#CAMS

(Business - Case Study) 👨🎓

Please Read Full Thread for Best Knowledge.🙏

#CAMS:Computer Age Management Service Incorporated 1988 in Chennai

✨Company is Technology Driver Financial Infrastructure and Service Provider to Mutual Funds & Other Financial Institutions..

1/n

(Business - Case Study) 👨🎓

Please Read Full Thread for Best Knowledge.🙏

#CAMS:Computer Age Management Service Incorporated 1988 in Chennai

✨Company is Technology Driver Financial Infrastructure and Service Provider to Mutual Funds & Other Financial Institutions..

1/n

In Simple Terms,

#CAMS is Service Solution Partner to Mutual Funds Industry..

Also Serving Service to Financial Institutions With 2+ Decades Track Records..✨

🔹 CAMS is "MARKET-LEADING" Register & Transfer Agent to Mutual Funds Industry of India Serving 70% of Total AUM..

2/n

#CAMS is Service Solution Partner to Mutual Funds Industry..

Also Serving Service to Financial Institutions With 2+ Decades Track Records..✨

🔹 CAMS is "MARKET-LEADING" Register & Transfer Agent to Mutual Funds Industry of India Serving 70% of Total AUM..

2/n

~ CAMS Bring Ability to Serving B2C (Direct to Customer) of Every Mutual Funds, Insurance & Other Financial Services..

🔹Highest Technological Competitive Advantage..👨💻

Technology is Core of #CAMS Service..

~ Company has Own Data Center as Well as Build Very Well RPA*.

3/n

🔹Highest Technological Competitive Advantage..👨💻

Technology is Core of #CAMS Service..

~ Company has Own Data Center as Well as Build Very Well RPA*.

3/n

RPA: Robotic Problem Automation

🔹 Provide Back Office Service to..

1. Mutual Funds

2. Insurance Company

3. Banks & NBFC's

💠 Shareholding Pattern:

Foreign Promoter: 31%

* Warburg Pincus A Leading Global Equity Firm

MF: 12%

Insurance Co. : 2.1%

FII's: 8.7%

Other's: 46.2%

4/n

🔹 Provide Back Office Service to..

1. Mutual Funds

2. Insurance Company

3. Banks & NBFC's

💠 Shareholding Pattern:

Foreign Promoter: 31%

* Warburg Pincus A Leading Global Equity Firm

MF: 12%

Insurance Co. : 2.1%

FII's: 8.7%

Other's: 46.2%

4/n

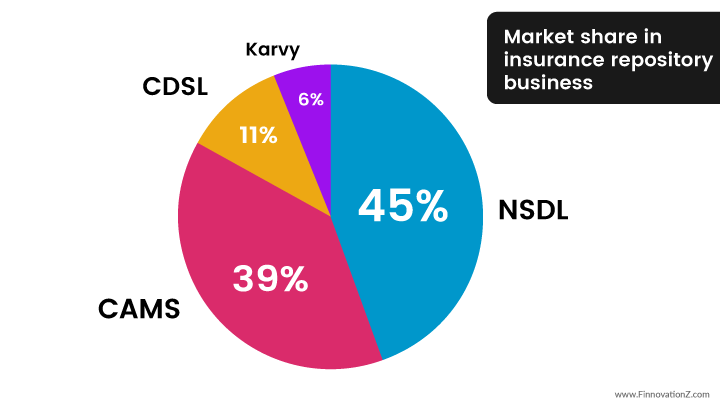

💠 Core Service/Subsidiary Company:

1️⃣. Mutual Funds Related Service Provided by CAMS Its-self.

~ One of The India's Largest Mutual Funds Transfer Agency

~ Distributor Service

~ Data Confidentiality & Security

(Save Impo Customer Data)

~ Handled Customer Care Services too.

5/n

1️⃣. Mutual Funds Related Service Provided by CAMS Its-self.

~ One of The India's Largest Mutual Funds Transfer Agency

~ Distributor Service

~ Data Confidentiality & Security

(Save Impo Customer Data)

~ Handled Customer Care Services too.

5/n

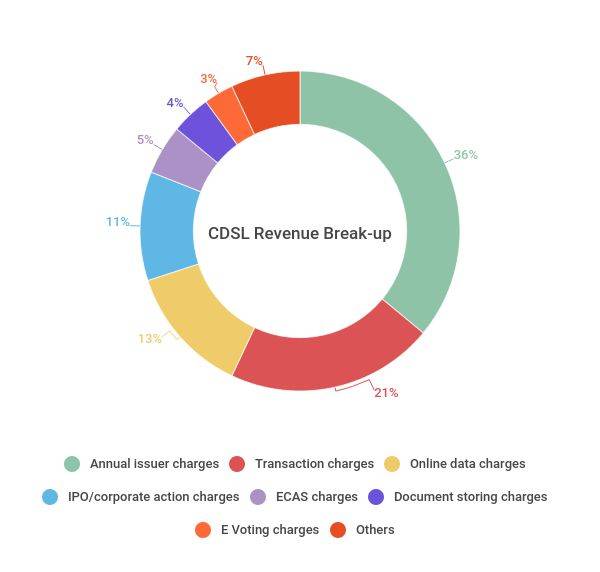

2️⃣. #CAMS Rep:

(E-Insurance Related Service)

~ India's Leading Repository Service Over 40 Insurance Companies and 2+ Million E-Insurance Policy..

~ E-Insurance Business has HUGE Potential in Future.

~ Placed 2nd in E-Isurance Market Just After NSDL with 39% Market Share..

6/n

(E-Insurance Related Service)

~ India's Leading Repository Service Over 40 Insurance Companies and 2+ Million E-Insurance Policy..

~ E-Insurance Business has HUGE Potential in Future.

~ Placed 2nd in E-Isurance Market Just After NSDL with 39% Market Share..

6/n

3️⃣. #CAMS Finserve:

~ RBI Permitted Account Aggregator Platform..🧾

~ CAMS Finserve Collect All of Customer Financial Information From Various Institutions and Provide all as Aggregatly to Customer for Easy and Repid Use..

4️⃣. #CAMS KRA: A Wholly Owned Subsidiary of CAMS..

7/n

~ RBI Permitted Account Aggregator Platform..🧾

~ CAMS Finserve Collect All of Customer Financial Information From Various Institutions and Provide all as Aggregatly to Customer for Easy and Repid Use..

4️⃣. #CAMS KRA: A Wholly Owned Subsidiary of CAMS..

7/n

~ CAMS KRA Provide Service Related to KYC Service.

5️⃣ Sterling Software:

~ Company Conducted Software Solution Business & Provide Mobility Solution to Customer Ease of Service to Customer.

✨ Company has Higher Standard of Corporate Governance With Experience Management.😎

8/n

5️⃣ Sterling Software:

~ Company Conducted Software Solution Business & Provide Mobility Solution to Customer Ease of Service to Customer.

✨ Company has Higher Standard of Corporate Governance With Experience Management.😎

8/n

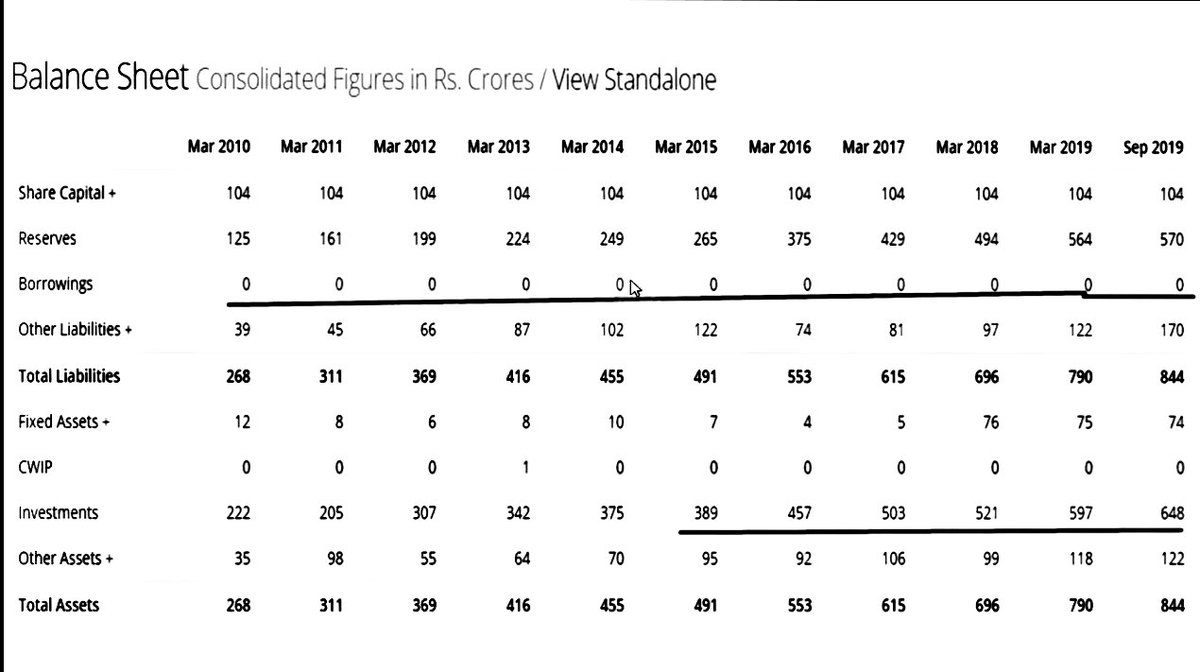

💠 Financials:

~ Company's Revenue Rise at 12.8% CAGR..

(Same as AUM ₹ Growth)

~ EBITA Margin: 42.9%

~ EPS: ₹ 35+ of FY 2020

*[Estimation for FY 2021 is 38-40+]

~ PE at 50

~ ROCE = 52.5%

~ ROI = 35%

🔹 89% Revenue Come From Mutual Funds Sector..

(Not Much Diversify)

9/n

~ Company's Revenue Rise at 12.8% CAGR..

(Same as AUM ₹ Growth)

~ EBITA Margin: 42.9%

~ EPS: ₹ 35+ of FY 2020

*[Estimation for FY 2021 is 38-40+]

~ PE at 50

~ ROCE = 52.5%

~ ROI = 35%

🔹 89% Revenue Come From Mutual Funds Sector..

(Not Much Diversify)

9/n

✨Service Oriented Asset Light Business Model, So Most Profit Only Converted into Cash.💸💵

~ Due to Cash Rich, Small but Regular Dividend Pay Company.

💠Relation with Other MF Company:

~ In Business From Which CAMS belongs, Relation between both Parties are V. Important

10/n

~ Due to Cash Rich, Small but Regular Dividend Pay Company.

💠Relation with Other MF Company:

~ In Business From Which CAMS belongs, Relation between both Parties are V. Important

10/n

~ Company has 70% of Total Market Share with 19.2 Laks Crore AUM & 16 Big Clients..

~ MF Business Will Grow Upto 16% CAGR Till end of 2024

~ "0" Probability to Switching Business with High Entry Barriers.

~ Healthy Relation & 20+ Y Experience Give Competitive Advantage✨

11/n

~ MF Business Will Grow Upto 16% CAGR Till end of 2024

~ "0" Probability to Switching Business with High Entry Barriers.

~ Healthy Relation & 20+ Y Experience Give Competitive Advantage✨

11/n

💠 Competitors:

#CAMS have Greater Competitive Advantage over Other's with Some High Technological Structure..

✨Almost in All Front of View, #CAMS is Better than Others as Described in below Table..

Karvey Own 26% M.Share & Frenklin Held 3-5% M.Share also..

12/n

#CAMS have Greater Competitive Advantage over Other's with Some High Technological Structure..

✨Almost in All Front of View, #CAMS is Better than Others as Described in below Table..

Karvey Own 26% M.Share & Frenklin Held 3-5% M.Share also..

12/n

4 Out of Top 5 and 6 Out of Top 10 Mutual Funds are Clients of #CAMS ..

🔹HDFC AMC, ICICI Pru. , SBI MF, Aditya Birla MF are Some Big Nme Who Own Service from CAMS..

✨ Company has Brighter Future in Coming Years If They Focus on Increase Revenue From Other Source..

13/n

🔹HDFC AMC, ICICI Pru. , SBI MF, Aditya Birla MF are Some Big Nme Who Own Service from CAMS..

✨ Company has Brighter Future in Coming Years If They Focus on Increase Revenue From Other Source..

13/n

A Worth Study:)

If You Enjoy Thread,Help to Spread it for Max.🤝

#Like

#RETWEEET 🎗️

@Investor_Mohit @Stockstudy8

@nakulvibhor @CAPratik_INDIAN @Jitendra_stock @sanstocktrader @Rishikesh_ADX @RajarshitaS @drprashantmish6 @caniravkaria @Atulsingh_asan @unseenvalue

Thank You.❤️

If You Enjoy Thread,Help to Spread it for Max.🤝

#Like

#RETWEEET 🎗️

@Investor_Mohit @Stockstudy8

@nakulvibhor @CAPratik_INDIAN @Jitendra_stock @sanstocktrader @Rishikesh_ADX @RajarshitaS @drprashantmish6 @caniravkaria @Atulsingh_asan @unseenvalue

Thank You.❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh