The people on the WallStreetBets subreddit sometimes all get into a stock at once.

This is fun, a nice social outing in an age of social distancing, a risky but potentially lucrative collective entertainment. Recently they decided to do GameStop trib.al/9sUTCWD

This is fun, a nice social outing in an age of social distancing, a risky but potentially lucrative collective entertainment. Recently they decided to do GameStop trib.al/9sUTCWD

Why GameStop? Maybe…

🎮They’re gamers

📈It’s fun to pump the stock of a mall video-game store mid-pandemic

💰A lot of pro investors are short GameStop

🚀They thought it’d be funny to mess with them

💸Their friends were buying GameStop and they wanted in trib.al/9sUTCWD

🎮They’re gamers

📈It’s fun to pump the stock of a mall video-game store mid-pandemic

💰A lot of pro investors are short GameStop

🚀They thought it’d be funny to mess with them

💸Their friends were buying GameStop and they wanted in trib.al/9sUTCWD

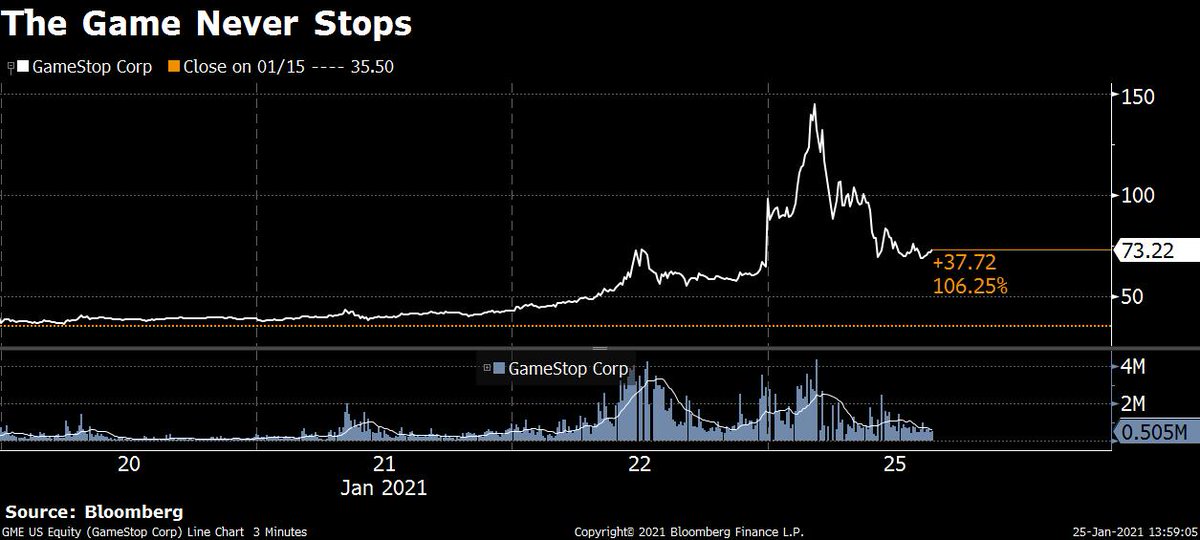

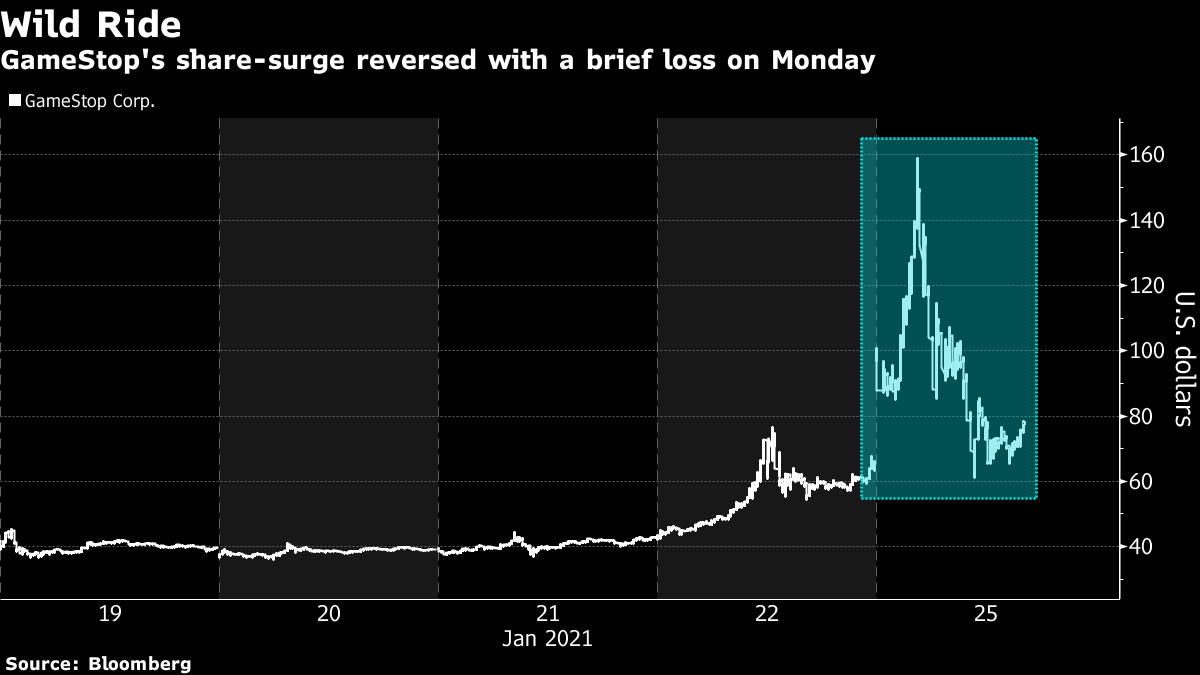

Take one person who’s long for fundamental reasons, add 100 people who are long for amusement reasons like “lol gaming” or “let’s mess with the shorts,” and then add thousands more who are long because they see everyone else long, and the stock moves: trib.al/9sUTCWD

On 1/22, 194 million shares were traded.

"I think the subreddit brings a new factor into stocks that wasn’t as prevalent as before,” WallStreetBets moderator Bawse1 told WIRED. “It’s called hype.” trib.al/9sUTCWD

"I think the subreddit brings a new factor into stocks that wasn’t as prevalent as before,” WallStreetBets moderator Bawse1 told WIRED. “It’s called hype.” trib.al/9sUTCWD

Here's a 7-hour video where a guy named “Roaring Kitty” dips a chicken tender in champagne to celebrate.

“Overbought can stay overbought, remain overbought, even get more overbought,” he says, which is as good a summary of the situation as anything else

“Overbought can stay overbought, remain overbought, even get more overbought,” he says, which is as good a summary of the situation as anything else

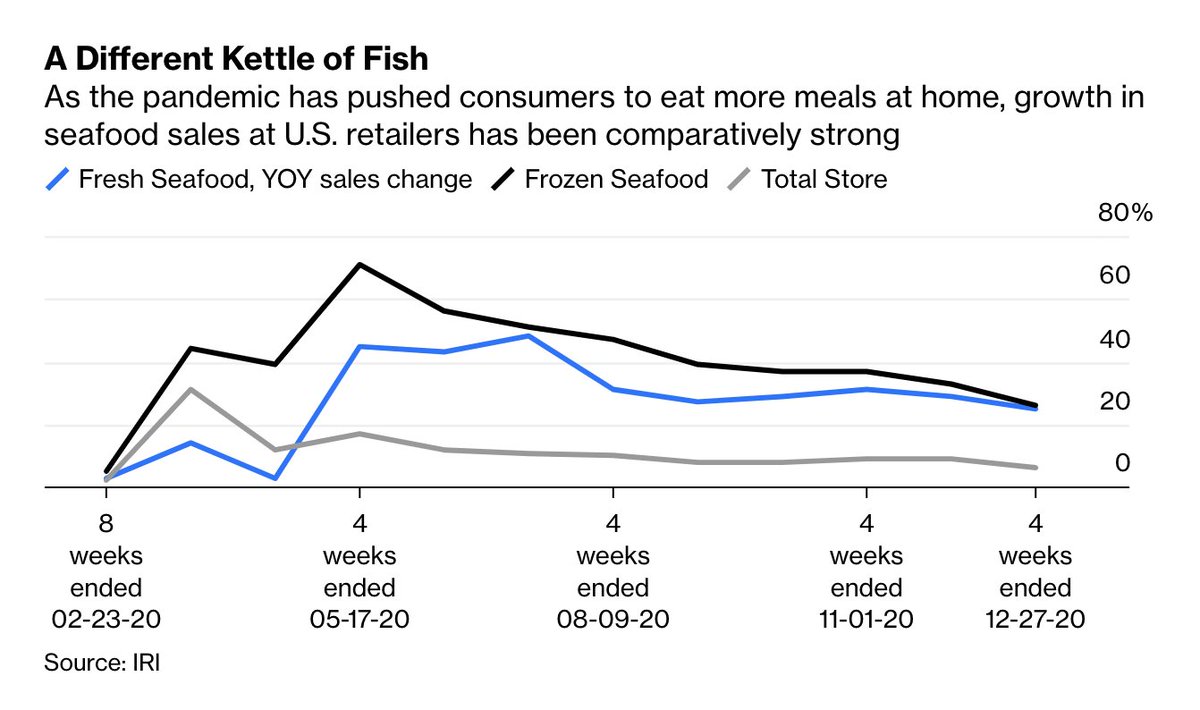

The “boredom markets hypothesis” follows the notion that stocks are driven by people who are bored at home during the pandemic and have nothing else to do but trade stocks with their pals on Reddit.

Why not trade GameStop, literally a stock about games? trib.al/9sUTCWD

Why not trade GameStop, literally a stock about games? trib.al/9sUTCWD

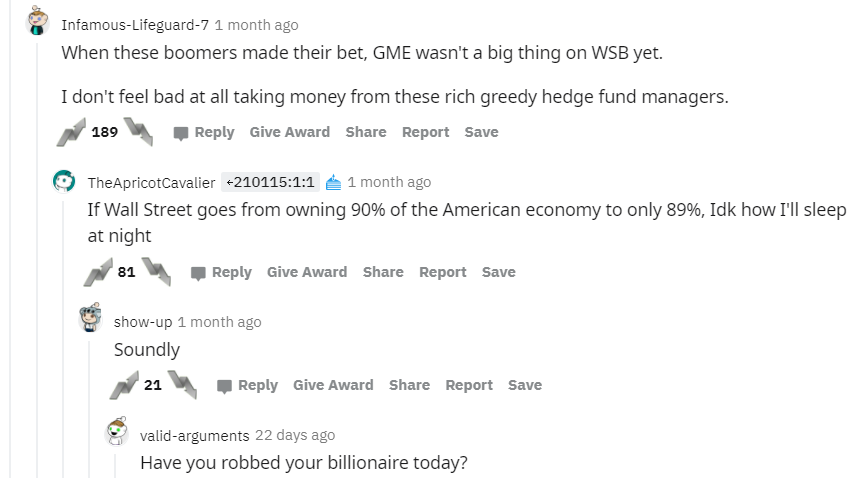

If you look at Reddit, there's a lot of rocket emojis and Lord of the Rings memes.

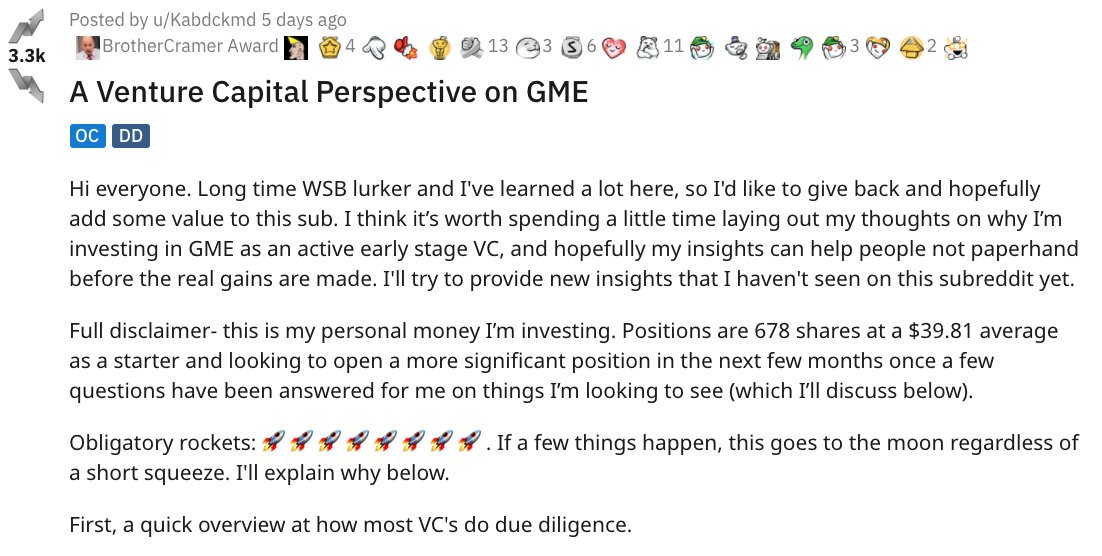

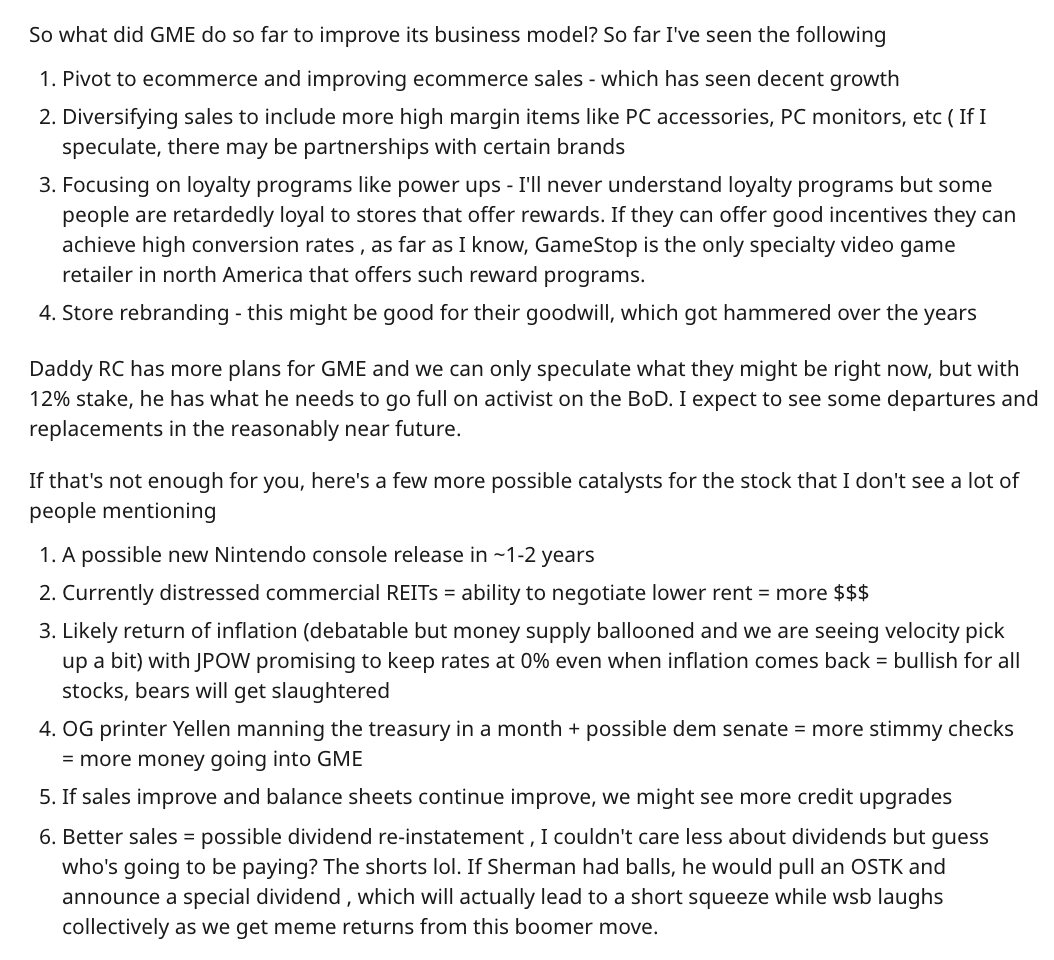

But to be fair that’s not all there is; there's some discussion of the fundamentals of the company, too. Here's a fundamental bull case for GameStop on Reddit: reddit.com/r/wallstreetbe…

But to be fair that’s not all there is; there's some discussion of the fundamentals of the company, too. Here's a fundamental bull case for GameStop on Reddit: reddit.com/r/wallstreetbe…

Here is another “DD”—“due diligence,” the WallStreetBets term for, like, an investment memo—discussing the business, albeit using more slurs and obscenities than is customary in equity research: reddit.com/r/wallstreetbe…

The GameStop phenomenon did not come from absolutely nowhere. There was at least a speck of fundamental dust for a cloud of meme-stock enthusiasm to form around.

So why did so many people all of a sudden want to risk a lot of money on GameStop calls? trib.al/9sUTCWD

So why did so many people all of a sudden want to risk a lot of money on GameStop calls? trib.al/9sUTCWD

Perhaps it’s the nihilism thesis.

Recently, the stock of a micro-cap company called Signal Advance Inc. shot up 5,100% after Elon Musk tweeted something about an unrelated app named Signal. The error was quickly corrected, but the stock kept going up trib.al/9sUTCWD

Recently, the stock of a micro-cap company called Signal Advance Inc. shot up 5,100% after Elon Musk tweeted something about an unrelated app named Signal. The error was quickly corrected, but the stock kept going up trib.al/9sUTCWD

It’s still trading at 10 times its pre-tweet price, weeks later. Why?

There was a mass of retail buyers who like to all buy the same stock, and Musk’s tweet gave them a Schelling point. They just like to all have fun together, pumping some stocks trib.al/9sUTCWD

