This has been an extraordinary moment in history for the silver market. It requires a thread to demonstrate the shear amount of money that is coming into the SLV etf. Information about SLV can be found here ishares.com/us/products/23…

The following is from the section "Description of the Shares and Trust Agreement" in the SLV offering prospectus: Each SLV Share represents a fractional undivided beneficial interest in the net assets of the Trust.

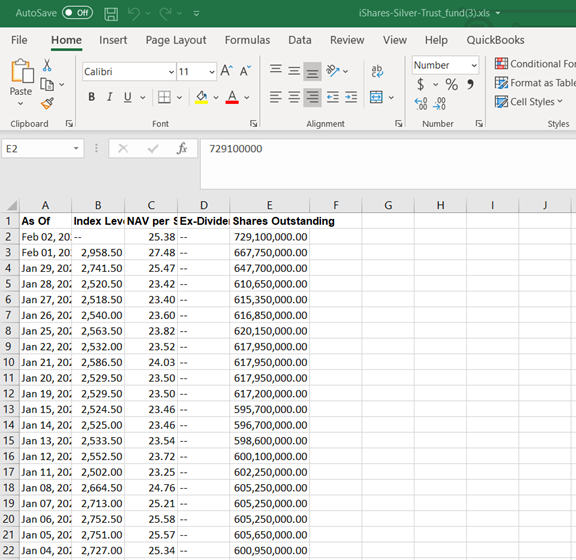

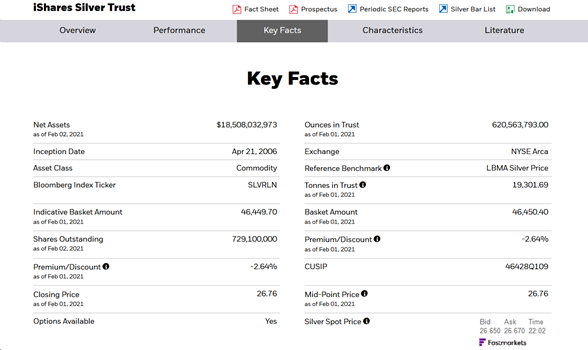

As of 2-1-2021: total ounces in the Trust was 620,563,793 and total shares were 667,750,000. Each share represent approx. .929 ounces. Therefore, 61,350,000 new shares represents 56,994,150 new ounces .

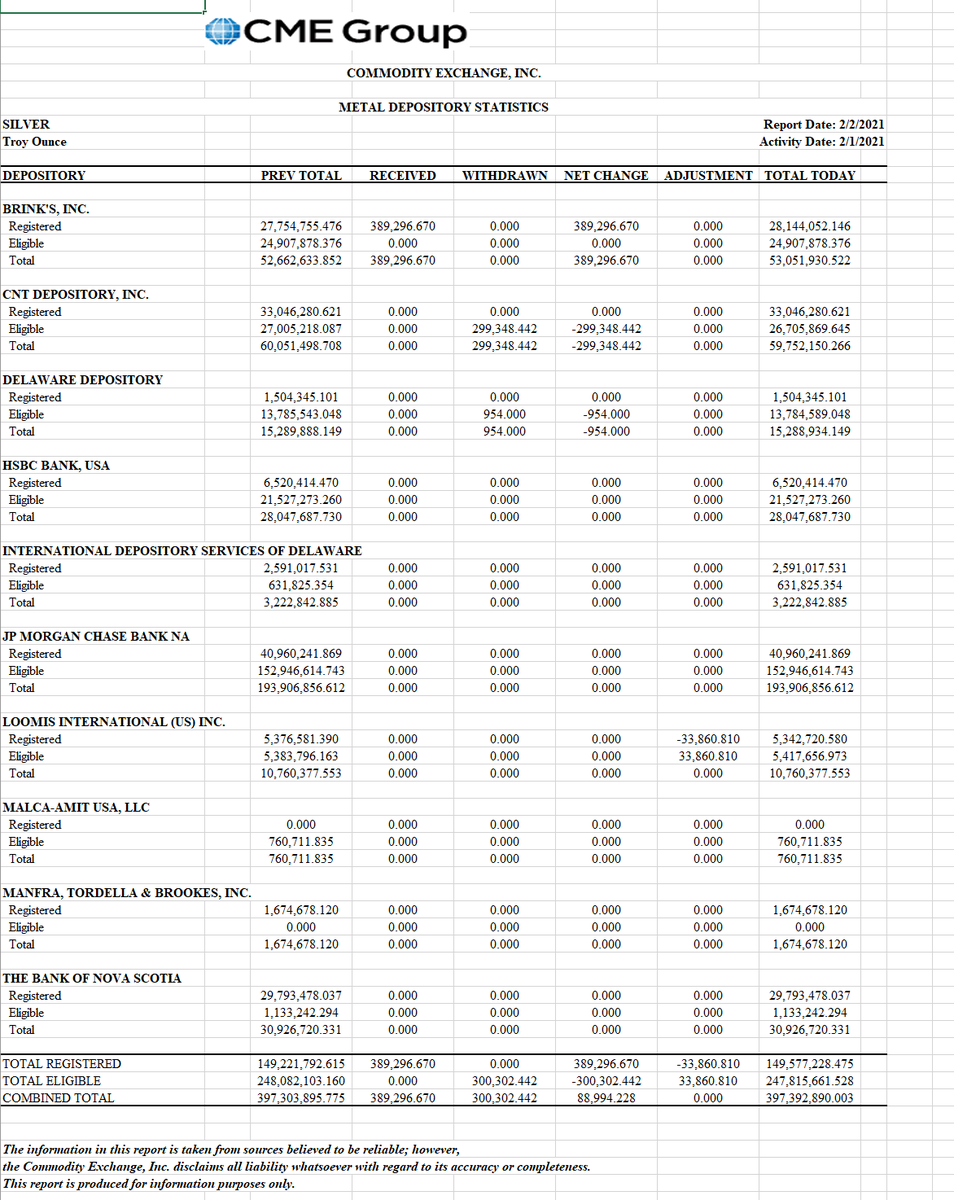

The 56,994,150 new ounces is equivalent to 38% of the total inventory in the registered category of the Comex as of today.

To put this in perspective, since 1-28-2021, 118,450,000 new shares have been created for the SLV etf. This is approx. 110,040,050 silver ounces. This is equivalent to 73% of the total inventory in the registered category of the Comex. AND THIS IS ONLY ONE ETF.

The physical silver market is on absolute fire. Premiums on all silver products are rising. This includes 1,000 oz silver bars as well. Oddly, the 1,000 oz bar market is very critical not only to industrial usage but financing, collateralization, and leasing activities.

Unlike March of last year, where production and logistics constraints impacted availability and created dislocations, the events unfolding today are focused on an actual metal squeeze. A true test of the paper silver market's dominance over the physical silver price.

The silver market has become a battle cry for individuals wanting to protect their purchasing power, as well as, recognizing the potentially massive undervaluation which may exist as compared to other financial assets or commodities. Please retweet to all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh