#GRAPHITE will be a necessary part of the EV BOOM! Here’s who I’m trying to capitalize with.

$LION DEEP DIVE

$GRAT $FMS $LEM $NOU $CCB $LI $NRM $QMC $S $JRV $FCC

$LION DEEP DIVE

$GRAT $FMS $LEM $NOU $CCB $LI $NRM $QMC $S $JRV $FCC

EV market is poised to grow $44B during 2020 - 2024 with CAGR of 22%

Graphite is an essential element in lithium ion batteries to power EVs

As $TSLA opens gigafactories the demand for graphite will spike. The Nevada factory alone will need 35K tons of graphite per year $LION.c

Graphite is an essential element in lithium ion batteries to power EVs

As $TSLA opens gigafactories the demand for graphite will spike. The Nevada factory alone will need 35K tons of graphite per year $LION.c

$LION is a principal supplier of graphite and a great opportunity for investors to capitalize on the massively expanding battery and EV sector

$LION.c announced TODAY that it continues to progress Madagascar project and are completing the final mine development plan right now.

$LION.c announced TODAY that it continues to progress Madagascar project and are completing the final mine development plan right now.

The graphite deposits there are associated with topographic highs that are exploited via cost-effective free-dig methods.

$LION also has the Neuron Graphite Project ion Manitoba = potentially richest graphite discovery in NA = 76% carbon content

$LION.c

$LION also has the Neuron Graphite Project ion Manitoba = potentially richest graphite discovery in NA = 76% carbon content

$LION.c

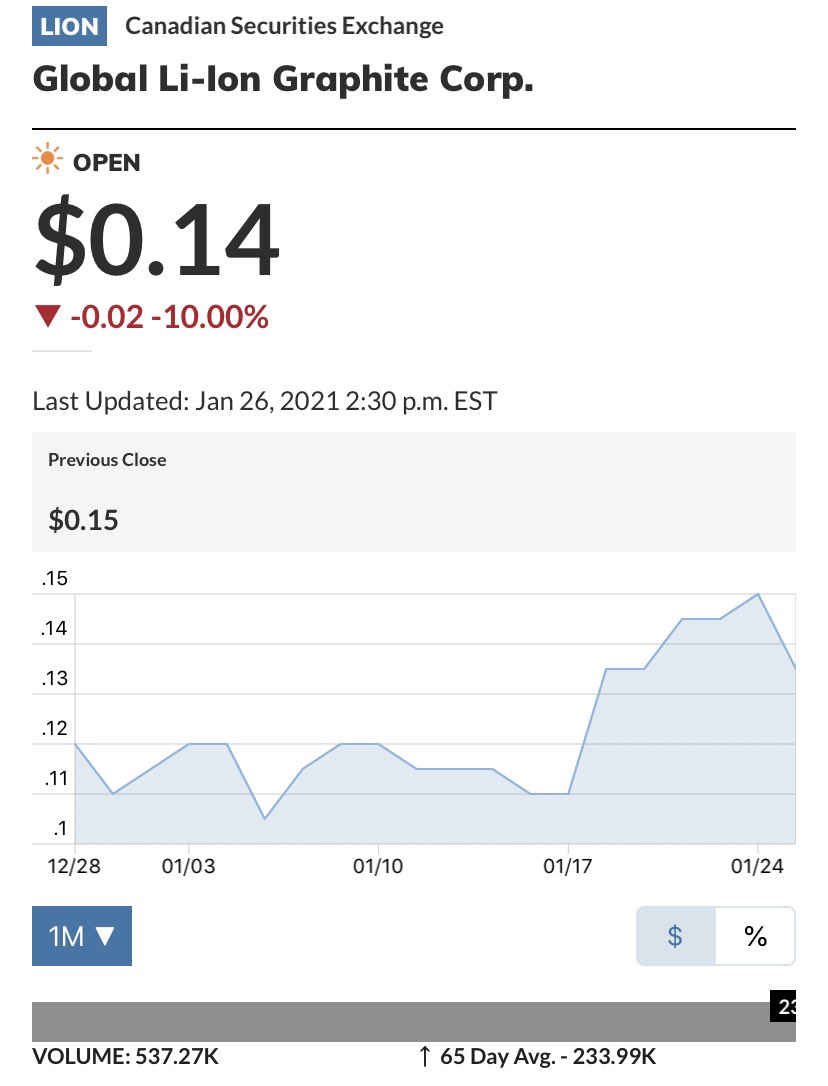

$LION price dipped today to $0.135 and is looking like a great opportunity to buy as news flow will continue and demand for graphite exponentially increases over the coming months and years. $LION.c

With mining assets in place and future assets in the works IMO $LION is poised to become a major provider of graphite for the global demand and therefore is undervalued rn. $LION.c

finance.yahoo.com/news/lion-move…

finance.yahoo.com/news/lion-move…

• • •

Missing some Tweet in this thread? You can try to

force a refresh