There was a mass of retail buyers who like to all buy the same stock, and Musk’s tweet gave them a Schelling point. They just like to all have fun together, pumping some stocks trib.al/9sUTCWD

You don’t actually need a Schelling point to coordinate around. You can just go on Reddit and talk about what stock you’re all going to buy.

Take Bitcoin: It's a financial asset with no cash flows. It has value purely because people think it’s valuable trib.al/9sUTCWD

Take Bitcoin: It's a financial asset with no cash flows. It has value purely because people think it’s valuable trib.al/9sUTCWD

Bitcoin is worth $34,000 because other people will pay you $34,000 for it. There is no underlying claim.

It is an amazing collective accomplishment to create a new thing, from scratch, that is valuable just because we collectively agree that it’s valuable trib.al/9sUTCWD

It is an amazing collective accomplishment to create a new thing, from scratch, that is valuable just because we collectively agree that it’s valuable trib.al/9sUTCWD

If pure collective will can create a valuable financial asset, just hop on Reddit and create value out of nothing.

If it works for Bitcoin, why not … anything? Why not Dogecoin? Why not Tesla? GameStop? trib.al/9sUTCWD

If it works for Bitcoin, why not … anything? Why not Dogecoin? Why not Tesla? GameStop? trib.al/9sUTCWD

Anyway, GameStop shares, which were up as much as 145% today, briefly turned negative.

As of 12:25 p.m., trading had been halted *eight* times trib.al/9sUTCWD

As of 12:25 p.m., trading had been halted *eight* times trib.al/9sUTCWD

• • •

Missing some Tweet in this thread? You can try to

force a refresh