Surging capital requirements led to liquidity issues that led to the Robinhood $GME PR mess

This doesn't mean that Robinhood is doomed.

It has to do with the DTCC & rules to protect our capital markets

The DTCC is under-appreciated. Let's use this opportunity to dig in 👇👇👇

This doesn't mean that Robinhood is doomed.

It has to do with the DTCC & rules to protect our capital markets

The DTCC is under-appreciated. Let's use this opportunity to dig in 👇👇👇

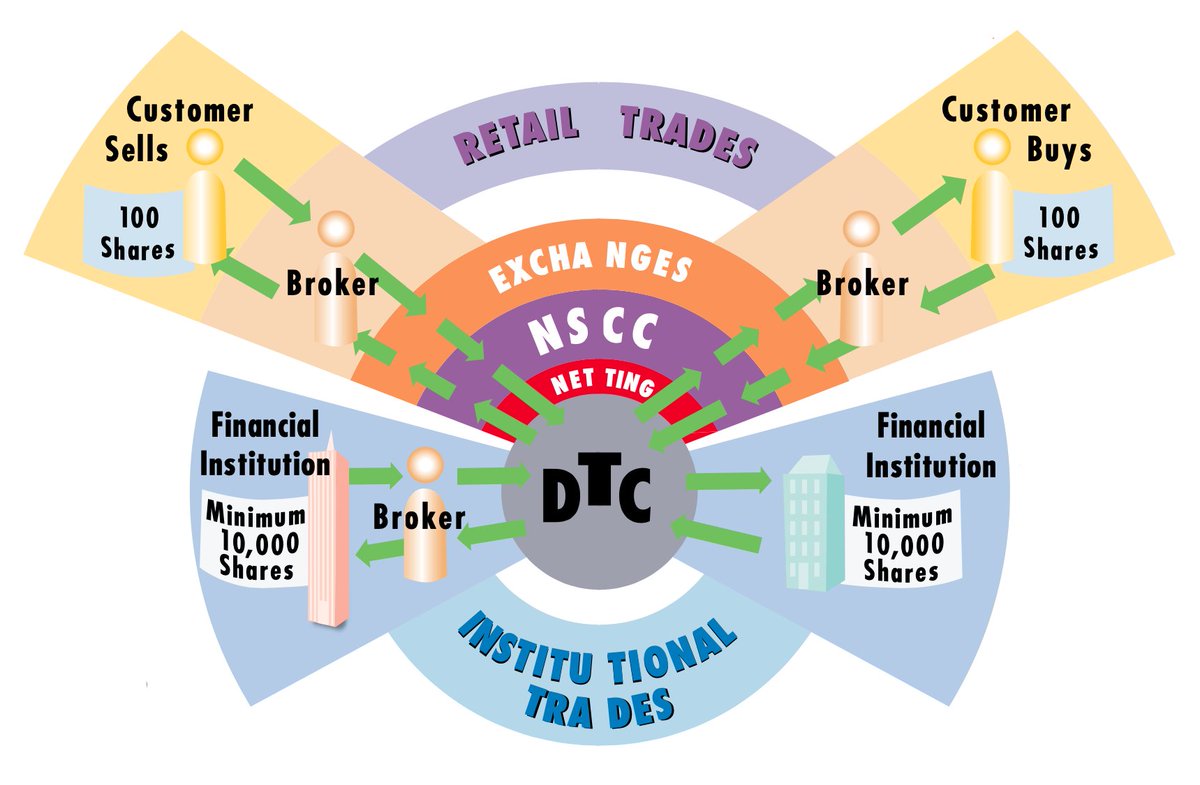

When a stock trades, transactions are handled through two subsidiaries of DTCC, the NSCC and DTC.

NSCC and DTC clear and settle nearly all retail securities transactions in the United States.

NSCC and DTC clear and settle nearly all retail securities transactions in the United States.

NSCC (National Securities Clearing Corp) is clearing. It acts as the seller for every buyer and buyer for every seller, on nearly EVERY retail trade in US equities.

DTC (Depository Trust Company) is a depository/custodian. They hold the "master ledger" for nearly all US equities

DTC (Depository Trust Company) is a depository/custodian. They hold the "master ledger" for nearly all US equities

Let's start with NSCC:

For equity trades, the settlement process begins the day the trade is made, or T for short. The transaction is settled two business days later on T+2, when the buyer receives credit for the purchased shares and the seller receives the payment due.

For equity trades, the settlement process begins the day the trade is made, or T for short. The transaction is settled two business days later on T+2, when the buyer receives credit for the purchased shares and the seller receives the payment due.

To reduce the risk of a ripple effect of a failed transaction, NSCC becomes the counterparty to all trades at midnight between T and T+2:

NSCC acts as seller for every buyer and buyer for every seller to guarantee a trade will complete even if a party to the trade goes bankrupt

NSCC acts as seller for every buyer and buyer for every seller to guarantee a trade will complete even if a party to the trade goes bankrupt

Without that guarantee, thousands of trades other firms had made with a firm that goes out of business would have to be unwound. This means the trades would be considered not to have taken place and would have to be re-executed at a new price with some other firm.

Trades are then finalized on T+2, the settlement date.

NSCC sends settlement instructions to the firms, and DTC communicates net credit or debit status to all clearing firms and their settling banks, which handle the payment or receipt through the Federal Reserve

NSCC sends settlement instructions to the firms, and DTC communicates net credit or debit status to all clearing firms and their settling banks, which handle the payment or receipt through the Federal Reserve

So to actually transact the shares between firms, each firm pays or is paid thru the Fed, and the DTC updates a record in its database for the number of shares that Clearing Firm X holds of Company Y. That's it.

DTC keeps track of how many shares each clearing firm holds of each stock, and each clearing firm keeps track of the breakdown of its clients' holdings (their clearing and custody duty).

The DTC holds over $40 Trillion!! of securities on its books.

The DTC holds over $40 Trillion!! of securities on its books.

So back to RH, the DTCC has many rules in place to limit the possibility that a transaction you authorize won’t settle...

That when you buy you won’t end up with the security you want or when you sell you won’t end up with the money that’s due

That when you buy you won’t end up with the security you want or when you sell you won’t end up with the money that’s due

These rules are briefly covered in the "Avoiding a Meltdown" section of the DTCC's "Life of a Security" mini-book, which I highly recommend reading.

And they're what caused the Robinhood crunch today.

And they're what caused the Robinhood crunch today.

To ensure all transactions can be completed in the event a participant firm fails, the DTCC maintains net capital and collateral programs.

NSCC takes on a lot of risk being central to every trade, and needs to make sure no one is caught "holding the bag" if a firm goes under

NSCC takes on a lot of risk being central to every trade, and needs to make sure no one is caught "holding the bag" if a firm goes under

They require every participant to maintain accounts that hold cash and securities to cover their daily settlement obligations, and tracks their collateral requirements throughout the trading day.

Firms are required to deposit more during the day as their risk increases.

Firms are required to deposit more during the day as their risk increases.

What happened to Robinhood today seems like a perfect storm to spike their capital requirements far beyond what they could have predicted in the weeks or days leading up.

There were at least three factors at play:

There were at least three factors at play:

1. Their user base was exploding (#1 on the app store), which led to more volume.

#ToTheMoon was trending on twitter, @AOC tweeted about RH, etc.

More volume means more settlement obligations which means more capital requirements!

#ToTheMoon was trending on twitter, @AOC tweeted about RH, etc.

More volume means more settlement obligations which means more capital requirements!

2. Their volume was shifting to 4GME and GME options.

Higher risk stocks have proportionately higher capital requirements and are have a "haircut" applied to them when used as collateral!

Higher risk stocks have proportionately higher capital requirements and are have a "haircut" applied to them when used as collateral!

3. And most 'duh' of all, The price of $GME was skyrocketing 1000+% in a week

Again upping the capital requirements!

Again upping the capital requirements!

All this spiking meant that Robinhood had to keep dumping money into reserve accounts at the DTCC and elsewhere, which is rightly required to prevent settlement issues from rippling through our markets.

At some point this morning, Robinhood must have been looking at the numbers and saw a worst case scenario to the tune of "hundreds of millions of dollars" due to the DTCC with not enough credit to pull from, and had to make the uncomfortable call to pause and sort things out.

This digs into the numbers more:

https://twitter.com/KralcTrebor/status/1354952686165225478

If you like analogies:

https://twitter.com/jtdaugh/status/1355180592418189318

• • •

Missing some Tweet in this thread? You can try to

force a refresh