I've been trying to understand for some time the impact of $GBTC (Grayscale Bitcoin Trust) on the price of $BTC. Here's a good article to start, and here's a thread on my current thoughts... 1/9

hackernoon.com/grayscales-gbt…

hackernoon.com/grayscales-gbt…

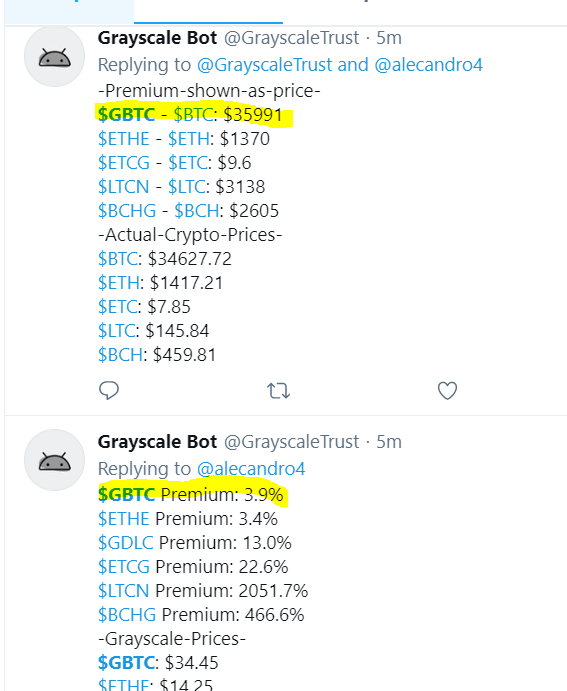

There's no doubt that $GBTC has been a driving force in allowing investors to gain exposure to $BTC. For many investors, it provides the easiest way to get crypto exposure. As a result, $GBTC often trades at a large premium (20%-30%) over spot $BTC 2/9

Recently in January, $BTC prices have declined from a high of >$40k to <$30k (now back near $35k). $GBTC's premium to NAV has also dropped to <5% 3/9

It's worth understanding the mechanics of $GBTC. $GBTC allows accredited investors to buy private shares for 0% premium to NAV, and in return the accredited investors are locked up for 6 months. If you are a non-accredited investor, i.e. retail, you don't have this option 4/9

Many sophisticated investors have taken advantage of this arbitrage opportunity. One way an accredited investor can buy private shares of $GBTC is by depositing BTC (often times with leverage). In doing so, they can collect the $GBTC premium 5/9

The decline in $BTC & $GBTC NAV premium has caused many to speculate as to the mechanics of what's going on & the ramifications. Here is one that is popularizing a fear of margin calls on $GBTC collateral & a negative spiral effect on $BTC price 6/9

https://twitter.com/std_dev/status/1352750362747351041

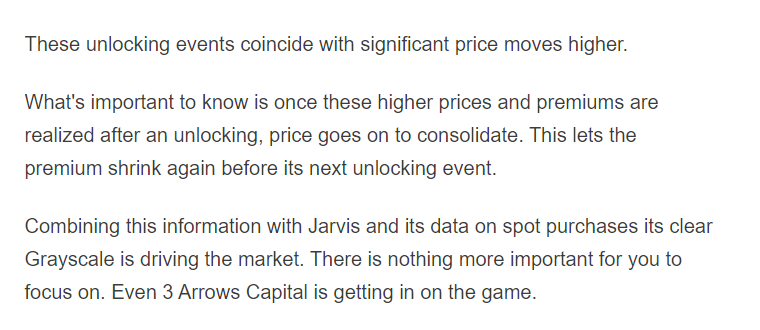

This article has identified a clear cause-and-effect between the "Unlocking Event", or when these private $GBTC shares are unlocked to be freely traded, and the price of $BTC. In my investigations, it has been the most credible theory out there 7/9

hackernoon.com/grayscales-gbt…

hackernoon.com/grayscales-gbt…

Shortly after these "Unlocking Events", you see a noticeable price increase in $BTC. This is caused by the private share investors selling their $GBTC at a premium and simultaneously buying spot $BTC 8/9

Because there were no unlocking events in January, the thesis correctly forecast a drift down in $BTC price & a collapse of the $GBTC NAV premium. The next unlocking event is February 10. The thesis suggests a price increase in $BTC subsequent to February 10. 9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh