In our latest for @RIPEJournal Joseph Baines and I examine some of the most important but under-researched corporations in the world today: the commodity trading firms. How do we make sense of these firms and their role in ecological devastation? [1/8] tandfonline.com/doi/full/10.10…

Some claim that financialization has encouraged a short-term outlook in the sector, with dire social and ecological consequences. But evidence for these claims is patchy, so part of our research involved mapping financialization metrics for the top commodity trading firms [2/8]

The evidence is mixed. For example, we find that commodity traders have become less financialized in the source of profits (financial income), but more financialized in the destination of profits (shareholder payouts) [3/8]

Does the trading firms’ growing commitment to shareholder payouts encourage them to prioritize short-term returns? Or do their linkages to financial markets lend clout to financial activists concerned by the environmental and social consequences of their operations? [4/8]

We argue that these firms are shielded from financial activist pressures due to the predominance of private ownership structures, the dispersion of holdings in the their bonds as well as company deleveraging and shadow banking activities [5/8]

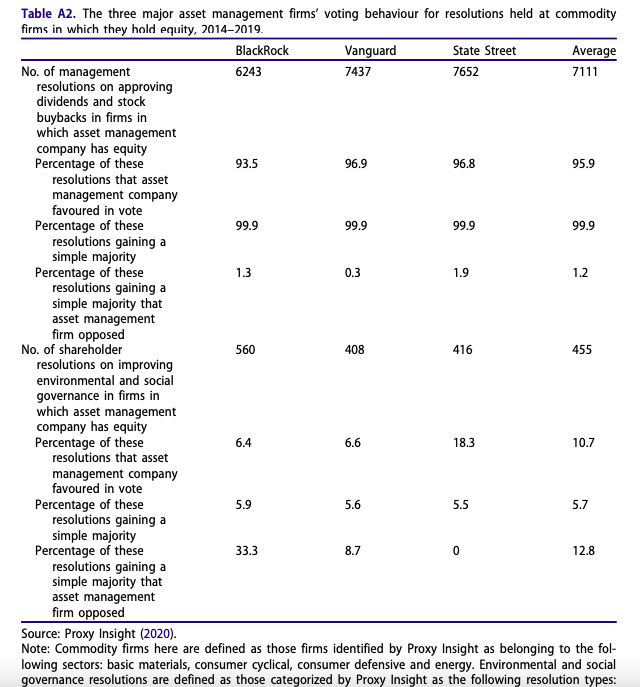

Also, voting data for the 'big three' asset managers in the commodity sector show that they almost always vote in favour of management resolutions for dividends and buybacks, and they almost always vote against resolutions aimed at environmental and social governance [6/8]

Our conclusion: we need much more than divestment campaigns and shareholder resolutions to push these firms onto a more sustainable pathway [7/8]

Unfortunately the paper appears to be behind a paywall, but a pre-print version can be found here [8/8]: sbhager.com/wp-content/upl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh