Some slides I thought were really interesting from @ARKInvest's recent 2021 Big Ideas presentation...

Source: research.ark-invest.com/hubfs/1_Downlo…

Source: research.ark-invest.com/hubfs/1_Downlo…

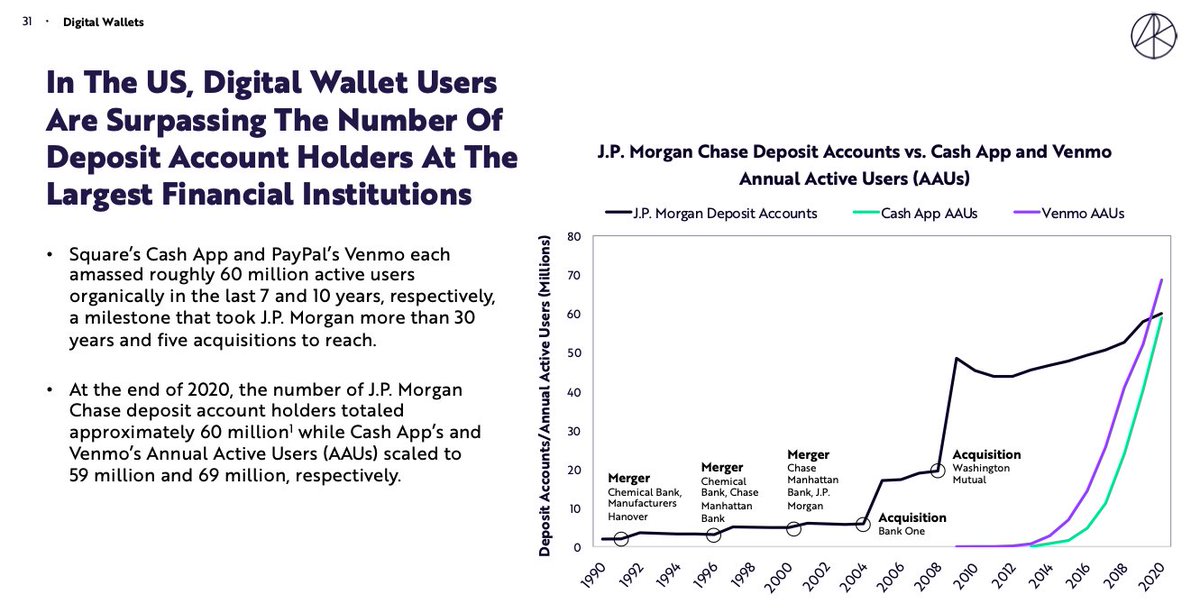

3/ Venmo and Cash App both have roughly 60 million annual active users.

Their CAC's are magnitudes lower than traditional banks as well.

Their CAC's are magnitudes lower than traditional banks as well.

6/ Later in the presentation, Ark also mentions how important drone delivery could be for food delivery

End/

Highly recommend going through the presentation.

Thanks to the team at ARK for sharing!

Highly recommend going through the presentation.

Thanks to the team at ARK for sharing!

• • •

Missing some Tweet in this thread? You can try to

force a refresh