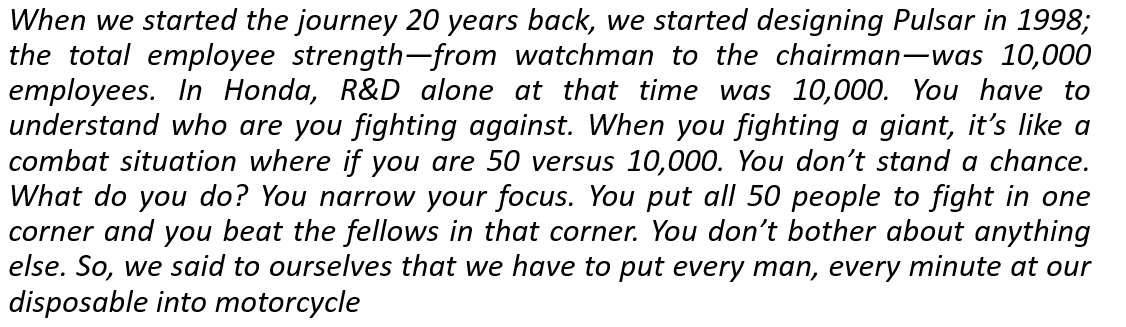

Before we end, some evidence of how Rajiv Bajaj thinks about his business:

During initial years of struggle in the motorcycle business

Before we end, some evidence of how Rajiv Bajaj thinks about his business:

During initial years of struggle in the motorcycle business

18/

•Guiding principle: " Do what you think is best but be best in what you do "

•"Best means being a global company.“: Main reason for getting into Motorcycles even when they were doing good in scooters

•Guiding principle: " Do what you think is best but be best in what you do "

•"Best means being a global company.“: Main reason for getting into Motorcycles even when they were doing good in scooters

19/

When stopped manufacturing scooters completely against the wish of his father to FOCUS on motorcycles only

“I care less for the solution from emotions, I believe more in the magic of logic.”

When stopped manufacturing scooters completely against the wish of his father to FOCUS on motorcycles only

“I care less for the solution from emotions, I believe more in the magic of logic.”

21/

Online articles referred:

~fortuneindia.com/enterprise/baj…

~businesstoday.in/magazine/cover…

~auto.economictimes.indiatimes.com/news/industry/…

Online articles referred:

~fortuneindia.com/enterprise/baj…

~businesstoday.in/magazine/cover…

~auto.economictimes.indiatimes.com/news/industry/…

22/

If you have come so far, check out our deep research on Bajaj Auto:

AR Notes: bit.ly/3iLphvV

5-Min Stock Idea: bit.ly/3ogH5Aj

Last 8 concall notes: bit.ly/2YfaS1m

Infographic: bit.ly/36dzuwa

Don’t forget to Like & RT

If you have come so far, check out our deep research on Bajaj Auto:

AR Notes: bit.ly/3iLphvV

5-Min Stock Idea: bit.ly/3ogH5Aj

Last 8 concall notes: bit.ly/2YfaS1m

Infographic: bit.ly/36dzuwa

Don’t forget to Like & RT

• • •

Missing some Tweet in this thread? You can try to

force a refresh